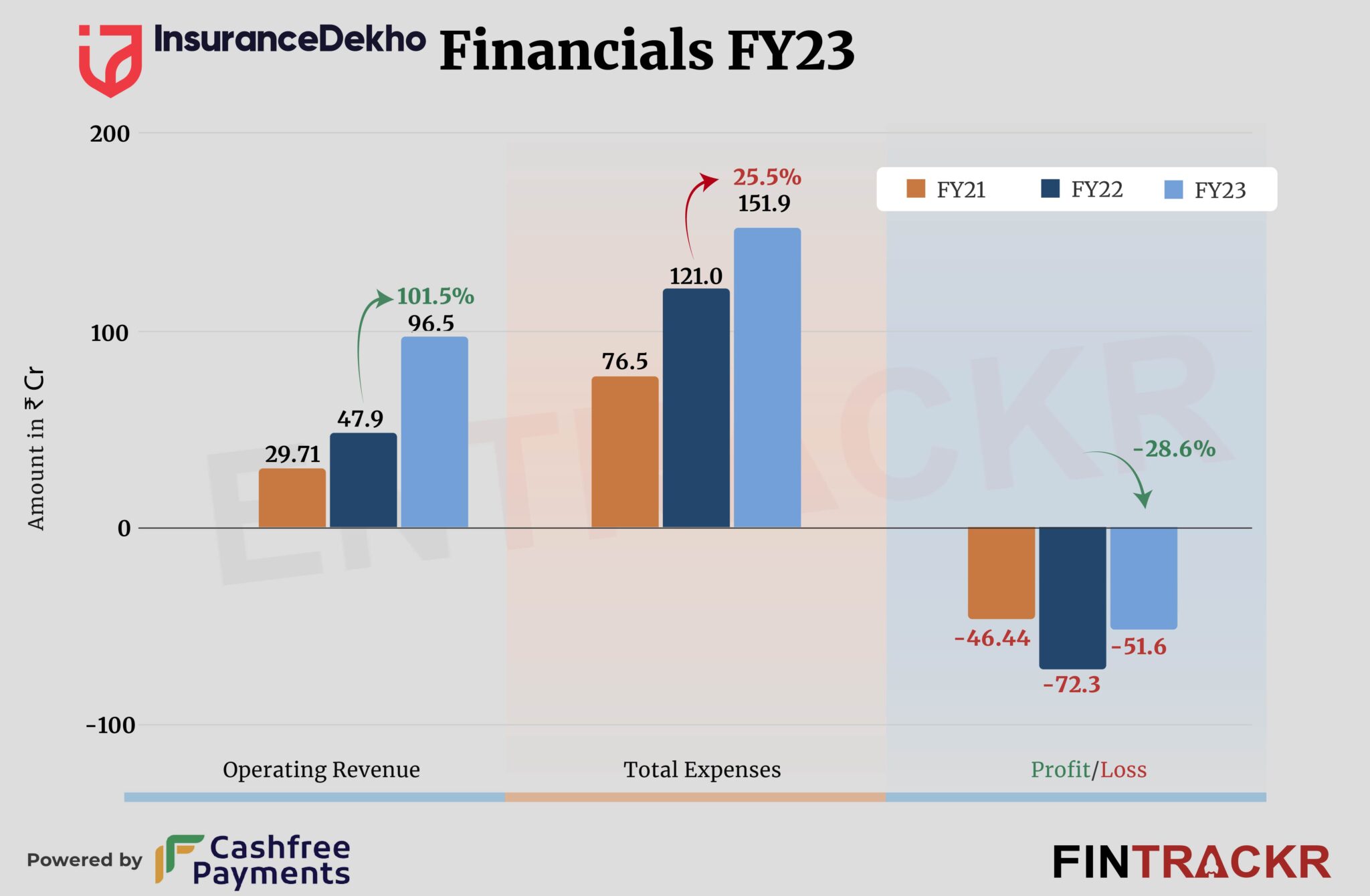

Insurtech firm InsuranceDekho raised $150 million at the end of the last fiscal year and the full impact of the big funding round on its scale will probably be seen after the end of the ongoing fiscal (FY24). However, the company saw a two-fold jump in its operating income in FY23.

InsuranceDekho posted Rs 96.5 crore income in FY23 as compared to Rs 47.9 crore in FY22, according to its standalone annual financial statement filed with the Registrar of Companies.

