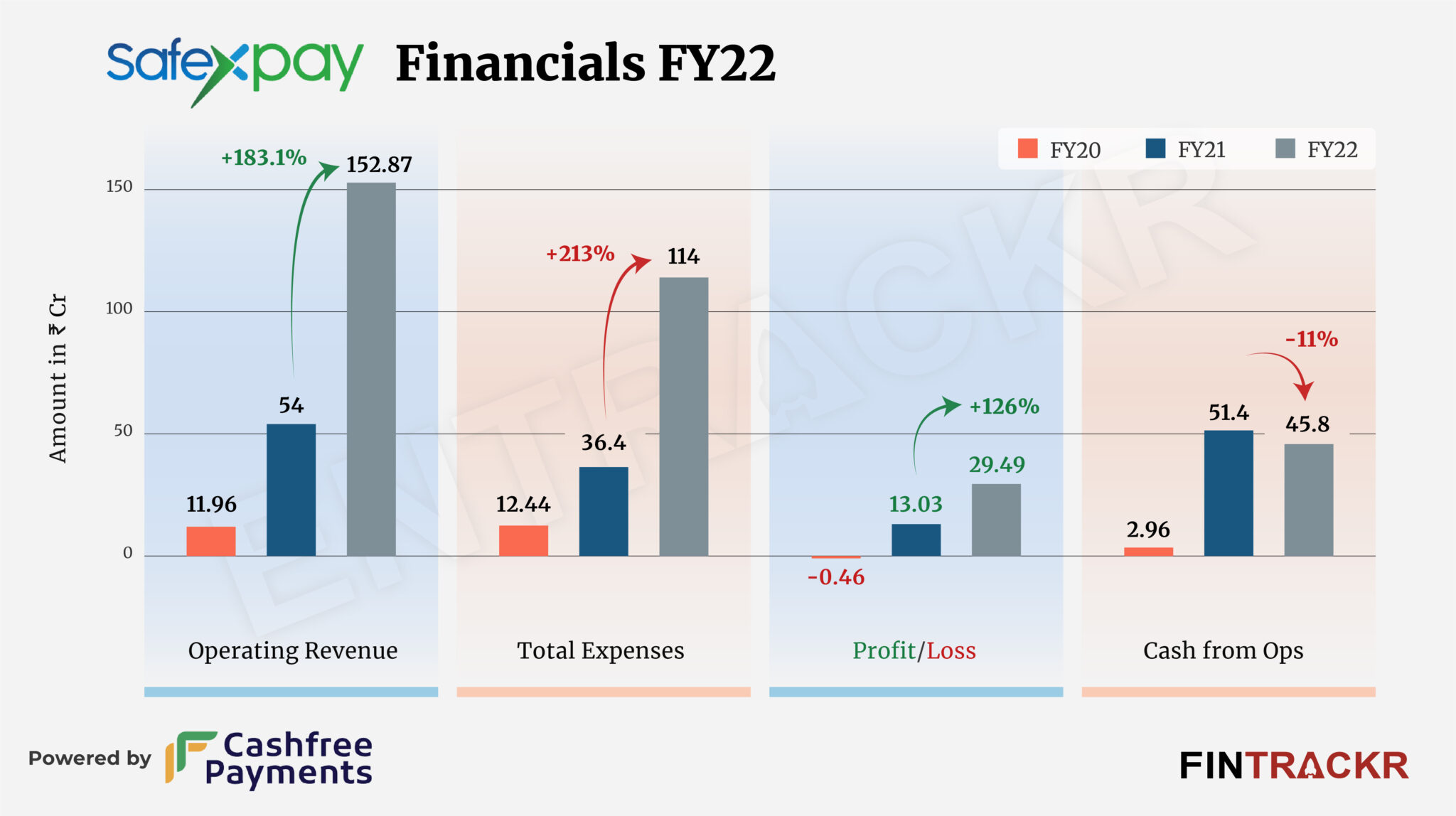

B2B fintech startup Safexpay has recorded an exceptional 12-fold growth in its scale in the last two reported fiscal years: from Rs 11.96 crore in FY20 to around Rs 153 crore in FY22. Importantly, the company also turned around its bottom line and churned over Rs 29 crore in profit during FY22 from a loss of Rs 46 lakh loss in FY20.

