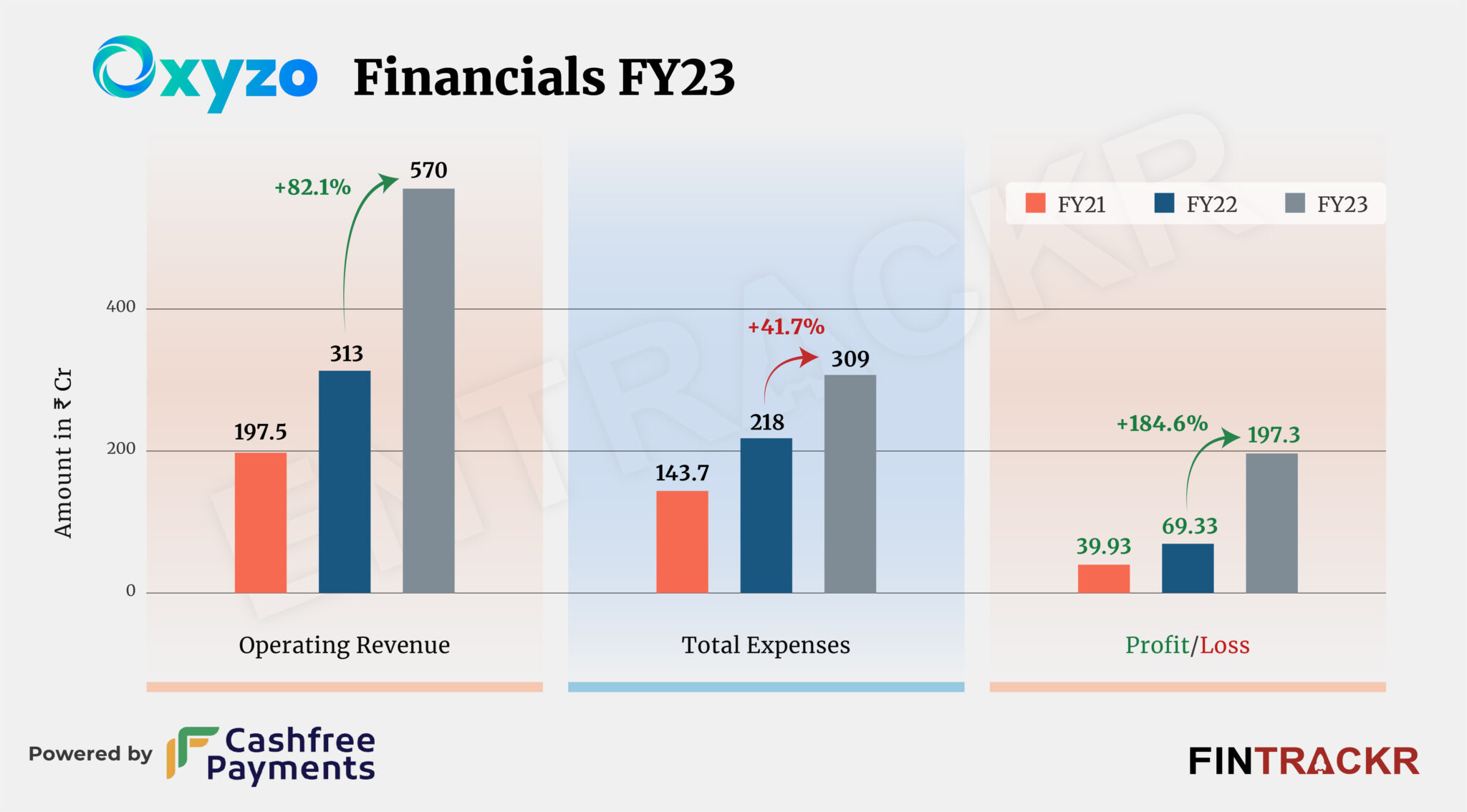

B2B fintech unicorn Oxyzo Financial Services crossed the Rs 570 crore revenue mark in the fiscal year ending March 2023 and also managed 2.8X growth in its profit after tax (PAT), according to the company’s consolidated financial statement reviewed by Entrackr.

Oxyzo, the lending arm of industrial goods and services procurement platform OfBusiness, provides credit solutions and loans to small and medium enterprises (SMEs) to expand their operations, revenue, and profits. The company works with over 10,000 SMEs across India.