The company is an online marketplace that lets you compare and buy third party insurance policies for vehicle, health, life and more. The income derived from brokerage fees paid by insurance providers after the sale of policies was the sole source of collections for Insurance Dekho.

InsuranceDekho claims to have direct integration with nearly 50 insurers which offer more than 400 products for health, life, motor and others.

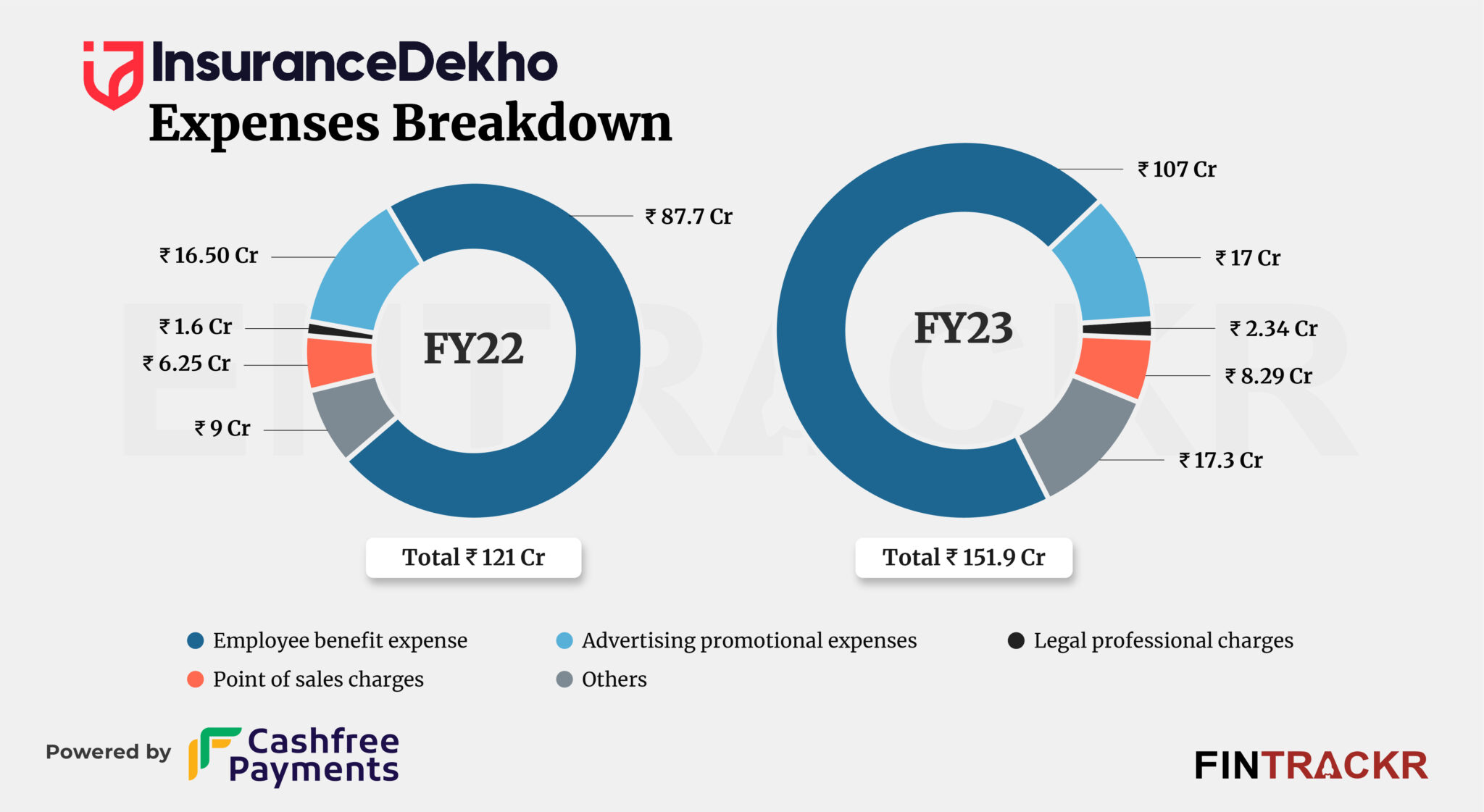

Employee benefits formed 70.4% of the overall expenditure for the Goldman Sachs-backed company. This cost surged 22% to Rs 107 crore in FY23 and includes Rs 30.82 crore as ESOP cost (non-cash in nature).

