MSMEs-focused digital lender NeoGrowth turned profitable in FY23, but its scale barely grew over five percent during the same period.

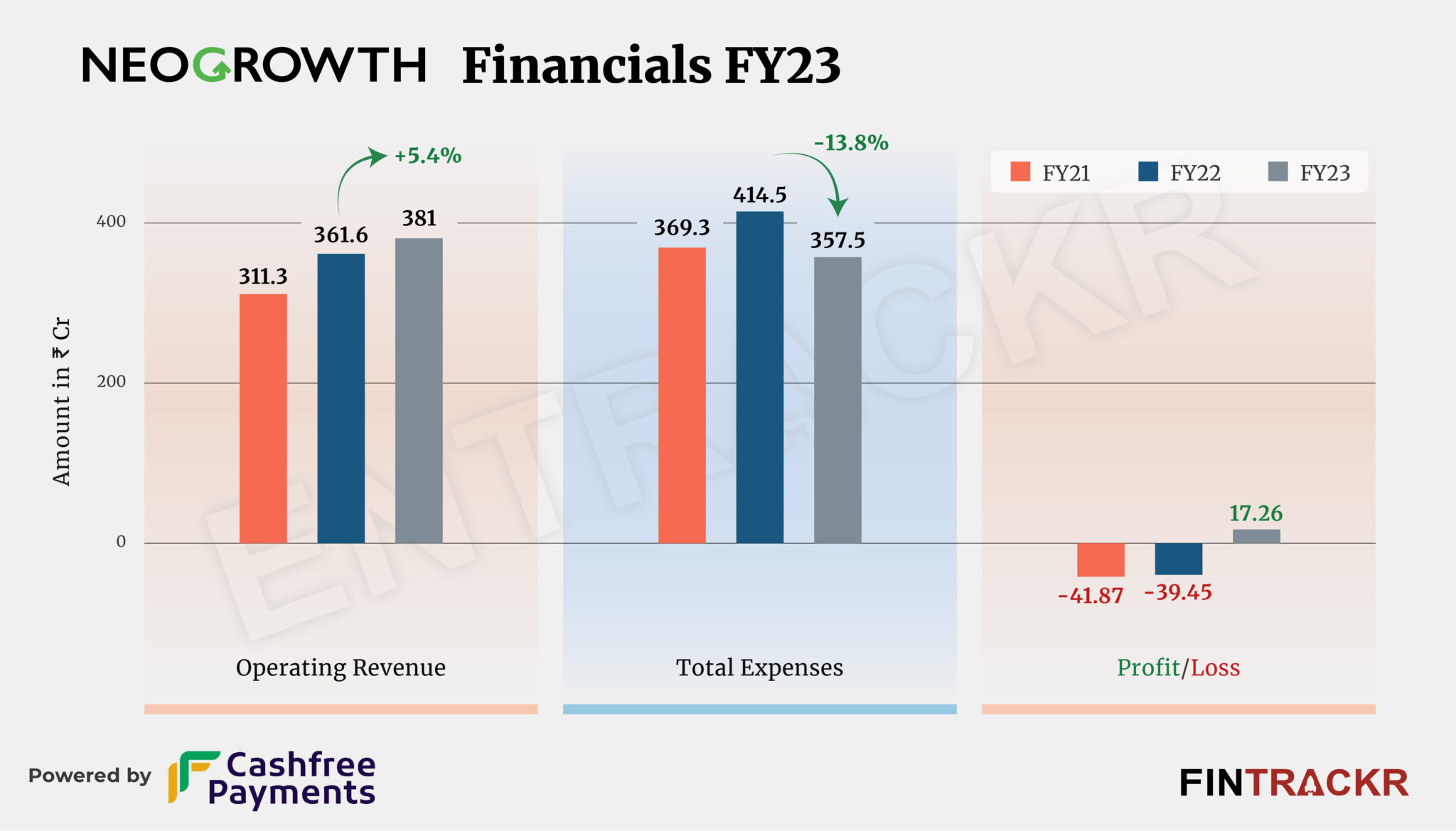

NeoGrowth’s revenue from operations remained flat at Rs 381 crore during the fiscal year ending March 2023, a 5.4% growth as compared to Rs 361.6 crore in FY22, as per the company’s annual financial statement with the Registrar of Companies.

