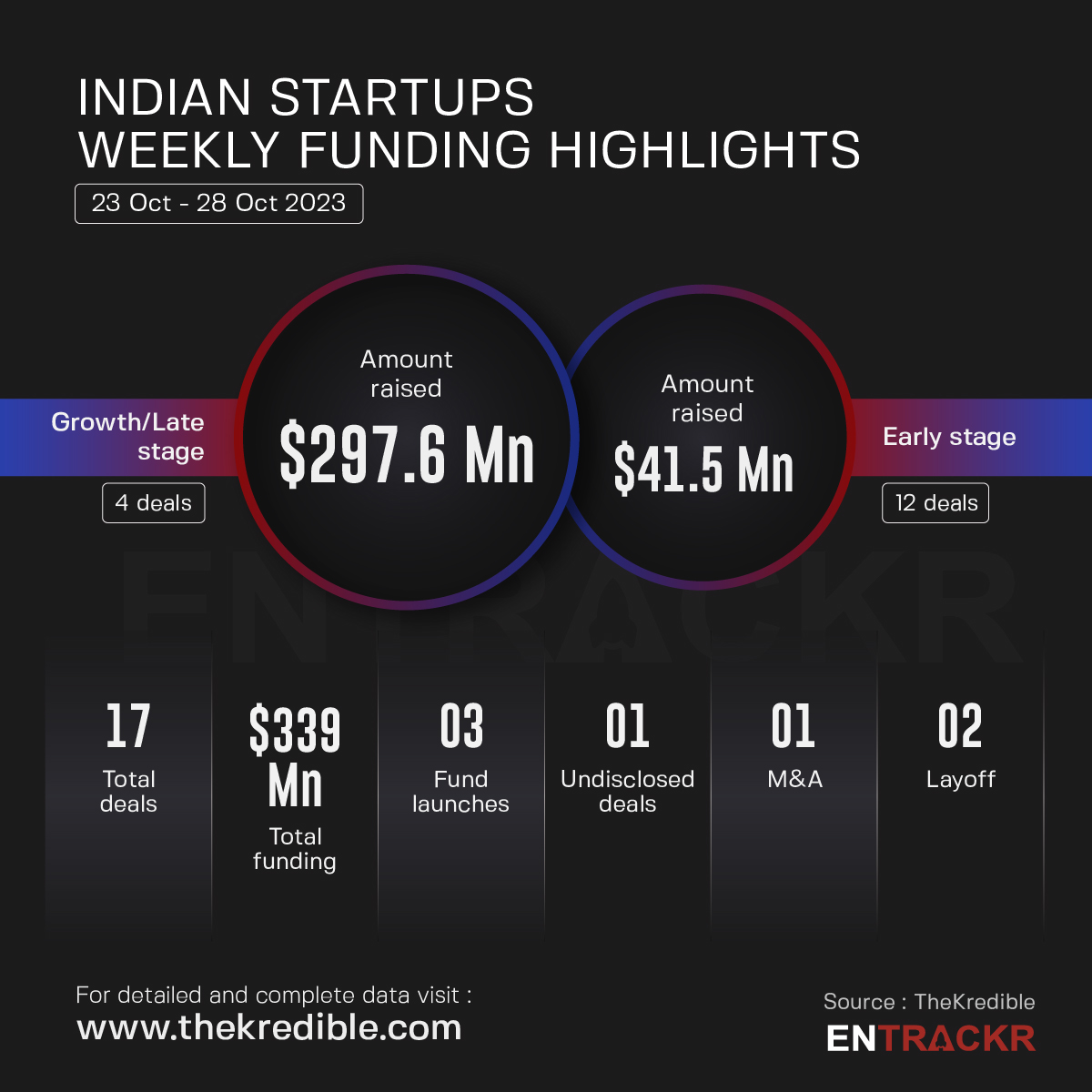

This week, 17 Indian startups raised about $339 million in funding. Electric vehicle manufacturer Ola Electric alone raised a $240 million Series E funding round. Importantly, this deal accounts for nearly 71% of the overall funding raised during the week.

Last week, 26 startups cumulatively raised around $244 million while the amount of four deals remained undisclosed.

[Growth-stage deals]

During the week, four growth-stage startups raised funding. The list counts electric vehicle manufacturer Ola Electric, EV firm PMI Electro and e-commerce company The Indian Garage Co. It’s worth highlighting that Ola Electric already raised the first tranche ($140 million) of this round in September.

