D2C nutrition brand Oziva had a topsy-turvy ride in FY23: it got acquired by FMCG giant Hindustan Unilever, and then it ended the fiscal year with a 20% drop in scale, which is in stark contrast to the five-fold growth it registered between FY20 and FY22.

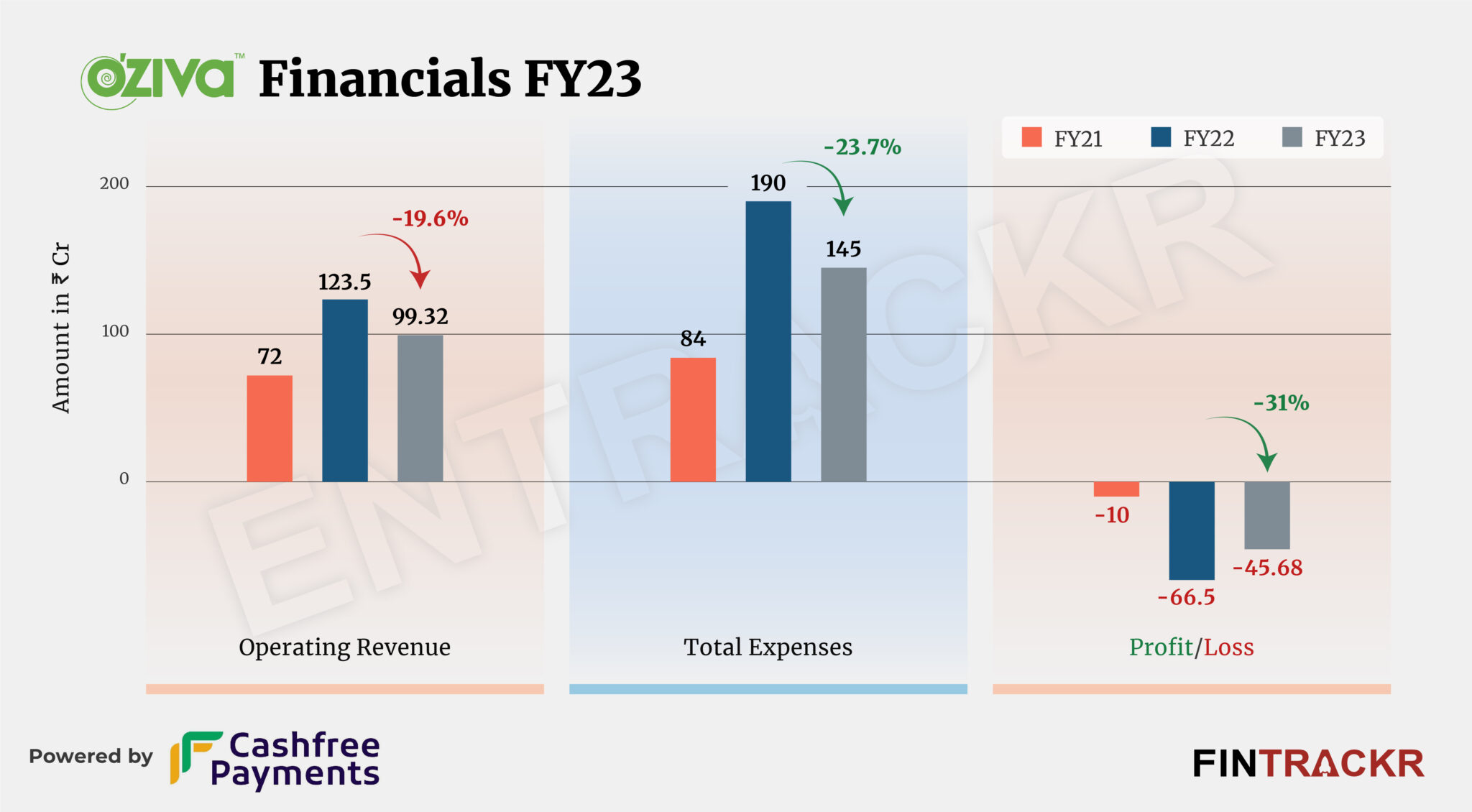

Oziva’s revenue from operations contracted 19.6% to Rs 99.32 crore in the fiscal year ending March 2023, according to its consolidated financial statements sourced from the Registrar of Companies. For perspective, the company had a 71.5% revenue growth in FY22 and 243% in FY21.

