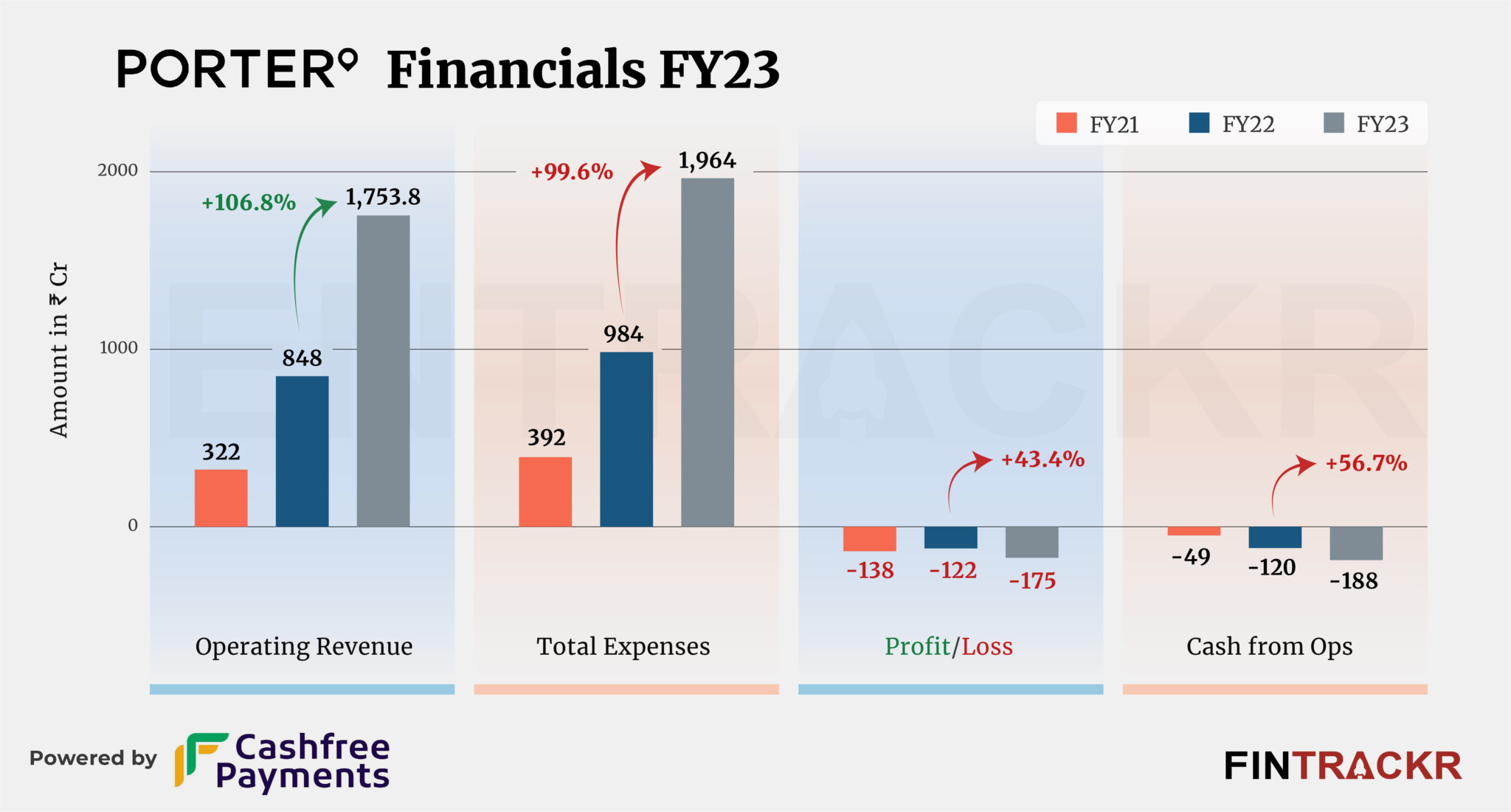

On-demand intra-city logistic company Porter grew at a rapid clip with over two-fold growth during FY23. However, the Tiger Global-backed company posted a loss of Rs 175 crore during the previous fiscal year ending March 2023.