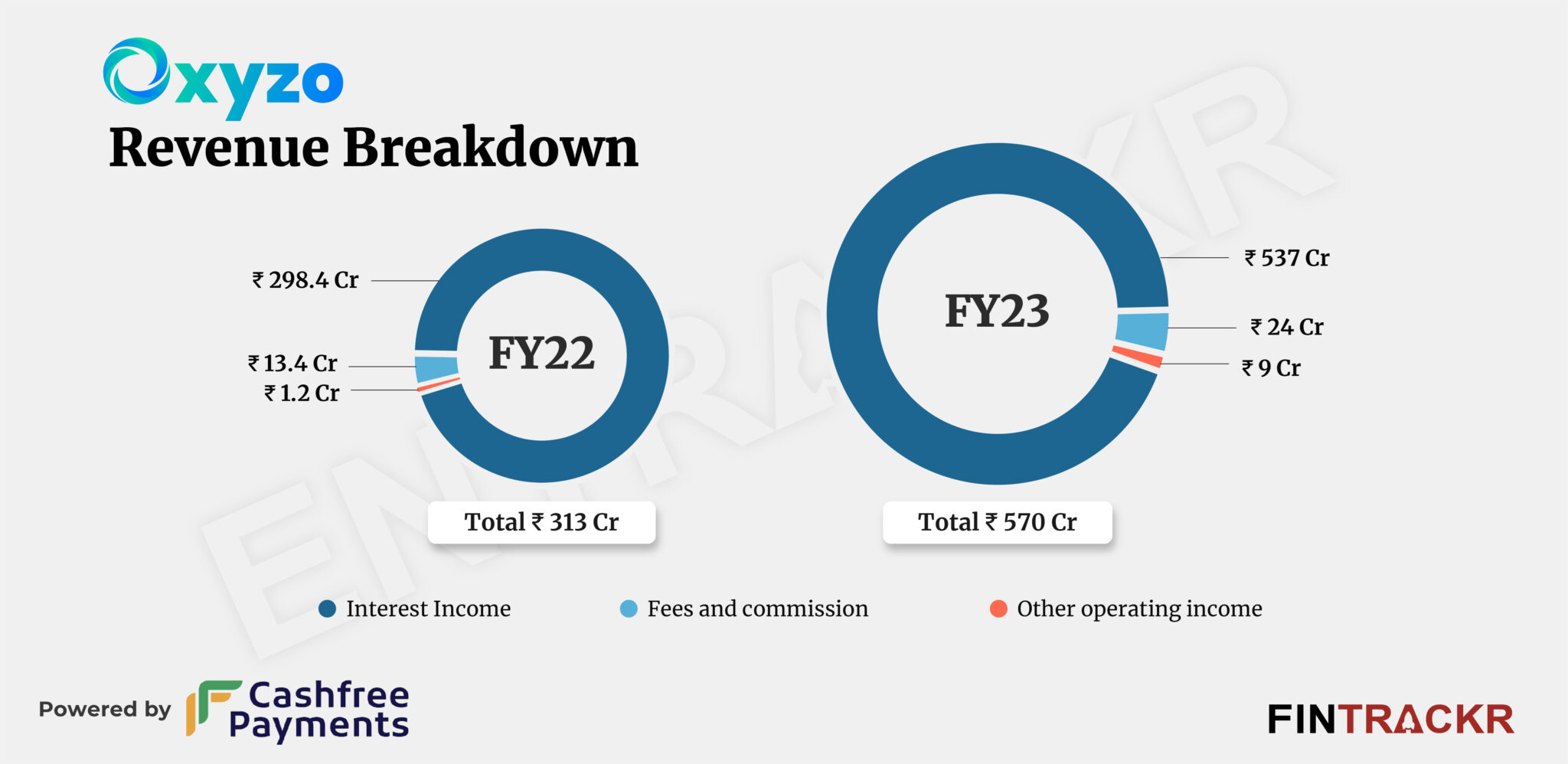

Interest collected on loans disbursed formed 94.1% of its total operating revenue which surged by 79.8% to Rs 537 crore in FY23, according to its financial statement. Income from platform fees and commissions grew by 79.1% to Rs 24 crore in FY23, while it also made Rs 9 crore from other operating activities.

The company has crossed a loan book of Rs 4,800 crore during the last fiscal year and aims to almost double down the numbers to Rs 8,200 crore in FY24. Importantly, Oxyzo maintained a GNPA (gross non-performing assets) of less than 1% throughout the year.

