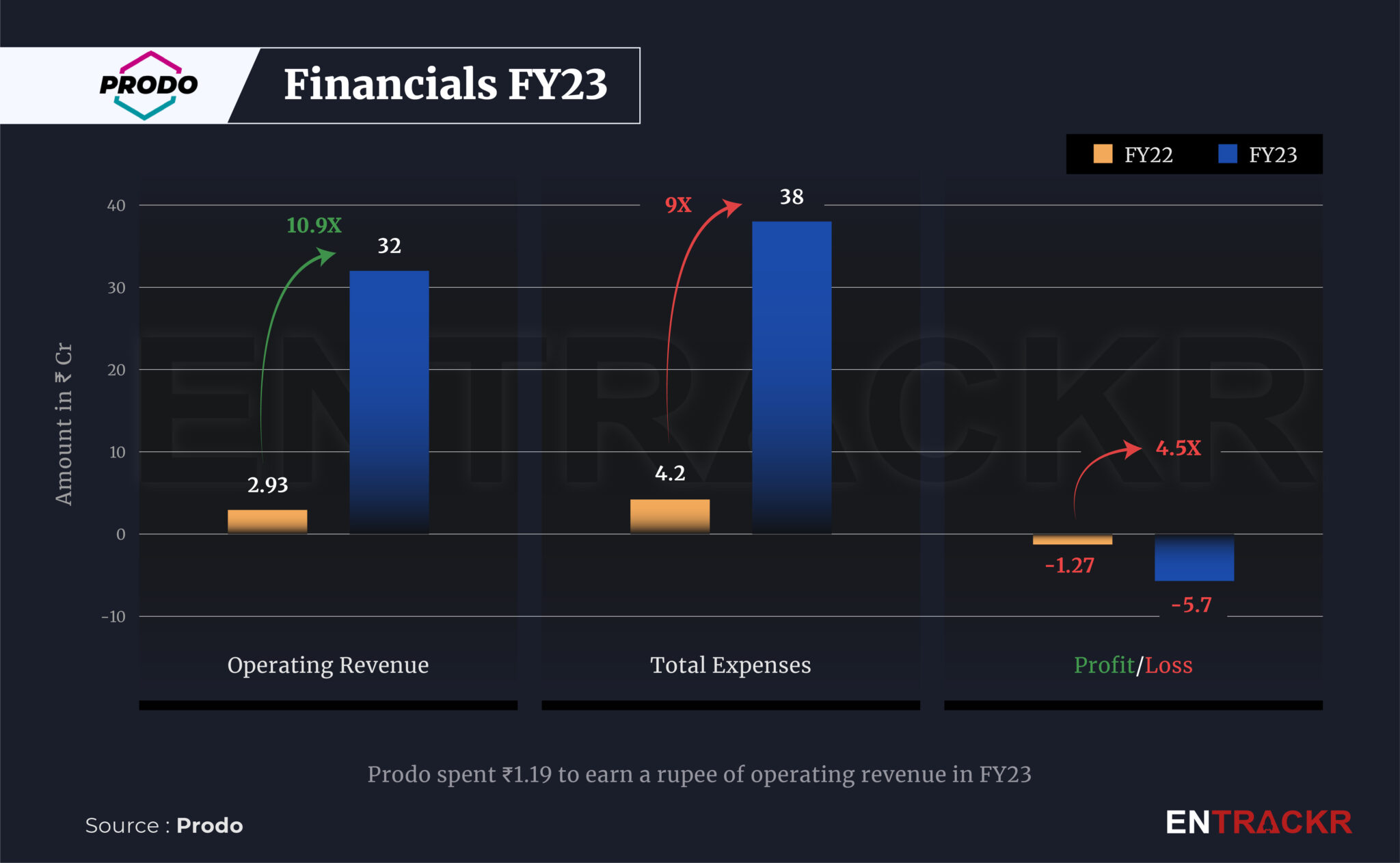

On-demand manufacturing and procurement marketplace, Prodo demonstrated noticeable financial performance during the last fiscal year without raising much capital. Started operations in mid 2021, Prodo managed to touch Rs 32 crore in topline while its losses stood at Rs 5.7 crore during FY23.

Prodo’s gross revenue shot up 10.9X to Rs 32 crore during the fiscal year ending March 2023 as compared to Rs 2.93 crore in FY22, the company’s spokesperson said in an interaction with Entrackr.

Gurugram-based Prodo is a manufacturing marketplace that provides a platform and app for B2B manufacturing to mid and large size organizations. It offers procurement with quality assurance and also enables last mile deliveries. It deals in categories such as packaging, warehousing, sustainability, F&B, uniform and apparel among others.

When asked about drivers for such growth, Prodo’s co-founder and CEO Sameen Husain said, “The reason we could grow so fast is because the size of pain is very large. Globally, procurement especially for made-to-order goods and business operations products remains largely offline. When companies work with Prodo they get clear visibility on timelines, and don’t have to get into the hassle of discoverability and access to our robust supply means.”

In the last two fiscal years, Prodo solely made revenue from India but the company is targeting to churn sizable income from overseas markets in the ongoing fiscal (FY24). “We are aiming to touch Rs 80 crore threshold in FY24 and new regions including North America, Europe and GCC will contribute significantly,” said co-founder and COO, Abhiroop Srivastava.

On the back of over 10X growth in operating scale, Prodo’s losses went up 4.5X to Rs 5.7 crore in FY23 against Rs 1.27 crore in FY22. As per the spokesperson, its monthly cash burn is under Rs 30 lakh and is eyeing profitability by October 2023.

Prodo spent Rs 4.23 crore on employee benefits during FY23, as per its spokesperson. While the company didn’t disclose the cost of materials during FY23, it stood at Rs 2.66 crore (after adjustment of changes in inventories) in FY22. It also booked finance costs and admin expenses of Rs 71 lakh and Rs 92 lakh respectively during the last fiscal year. “Our total expenditure jumped 9X to Rs 38 crore in FY23,” added the spokesperson.

Prodo has raised $1.4 million funds to date across two rounds from Titan Capital, Inflection Point Ventures, and LetsVenture. It competes with Zetwerk and Moglix among several small scale platforms.