Porter’s revenue from operations surged 2.06X to Rs 1,753.8 crore during FY23 from Rs 848 crore during FY22, according to its consolidated financial statements sourced from the Registrar of Companies.

The Bengaluru-based company provides a full-stack logistics platform to help businesses optimize their last-mile delivery operations. Income from goods transportation services is the only source of income for Porter. The company also has an interest income of Rs 35.2 crore (non-operating) during FY23.

It’s worth highlighting that Porter last raised $100 million in a Series E round led by Tiger Global during FY22 and did not raise any capital during FY23.

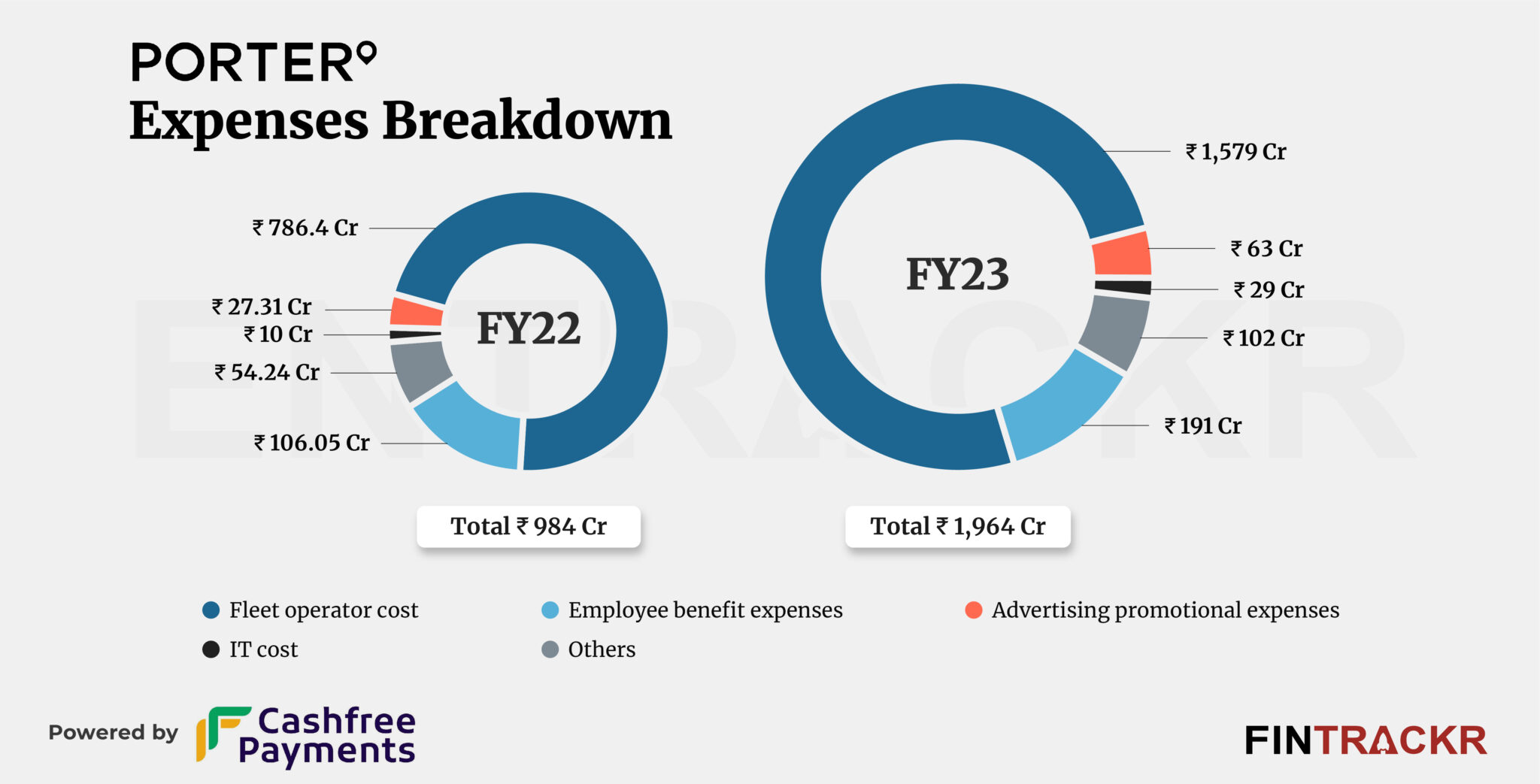

Vehicle running expenditure which includes all vehicle-related and delivery personal costs accounted for 80.4% of overall cost. In line with scale, this cost blew 2X to Rs 1,579 crore during FY23 from Rs 786.4 crore in FY22.

