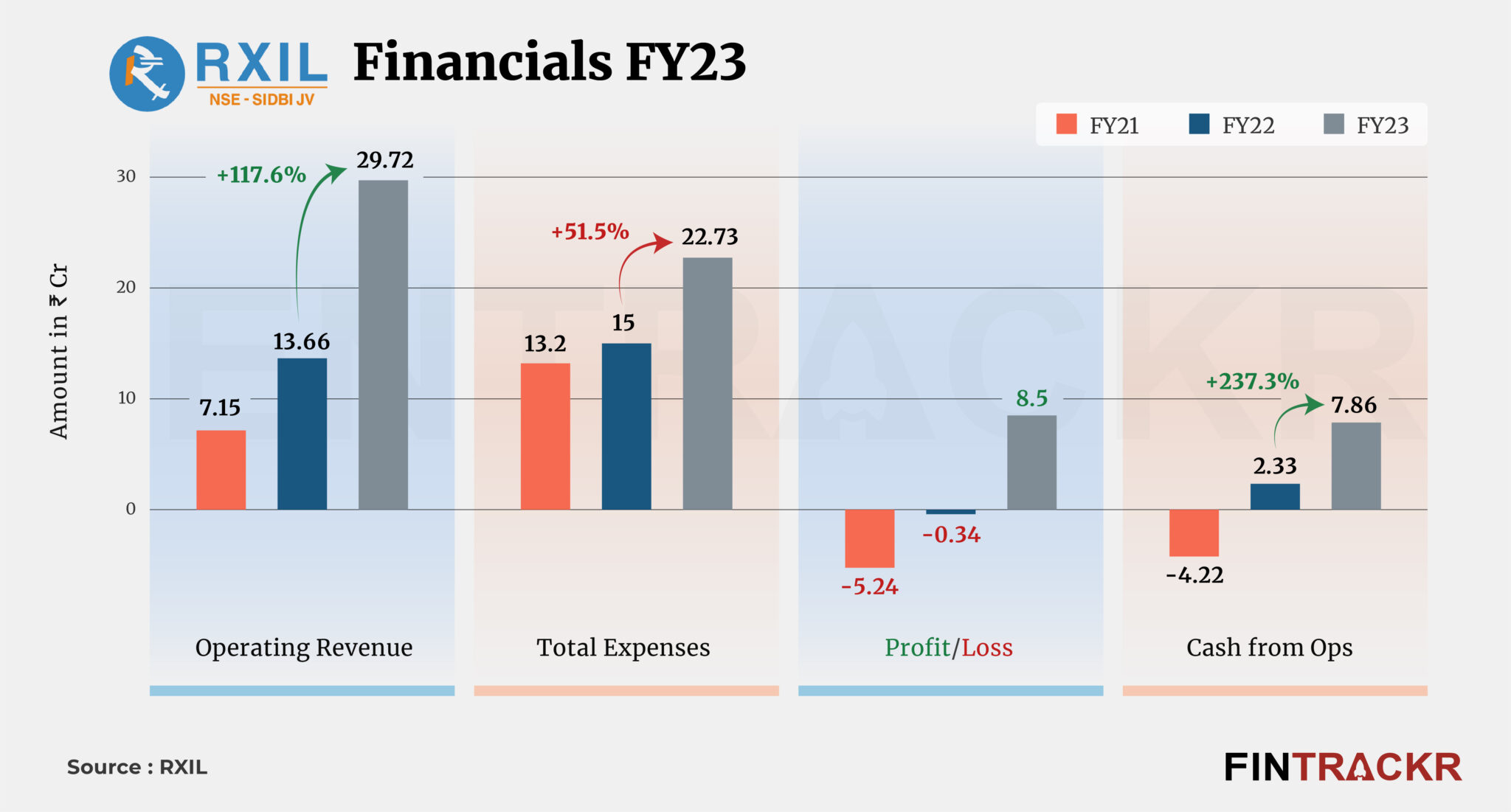

RXIL (Receivables Exchange of India Limited), a Mumbai-based firm that facilitates digital invoicing and discounting for MSMEs, corporates and financiers, has witnessed over four-fold growth in collection between FY21 and FY23.

RXIL managing director and CEO Ketan Gaikwad told Entrackr that the company collected Rs 30 crore during FY23 and turned profitable during the fiscal year.

