Peak XV Partners’ Surge recently launched its ninth cohort focused on early-stage startups featuring 32 founders across 13 startups.

Notably, 10 out of the 13 startups are focused on AI and deeptech with companies in advanced manufacturing, quantum computing, climate tech, and health tech among others. Among the 13 startups, seven are based in India, four are from South East Asia, and two are based in Australia.

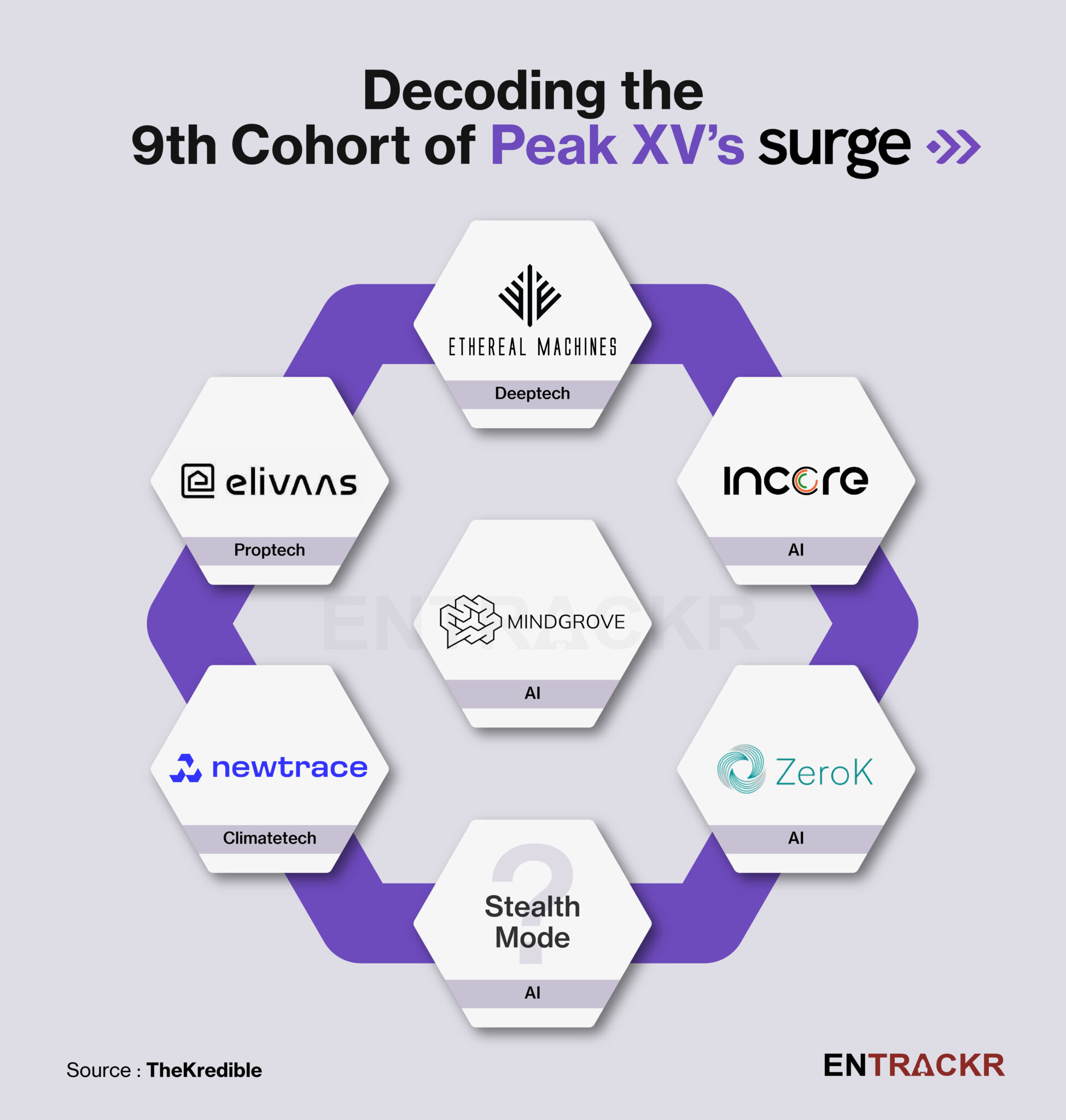

The Indian startups in the list are Ethereal Machines, Elivaas, Incore, Mindgrove, Newtrace and ZeroK while one startup is in stealth mode.

