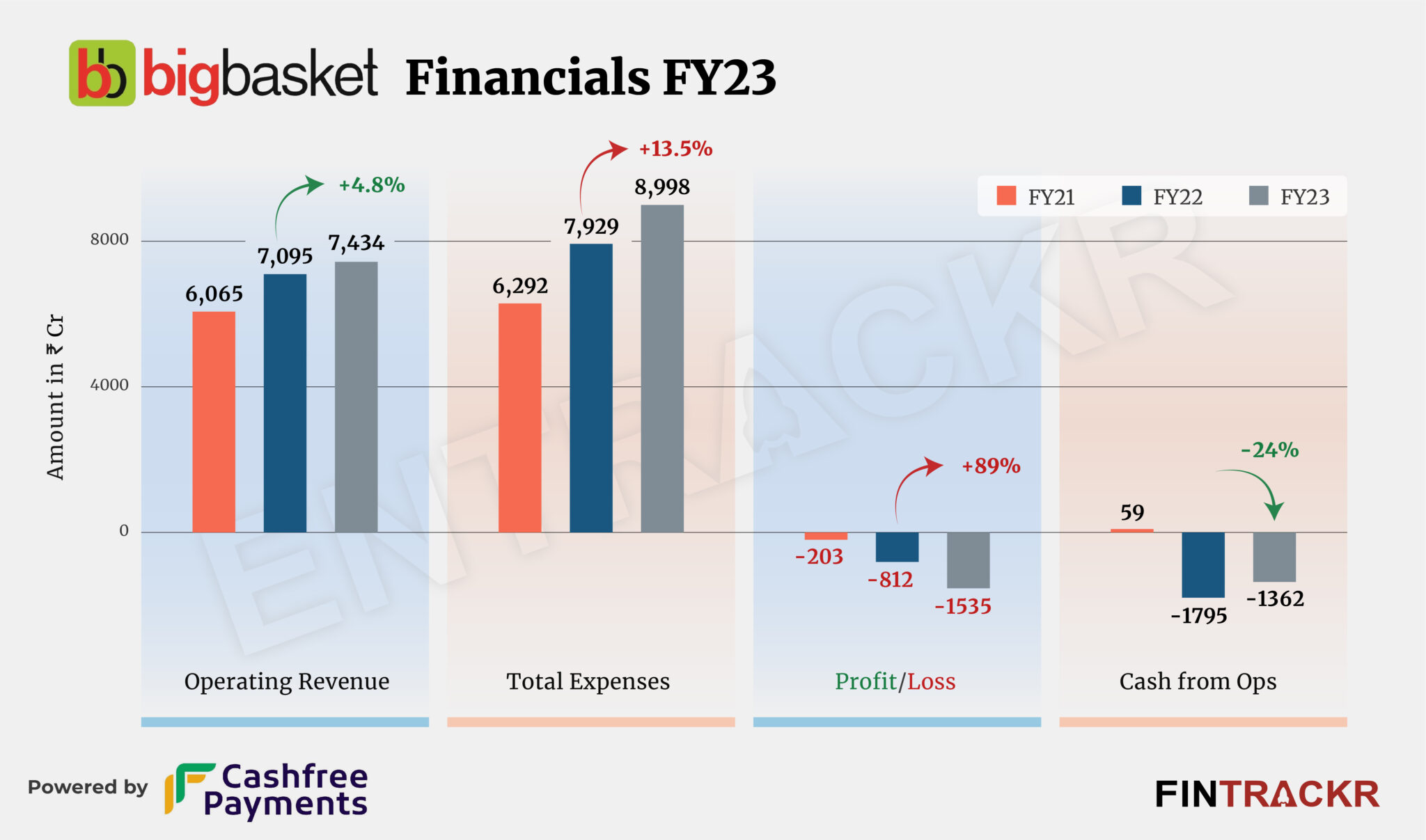

After its acquisition by Tata Group in 2021, BigBasket’s consumer facing arm Innovative Retail has struggled to grow its scale. The e-grocer under Tata’s umbrella registered 17% growth in its topline in FY22 which further nosedived to around 5% in FY23.

While the growth has remained flat, BigBasket’s B2C biz losses soared 89% due to mounting advertising, employee, and logistics costs. We will look into its expense and losses part in the second half of the story, let’s first analyze its revenue generation.