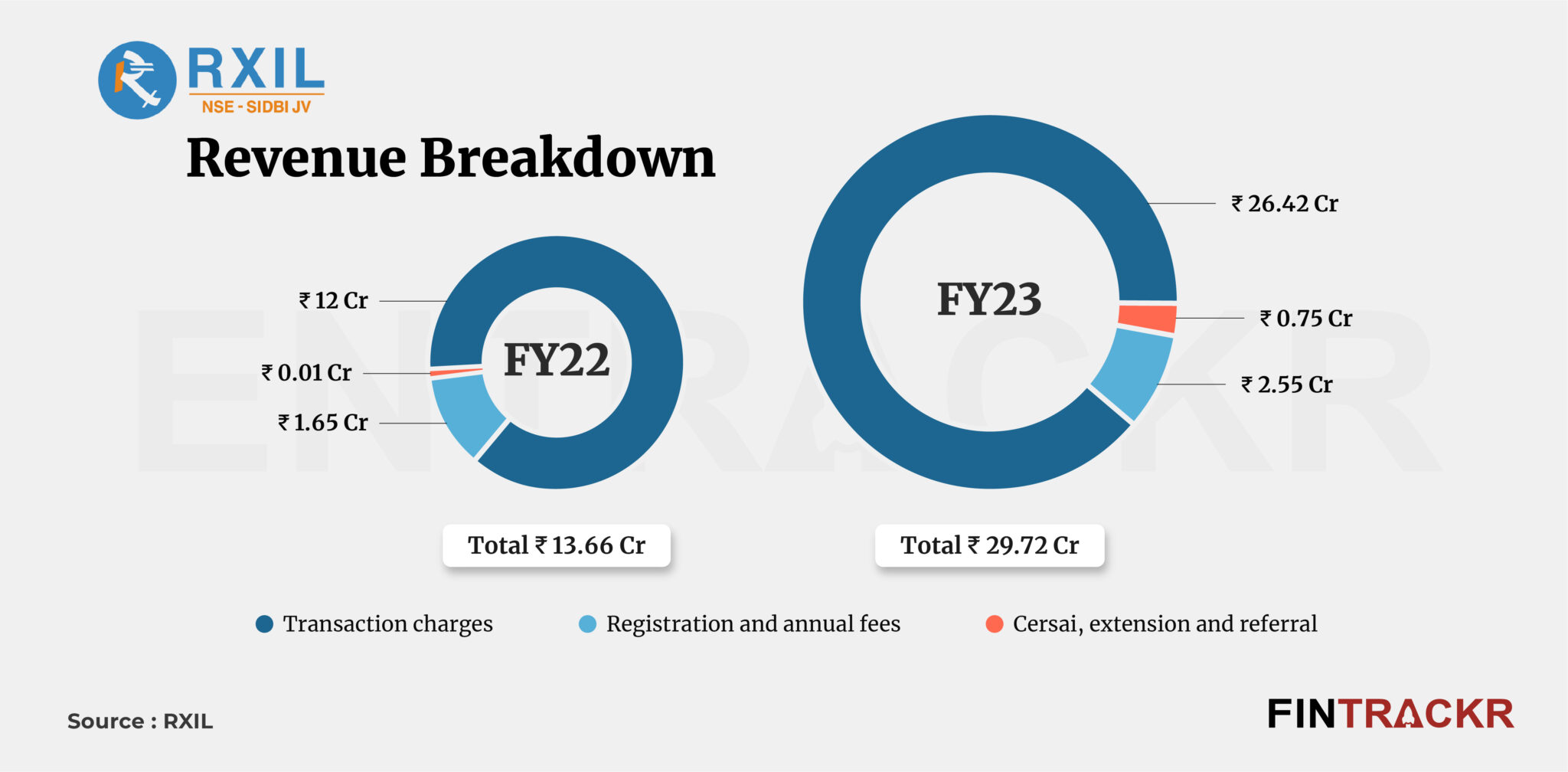

For background, the firm posted Rs 13.66 crore revenue from operations in FY22, according to the company’s FY22 annual financial report with the Registrar of Companies (RoC).

Gaikwad further disclosed that earnings from transaction charges accounted for 89% of the total revenue. This income surged 2.2X to Rs 26.42 crore during FY23 from Rs 12 crore in FY22, he added.

“We also made Rs 2.55 crore via registration and annual fees while the remaining came through CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest) fee, extension and referral,” he said.

CERSAI is a government company which operates to prevent fraudulent lending practices related to equitable mortgages with a primary purpose is to centralize and maintain records of mortgages on properties, ensuring transparency and discouraging the misuse of assets for multiple loans.

The company also earned Rs 1.5 crore as interest and gain on financial assets during FY23, taking the firm’s overall revenue to Rs 31.22 crore.

