Coliving operator Settl is eying Rs 41 crore in topline in the ongoing fiscal year (FY24) after its scale skyrocketed more than 15x to around Rs 16 crore between FY21 and FY23.

We will dive deeper into the company’s bottom line later in the story, but let’s take a look at its operations first.

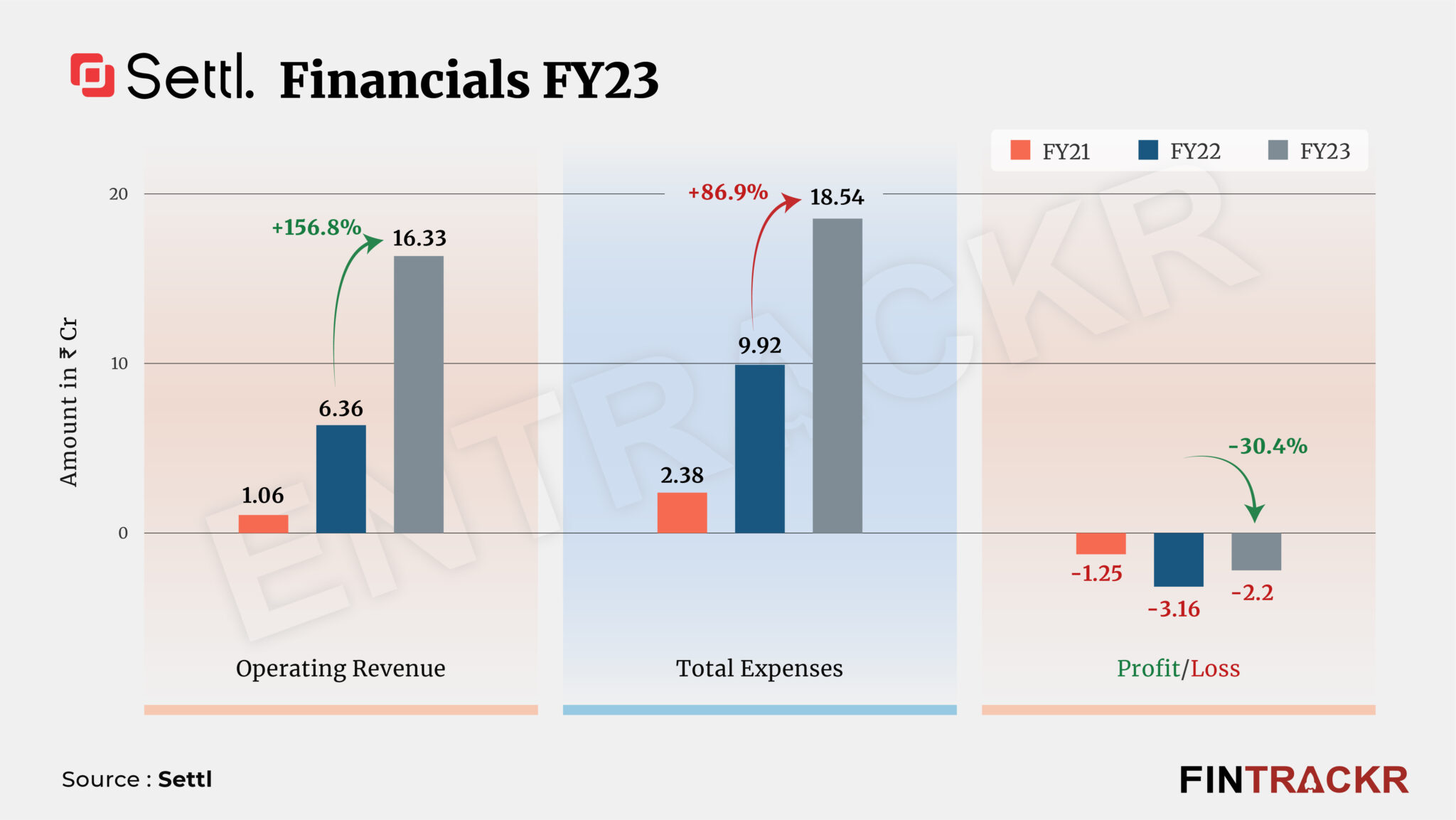

Settl’s revenue from operations grew over 2.5X to Rs 16.33 crore during the fiscal year ending March 2023 as compared to Rs 6.36 crore in FY22, the company said in an interaction with Entrackr.

During FY22, Settl recorded about 6X growth in revenue from operations. As mentioned above, Settl is targeting Rs 41 crore revenue for the current fiscal year (FY24).

Founded in 2020, Settl is a full-stack real estate operator that acquires assets of the builders or asset owners for a long lease to provide co-working, co-living, and community-living solutions to working professionals. It operates on an asset-light model wherein it ties up with property owners to open new centers.

It presently operates 2,000 beds in Bangalore, Hyderabad, and Gurugram across 40 centers. Settl also plans to expand its capacity by 2.5X to 5,000 beds as well as enter other cities such as Noida, Pune, and Chennai.

