Wealth and asset management company Neo recently announced raising a $35 million round from Peak XV Partners. The company said it plans to use the funds to develop and expand the wealth management business, deepen the asset management franchise, and hire fresh talent.

While the company did not disclose the crucial details such as post-money valuation and shareholding pattern, startup data intelligence platform TheKredible has sifted through the regulatory filings to decode the key details.

The board at Neo passed a special resolution to issue 10 equity shares and 10,120 Series A compulsory convertible preference shares at an issue price of Rs 2,87,716 per share to raise Rs 291.45 crore or $35 million from the venture capital firm Peak XV Partners (formerly Sequoia Capital).

Launched by Nitin Jain in 2021, Neo provides clients, who are some of the top billionaires in the country, with advisory and yield-based investment solutions which it claims to deliver in a transparent and cost-effective manner.

As per TheKredible’s estimates, the company’s valuation jumped around 3X to Rs 1,366 crore or $165 million (post-money).

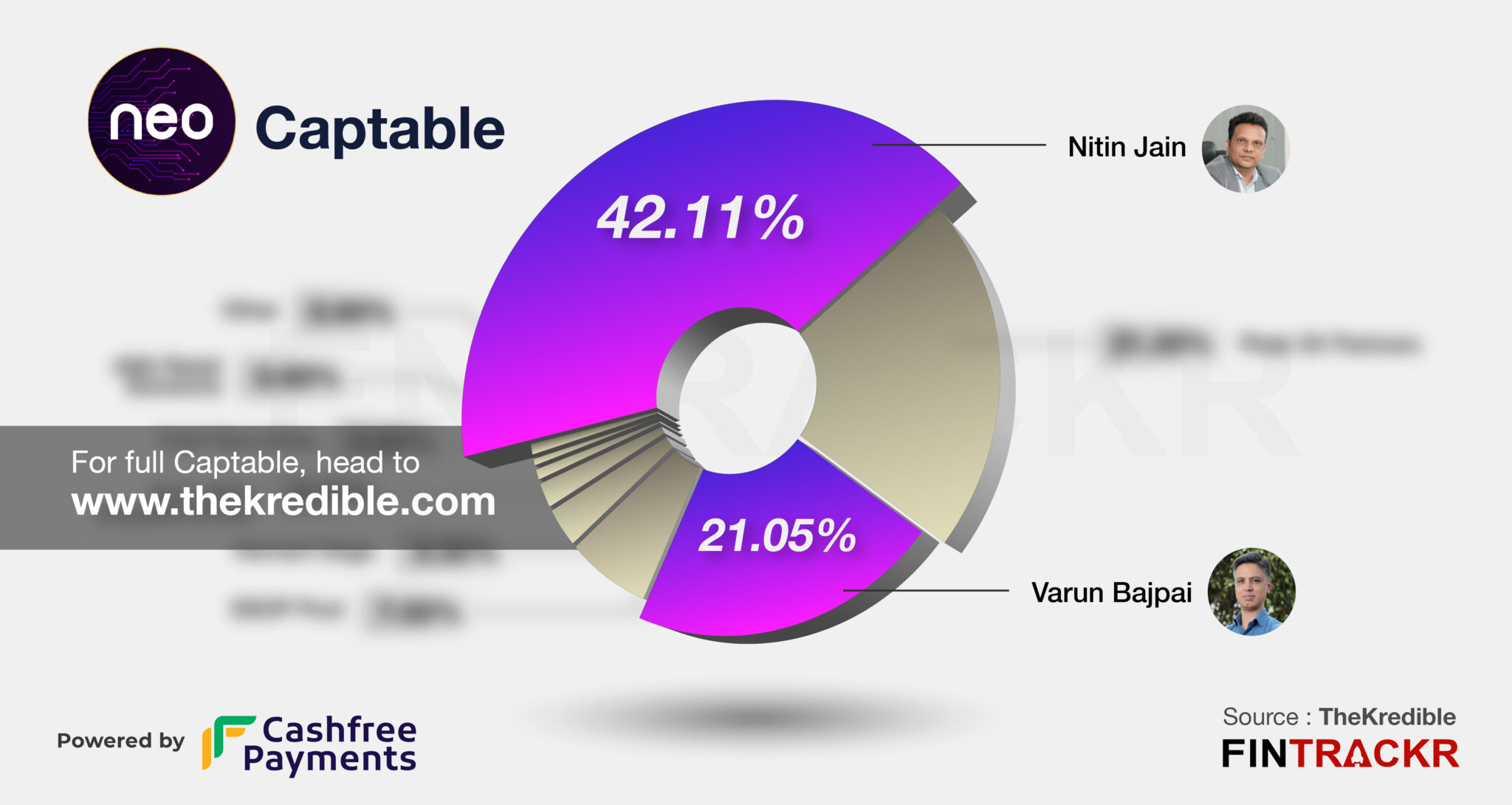

Following the capital infusion, founder Nitin Jain and CEO Varun Bajpai own around 42% and 21% stake in Neo respectively. Peak XV Partners took over significant shares in the company. Moreover, Hemant Daga and Aniruddha Gopalakrishnan also command stake in the company. For complete shareholding structure, visit TheKredible.

As per Neo, it has more than 1,000 clients across high-net-worth individuals, ultra-high net worth individuals and multi-family office segments. It also serves global institutions such as pension funds, insurance companies, endowments, and sovereign wealth funds, among others.

The two-year-old company also claims that it has more than $3 billion (close to Rs 25,000 crore) in assets under advisement (AUA), including $360 million (around Rs 3,000 crore) in assets under management (AUM).

Including the fresh infusion, Neo has raised around $40 million or Rs 340 crore to date across three funding rounds from the likes of Hemant Daga, Aniruddha Gopalakrishnan, Yukti Securities, ASA Retail Solutions among others.

Neo is yet to disclose its FY23 numbers. During FY22, it recorded a consolidated operating revenue of Rs 7.06 crore with a loss of Rs 6 lakh. However, on the standalone basis, the company posted a profit of Rs 11 lakh during the period (before the adjustment of minority interest). For context, Neo controls four subsidiaries including Nieuwe Tech Server, Neo Wealth Management, Neo Asset Management, and Neo Market Services.