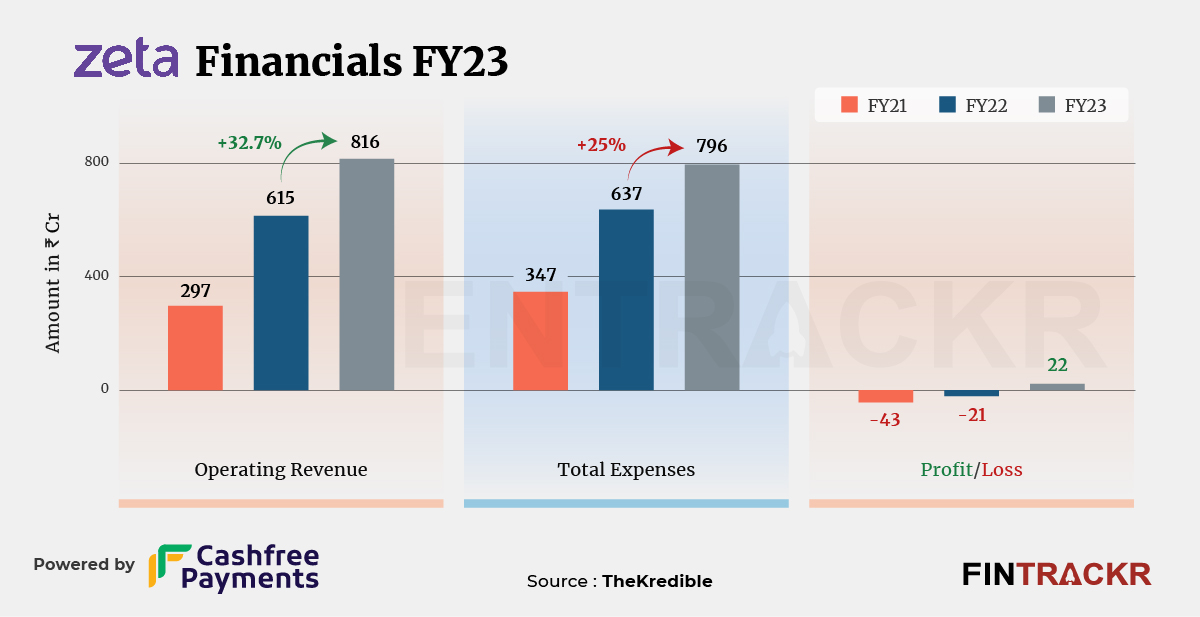

The India entity of the banking tech firm Zeta maintained its upward momentum in the fiscal year ending March 2023. Moreover, it turned profitable in the said period as well. The milestone comes despite the company not matching the growth levels of the previous fiscal year (FY22).

Zeta India’s revenue from operations grew by 32.7% to Rs 816 crore in FY23 from Rs 615 crore in FY22, according to its annual financial statement filed with the Registrar of Companies.

Zeta is designed for financial institutions, encompassing credit, DDA, prepaid, loans, savings, processing, authentication, and FRM solutions. It offers services such as credit and debit card processing, and APIs to operate natively within cloud-native apps.

The sale of software development services is the only source of revenue for the company. With a global presence in 7 countries, the firm generated 76% income from outside India.

Similar to several SaaS companies, Zeta’s employee benefits accounted for the majority of expenses. In FY23, it formed 79% of the overall expenditure. This cost increased by 22.7% to Rs 632 crore in FY23 from Rs 515 crore in FY22. This includes Rs 68.3 crore as ESOP cost which is non-cash in nature.

Expenses Breakdown

https://thekredible.com/company/zeta/financials

View Full Data

https://thekredible.com/company/zeta/financials

View Full Data

- Employee benefit expense

- Legal professional charges

- Subscriptions membership fees

- Rent

- Others

Its subscription, server, rent, and legal/professional cost took the overall expenditure by 25% to Rs 796 crore in FY23 from Rs 637 crore in FY23.

The decent scale and controlled expenditure helped the company to turn profitable in FY23. The company posted Rs 22 crore in profits (PAT) during the previous fiscal year as compared to Rs 21 crore loss in FY22. Its EBITDA margin improved to a positive 4.3% On a unit level, it spent Rs 0.98 to earn a rupee of operating revenue during FY23.

Zeta turned unicorn in May 2021 following a $250 million round led by SoftBank. The company also raised $30 million from Mastercard at a valuation of $1.5 billion.