MSME lender Indifi Technologies raised $35 million led by ICICI Venture in June this year. The fresh investment was driven by Indifi’s scorching growth which saw it scale over two-fold and approach Rs 200 crore during the previous fiscal year.

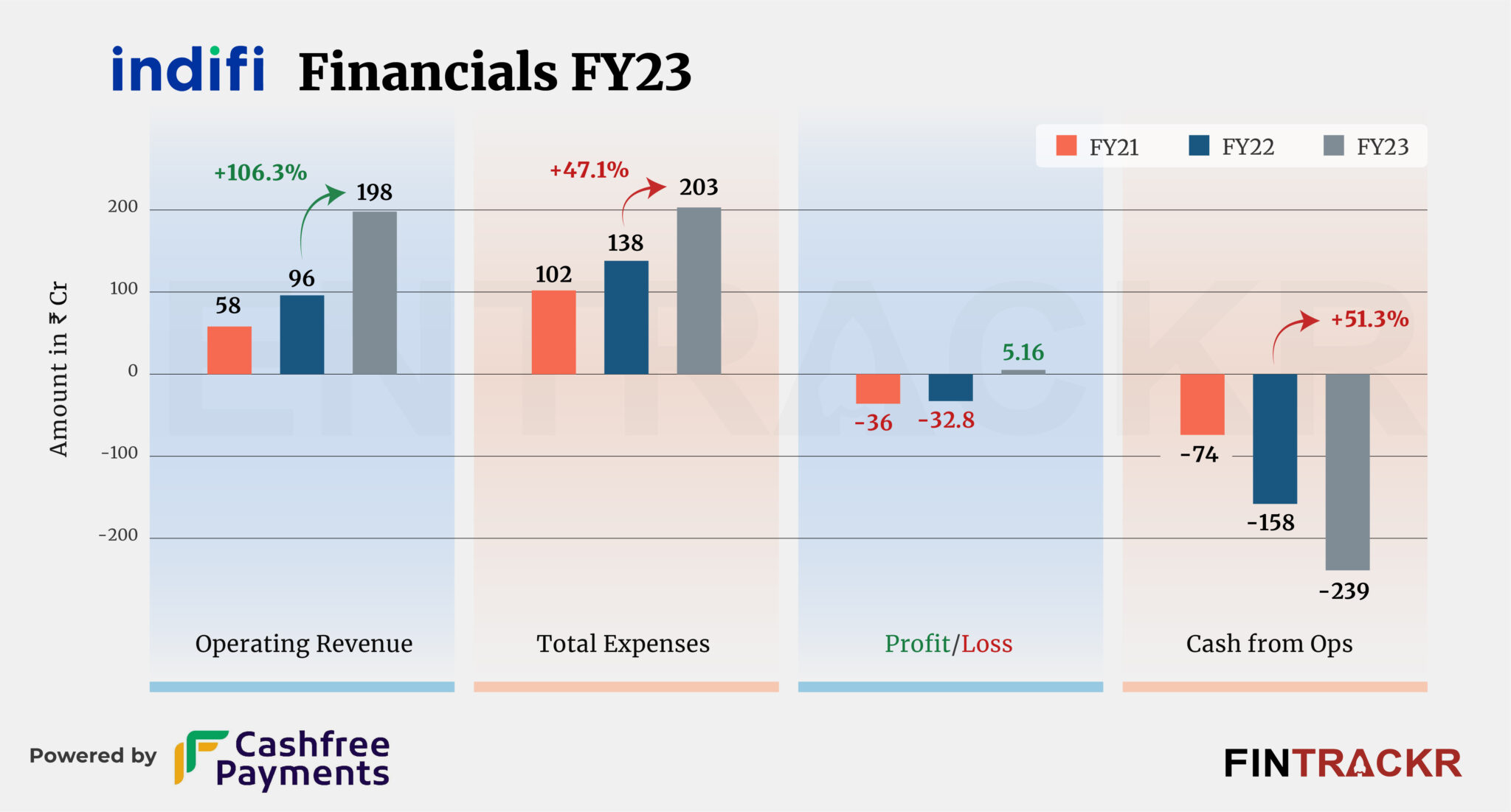

Indifi’s operating revenue grew 2.06X to Rs 198 crore during FY23 from Rs 96 crore in FY22, according to its consolidated financial statements filed with the Registrar of Companies.

