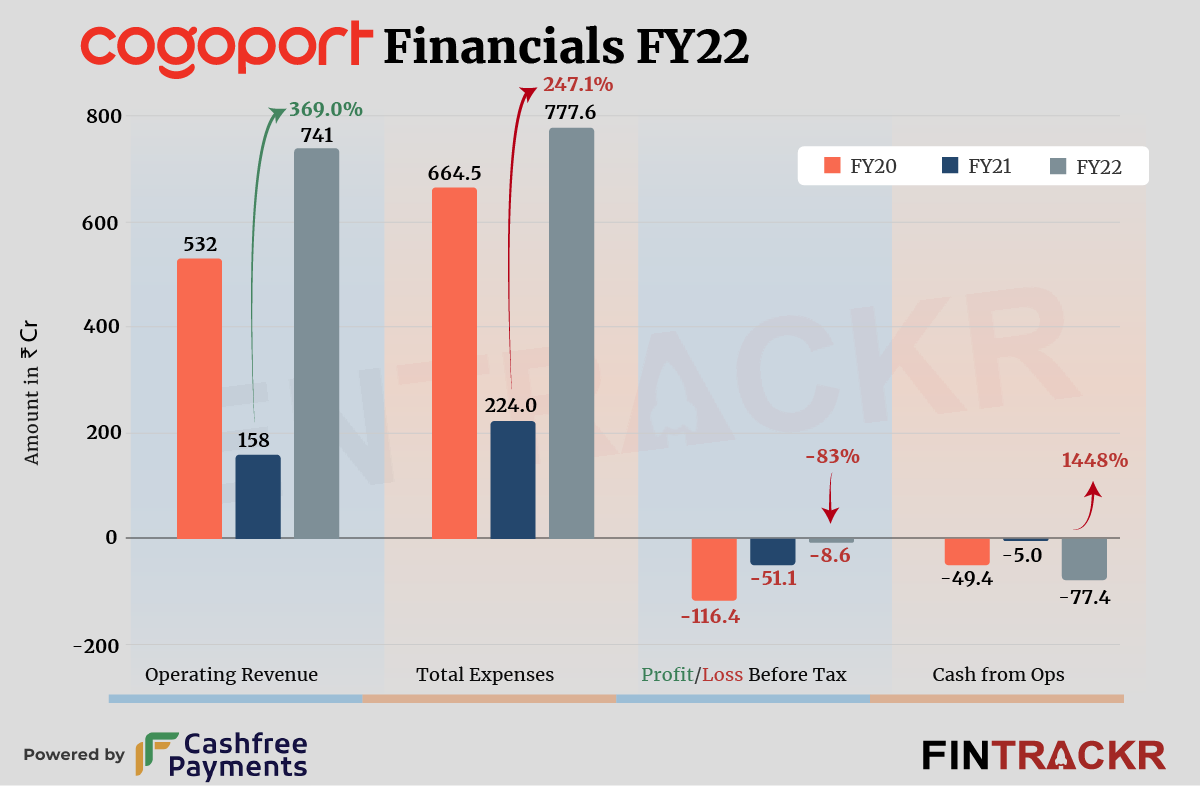

Online logistics platform Cogoport has demonstrated remarkable financial performance in FY22 as its scale shot up over 4.6X, and losses dwindled 83% in the same period.

We will come to the expense and bottomline of the Mumbai-based company in the later half of the story. For now, let’s focus on its collections.

Cogoport’s revenue from operations grew 4.6X to Rs 741 crore in FY22 from Rs 158 crore in FY21, according to its consolidated financial statements with the Registrar of Companies.

For the uninitiated, Cogoport is an online logistics marketplace aggregating ocean and airline freight carriers for exporters and importers. The collections from logistics services was the only source of revenue for the seven-year-old company.

Cogoport also has other income of Rs 27.9 crore mainly from interest on deposits and other non-operating activities.