Porter’s employee benefits soared 80.1% to Rs 191 crore in FY23. This includes Rs 14.6 crore as ESOP cost which is non-cash in nature. Its advertisement and IT costs elevated 2.3X and 2.9X to Rs 63 crore and Rs 29 crore respectively during FY23.

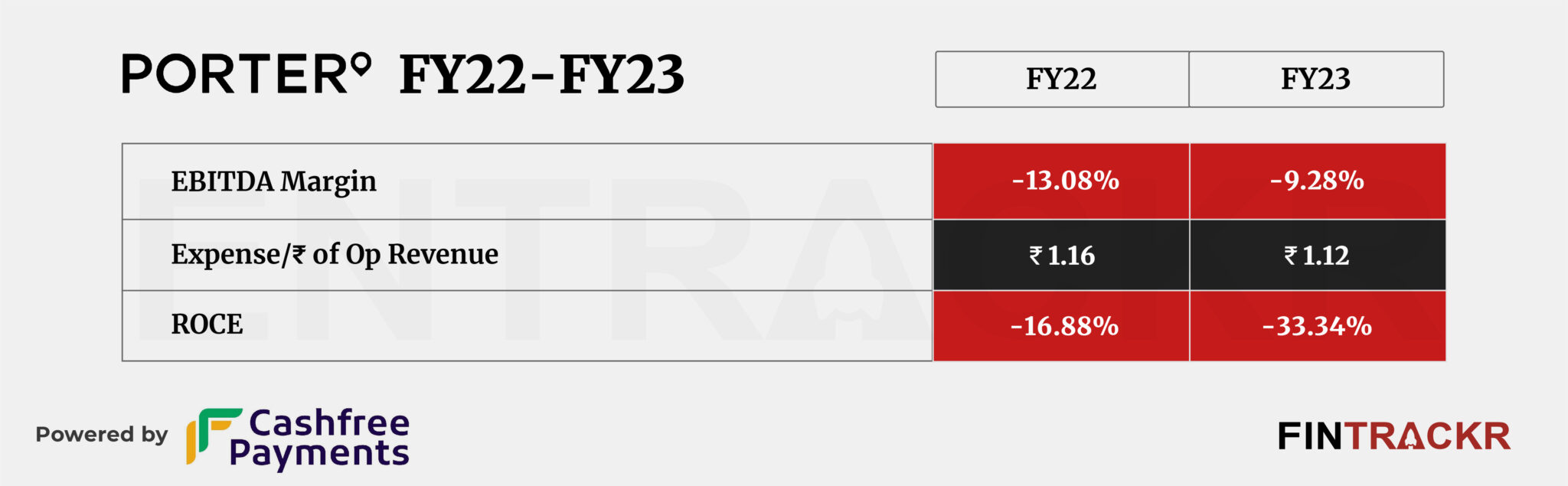

Experiencing more than a twofold expansion in the previous fiscal year, the company effectively managed its expenses. This was evident by its bottom line, which surged by 43.4% to reach Rs 175 crore in FY23, up from Rs 122 crore in FY22. Porter’s ROCE and EBITDA margin stood at -33.34% and -9.28% during FY23.

On a unit level, the firm spent Rs 1.12 to earn a unit of operating revenue.

With breakeven not too distance, and dry powder in the bank, Porter seems well placed for a strong run. Intra city logistics can be a capital intensive effort, which explains Porter’s slow expansion to its current network size of around 20 cities. However, with goods movement only expected to grow strongly, the firm should have every reason to deliver new milestones, including a possible move into profitable territory, during the current fiscal.