Indifi offers loans for small businesses across travel, hotel, e-commerce, restaurant, trading, and retail sectors which have limited credit access from financial institutions. According to the company, it had crossed Rs 1,500 crore AUM in March 2023, having disbursed over 73,000 loans worth Rs 4,100 crore across the country.

Processing and service fees on loans are the only source of collections for Indifi. This income surged by 102% to Rs 198 crore in FY23. The company also had other income (non-operating) of Rs 15 crore mainly from interest on deposits and other miscellaneous activities during the previous fiscal year.

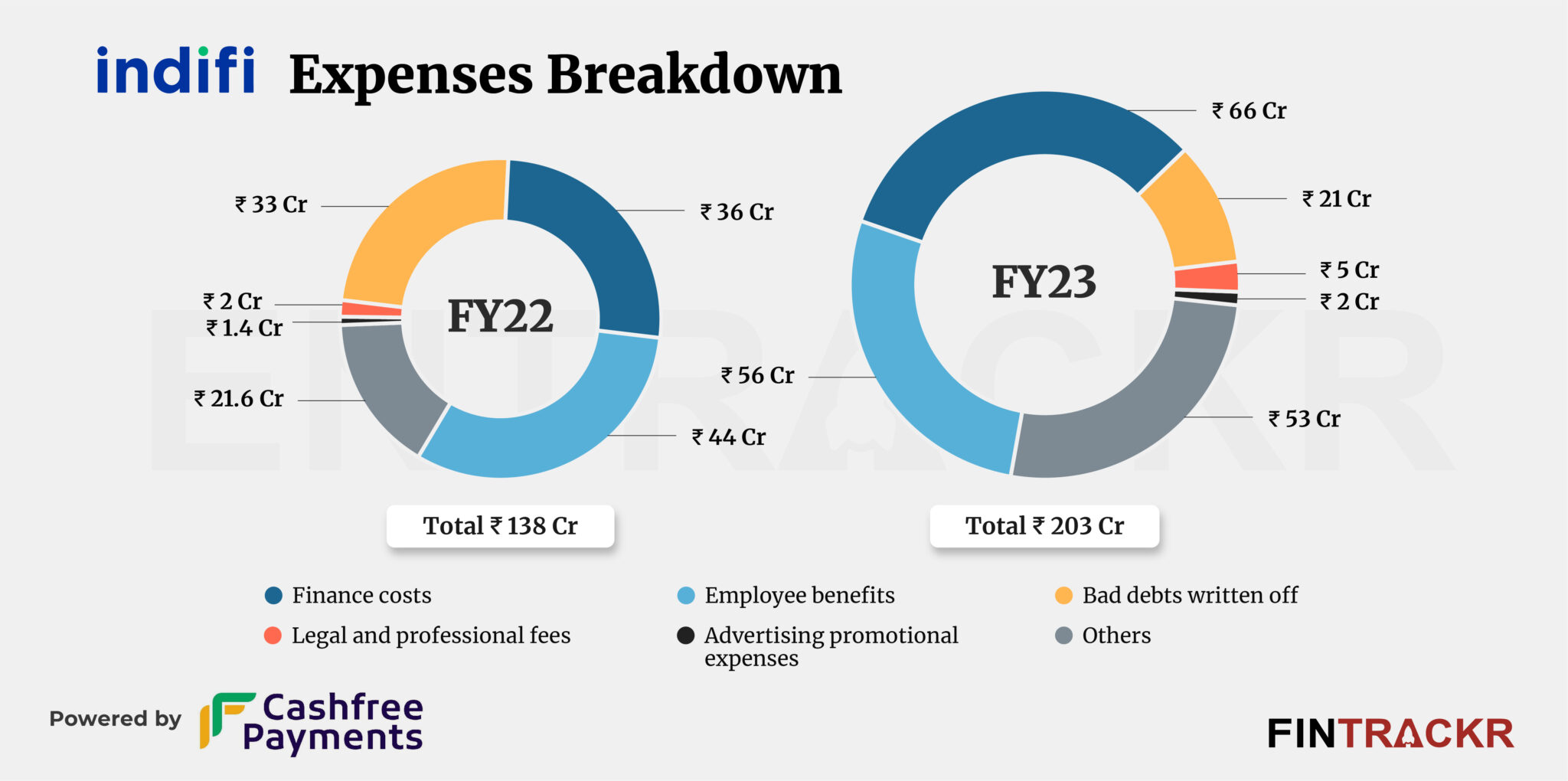

As the company is in the business of facilitating loans, interest charges and borrowing costs formed a significant part (32.5%) of the total expenses. This cost surged 83.3% to Rs 66 crore in FY23.