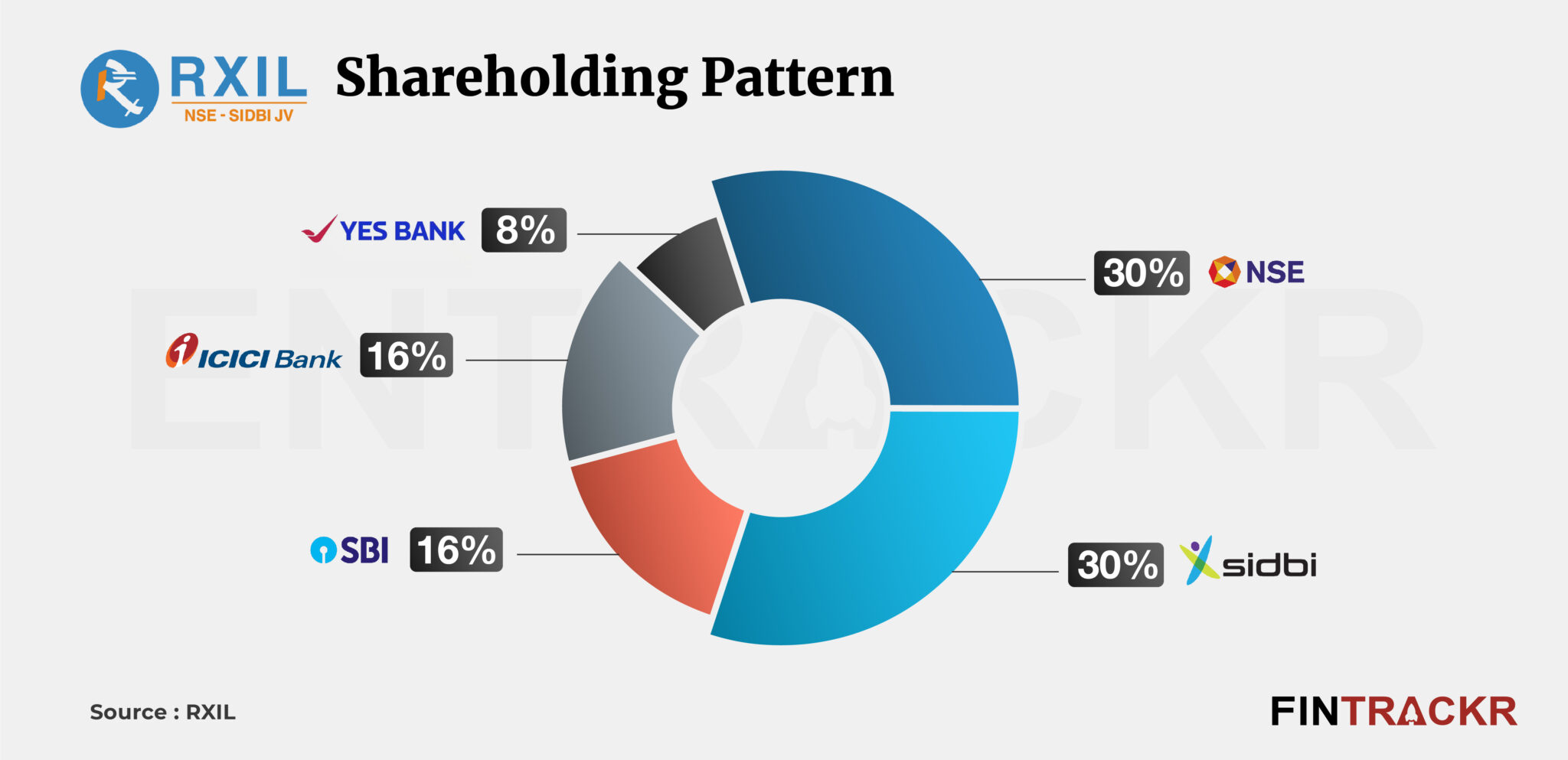

RXIL is a joint venture promoted by SIDBI (Small Industries Development Bank of India) and NSE (National Stock Exchange). The platform enables discounting of invoices/bills of exchange. Notably, RXIL is the only platform to operate domestic as well as international as the company also operates globally via its wholly owned subsidiary, RXIL Global IFSC Ltd.

NSE Investments Ltd (wholly owned subsidiary of NSE) and SIDBI own 30% stakes each in RXIL. SBI and ICICI Group command 16% shares each while the remaining 8% is held by Yes Bank.