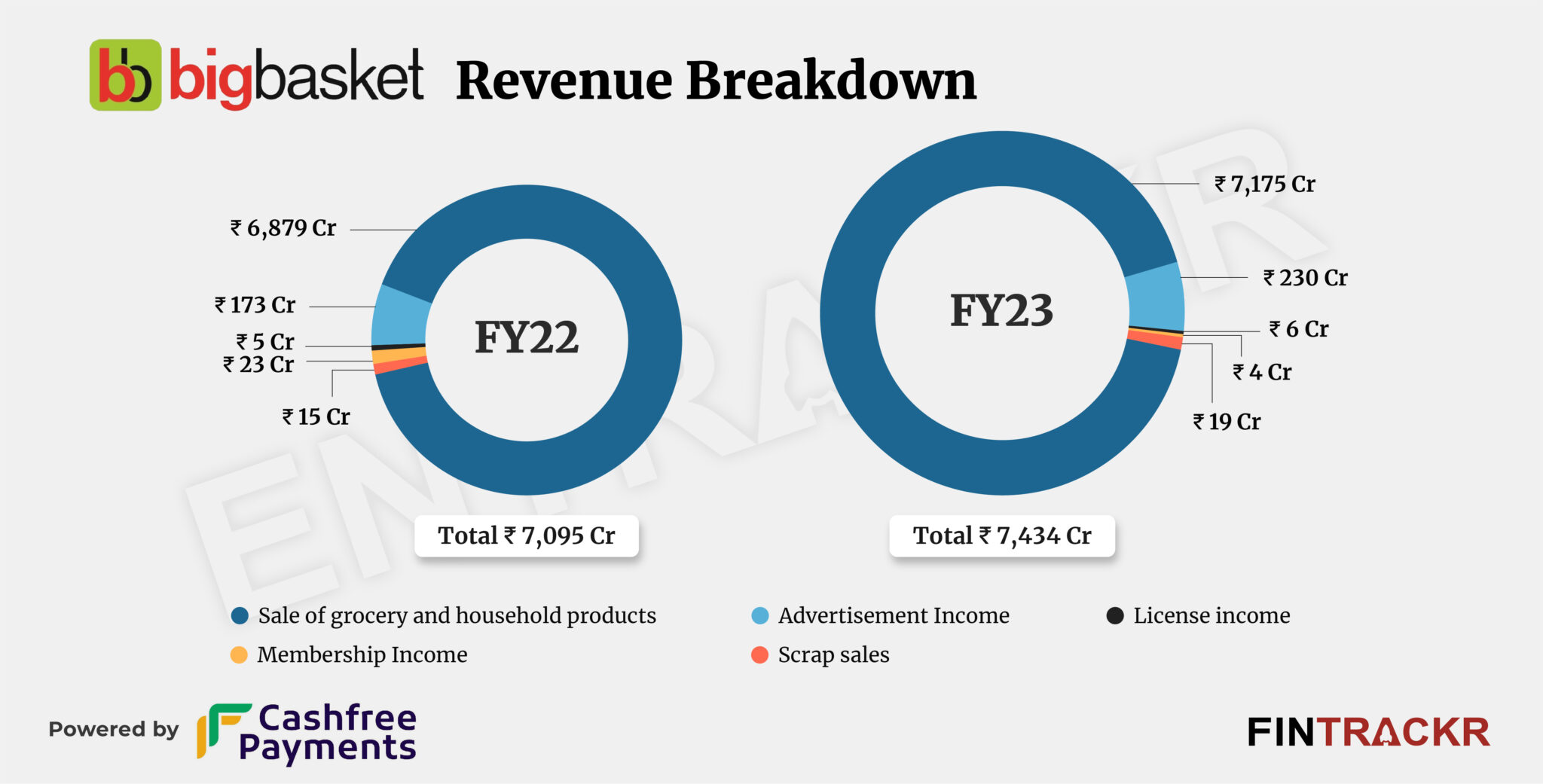

Innovative Retail Concepts Private Limited, which handles sales and home delivery of groceries for BigBasket’s B2C unit, registered a mere 4.8% growth in its scale to Rs 7,434 crore in FY23 from Rs 7,095 crore in FY22, according to its annual financial statement with the Registrar of Companies (RoC).

