SaaS company Whatfix was in the news for hitting $50 million ( Rs 400 crore approximately) in annual recurring revenue (ARR) in May this year. While the company’s performance for the current fiscal year will be worth watching out for, in FY23 the firm managed to grow more than 65%.

Whatfix’s revenue from operations surged by 65.7% to Rs 285 crore in FY23 from Rs 172 crore in FY22, according to its consolidated financial statements filed with the Registrar of Companies.

Financial FY23

Operating Revenue

Total Expense

Profit / Loss

View Full Data

View Full Data

View Full Data

Whatfix generates its income primarily through software subscriptions and professional services that enable customers to utilize its hosted platform throughout the contract duration. These services are provided on a subscription basis.

Founded by Khadim Batti and Vara Kumar, Whatfix provides in-app guidance and performance support for web applications and software products. Its tools can be used by large companies and organizations, and integrate into their own apps to help guide the workforce in using them more efficiently.

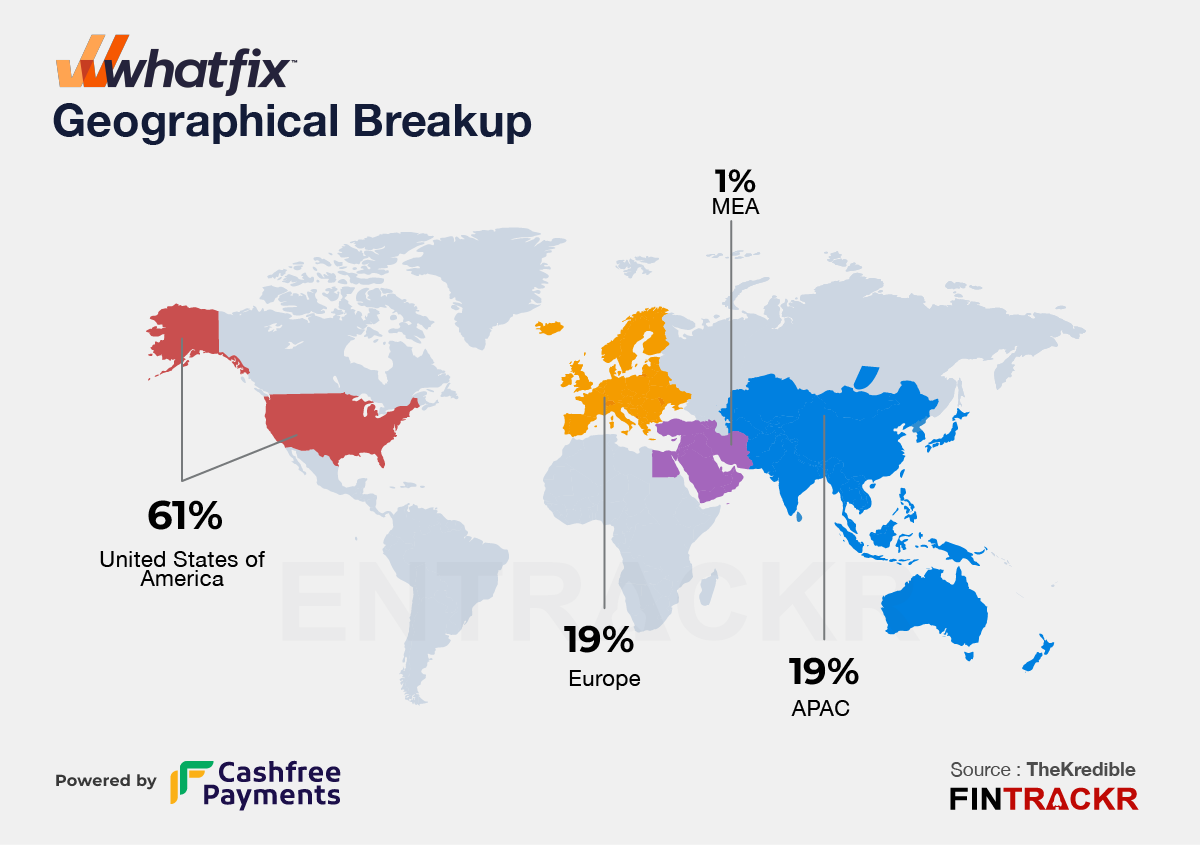

Importantly, Whatfix’s entire revenue came from global markets: America, Europe, Asia Pacific, and the Middle East region. About 61% of the revenue emerged from the US followed by Europe. Country-wise revenue breakup can be seen below:

Like several SaaS companies, Whatfix’s employee benefits accounted for the majority of expenses. In FY23, it formed 66% of the overall expenditure. With the increase in headcount, this cost elevated by 41% to Rs 416 crore in FY23 from Rs 295 crore in FY22. This includes Rs 23 crore as ESOP cost which is non-cash in nature.

Its information technology cost, legal professional fees, traveling conveyance, advertising, and other operating overheads pushed the overall expenditure 43.4% to Rs 631 crore in FY23 from Rs 440 crore in FY22.

Expense Breakdown

https://thekredible.com/company/whatfix/financials

View Full Data

https://thekredible.com/company/whatfix/financials

View Full Data

- Employee benefit expense

- Information technology expenses

- Legal professional charges

- Travelling conveyance

- Advertising promotional expenses

- Others

Even as the overall cost surge outpaced the revenue growth, resulted in a 31.2% increase in losses from Rs 250 crore in FY22 to Rs 328 crore in FY23. Its ROCE and EBITDA margin improved to -93% and -96% respectively in FY23. On a unit level, it spent Rs 2.21 to earn a rupee of operating revenue.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -124% | -96% |

| Expense/₹ of Op Revenue | ₹2.56 | ₹2.21 |

| ROCE | -41% | -93% |

According to the startup data intelligence platform TheKredible, Whatfix has raised over $140 million across rounds and was last valued at $595 million. Helion is the largest external stakeholder with 14.38% followed by SoftBank and EightRoad Venture. See, TheKredible for complete captable.

Recently, Economic Times reported that Whatfix is in talks with Warburg Pincus to raise a new round at a valuation of more than $800 million.

With its focus on employee training and content support, Whatfix has a large addressable market globally, explaining the rich valuations from investors despite the burgeoning losses. As the firm continues to perfect its offering and acquire more customers, the odds that these become sticky also increase, offering visibility on long term revenues. However, one wouldn;t venture to look too far out into the future, as this is the kind of model that, even as it promises to use AI to deliver better, is always at risk from a disruption from such technologies as well. That leaves the question wide open on whether Whatfix has a fix on its own long term sustainability.