The six-year-old D2C firm sells plant-based nutrition products for health, skin, hair and general wellness. The sale of health and nutrition products accounted for its total operating revenue in the last fiscal.

Importantly, the company also booked a miscellaneous non-operating income of Rs 100 crore during FY23. Note that we have excluded the same as this component is non-operating in nature.

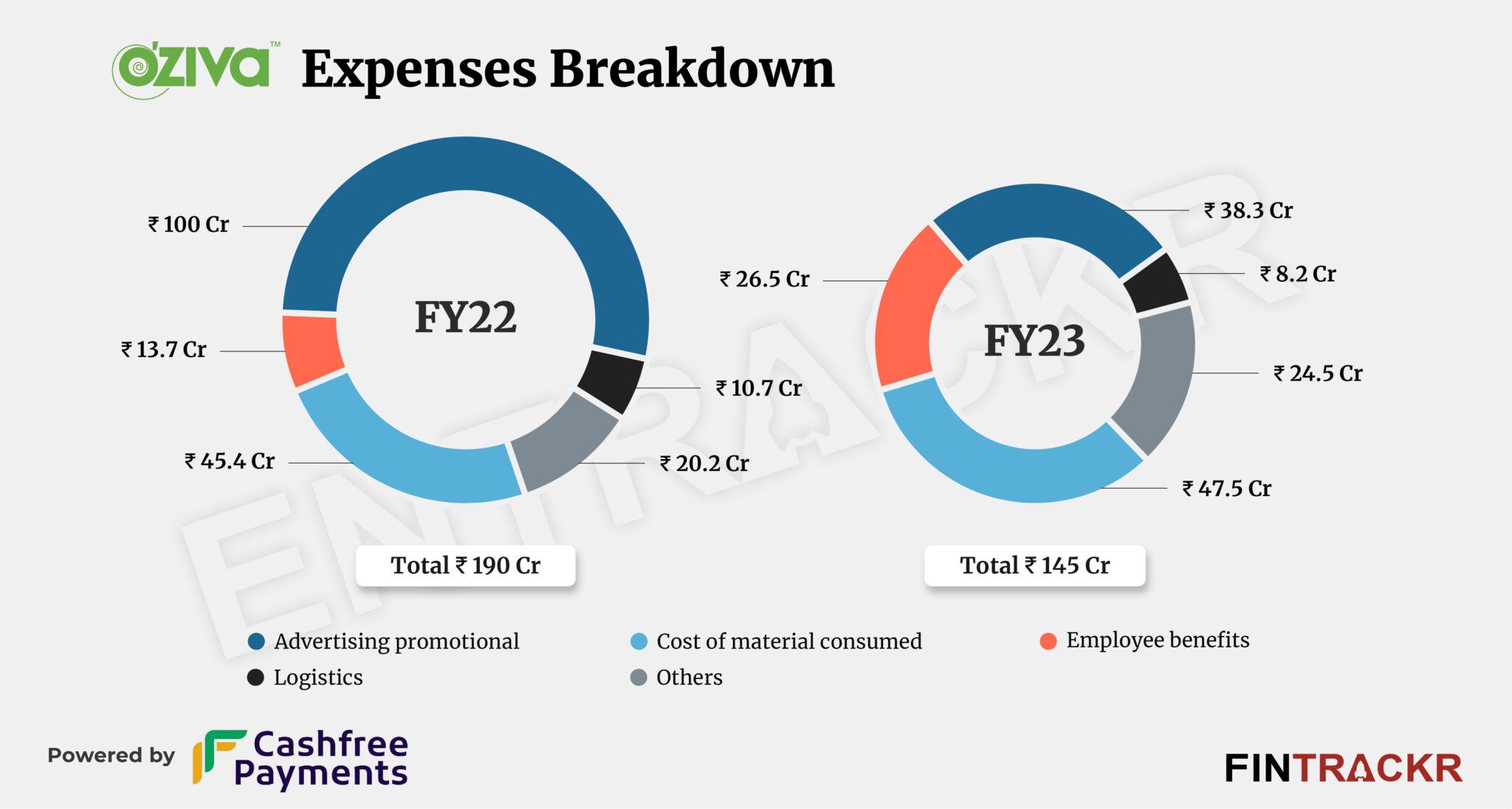

The cost of procurement emerged as the largest burn for Oziva as it formed 32.7% of its total expense in FY23. This cost increased by 4.6% to Rs 47.5 crore during FY23. Its employee benefit costs surged 93.4% to Rs 26.5 crore in during the same period. Significantly, this includes Rs 7.5 crore as ESOP expenses which were non-cash in nature.