We will analyze the expense and loss pattern of the company during FY22 in the second half of the story. For now, let’s look at where its topline came from.

Safexpay’s operating revenue surged 2.8X to Rs 152.87 crore in FY22 from Rs 54 crore in FY21, according to its consolidated financial statements with the Registrar of Companies (RoC).

For background, the Gurgaon-based firm is a white-label payment aggregation platform which provides payment gateways, neo-banking, QR Code management tool, Payout API, and customized payment solutions to banks and other financial entities.

Launched in 2017, Safexpay has more than 250 employees with five global offices spread across the UAE, Qatar, Saudi Arabia, and India.

Transaction or payment gateway services formed 95% of Safexpay’s total revenue while the rest came from technical service fees.

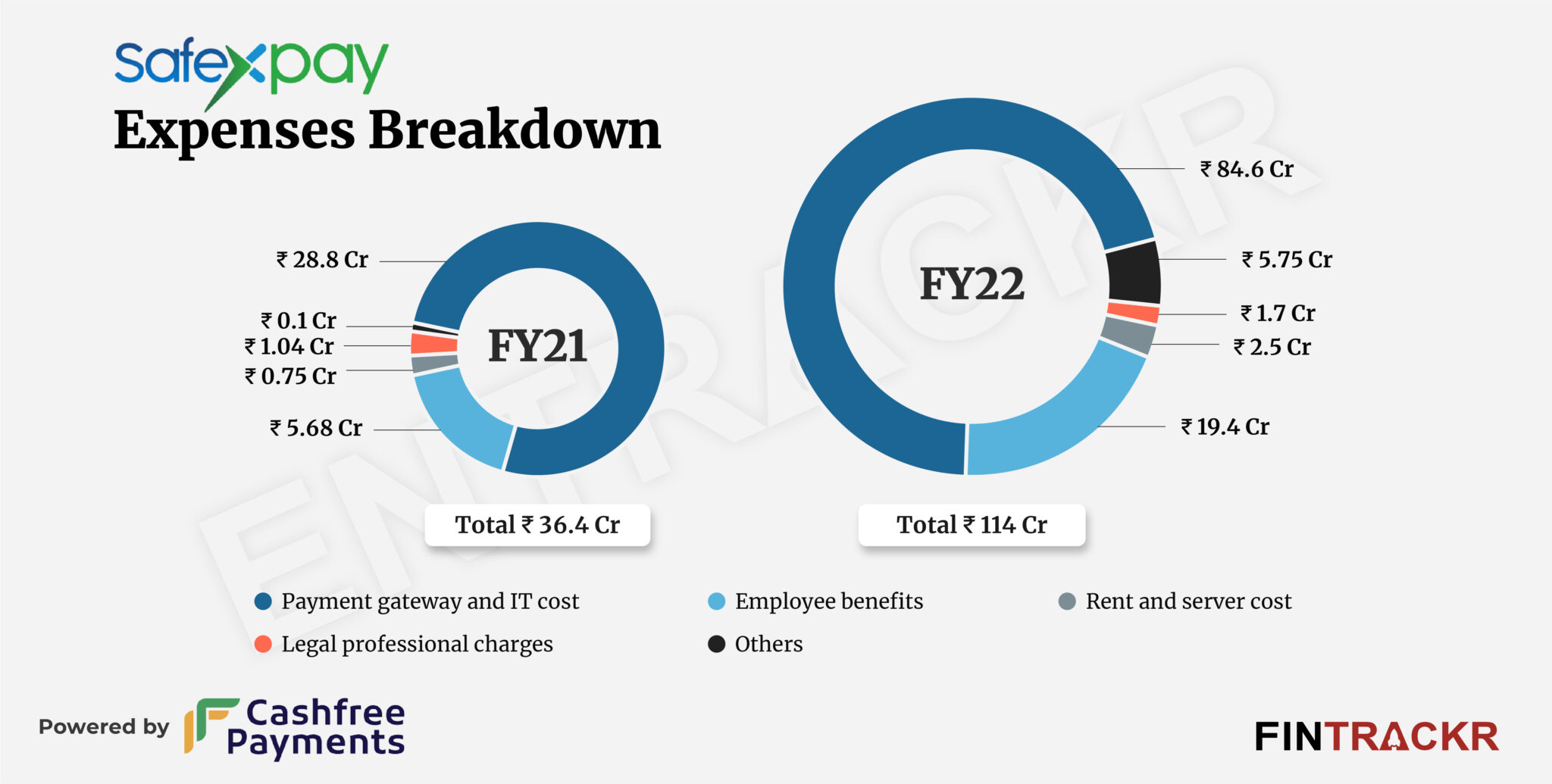

On the cost side, its payment gateway accounted for 74.2% of the overall expenditure which grew 2.9X to Rs 84.6 crore in FY22.

