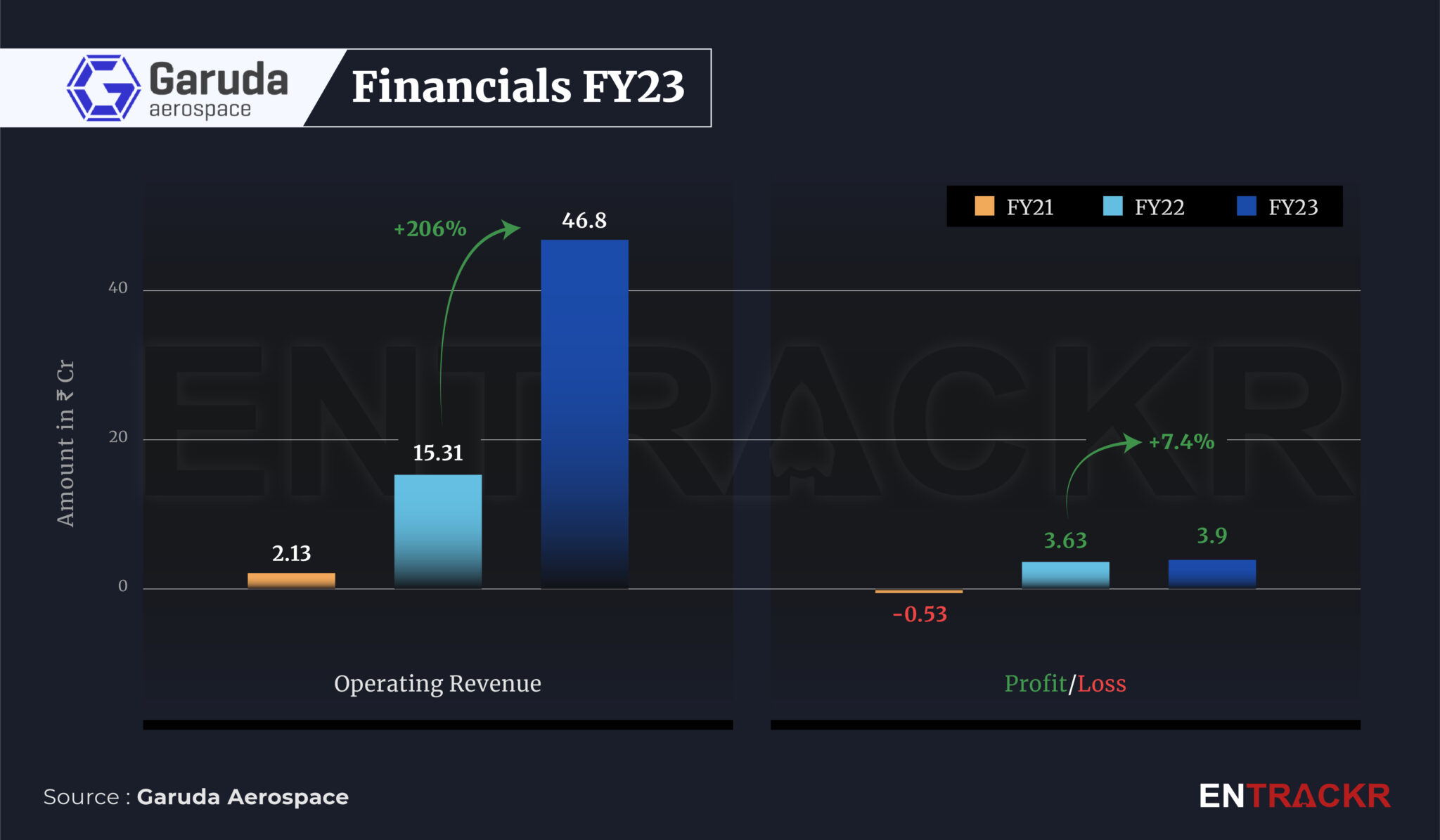

After achieving profitability and over seven-fold growth in scale FY22, drone startup Garuda Aerospace claims to close FY23 with over 200% growth in its operating income.

The Chennai-based startup recorded a 7.2X surge to Rs 15.31 crore in operating revenue during FY22. Continuing the momentum, it managed to grow its revenue to Rs 46.8 crore during FY23, the company said in an interaction with Entrackr.

Garuda collects revenue from surveillance charges and related operating services while the rest comes via sale of drones and accessories.

Founded in 2015 by Agnishwar Jayaprakash, Garuda Aerospace is a drone-as-a-service (DaaS) startup that designs, manufactures and customizes Unmanned Aerial Vehicle (UAVs or Drones) for various use cases such as deliveries, disaster management agriculture et al.

The company manufactures 30 types of drones and offers 50 types of services, according to its website. It claims to have served over 750 clients including TATA, Godrej, Adani, Reliance, Swiggy, Flipkart et al.

Coming to the bottomline of the company, along with rising scale, Garuda also maintained its profitability during the last fiscal. As per the company, it recorded Rs 3.9 crore profits during FY23, 7.4% up from Rs 3.63 crore in FY22.

Garuda is planning to close the current financial year (FY24) with a 10X jump to Rs 400 crore revenue, the company told Entrackr.

Garuda raised the largest Series A funding round in the space in February this year. As per the company, its current valuation stands at $250 million. With further expansion plans, the company is looking to raise another $50-70 million in Series B round at a valuation of $300-400 million with an aim to become the first drone unicorn in space by 2024.

To date, the drone startup has raised $24 million in funding. Former Indian cricket team captain Mahendra Singh Dhoni has also invested in it and is the brand ambassador of the company.

The company also said that it has received pre-bookings of over 9000 drones, the largest order book among any other leading drone companies in India & Revenues worth more than Rs 300 crore waiting to be realized with healthy margins of 26% over the next year.

Recently, Garuda has secured a significant order of 400 Agri Kisan Drones from Indian Farmers Fertilizer Cooperative Limited (IFFCO) in the first quarter. Following this, Garuda’s order book increased to a count of 10,000 drones for the year within the first three months. Additionally, Garuda Aerospace has received dual DGCA certification for their Garuda Kisan Drone, further solidifying their position in the industry.

It competes with Skyroot Aerospace, Bellatrix Aerospace, ideaForge, among others.

It’s certainly a good time to be in the Drones business in India, with policy support surprising even the most die-hard optimists, one would argue. With the market divided between the defense sector and others, Garuda, it would appear, has placed its bets on ‘others’. That’s well and good, and with a healthy order book, the firm certainly has much to look ahead to. The biggest risk for players remains the dependence on imports, which even as it might vary from player to player, remains high. As we saw recently with curbs on technology transfer to export of critical minerals, the China factor looms large here as a disruptive force, and it will be interesting to see just how far Indian drone sellers (rather than manufacturers) have insulated themselves from the same.