In India, the craze for fantasy, e-sports and real-money gaming has grown significantly in the last couple of years. According to an industry report, the number of gamers in the country is expected to jump from 420 million in 2022 to hit 500 million by 2025.

This massive market and the opportunities it has thrown up has prompted many entrepreneurs to launch startups in this space, leading to intense competition and efforts to retain their users.

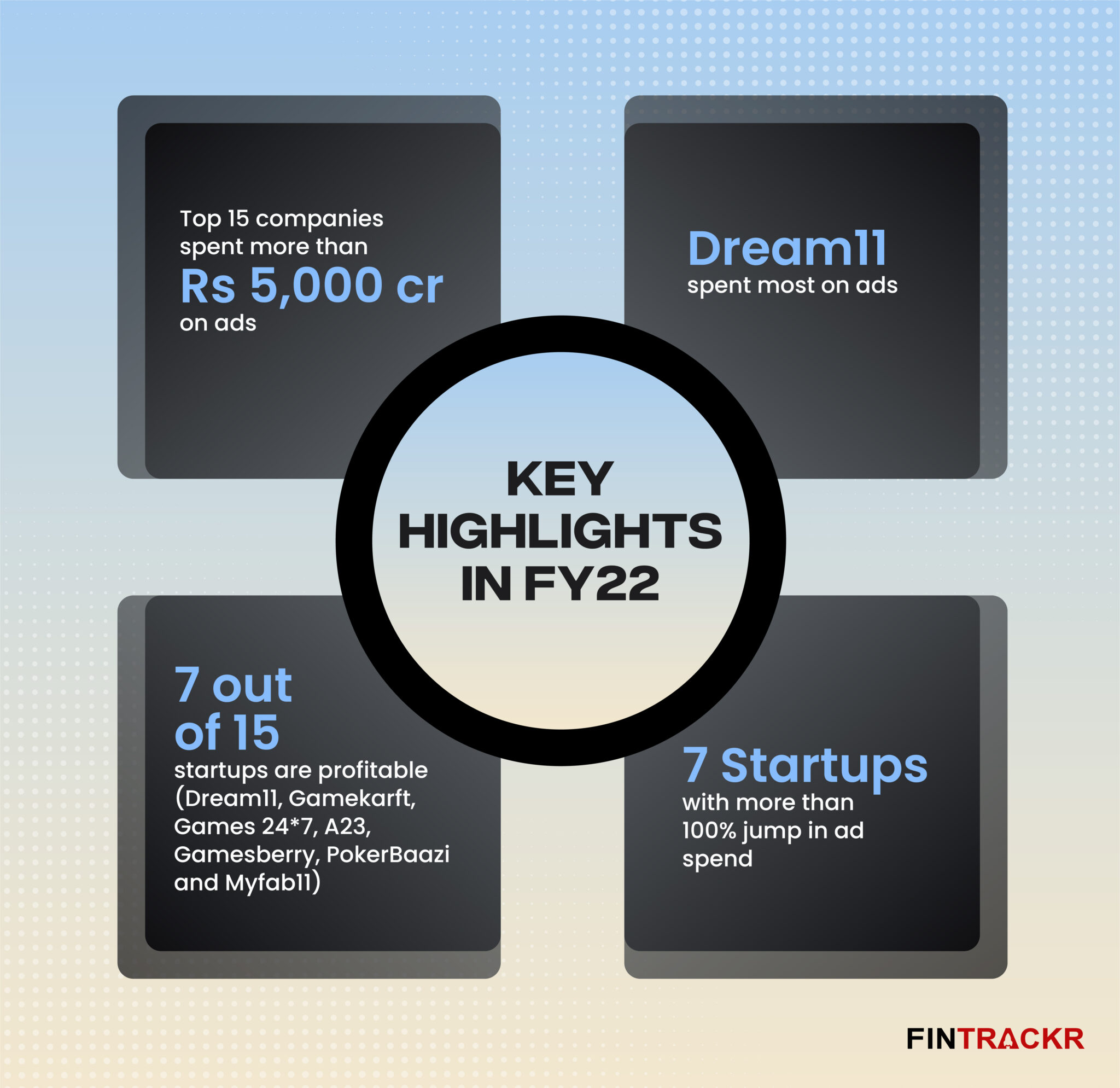

The top 15 revenue-generating companies in this segment — some of which include Dream11, Gameskraft, Games24x7, A23 and MPL — have cumulatively generated Rs 9,093 crore in topline during FY22. But, more interestingly, these companies spent over half of that amount on advertisement and promotions: over Rs 5,000 crore.