Startup data intelligence platform TheKredible has sifted through the regulatory filings of these startups to decode crucial details such as funding breakup, shareholding pattern and post-money valuation.

Ethereal Machines

Manufacturer of precision engineering components, Ethereal Machines raised $7.3 million or around Rs 60 crore in its Series A funding round led by Peak XV’s Surge with an infusion of Rs 23.35 crore. Elimath Advisors and Ganapathy Subramaniam invested Rs 7.5 crore each. A&E Investment, Blume Ventures, SAB Holdings, Saascorp Holdings and 9Unicorns poured in the remaining sum.

Following the capital infusion, the company has been valued at around Rs 175-190 crore. The company is yet to receive around Rs 16 crore in this round and the shareholding and valuation is based on the first tranche of Series A funding round. As per the documents sourced from RoC, the company has received only Rs 43.7 crore in Series A until now.

Post-allotment, Surge Ventures owns 17.6% stake in the company while Elimath Advisors and Ganapathy Subramanian command 4.27% and 6.64% respectively. Visit TheKredible for complete captable.

Elivaas

Villa and luxury apartment management startup, Elivaas raised $2.5 million in a seed round. Surge led the round with Rs 16.4 crore followed by Naveen Kukreja and Neetu Gujral who invested Rs 1 crore each.

Anant Kumar (Rs 50 lakh), Kunal Shah (Rs 35 lakh) and Mohit Gupta, Amit Lakhotia, Parag Aggarwal, Toranj S Mehta, Santosh Mohan and Ravi Singhvi invested Rs 25 lakh each.

The fresh capital infusion valued the company at Rs 91 crore. Peak XV Partners (Surge) acquired 18% stakes in the company while Naveen Kukreja and Neetu Gujral got 1.6% shares each. Visit here for more details.

Incore

Provider of RISC-V-based processor solutions, Incore received an investment of Rs 24.6 crore from Peak XV Partners (Surge) in its seed funding round. Following this, the company’s valuation stands at Rs 168 crore.

Post-allotment of the round, co-founders – G S Madhusudan, Neel Gala and Arjun Menon diluted their stakes to 23.4% each while Peak XV Partners acquired 14.63% of the company.

Visit TheKredible for more about the company’s funding, financial details and captable.

Mindgrove

Provider of System-on-Chips solutions (SoCs), Mindgrove raised Rs 19.1 crore in Surge’s 9th cohort. While Peak XV Partners led the round with Rs 16.4 crore, it also saw participation from Special Invest, Whiteboard Capital, and Nischay Goel putting in smaller amounts of Rs 1.5 crore, Rs 0.8 crore, and Rs 0.28 crore respectively.

Being its maiden round, the AI startup accumulated over Rs 19 crore in funding and was valued at Rs 60 crore post the cohort. Peak XV holds 27.31% of the company shares, just a second to the 44.46% held by the CEO and co-founder T.R. Shashwath. Special Invest and Whiteboard Capital hold 2.46% and 1.31% respectively.

Visit here for more details on Mindgrove.

Newtrace

Manufacturer of electrolyzers to produce green hydrogen Newtrace raised a total of Rs 46.91 crore in its seed round led by Peak XV Partners. While Surge’s parent entity put in a total of Rs 22.84 crore, other venture capitals like Aavishkaar Capital, and Speciale Invest invested Rs 9.22 crore and Rs 7.55 crore respectively. Micelio, Ashish Goel, and IKP Knowledge Park were others that invested a significant amount in the round.

Speciale Invest has acquired 12.65% of the company whereas Peak XV Partners and Aavishkaar Capital held 11.16% and 4.50% stake respectively.

The Bengaluru-based company’s valuation stands at Rs 204.7 crore post the recent round. So far, the climate tech company has raised a total of Rs 54.7 crore over 2 funding rounds.

Visit TheKredible for complete shareholding and financials.

ZeroK

ZeroK, which offers troubleshooting solutions to developers, is based out of the US, hence the details about the company could not be ascertained.

Led by Varun Ramamurthy Dinakar, Mudit Krishna Mathur, Shivam Nagar and Samyukktha Thirumeni, ZeroK is an AI platform that helps developers troubleshoot production incidents faster. ZeroK is an Observability copilot that intelligently performs checks to guide developers to root causes faster, reducing downtime.