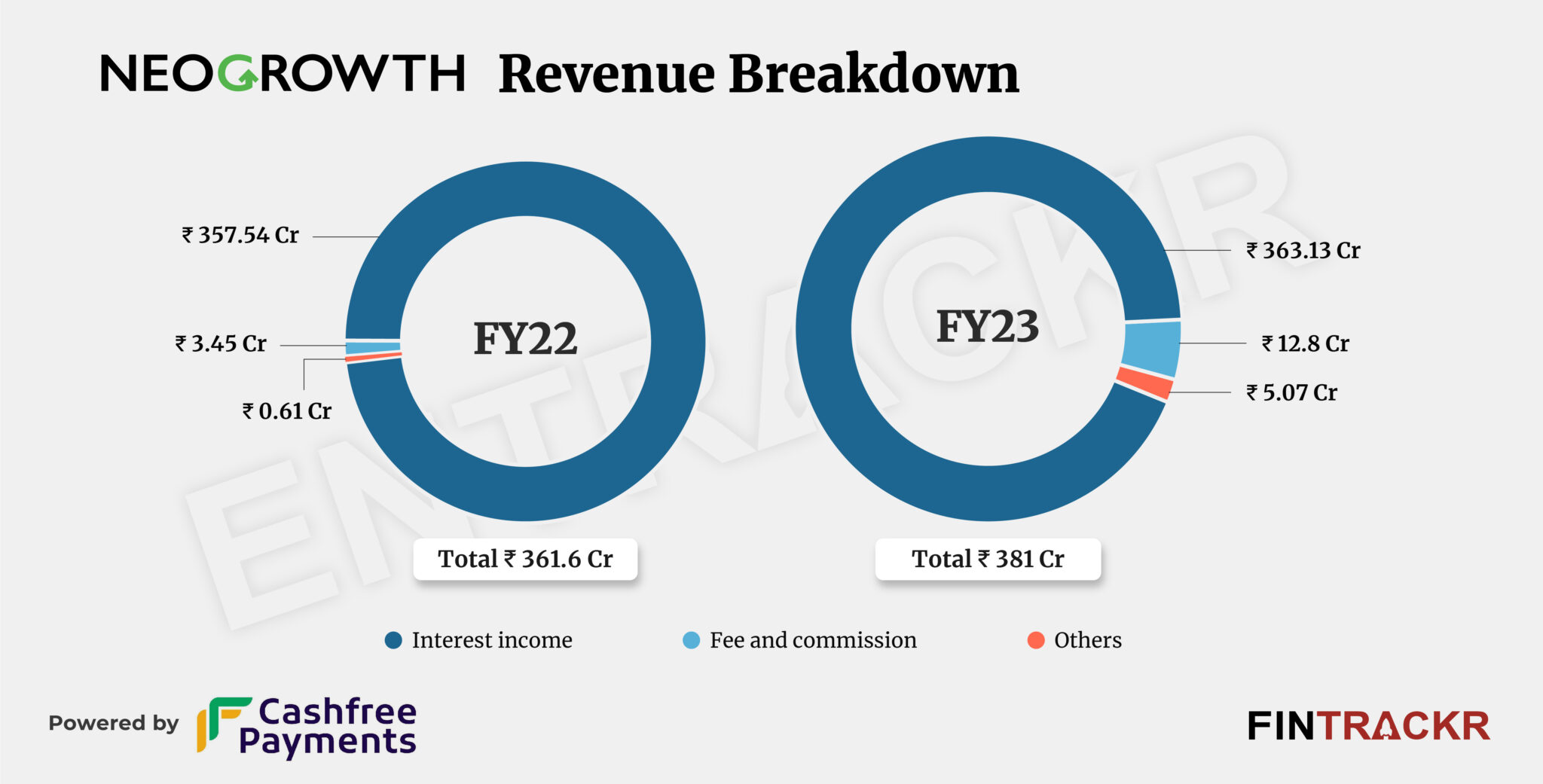

NeoGrowth collected over 95% of its operating income from interest which grew only 1.6% to Rs 363.13 crore during FY23 from Rs 357.54 crore in FY22. Revenue from fee and commission jumped 3.7X to Rs 12.8 crore in FY23 from Rs 3.45 crore in FY22.

Further, income from the derecognition of loan assets and net gain on fair value change stood at Rs 1.81 crore and Rs 3.18 crore, respectively, in FY23. Besides this, it also earned a non-operating income of Rs 2 crore during the last fiscal, taking overall revenues to Rs 383 crore.

Co-founded by Dhruv Khaitan and Piyush Khaitan, NeoGrowth is an NBFC that provides short-term unsecured loans to MSMEs amounting to up to Rs 75 lakh for a tenure of up to 100 months along with flexible repayment options.

So far, the company has secured approximately $138 million in equity and debt funding from various investors such as MicroVest, FMO, Omidyar Network, DFC, and others. It includes a recent debt round of $10 million raised in the final quarter of FY23.

