Early April, when the Ola ride from Khar Danda to Bandra West in Mumbai was not marked as ‘ride ended,’ the total postpaid bill ended with a drive 14 kms away from the drop point and Phalguni Desai was presented with a bill of Rs 350 — five times higher than the normal Rs 65 it would usually take. After multiple failed attempts at raising a complaint ticket on Ola’s platform and trying to get in touch with a representative, she refused to pay the unfairly charged amount included in her postpaid bill. This is when the more pressing issues started.

“A lot of people told me to be careful while using [OlaMoney Postpaid] …I never had an issue, so I continued to use it,” Desai, an Ola postpaid user since 2019, told Entrackr. “I’m not sure if that was a smart thing to do anymore.”

After a few automated calls from Ola’s registered business numbers, messages from various personal numbers started coming in. These messages initially started off by asking to pay the excess amount then progressively escalated to threatening to visit her residence with legal notice to collect the payment.

One such message read “Our Executive is on the way and he will reach at your residential address with LEGAL Notice today anytime before 2 PM to avoid this kindly revert. This will impact on your CIBIL score (sic).”

Desai isn’t alone. Astha Gupta from Bangalore and Kanika Mehrotra from Hyderabad faced similar situations. Gupta received over 30 automated calls regarding payments she had already paid off, while Mehrotra has been receiving multiple calls and messages from personal numbers for over a year for a wrong charge on one of her trips.

Recently, Ola Support’s Twitter page has been flooded with complaints by users. A majority of these are about harassment they are facing through calls and messages by Ola’s collection agents. The common factor: all are OlaMoney Postpaid users.

Bengaluru-based cab aggregator Ola came out with its OlaMoney Postpaid services in 2019. It is essentially a use-now-pay-later method where a single bill is generated every 15 days totaling the amount of all the rides taken within that time. This was introduced for daily Ola users, assuring a “fast and hassle-free” way to pay.

Although OlaMoney Postpaid was started with an altruistic vision, its current state of operations do not follow through with its promise. Instead of “hassle-free” travel, users are having to deal with calls and messages from Ola collection agents threatening to visit their homes.

Several users with such complaints have taken to social media platforms mainly Twitter and LinkedIn to express their grievances. Although many have not gotten a solution to their complaints raised on Ola, some have stopped receiving such calls and messages once their complaint was on a public platform.

A majority of the posts are met with a meager automated message from Ola’s customer support account reading “Hi, we want to help you with this. Please share your registered contact details via DM so that we can assist you further.”

Entrackr spoke to over half a dozen Ola users, all who reported similar complaints. Ola did not respond to the queries sent by Entrackr. The story will be updated with their comment in case the company responds.