As per the data analyzed by Fintrackr, the advertisement and promotional spends for these startups grew 27% year-on-year to Rs 5,191.3 crore in FY22 from Rs 4,197.9 crore in FY21 while the revenue also scaled at the same pace and grew 27% to Rs 9,093 crore during FY22 from Rs 7,157.81 crore in the previous year.

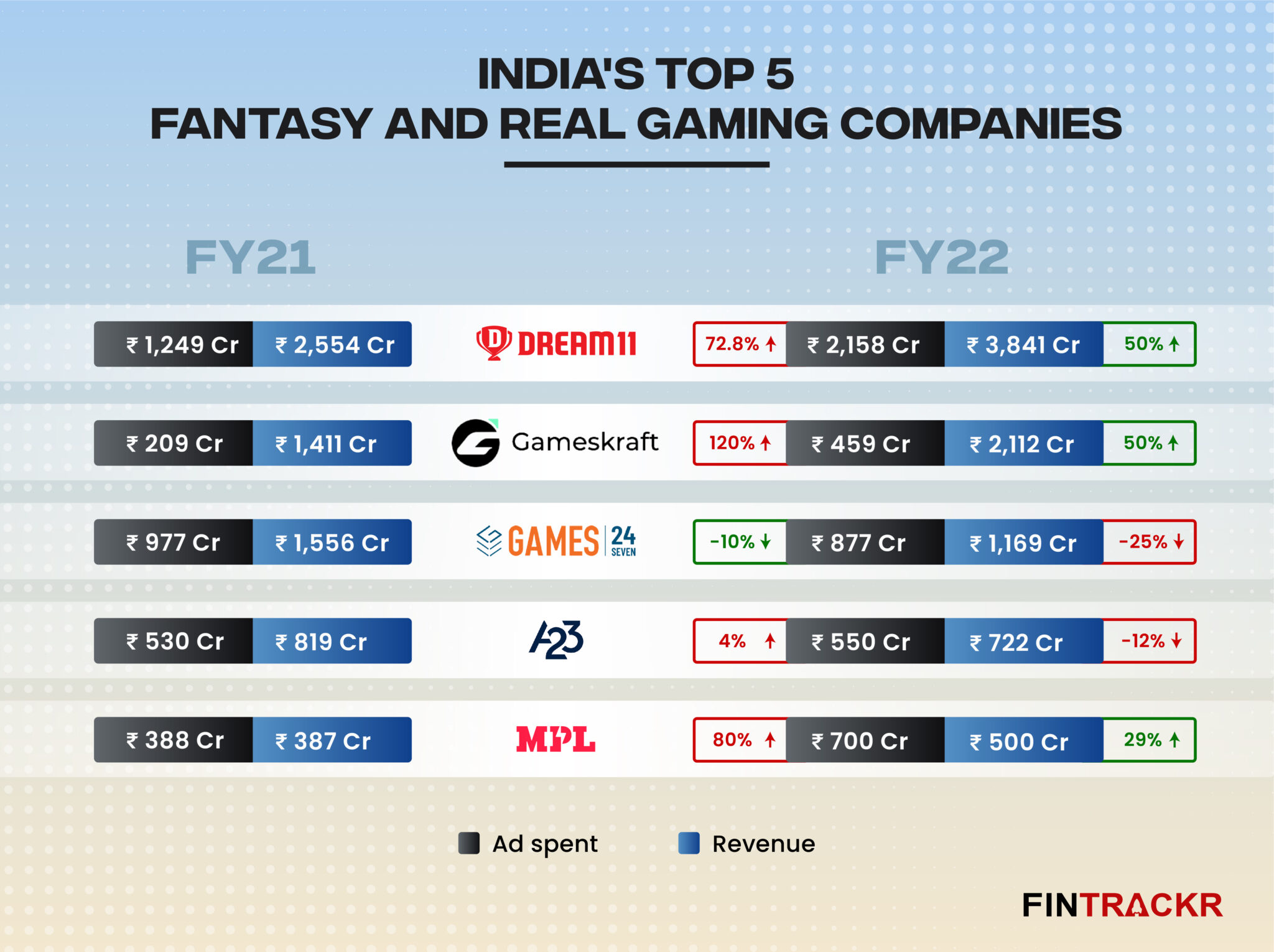

Top 5 revenue-generating fantasy and real money gaming startups

Unsurprisingly, Dream11 is the highest revenue-generating fantasy sports company in India, forming 42.2% of the overall industry revenues. The company registered Rs 3,841 crore in revenue during FY22. With almost every leading cricketer and a bunch of celebrities as its brand ambassadors, the company spent Rs 2,158 crore on advertising, accounting for 41.5% of the overall ad spent by these 15 companies in the list. For Dream11, there has been a 72.8% growth in ad spending against 50.4% growth in revenue between FY21 and FY22.

Gameskraft, which runs RummyTime and Pocket52, and Games24x7, which runs RummyCircle and My11Circle, are in second and third positions with Rs 2,112 crore and Rs 1,546 crore revenue in FY22, respectively. These two entities collectively spent Rs 1,336 crore on advertisements and promotion during the same period.

While Gameskraft registered nearly 120% growth in ad spend, Games24x7 saw a decline of 10% in terms of ad spending between FY21 and FY22.

E-sports and skill gaming platform MPL and real-money gaming company A23 recorded Rs 500 crore and Rs 722 revenue in FY22 while the advertisement spend was Rs 700 crore and Rs 550 crore, respectively, during the same period. The growth in ad spending against revenue for all companies in the past two fiscal years can be seen in the graph.

