Unified Payments Interface (UPI) has crossed 10 billion transactions for the first time on a monthly basis. It took more than 7 years for the instant payments system to achieve this milestone.

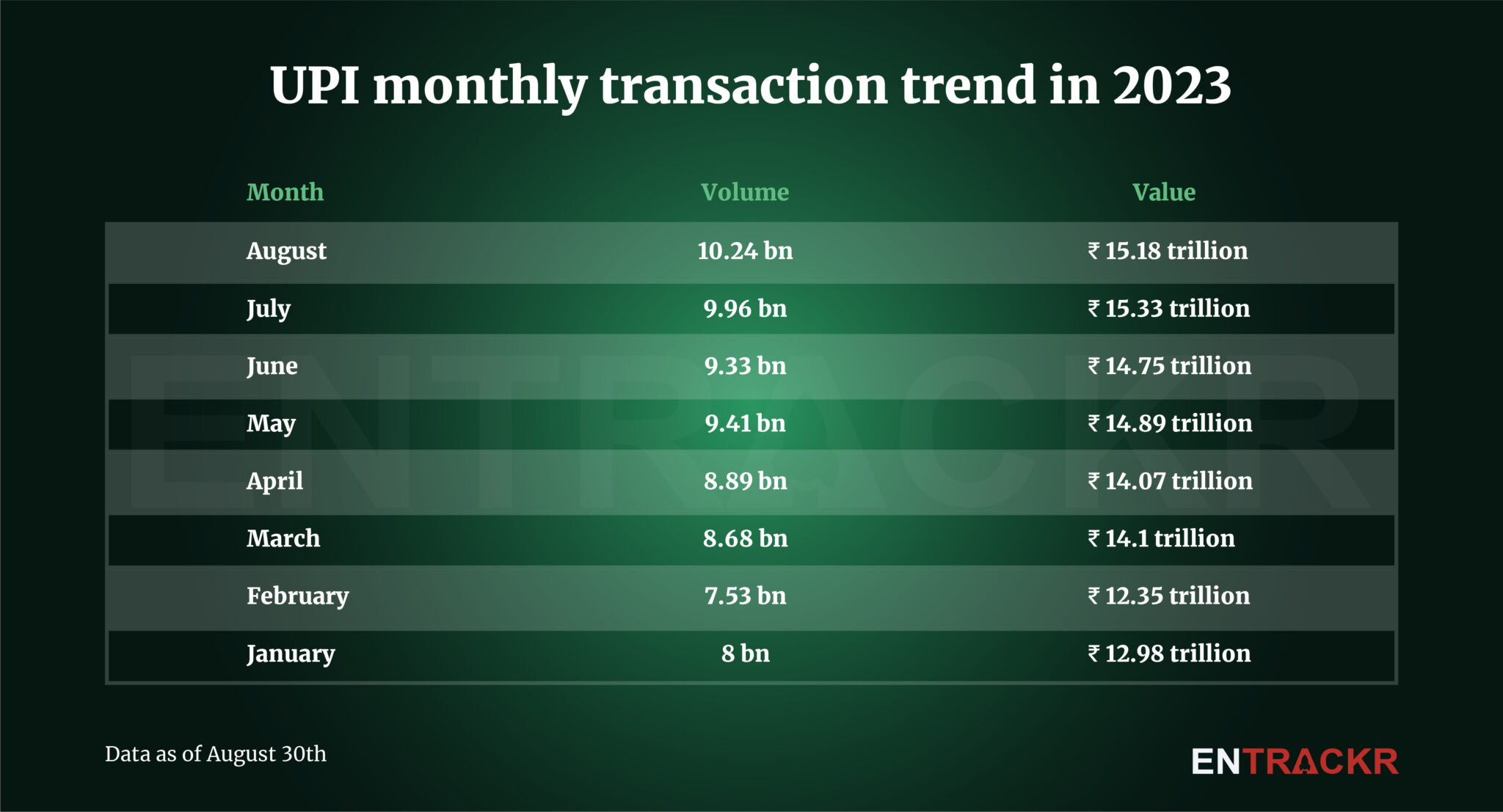

UPI recorded 10.24 billion transactions worth Rs 15.18 lakh crore (Rs 15.18 trillion) as of August 30, according to data issued by the National Payments Corporation of India (NPCI). With this, UPI has surpassed July’s record of 9.96 billion transactions worth Rs 15.34 lakh crore (Rs 15.34 trillion).

The volume and value will further go up with 1 more day to go in this month.

This is quite a big development for UPI which crossed 1 billion monthly transactions for the first time in October of 2019. As per NPCI chief Dilip Asbe, UPI has the ability to grow further and India may see 1 billion transactions on a daily basis.

PhonePe maintained its dominance over other apps with more than 47% market share in terms of volume in July, according to the NPCI data. Google Pay and Paytm had 35% and 13% market share respectively. The break up for August is yet to be published.

The Indian government has been working to expand UPI support in overseas countries. After Bhutan, Nepal, Singapore and France, NPCI is likely to launch the payments service in New Zealand and North America, Middle East, and more European countries.

To promote micro transactions and digital payments in offline mode, RBI in collaboration with NPCI launched UPI Lite in September 2022. Since then, leading UPI platforms such as Google Pay, PhonePe, BHIM, and Paytm have adopted UPI Lite. Recently, RBI announced that it increased the offline transaction limit for the lite version from Rs 200 to Rs 500.

Update at 11:45 pm IST: We have updated the headline of the story.