Collection from groceries and household products constituted 97% of its total operating revenue, which grew 4.3% to Rs 7,175 crore in FY23.

The company also generates income through ads on its mobile app and website. Revenue from this vertical increased 32.9% to Rs 230 crore in FY23, whereas income from licensing, membership fees, and the sale of scrap collectively was recorded at Rs 29 crore in the preceding fiscal year.

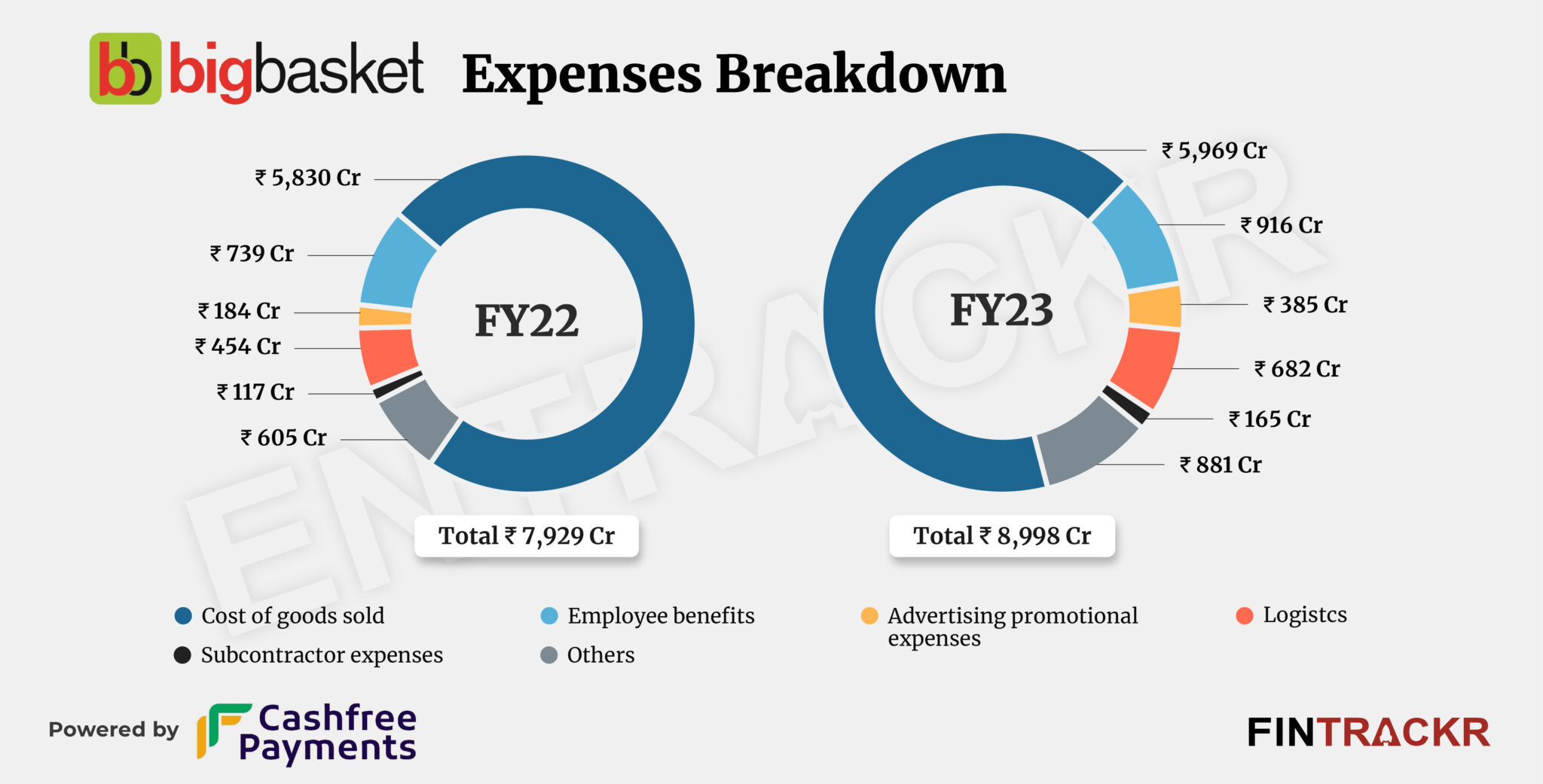

On the expense side, the cost of procurement of goods was the largest cost center, which formed 66.3% of the total cost. In line with scale, this cost increased by 2.4% to Rs 5,969 crore in FY23.