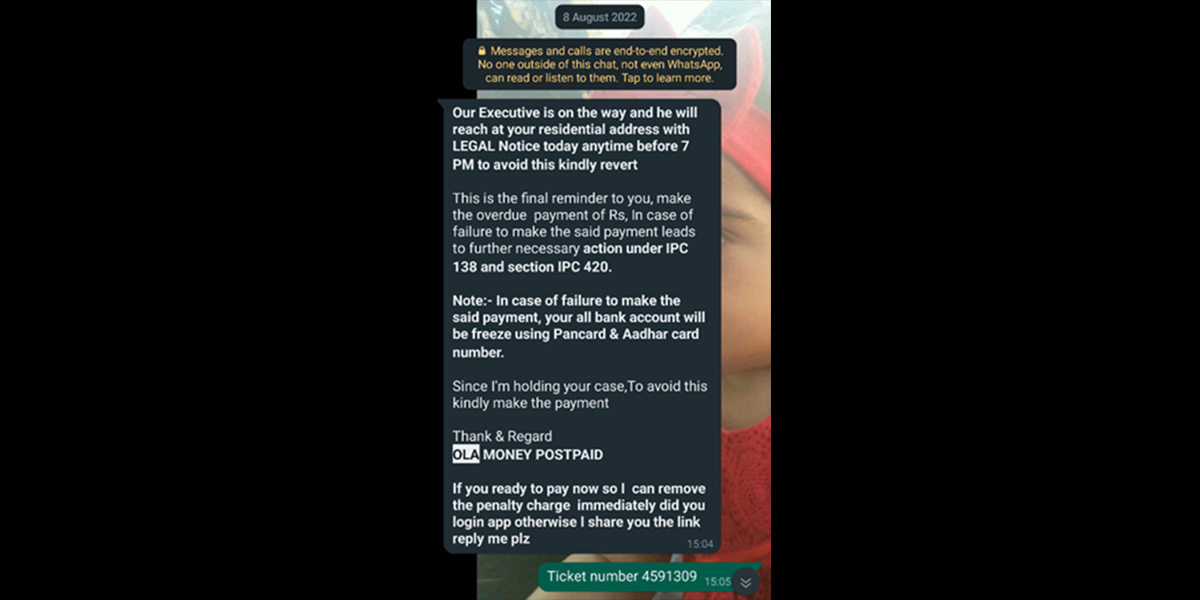

One of the messages received by a Mehrotra mentioned that action would be taken against the user according to IPC 138 and section IPC 420. Many were threatened that their CIBIL scores would be affected.

(Attached is a screenshot of a message received by Kanika Mehrotra.)

The IPC Section 138 talks about abetment of act of insubordination by an officer, soldier, sailor, or airman, in the Army, Navy or Air Force, of the Government of India and IPC 420 talks about cheating and dishonestly inducing delivery of property.

Both these sections under the Indian Penal Code cannot be used in this particular situation. Further, using legal language which is not related to a case can be seen as coercive acts from the company’s side in order to get something out of a user. This also shows that the individual contacting the user on behalf of Ola does not have a clear picture of the legal actions that a private company can take and is merely throwing around legal terms to force the user to cooperate with the company.

“Section 138 [of IPC] is inapplicable in [this] case,” Sohil Shah, a principal associate at Pioneer Legal told Entrackr. “[As far as] Section 420 of IPC is concerned, the same can be applicable only if there is an element of cheating involved, however, in the present case it is unlikely that there can be any cheating. This is a case where an Ola user/driver is unable to pay the installments to Ola. ”

While people familiar with legal terms could argue that the message could be pointing to section 138 of the Negotiable Instruments Act rather than IPC 138, the messages failed to mention these specifics especially since they are being sent to common users. Section 138 of the Negotiable Instruments Act talks about the dishonor of cheque for insufficiency of funds in the account.

Mumtaz Bhalla, a partner at Economic Laws Practice, told Entrackr, “Section 138 of NI can only be used when a cheque comes into play. It cannot be used if the user has not used a cheque to pay the amount required.”

Both Bhalla and Shah also confirmed that a private company like Ola cannot directly affect the CIBIL score of its users. Bhalla said, “Ola here cannot directly affect the CIBIL score of a user. That power only lies with the bank/nbfc/financial institution that is partnering with Ola to provide the Postpaid services.”

This is not the first instance of a company using coercive methods to drive business. Previously, several complaints have been registered against companies like Byju’s for reportedly indulging in malpractices to lure parents to buy their courses. Complaints have also been registered against banks and non-banking financial corporations for harassment by recovery agents.

These are not the only examples of an aggressive collection agents issue faced by users. While not all of them came from the same circumstance as Desai, a few faced harassment from agents even though their dues and bills were cleared.

“My postpaid bills are all paid, and nothing is pending… yet I get calls harassing me for some 400 bucks which I can see nowhere on my app,” Shrudi Johnson told Entrackr. She started facing an issue while using the app in May and the calls started coming in just a couple of days later. She gets close to 30 calls every day.

While most of these calls were automated, a few involved people calling on behalf of the company. “These people spoke very rudely, and I was asked why my Ola bills weren’t paid. When I said I couldn’t see it on my app, they hung up,” Johnson said. One such automated call suggested that the company had registered a case against her in the Lok Adalat for which she had to be present.