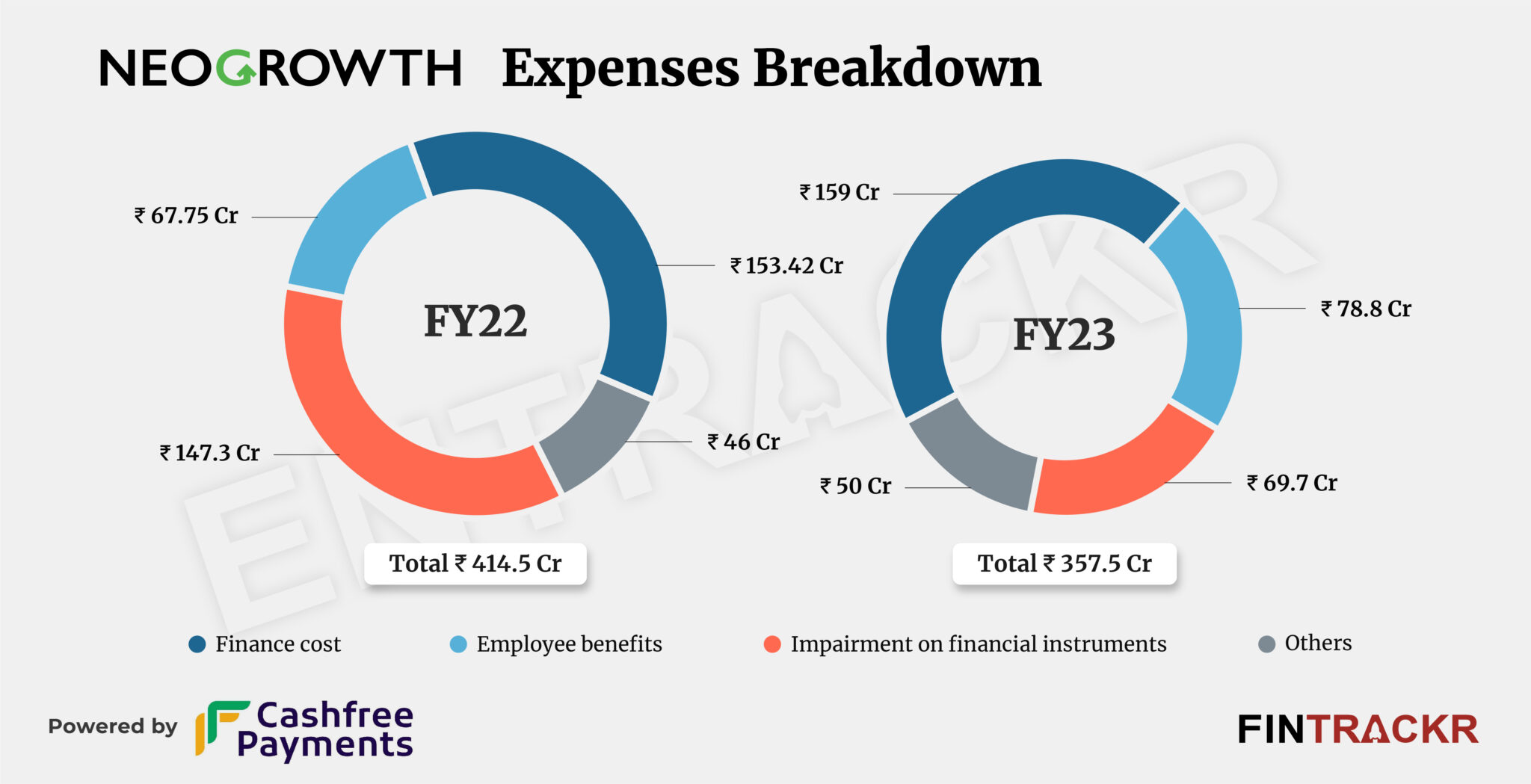

Heading towards expenses, finance costs accounted for 44.5% of the total expenditures. This cost increased 3.6% to Rs 159 crore during FY23 from Rs 153.42 crore in the previous fiscal. Employee benefits were another major cost for NeoGrowth, surging 16.3% to Rs 78.8 crore year-on-year from Rs 67.75 crore in FY22.

The company also recorded impairment on financial instruments (including provision for expected credit loss) worth Rs 69.7 crore during FY23. It’s worth noting that compared to the previous fiscal year, the company has brought down these expenses by 52.7% from Rs 147.3 crore in FY22. The numbers suggest the company may have strengthened its credit risk management practices or written off some of its impaired financial instruments.

In the end, NeoGrowth’s total expenditure declined 13.8% to Rs 357.5 crore in FY23 from Rs 414.5 crore recorded in FY22.

The decline in impairment expense and stable finance and employee cost helped the company to turn profitable during the year. NeoGrowth booked Rs 17.26 crore profits during FY23 against Rs 39.45 crore loss in FY22.

On a unit level, the company spent Re 0.94 to earn a unit of operating income during FY23.

In FY23, NeoGrowth witnessed a 19.4% increase in its assets under management (AUM), reaching Rs 1,850 crore compared to Rs 1,550 crore in FY22.

The company also achieved a significant 30% growth in loan disbursements with approximately Rs 1,900 crore disbursed in FY23.

Out of the total loans disbursed, approximately 30% were dedicated to supply chain finance, catering to vendors, manufacturers, suppliers, and service providers who serve large corporations. The remaining 70% were allocated to retail finance and supporting customer-facing businesses.

Approximately 45% of NeoGrowth’s business in FY23 was driven by repeat customers or renewals. Looking ahead to FY24, the company anticipates a 40% growth in AUM and aims to onboard approximately 10,000 new customers. Having already served over 1.5 lakh MSMEs, NeoGrowth also plans to venture into the co-lending model during the second half of the current fiscal year.

Operating in the domain of unsecured loans, NeoGrowth’s model is bound to be linked to repeat, and expansion of credit facilities to an existing set of customers as they build a history with the firm. That puts the onus of being competitive on NeoGrowth firmly, especially at a time when interest rates have started inching up again. All in all, with operations in the black, the firm seems well set for a long runway of growth in this underserved market.