Its advertising cost remained flat at Rs 17 crore in FY23 while legal and professional fees rose 46.3% to Rs 2.34 crore during FY23. The company added another Rs 8.29 crore towards point-of-sale charges in FY23. Its overall costs stood at Rs 151.9 crore during the previous fiscal year.

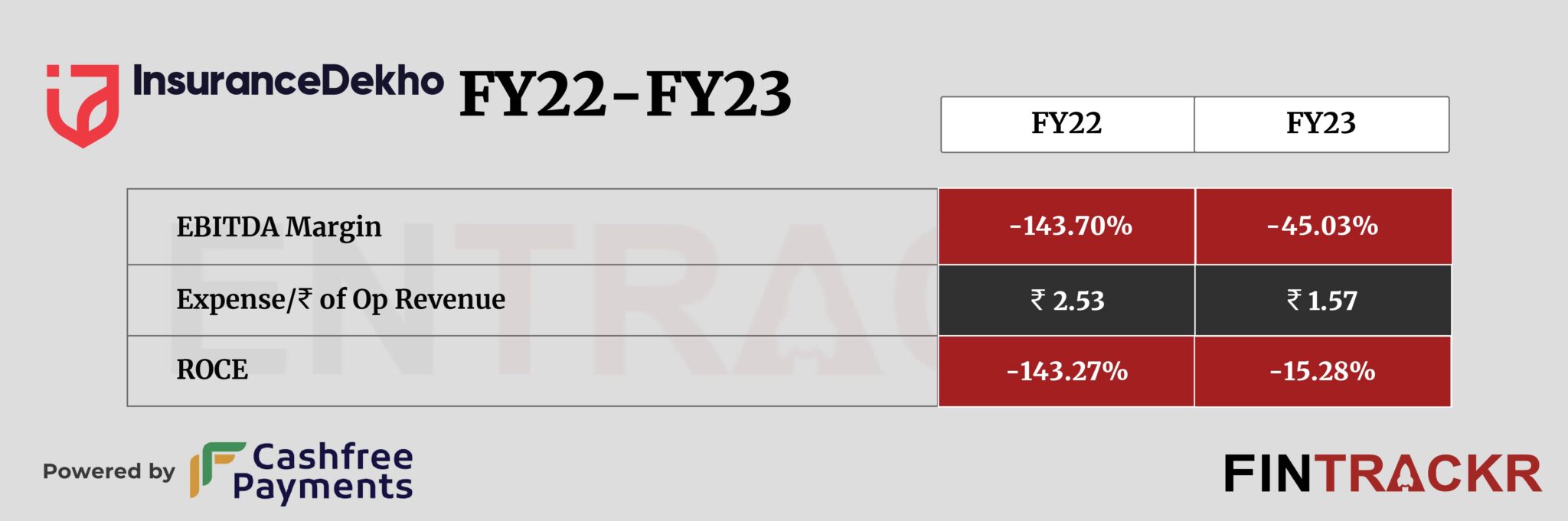

The two-fold jump in the scale and controlled expenditure helped InsuranceDekho reduce its losses by 28.6% to Rs 51.6 crore during FY23 from Rs 72.3 crore in FY22. Its ROCE and EBITDA margin stood at -15.28% and -45% respectively. On a unit level, the company spent Rs 1.57 to earn a rupee of operating revenue in the last fiscal year (FY23).

According to experts tracking the online insurance space, InsuranceDekho has huge headroom for growth and it’s likely to grow multi-fold in the ongoing and coming financial years. Its potential is also attracting new investors and the company is in late-stage talks to raise $50 million at around $500 million valuation. Entrackr exclusively reported the new fundraise on August 9.

InsuranceDekho is looking to turn profitable in FY24, according to the company’s CEO and co-founder Ankit Agrawal.

A solid name, growing market and feet on the ground has certainly helped InsuranceDekho turn potential into a seriously large opportunity for itself. So far, one would imagine that the changes in the insurance sector have also played to its strengths, as new players enter and multiple products are launched across segments. However, policy changes continue to cast a shadow in terms of rules around commission payments, as well as better marketing by many of the newer digital players as they seek to reduce the role of intermediaries. The answer seemed to have been even stronger integration as seen in the case of Policy Bazaar. But clearly, even that has its limits as seen in the talk of the firm launching its own offerings in time possibly. All in all, a business, yes. But a business good enough to make investors thrilled ? Time will tell.