Data analytics and engineering firm MathCo (previously TheMathCompany) has demonstrated notable growth with a fourfold scale over the past two years as its revenue surged to Rs 420 crore in FY23 from Rs 103 crore in FY21. At the same time, the Bengaluru-based company’s profit declined significantly in the last fiscal year.

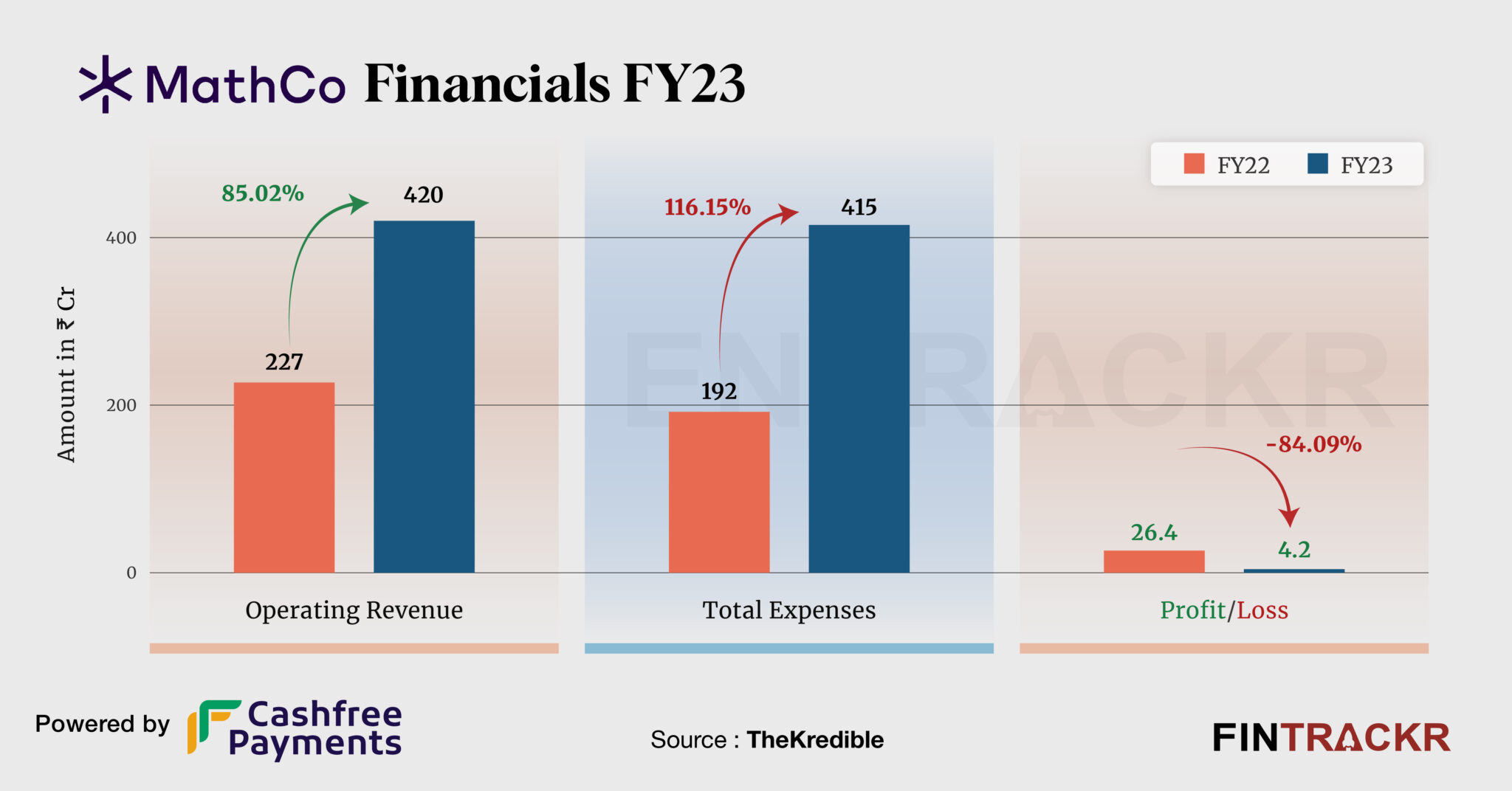

MathCo’s revenue from operations spiked by 85% to Rs 420 crore in the fiscal year ending March 2023 from Rs 227 crore in FY22, its consolidated financial statements with the Registrar of Companies show.

The MathCo is an artificial intelligence and machine learning firm that creates data-based AI modules to drive efficiency, productivity, and expedited decision-making capabilities for retail, healthcare, and consumer product companies. Revenue from the sale of user licenses for software applications is the sole source of revenue for MathCo.

The company has a presence in the US, UK, Singapore, Hong Kong, Europe, and the Middle East as well. Its 95% of the revenue came from outside India which increased 92.3% to Rs 400 crore in FY23.

Its employee benefits accounted for 82% of the overall expenditure. This cost increased 2.13X to Rs 341 crore in FY23 from Rs 160 crore in FY22. This also includes Rs 3 crore as ESOP cost.

Its advertising cum promotional, training recruitment, conveyance, rent, and other overheads took the overall cost up by 116.1% to Rs 415 crore in FY23 as compared to Rs 192 crore in FY22.

Head to TheKredible for the detailed expense breakup.

Expenses Breakdown

https://thekredible.com/company/themathcompany/financials

View Full Data

https://thekredible.com/company/themathcompany/financials

View Full Data

- Employee benefit

- Rent

- Information technology

- Travelling conveyance

- Training recruitment

- Advertising promotional

- Others

With over 2X growth in the overall cost, Match Co’s profits declined to Rs 4.2 crore in FY23 in contrast to Rs 26.4 crore in FY22. Its ROCE and EBITDA margin stood at 6.3% and 5.7% respectively. On a unit level, it spent Rs 0.99 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 17% | 5.7% |

| Expense/₹ of Op Revenue | ₹0.85 | ₹0.99 |

| ROCE | 12% | 6.3% |

MathCo has raised around Rs 390 crore to date including a $50 million round from Brighton Park Capital in January 2022. Soon after the fundraise, it also announced a $12 million ESOP buyback program for its employees. According to the startup data intelligence platform TheKredible Brighton Park Capital holds 16.01% stake in MathCo while its co-founders Sayandeb Banerjee, Sayandeb Banerjee, and Anuj Krishna Mandayam cumulatively command 59.7% of the company.