Its employee benefit and rent cum server costs climbed 3.4X and 3.3X to Rs 19.4 crore and Rs 2.5 crore respectively during FY22. The company spent Rs 1.7 crore towards legal fees which steered its total expenses up by 3.1X to Rs 114 crore in FY22.

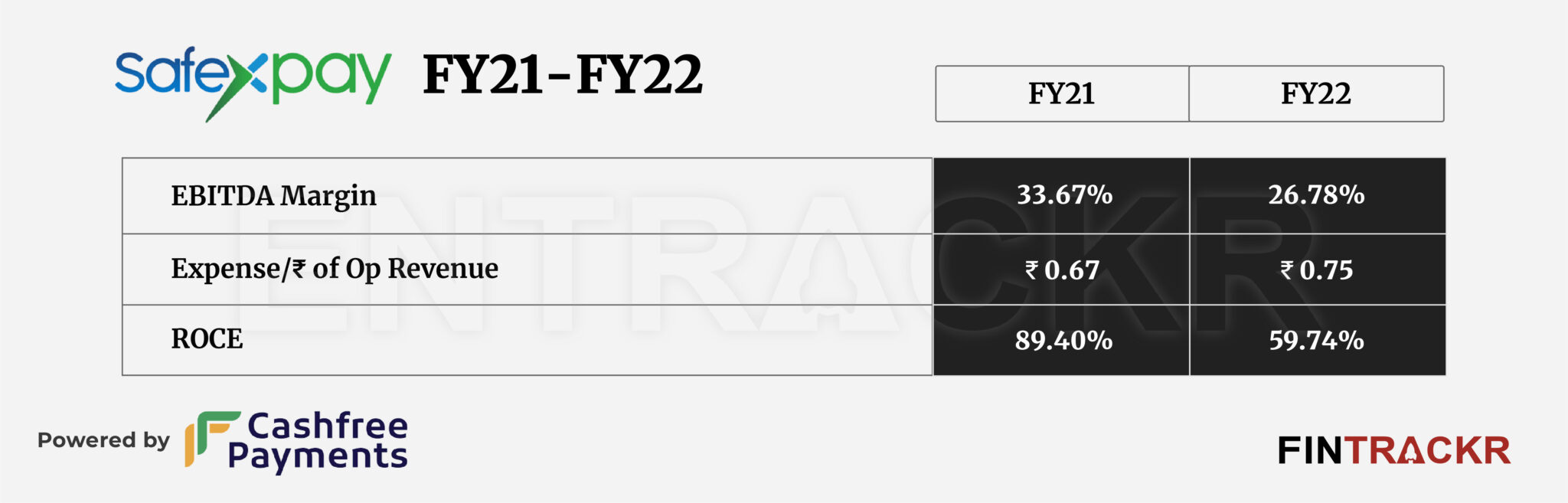

With a good hold over expenditure, the PAT (profit after tax) of Safexpay jumped by 126% to Rs 29.49 crore in FY22. Its ROCE and EBITDA margin were registered at 59.74% and 26.78%, respectively. On a unit level, the company spent Re 0.75 to earn a rupee of operating revenue.

With a firmly entrenched position in its operating markets and profitable to boot, Safexpay certainly seems poised to grow well, and in doing so, will have enough access to capital if needed. With a last valuation of $100 million in 2022, the firm will have every reason to expect a multiple growth over that number as it seeks growth. As FY23 numbers come in, expect a clearer picture on the next big steps for this smart little fintech.