Further, QSR platform Wow! Momo secured $9 million in its ongoing Series D round.

[Early-stage deals]

In early-stage deals, e-commerce brand Inc.5 led the pack with its Series A funding round subsequently SaaS platform Blubirch picked up capital from Cornerstone Ventures and Capital 2B.

Other firms in the list include Olive Gaea, Escrowpay, GigaML, Garuda Aerospace and Proost Beer among others.

Besides this, the details of one funding deal remained undisclosed which include workspace marketplace Qdesq’s funding round led by Gruhas. For more information, visit TheKredible.

[City and segment-wise deals]

This week, once again Bengaluru-based startups featured on top in terms of number of funding deals as well as amount raised. As per TheKredible, eight Bengaluru-based startups raised funds this week amounting to $277.1 million or 81.7% of the total funding. Delhi-NCR, Mumbai, and Kolkata-based startups are next on the list in terms of number of deals.

The complete breakdown of city and segment can be found at TheKredible.

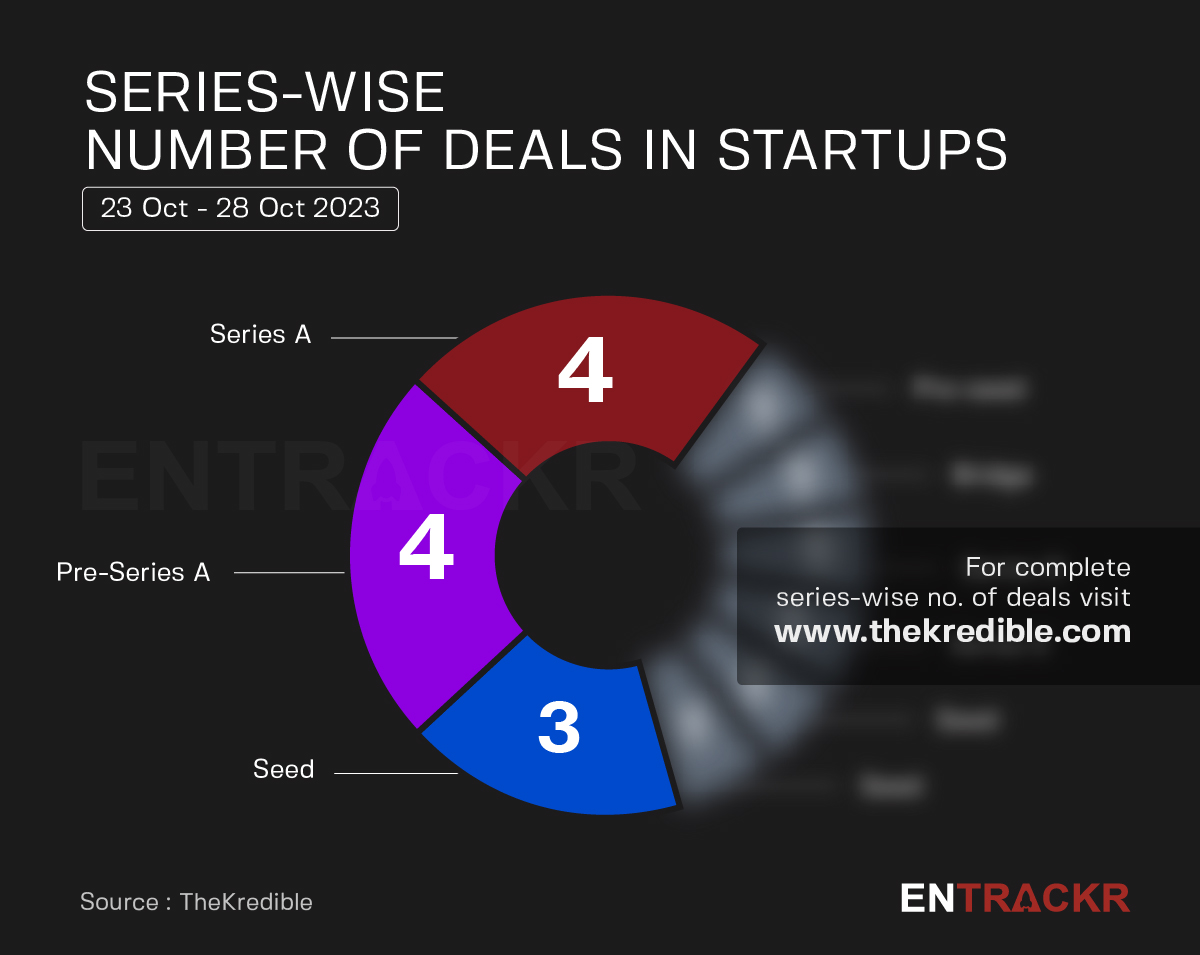

[Series wise deals]

Series A and pre-Series A stage startups dominated the chart with four deals each. This was followed by Seed, Series E, Series C, Series B, Series D and Bridge funding deals.

