E-commerce-focused logistics company XpressBees raised $80 million, a mix of primary and secondary in its Series G round from Teachers’ Venture Growth (TVG), the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan in November last year.

While the Pune-based company did not disclose details of the round, Fintrackr has sifted through its regulatory filings to decode the round break-up, captable, and exact valuation.

XpressBees has raised Rs 574 crore or $70 million in the primary round by issuing 21,665 shares (as per the conversion ratio) at an issue price of Rs 2,48,274 per share. The rest of the amount will be pumped by buying back ESOPs or shares of existing shareholders.

The company will use these fresh proceeds for the growth and expansion of the business, the filings further said.

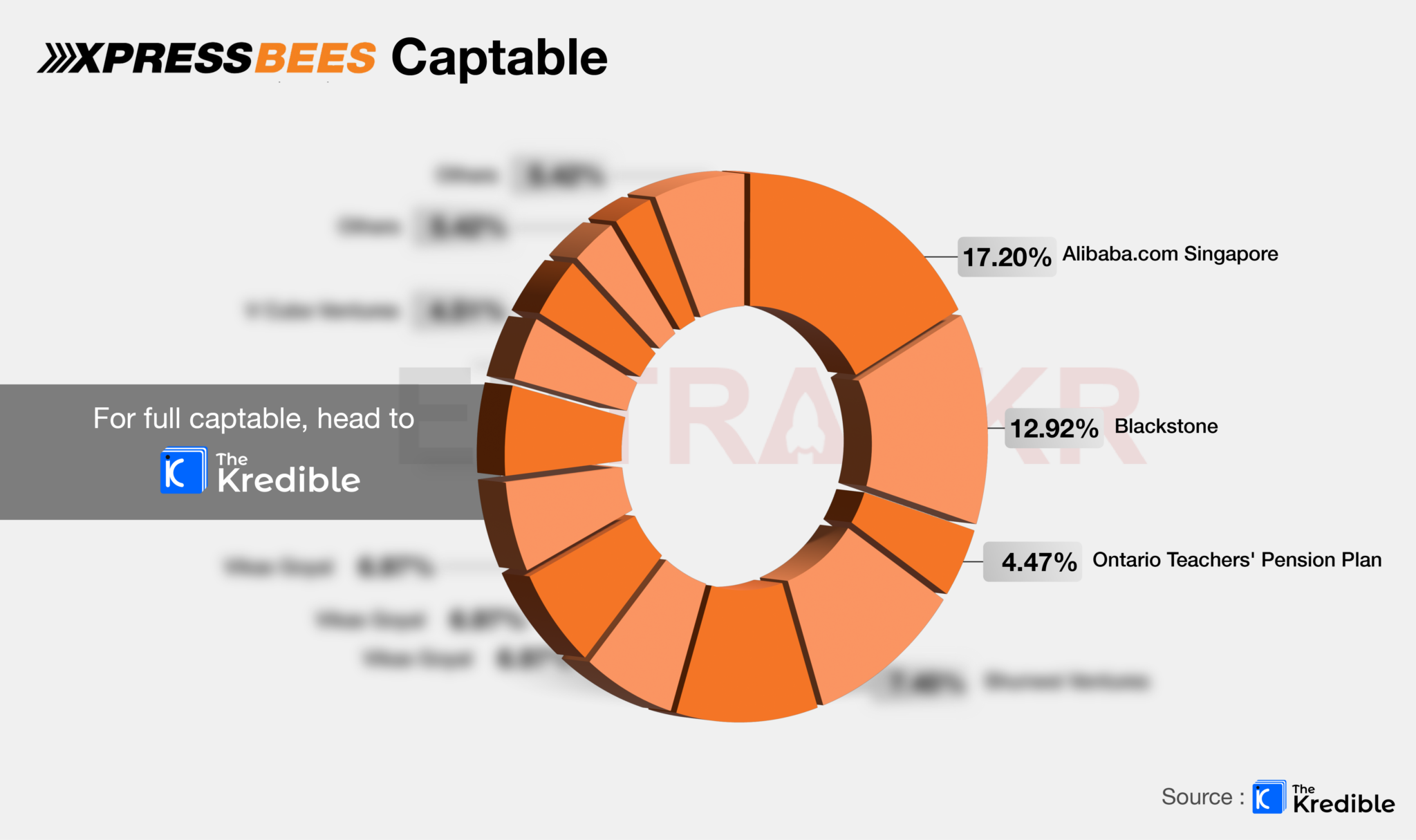

Following the latest investment, the new investor Ontario Teachers will hold 4.47% of the company. As per TheKredible estimates, the company has been valued at around Rs 12,450 crore or $1.5 billion post-allotment.

Just after the announcement of its Series G round, the board at Xpressbees has passed another resolution to offer a buyback for its employees worth Rs 55 crore. According to TheKredible estimates, their total ESOP pool stood at around $55 million.

XpressBees has raised over $390 million across rounds to date. Alibaba is the largest external stakeholder with 17.2% followed by Blackstone Growth and Norwest Ventures.

XpressBees also demonstrated strong financial performance in the last fiscal year as its operating revenue jumped 33% to Rs 2,531.5 crore with a loss of Rs 180.4 during the period. In the ongoing fiscal year, XpressBees also acquired the logistics and supply chain firm, Trackon. The deal marked the first acquisition for the Amitava Saha-led firm since its inception.