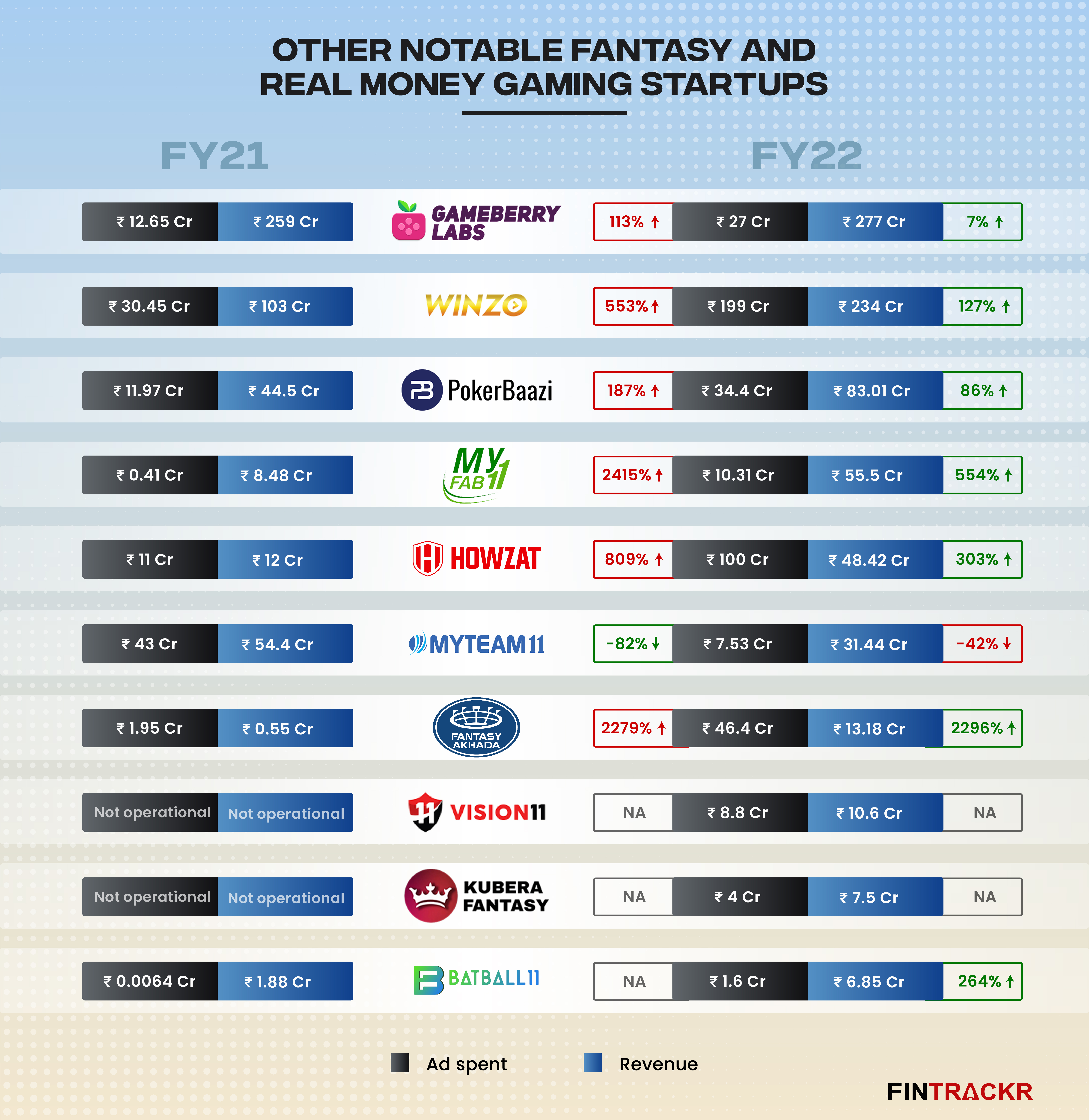

Other notable startups in this space

Even as the top 5 companies have managed to go past at least Rs 500 crore in revenue, Delhi-based WinZo and bootstrapped gaming firm Gameberry reported Rs 234 crore and Rs 259 crore in revenue in FY22. The duo collectively spent Rs 226 crore on advertisements during FY22. WinZo leads the list with a 553% jump in ad spending to Rs 199 crore.

Meanwhile, Howzat, Vision 11, MyTeam11, MyFab11, BatBall11, Kubera Fantasy, MyFab11, and Fantasy Akhada are other emerging companies that cumulatively generated Rs 173.9 crore revenue in FY22. And in line with other startups, their customer acquisition spends were close to Rs 178.6 crore during FY22 — outpacing their cumulative revenue. Apart from Games24x7, only MyTeam11 saw a decline in its ad spending during the period.

In terms of profitability, all top four companies have posted huge profits in FY22 whereas MPL fell behind with more than Rs 1,000 crore in losses during the fiscal year. Overall 50% of these companies were profitable in FY22. Public company Nazara Technologies, which runs fantasy and e-sports apps such as Halaplay and Nodwin, also reported back-to-back profits. The company registered Rs 50.7 crore profit in FY22 and Rs 55.8 crore profit in the three quarters (April to December) of FY23.

Moreover, these apps are spending huge amounts on advertising in FY23 and this can be gauged from several ads in the ongoing season of the Indian Premier League (IPL). Given the surge in the gaming population, the number of apps in this space is also likely to go up. Recently, BharatPe’s co-founder and former Shark Tank India judge Ashneer Grover launched a new fantasy league application CrickPe to compete with the existing players.

With significant scale, the industry has also made efforts to avoid formal regulation that could slow down growth. Recently, the Federation of Indian Fantasy Sports developed a self-regulatory framework aimed at ensuring fair play, responsible gaming, and data protection for fantasy sports companies. This framework encompasses guidelines for fair play and is intended to maintain integrity within the industry.

While whether that will be enough to keep the government at bay remains to be seen, there is no doubt that India’s official approach to the segment has surprised quite a few onlookers. A benign approach might have allowed a plethora of firms to come up and even thrive, but it is no guarantee that the rules can’t change. Much like edtech, where India has stood out when we compare the approach of the government vis a vis the crackdown that the Chinese authorities did, for instance, online gaming is counting on that approach to continue.

However, with multiple state laws and the Information Technology Act being used to police the online gaming field in India, the possibilities for disruptions are never too far away. In a cut throat market, there is every possibility that a startup will push the envelope too far, and invite action that eventually impacts every firm in the business. Considering the institutionally benign response to firms earning ‘export’ income, for India’s gaming champions, the best option would seem to be to build global credibility and user bases, as the most powerful case for their long term relevance and future growth.