Oziva’s marketing and advertising cost nosedived 61.7% to Rs 38.3 crore during FY23. This could be the biggest factor for low sales as advertising and marketing are a function of growth for D2C brands. The company also spent Rs 8.2 crore towards logistics during the last fiscal. At the end, its overall expenditure contracted 23.7% and stood at Rs 145 crore during FY23.

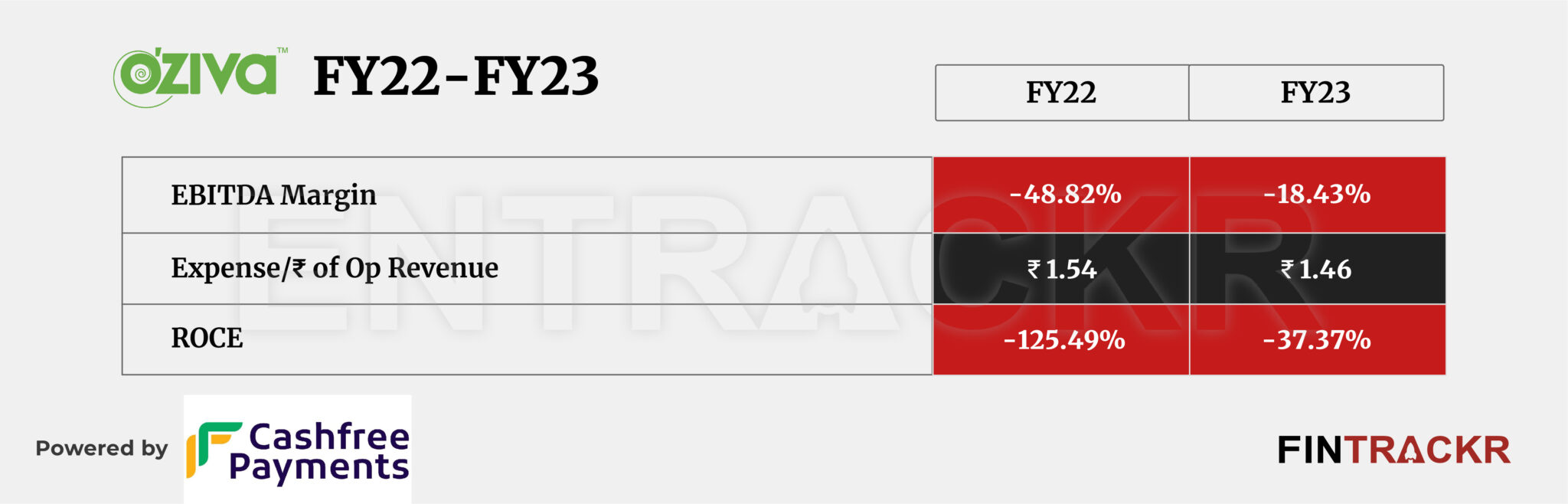

A tighter control on marketing expenses, however, helped Oziva cut off its losses by 31% to Rs 45.68 crore. The losses stood at Rs 66.5 crore in FY22. On a unit level, the company spent Rs 1.46 to make a single rupee of operating revenue in FY23.

Oziva’s struggles encapsulate the perfect example of an established, bottomline-focused player taking over a growth-first startup. The conservatism on costs, especially marketing and advertising costs is the most obvious example as the new parent will seek to make the business sustainable.

Oziva will have known by now that the cuts and streamlining are not over yet, and the firm might be in a race against time to justify further attention or even be shut eventually if it doesn’t latch on to a more sustainable business model in the next few months. On a balance sheet the size of Unilever, it will hardly be missed, so the onus is on Unilever to help make it happen.