To match the line of scale, the company hired more employees in the team which is evident from the employee benefit cost that increased 27.3% to Rs 56 crore in FY23. Indifi’s bad debts declined by 36.4% to Rs 21 crore in the preceding fiscal year.

The company added another Rs 5 crore and Rs 2 crore on legal/professional fees and advertisement which pushed its overall expenditure by 47.1% to Rs 203 crore in FY23.

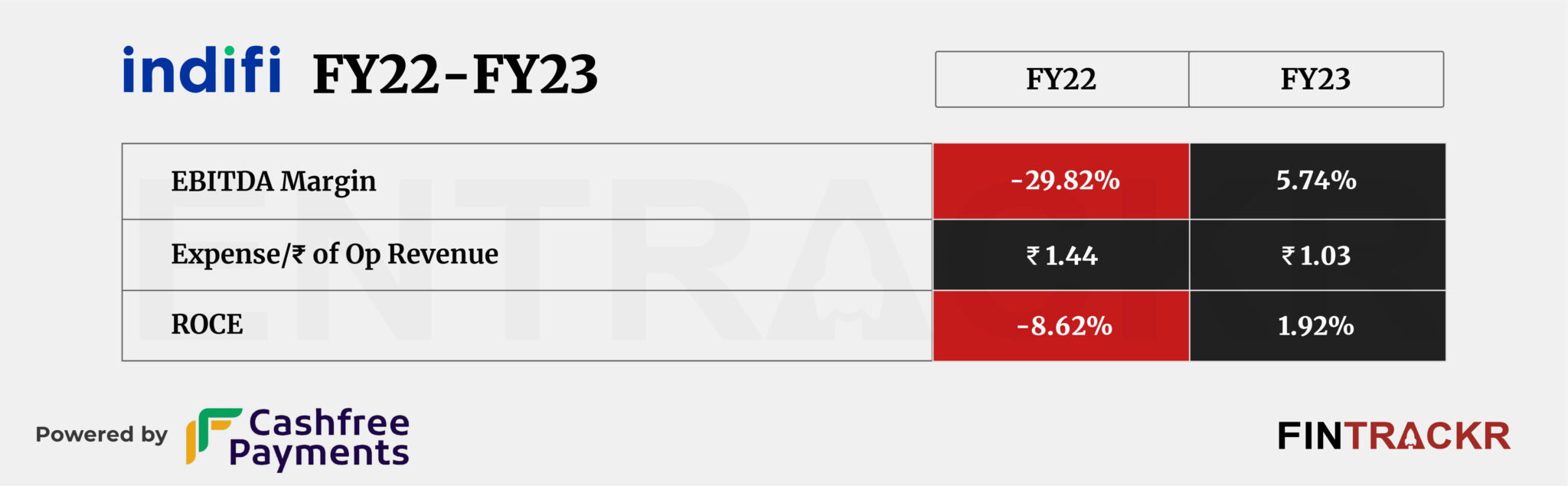

The two-fold scale and controlled expenditure helped the Gurugram-based company to achieve profitability. Indifi registered a PAT (profit after tax) of Rs 5.16 crore in FY23, where the figures stood at a loss of Rs 32.8 crore in FY22. Its ROCE and EBITDA margins turned positive with 1.92% and 5.74% respectively in FY23. Indifi spent Rs 1.03 to earn a unit of operating revenue.

Alok Mittal-led Indifi competes with Axio (earlier Capital Float), InCred, Aye Finance and Lendingkart.

It’s a wonder how many firms claim to arrange credit for segments that have ‘limited’ access to such credit from mainstream financial firms. However, the very fact that the money is eventually sourced from the same firms that seemingly are not available, makes it clear that the problem being tackled is more of information access and navigating the loan process. One has to wonder about the long-term future of such intermediaries, as access credit information and records are continuously enhanced. Indifi has done well to reach scale in this business, and that places it well to build a long-term case for entrenched relationships with institutions for loans, somewhat like PB Fintech for policies, where the latter practically handle most customer service and renewal processes for the partner institutions.