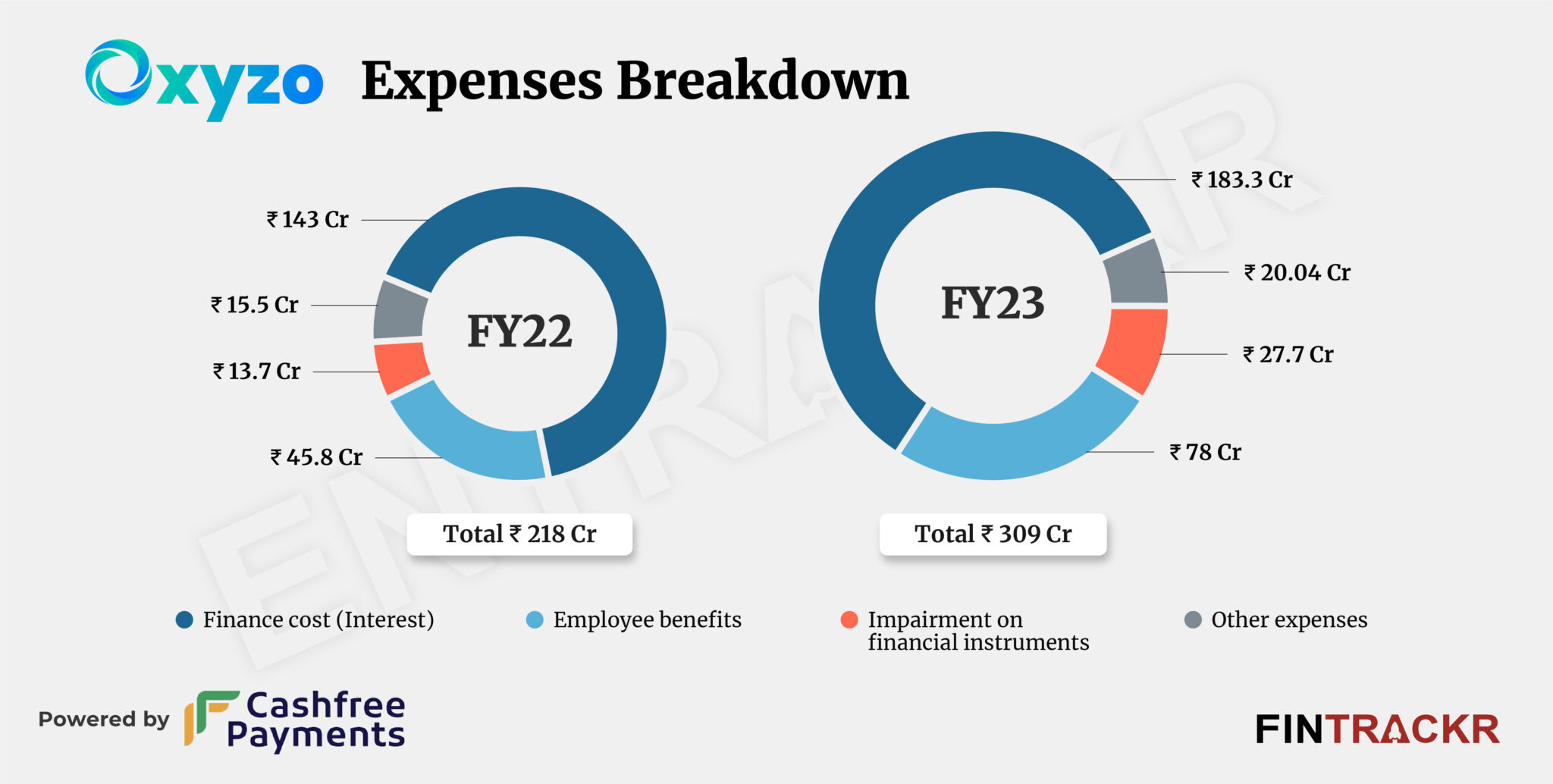

On the expense front, the fintech unicorn’s finance cost (interest) accounted for 59.3% of the total expenses. This cost surged 28.2% to Rs 183.3 crore in FY23 from Rs 143 crore in FY22, as per documents.

Spending on employee benefits went up 70.3% to Rs 78 crore during the last fiscal year. This includes Rs 17.1 crore as ESOP expenses (non-cash). Oxyzo also booked impairment on financial instruments of Rs 27.7 crore which jumped 2X in FY23 from Rs 13.7 crore in the preceding fiscal.

