Retail-tech startup Daalchini scooped up a $4 million Series A round in September last year which helped the company raise its scale by nearly four-fold in the fiscal year ending March 2023.

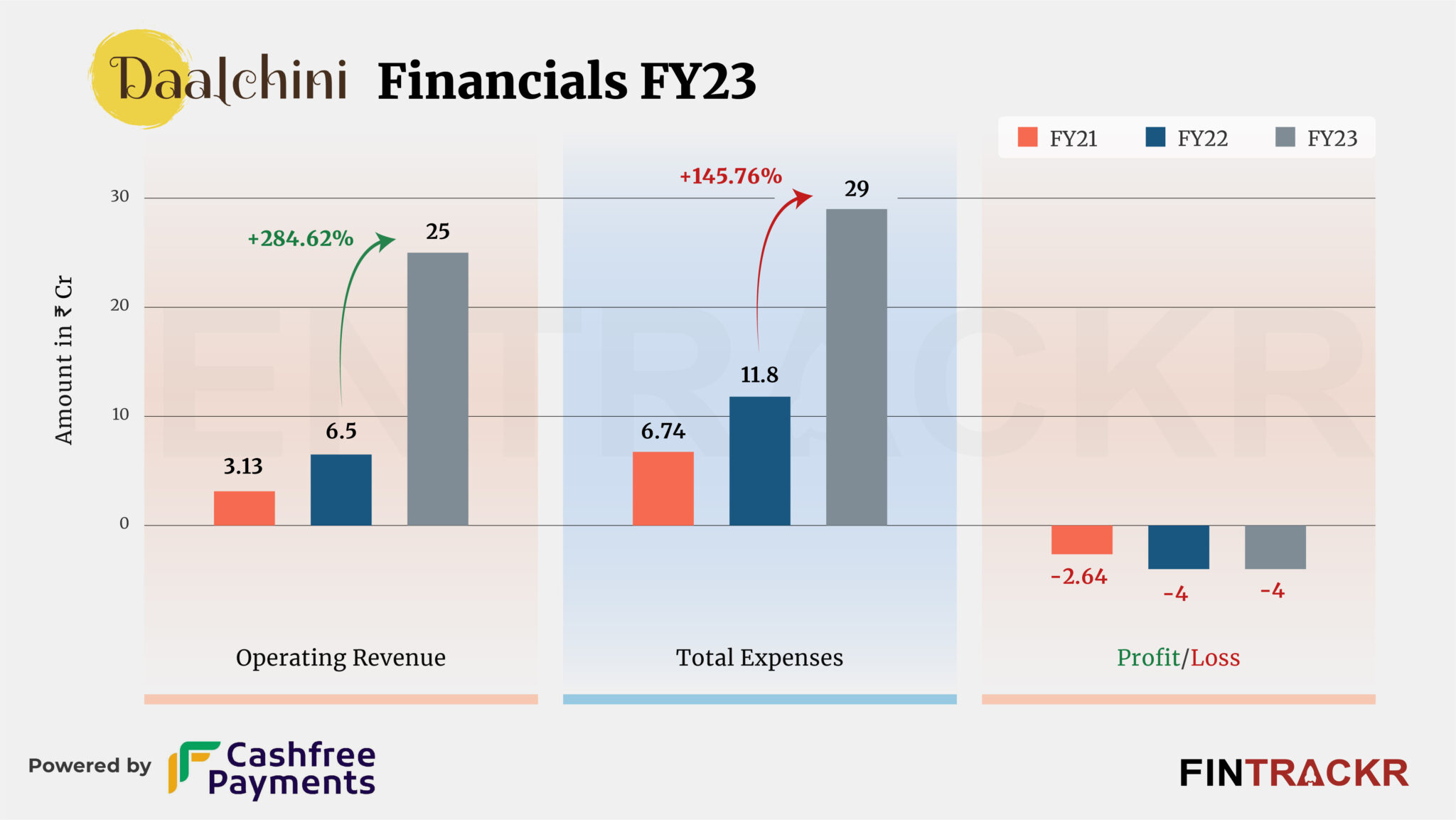

“We saw a 3.8X surge in our gross scale which stood at Rs 25 crore during FY23 and also registered positive EBITDA in our core food & beverage division,” Prerna Kalra, co-founder and chief executive of Daalchini, told Entrackr in an interaction.

According to data intelligence platform TheKredible, Daalchini reported a gross revenue of Rs 6.5 crore in FY22.

Daalchini provides instant meals through IoT-enabled physical vending machines. According to Kalra, the company has presence across 100 sites which include startups, co-working spaces, MNCs, hospitals, educational institutes, and residential complexes. “We have deployed more than 1,400 vending machines until now,” said Kalra.

When it comes to expenses, the cost of goods blew up 6.8X to Rs 15 crore during FY23, added Kalra.

“We spent Rs 3.7 crore and Rs 2 crore towards commission to partners and refiling costs and our total cost stood at around Rs 29 crore,” Kalra further said.

She also highlighted that Daalchini controlled its expenditure with losses remaining unchanged at Rs 4 crore during FY23.

Projecting a similar growth momentum in the ongoing fiscal year, Kalra said that the company will grow its gross collection by 4X. “We have an average revenue run rate of Rs 100 crore and we are confident to breach into a three-digit revenue figure (Rs 100 crore +) in FY24,” she added.

Kalra did not comment on the bottomline projections but the company is likely to post a loss in the fiscal year ending March 2024.

According to Kalra, the Indian vending machine and smart store market is predicted to grow fourfoldp over the next two years. The adoption of smart vending machines will certainly go up across public places [airports, malls, railway stations et al] as well as commercial and residential complexes.

Daalchini appears to have an early mover advantage and it has potential to become several thousand crore business by the end of this decade. The firm competes with a clutch of companies: Vendiman, Gobbly and Nutritap among many others. Tata-owned BigBasket also forayed into the vending machine space but it seems not to be focusing much on it.