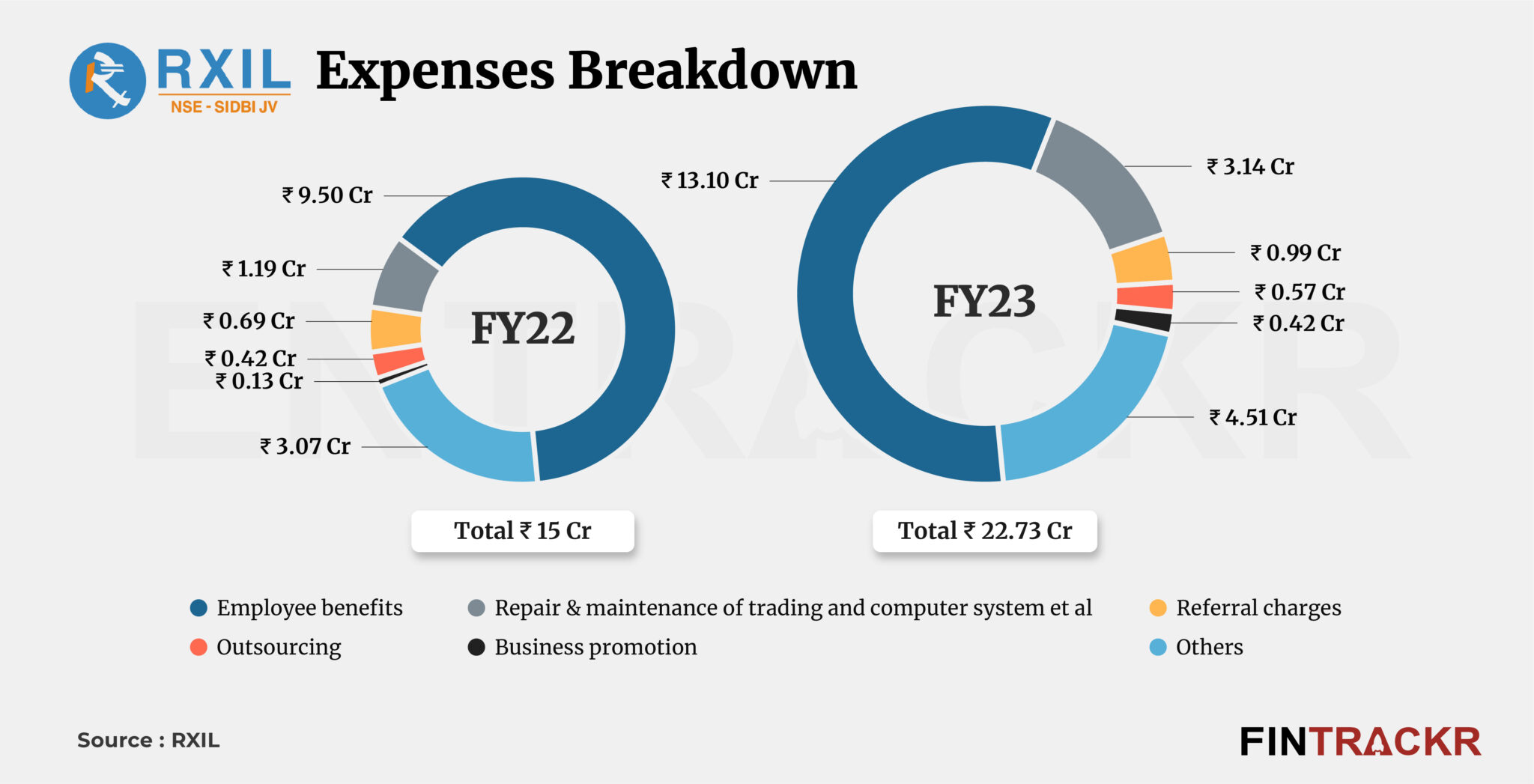

According to the CEO, RXIL spent around Rs 13.1 crore on employee benefits in FY23 and its total expenditure stood at around Rs 22.73 crore during FY23. “We turned profitable in the last fiscal and grossed Rs 8.5 crore in profit after tax (PAT),” emphasized Gaikwad.

On a unit level, the company spent Re 0.76 to earn a rupee of operating income. Followed by improved financial performance, EBITDA margin and ROCE of the company also strengthened to 31.65% and 25.35% during FY23.

RXIL directly competes with M1xchange which recorded over 2X growth in scale to Rs 29.52 crore in FY23 from Rs 14.32 crore in FY22. Unlike RXIL, M1xchange booked a loss of Rs 7.92 crore during the last fiscal year.

However the loss of Rs 7.92 crore posted on a consolidated level which include the parent, Mynd Solutions Pvt Ltd (M1xchange) and its two subsidiaries. On a standalone level, M1xchange posted a profit of Rs 1.64 crore during FY23.

Testing 1

Financials FY23

466.5

113.3

414.4

98.3

41.23

11.68

Testing 2

Financials FY23

466.5

113.3

414.4

98.3

-41.23

-11.68

Testing 3

Financials FY23

2500

7500

2000

6000

500

1500

Testing 4

Financials FY23

2500

7500

3000

9000

-500

-1500

Update at 9 AM, Sep 27: The story has been updated to reflect M1xchange’s profitability on a standalone basis.