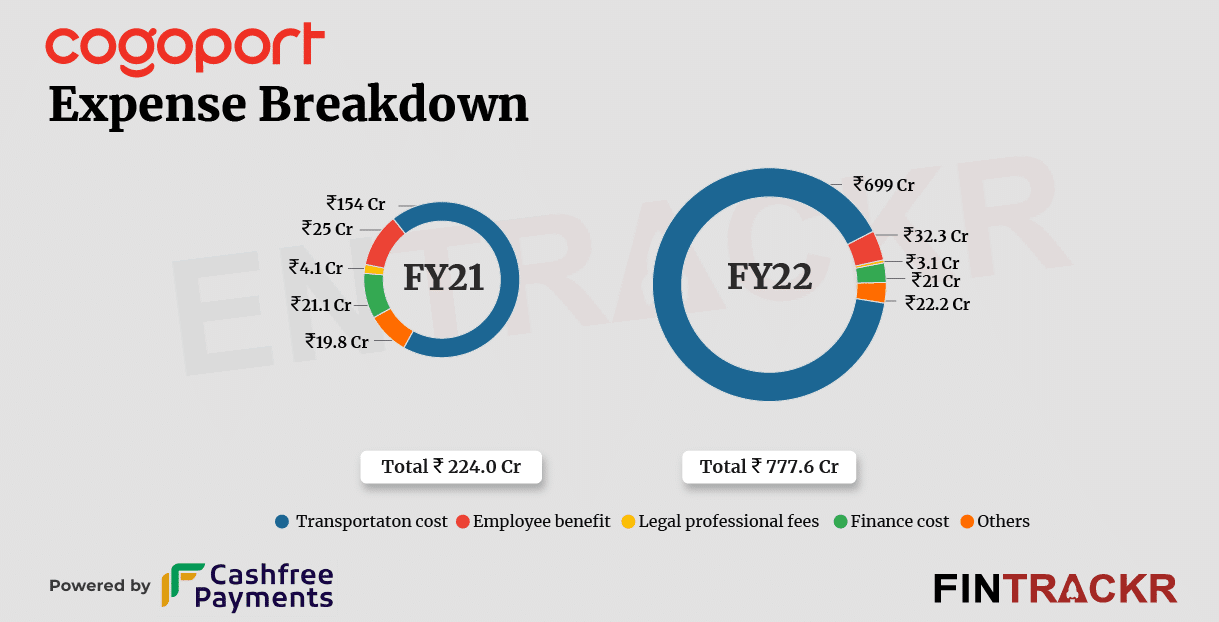

When it comes to cost, transportation formed 89.9% of the overall expenditure in FY22. Similar to the revenue growth, this cost soared 4.5X to Rs 699 crore.

Its employee benefit expenses grew 29.2% to Rs 32.3 crore during FY22 while Cogopaort had a total borrowings of Rs 354 crore (long and short term) on which it spent Rs 21 crore as interest (finance cost).

The company also spent Rs 3.1 crore on legal and professional services, accelerating the total cost 3.4X to Rs 777.6 crore in FY22 from Rs 224 crore in FY21.

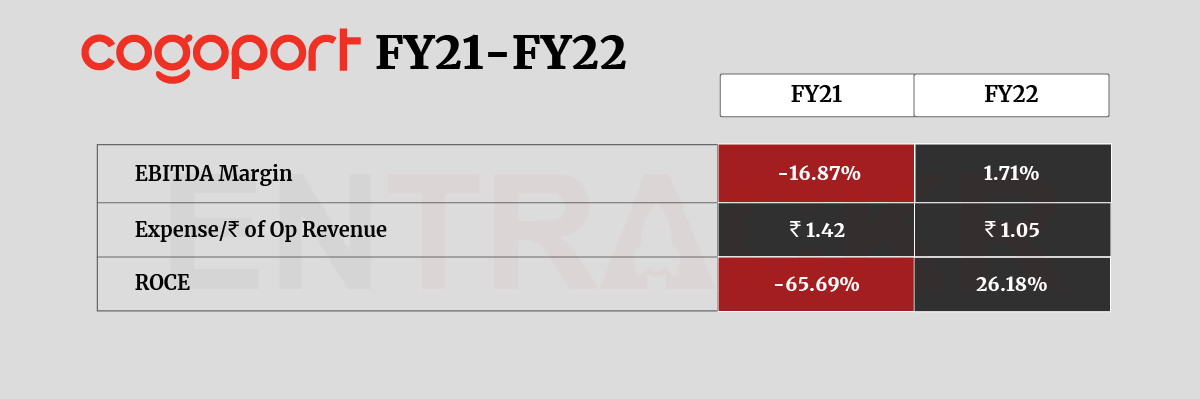

With a sharp spike in its scale and control on expenses, Cogoport has kept a tab on its losses which shrank 83% to Rs 8.6 crore in FY22. Its ROCE and EBITDA margin were registered at 26.18% and 1.71%, respectively, in FY22. On a unit level, the company spent Rs 1.05 to earn a rupee.