The company’s employee benefit spending surged 24% to Rs 916 crore during FY23. Meanwhile, its advertisement cost swelled two-fold to Rs 385 crore in the preceding fiscal year.

The company incurred Rs 682 crore and Rs 165 crore on logistics (transportation) and contract costs, which pushed the overall cost up by 13.5% to Rs 8,998 crore in FY23 from Rs 7,929 crore in FY22.

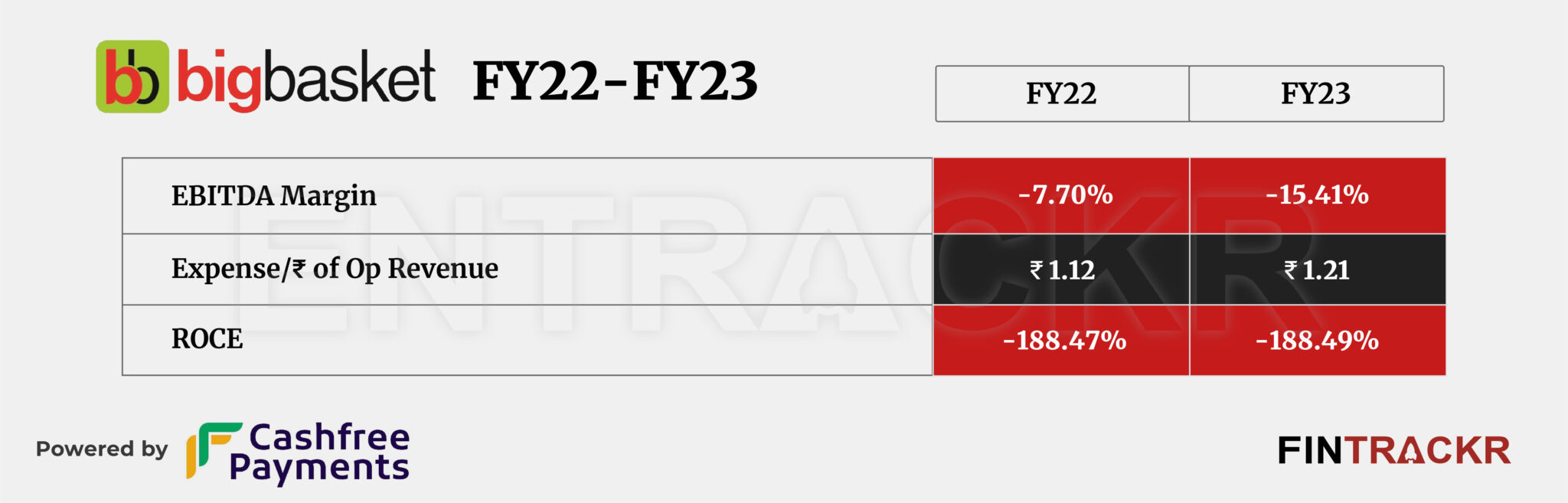

BigBasket’s B2C unit witnessed sluggish growth with a sizable cash burn during FY23. Consequently, its losses spiked 89% to Rs 1,535 crore in FY23. Its ROCE and EBITDA margin stood at -188.49% and -15.41%. It spent Rs 1.21 to earn a unit of operating revenue in FY23.

The continuous losses, while not unexpected, would certainly worry the Tatas, considering the tepid growth in topline. Granted, the business remains intensely competitive with multiple players in the top markets especially sniping away, but worry they must. From Zepto to Otipy to Blinkit to Swiggy Instamart, or the many segment specific specialists like Licious or Fresh to Home, the fact remains that broad grocery provider like Big Basket still possibly lacks a clear differentiation in a market with giants like Flipkart and Amazon. Not that it is ever going to be easy in a value conscious market like India. ‘In-store’ brands like BB Royal have been developed, but short of specific breakup of sales, it is tough to say how far and long the path to profitability remains.

But there appear to be no short cuts in this cut throat market, and perhaps its B2B operations will provide some relief. More on that as soon as the numbers are filed there.