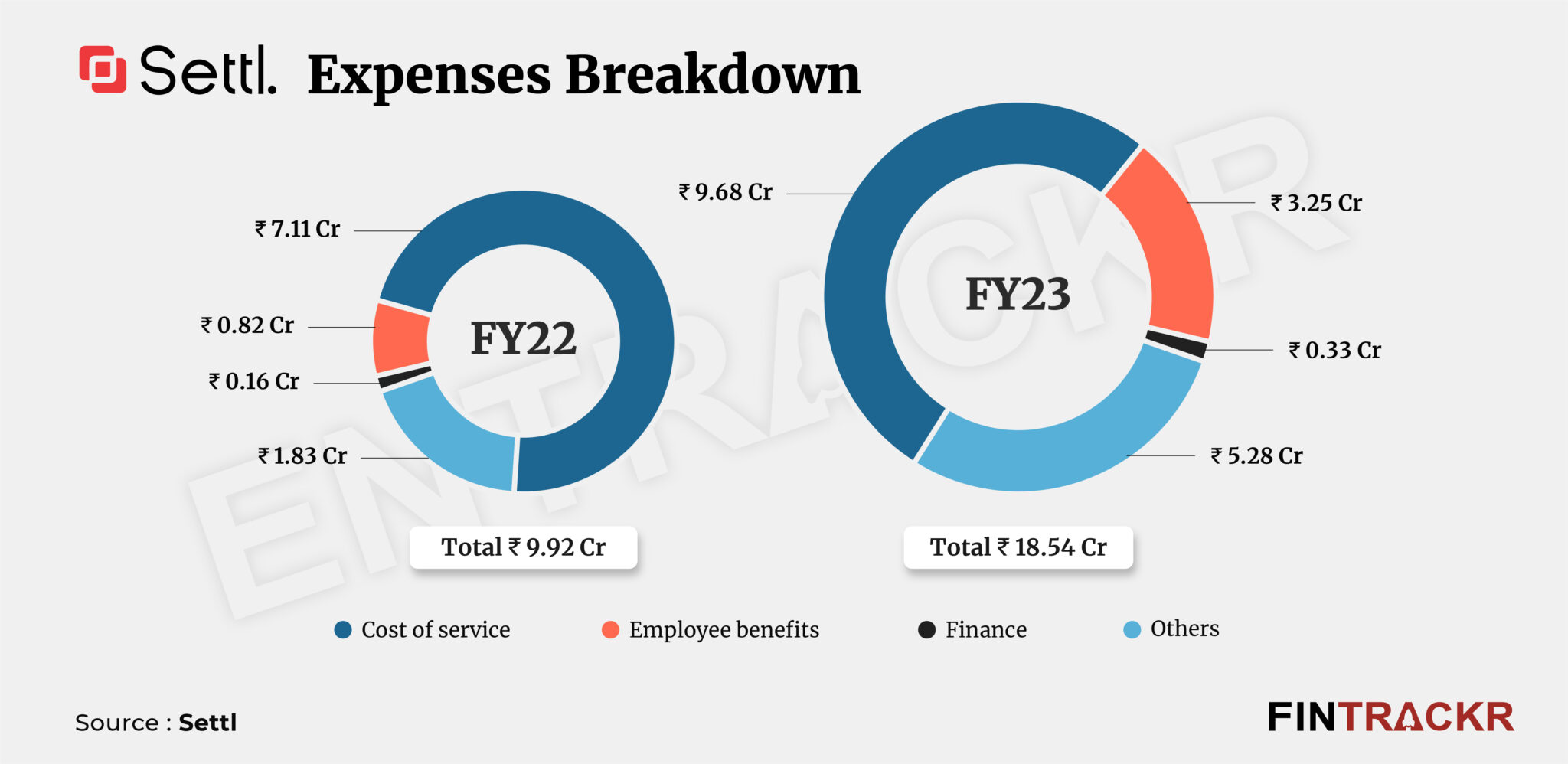

On the expense front, the cost of services, including lease & equipment rentals, property maintenance, housekeeping, information technology, subscriptions, and other utility costs, accounted for over 52% of the total expenditure. This cost was up 36% to Rs 9.68 crore during FY23 from Rs 7.11 crore in FY22.

Spending on employee benefits jumped nearly 4X to Rs 3.25 crore during the fiscal from Rs 82 lakh in FY22. Further, the finance cost of the company doubled to Rs 33 lakh during the same period.

Other expenses such as advertisement, marketing, commission, legal and professional took Settl’s total expenditure up by 87% to Rs 18.54 crore in FY23 in contrast to Rs 6.36 crore in FY22.

Settl kept tight control over expenses compared to the previous fiscal year and subsequently managed to bring down losses. The company’s losses (before tax and exceptional items) shrank 30.4% to Rs 2.2 crore in FY23 against Rs 3.16 crore during the preceding fiscal year.

For contrast, Settl’s total expenses and net losses soared around 317% and 153%, respectively during FY22.

On a unit level, Settl spent Rs 1.14 to earn a rupee of operating revenue during FY23.

Settl is currently focusing on driving growth to establish itself as the leading player in the premium coliving space. When it comes to the bottom line, it claims to be operationally profitable, and the losses are primarily due to corporate expenses. The company aims to become profitable by November 2023, Settl said in a statement.

Settl has raised around Rs 4.9 crore to date from investors, including ah! Ventures, We Founder Circle, and other angel investors. As per Fintrackr’s analysis, it was valued at around Rs 30 crore following the latest fundraise in September 2021. The company plans to initiate its Series A round in March next year.