[Week-on-week funding trend]

On a weekly basis, after crossing the $244 million mark last week, startup funding surged nearly 40% to $339 million. Considering the last eight week’s funding trend, the average funding stands close to $246 million.

[Layoffs, Shutdowns & Departures]

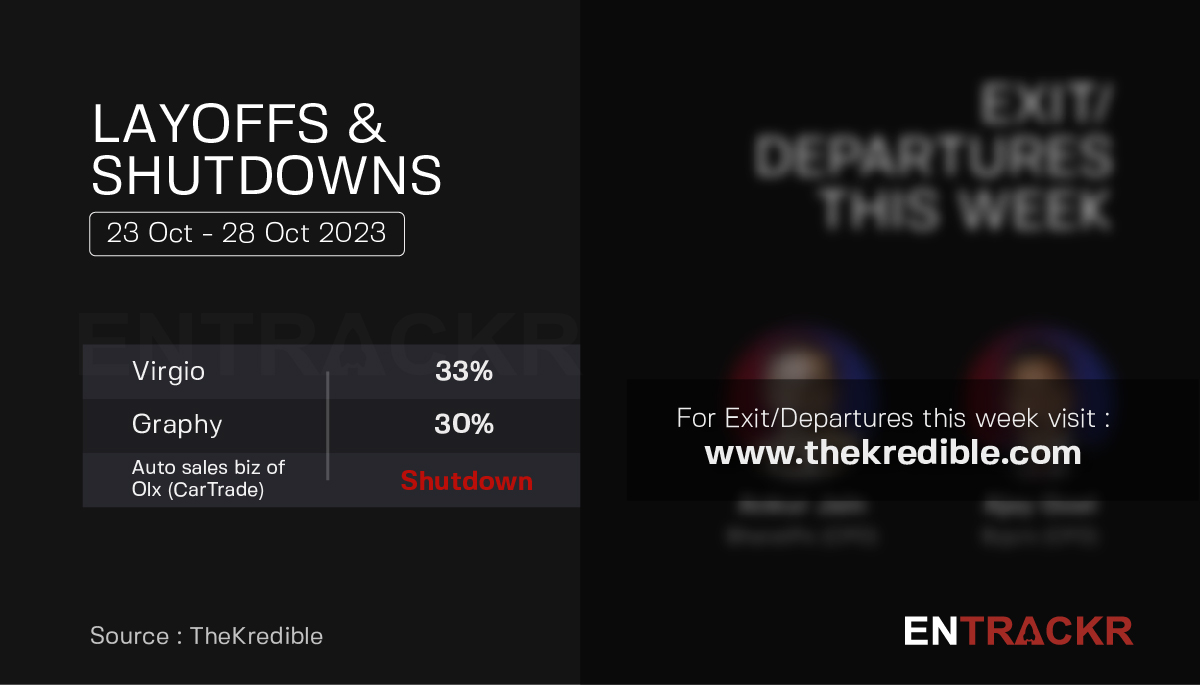

This week, fashion tech startup Virgio fired around 33% of employees across verticals whereas Unacademy’s Graphy fired 30% of its total workforce. Meanwhile CarTrade is shutting down the auto sales biz of OLX.

Visit TheKredible to see fund launches, series wise deals and amount breakup, and more insights.

[Fintrackr’s picks]

[Entrackr’s exclusives]

[News flash this week]

[Entrackr’s analysis]

On the back of new funding for two electric vehicle focused startups, Ola Electric and PMI Electro, the investment in Indian startups reached a new high this week. Importantly, State Bank of India has alone pumped in $240 million in Ola Electric as debt. However, the $18 million investment from Aditya Birla Group’s house of brands business TMRW in D2C brand The Indian Garage Co (TIGC) was the surprise deal of the week.