At the end, Oxyzo’s annual expenditure inclined 41.7% to Rs 309 crore in FY23 as compared to Rs 218 crore in FY22. Oxyzo has managed to keep a tab over its expenses in FY23 and this could be noticed from its profit which shot up 2.8X to Rs 197.3 crore during FY23. Its profits during FY22 stood at Rs 69.33 crore.

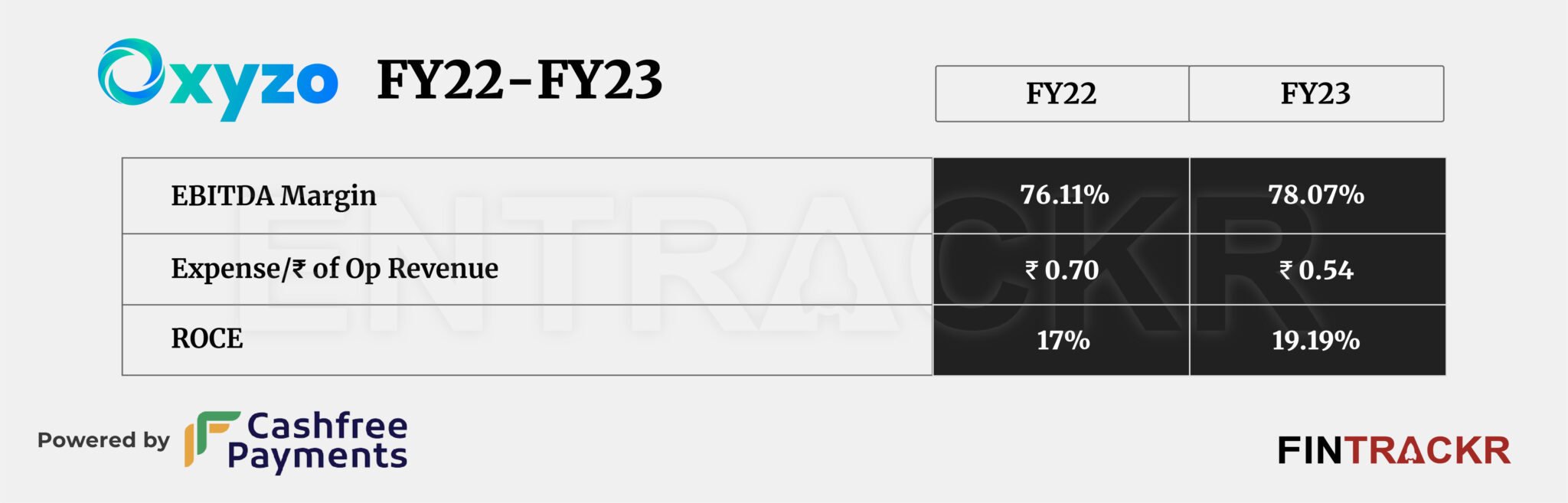

Oxyzo’s cash outflows from operations spiked 67% to Rs 1,870 crore during FY23. Its EBITDA margin and ROCE strengthened to 78.07% and 19.19% respectively. On a unit level, Oxyzo spent Re 0.54 to earn a rupee of operating income in FY23.

Oxyzo aims to be a full-service provider from lending to capital markets. It also expanded its customer base from SMEs to micro-enterprises, mid-corporates, and financial institutions. As per the company, it will invest and scale co-lending partnerships, debt capital market, and supply chain platforms.

The company expanded its micro-enterprises lending segments through its investment in ZIEL Financial Technologies which has a vast network of over 75 branches and a presence in Rajasthan, Uttar Pradesh, Haryana, Uttarakhand, and Punjab.

Also read: Decoding Oxyzo’s unicorn round and captable

Oxyzo turned unicorn after raising its first ever external funding round worth $200 million during the last quarter of FY22. The round was led by Alpha Wave and co-led by Tiger Global along with Norwest Venture Partners, Matrix Partners and Creation Investments.

Latching on to an opportunity its promoters spotted early on, and hived off as a separate business, Oxyzo is a solid example of an opportunistic success story. In hindsight, the firm also had the benefit of a banking system that was finishing up an extended clean up, and hence, let down many of its customers in segments that Oxyzo serves currently.

With most indicators pointing to a banking system that is as healthy as it has ever been in the past two decades, it should be very interesting to see just how the banks try and recover a market that should rightfully have been theirs, they will feel. India’s vast SME market is served primarily by its PSU banks, which allowed Oxyzo to step in, helped no doubt by learnings at OfBusiness. The next phase of growth will need to be hacked out completely on the basis of a product that exceeds offerings from a banking system eager to make a comeback.