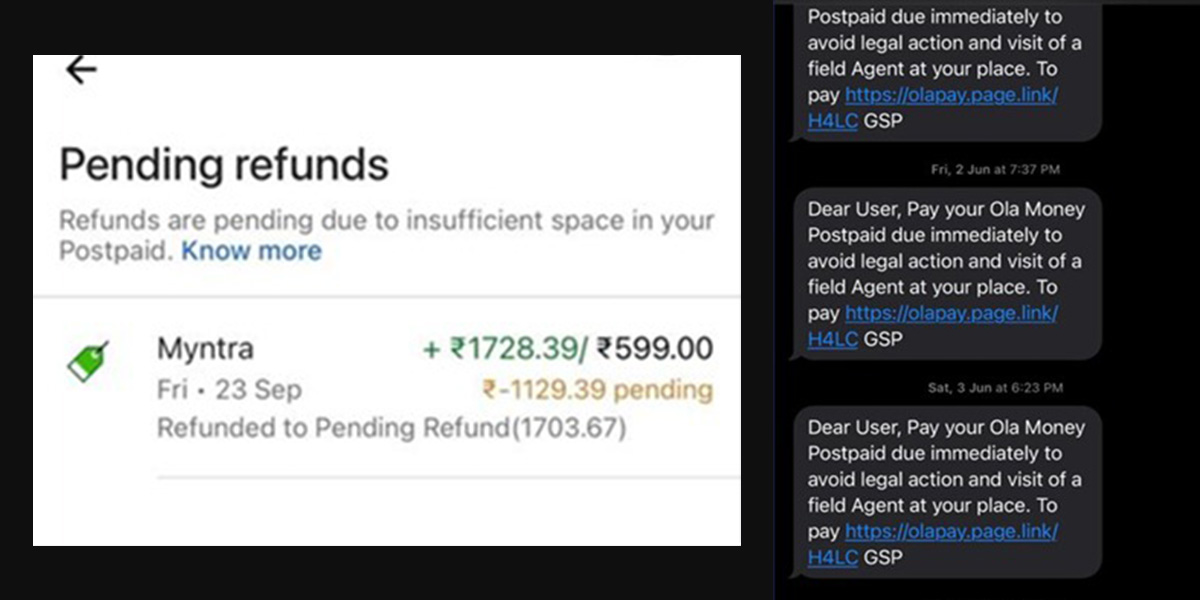

In fact, Johnson has to get a refund of Rs 1129.39 from Ola. She is yet to receive the amount, which is now pending for over eight months, after returning an item which was bought online using OlaMoney.

(Attached are the screenshots of messages received by Shrudi Johnson and of the pending refund on the Ola app.)

Shah explained that it may not be illegal for private companies to engage third party agents to recover debts. What could be illegal, however, is the manner in which the recovery is undertaken.

“The RBI has published guidelines governing recovery agents… that require the agents to not resort to intimidation or harassment, verbal or physical, while collecting debts, including acts intended to humiliate publicly or intrude upon the privacy of the debtors’ family members, sending inappropriate messages,… making threatening and/ or anonymous calls, persistently calling the borrower and/ or calling the borrower before 8:00 a.m. and after 7:00 p.m., making false and misleading representations, etc.” he said.

In a slightly altered situation, Rahul Dehedkar, an NRI traveling to India, updated his Ola Money wallet to have a stress-free travel option in the city. “I recharged for Rs 2500 and used the app for 3 days … the total cost was around Rs 1200, so I didn’t bother as I had recharged more than that.”

Last month, Dehedkar started receiving 15 to 20 calls daily regarding his remaining dues. He claims to have not chosen the services of Ola postpaid and yet being charged for it. Despite having paid the unfairly charged amount through Ola money wallet, the calls haven’t stopped, he added. “Ola support assured me that [the calls] would stop. I still get 8-10 calls every day,” Dehedkar said.

Bhalla said that the most effective action a user can take in this case would be to file a police complaint of criminal intimidation and extortion against Ola and the individual collection agents contacting them if the claim is not lawful.

After Desai’s Twitter posts, an Ola representative got in touch with her and said the extra fee would be waived off and she’d get an email regarding the same. While the harassing calls from collection agents have stopped, she says she hasn’t yet received any such email yet. As for her cab rides, after the unpleasant experience with Ola, Desai said she has moved on to other cab-hailing alternatives.