Artificial Intelligence firm Fractal is among handful of unicorns to post a profit in FY23 as the company came into the black in the last fiscal year (FY23) with decent growth in contrast to FY22 when it slipped in losses.

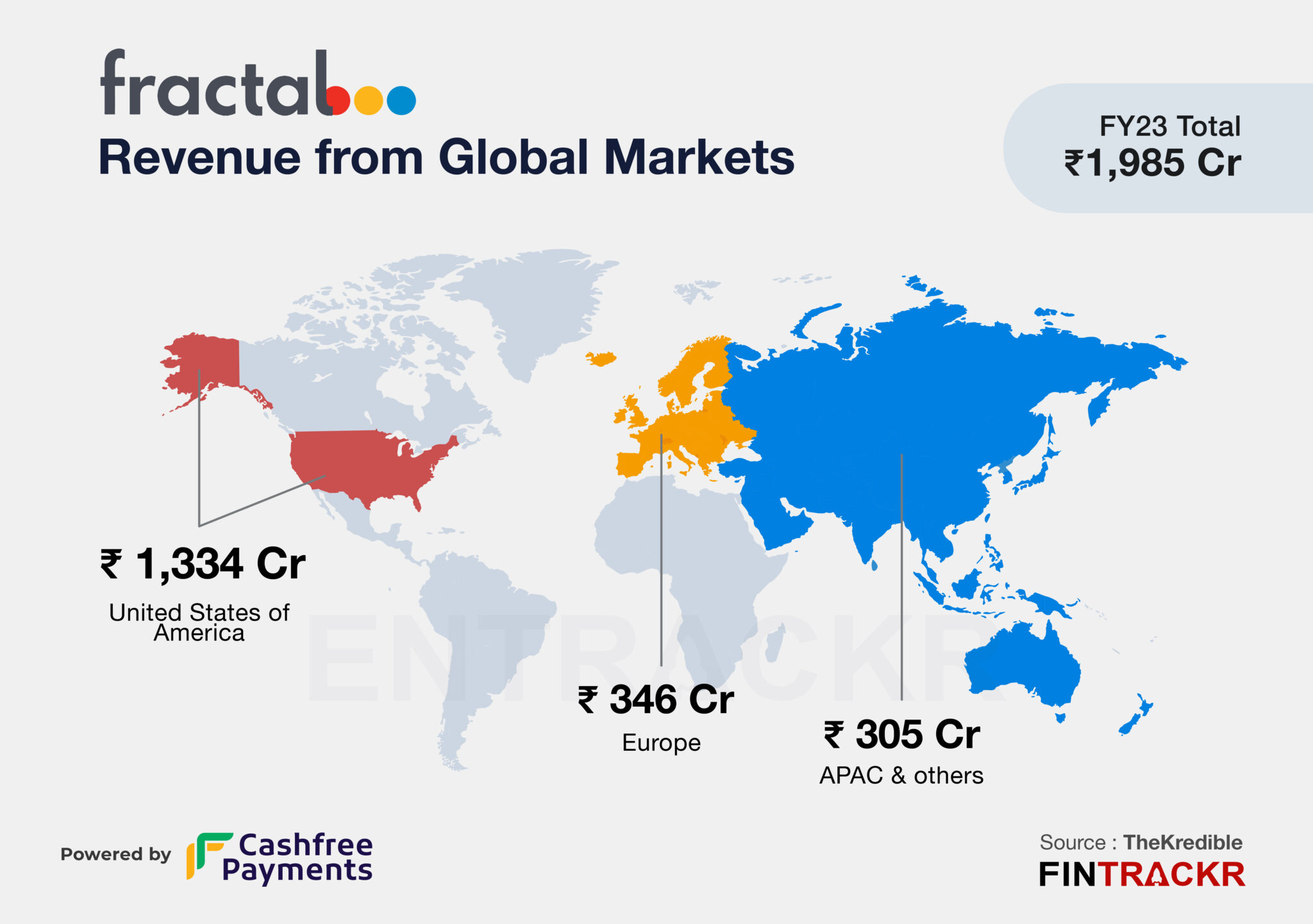

Fractal’s revenue from operations grew 53.3% to Rs 1985 crore in FY23 from Rs 1295 crore in FY22, according to its consolidated financial statements filed with the Registrar of Companies (RoC).

Financial FY23

Operating Revenue

Total Expense

Profit / Loss

View Full Data

View Full Data

View Full Data

Fractal is a prominent player in the Artificial Intelligence(AI) space with a product portfolio: Qure.ai, Crux Intelligence, Theremin.ai, Eugenie.ai and Samya.ai. Income from analytics and consulting services accounted for 98.5% of the total revenue which grew 57.2% to Rs 1,955 crore in FY23. The rest of the collections come from licenses and subscriptions.

Revenue Breakdown

https://thekredible.com/company/fractal/overview

View Full Data

USA, which is the company’s headquarters, remained the largest revenue market for Fractal, accounting for 67.2% of the total income while Europe and Asia Pacific region collected 17.4% and 15.4% respectively in FY23.

On the expense side, employee benefits constituted 79.4% of the overall expenditure. This cost elevated 59.5% to Rs 1,767 crore in FY23 from Rs 1,108 crore in FY22. This includes Rs 159 crore as ESOP expenses. Its IT cost, legal and professional fees, advertising, and outsourced manpower cost took the overall expenses 52.3% to Rs 2,225 crore in FY23 from Rs 1,461 crore in FY22.

Expense Breakdown

https://thekredible.com/company/fractal/overview

View Full Data

https://thekredible.com/company/fractal/overview

View Full Data

- Employee benefit expense

- Legal professional charges

- Software and maintenance

- Outsourced manpower cost

- Advertising promotional expenses

- Others

The measurable growth and controlled expenditure helped the company churn out a profit of Rs 194.4 crore in FY23 as compared to Rs 14.84 crore in FY22. Importantly, the profits were derived from the gain of Rs 541 crore which has been recorded under exceptional items and deferred tax liability.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -4.93% | -2.84% |

| Expense/₹ of Op Revenue | ₹1.13 | ₹1.12 |

| ROCE | -9.26% | -7.41% |

Its ROCE and EBITDA margin stood at -7.41% and -2.84% respectively. On a unit level, it spent Rs 1.12 to earn a rupee of operating revenue in FY23.

Fractal has raised around $685 million to date including its $360 million round, where the Srikanth Velamakanni and Pranay Agrawal-led company turned unicorn. According to the startup data intelligence platform The Kredible, Apax Partners is the largest external shareholder with 28.74% followed by TPG growth. Check TheKredible to see the complete shareholding pattern.

For Fractal, the AI connect has been a presence from the beginning, and the firm finds itself well placed to build on it now, when awareness of its possibilities is no longer an issue with potential clients. The ‘product’ portfolio is not as productised as one would like perhaps, considering the high employee costs and the consulting focus the firm has retained. With operating profits still elusive, the firm will find that a very useful short term target, to possibly consider the IPO route in a receptive market.