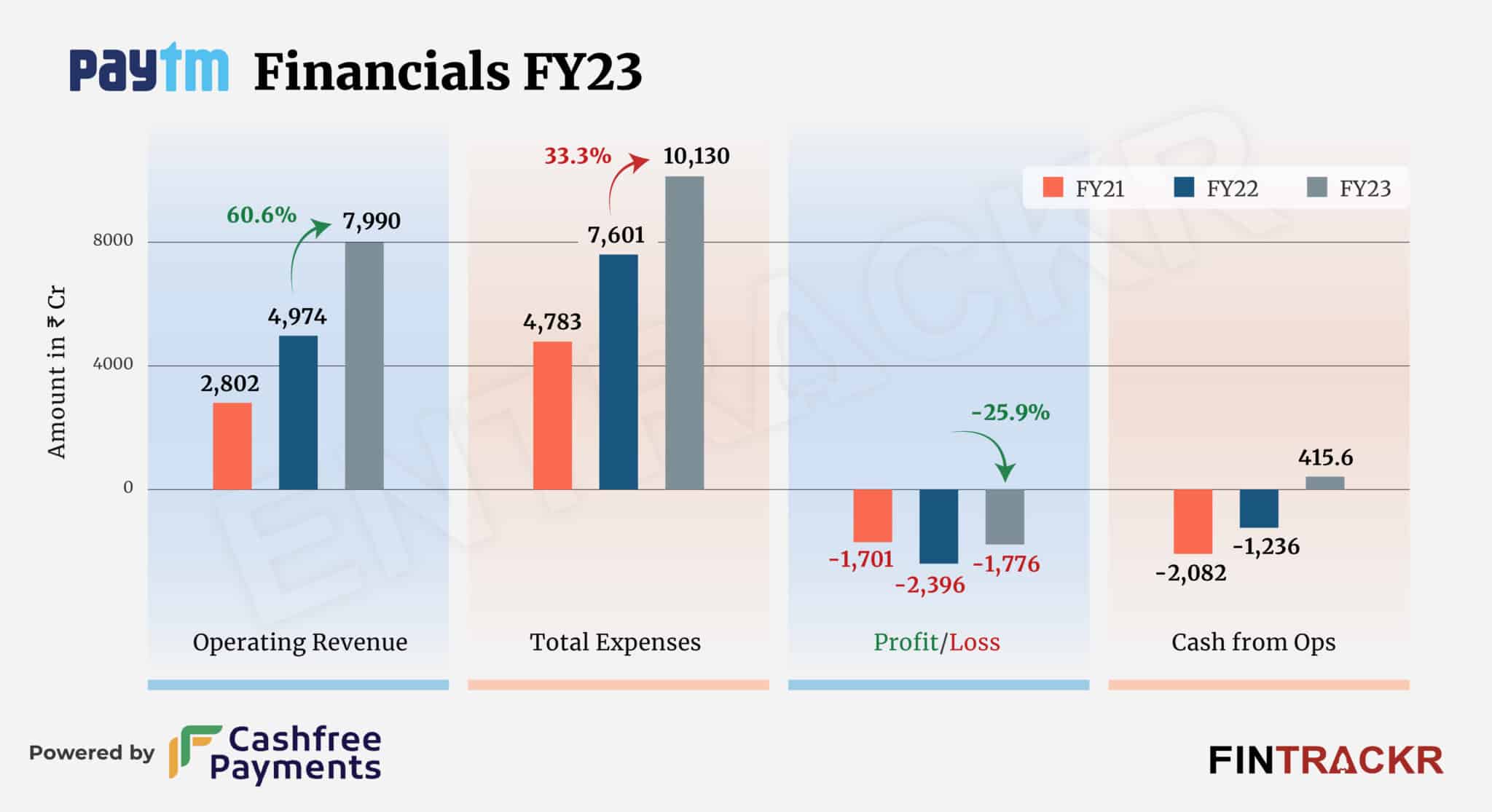

Paytm’s revenue from operations grew 60.6% to Rs 7,990 crore during the fiscal year ending March 2023 in contrast to Rs 4,974 crore in FY22, according to the consolidated annual financial statements (audited) published on its website.

Moreover, Paytm’s non-operating income also soared 41% to Rs 409 crore during the year which took the overall revenue to Rs 8,400 crore or over $1 billion during FY23.

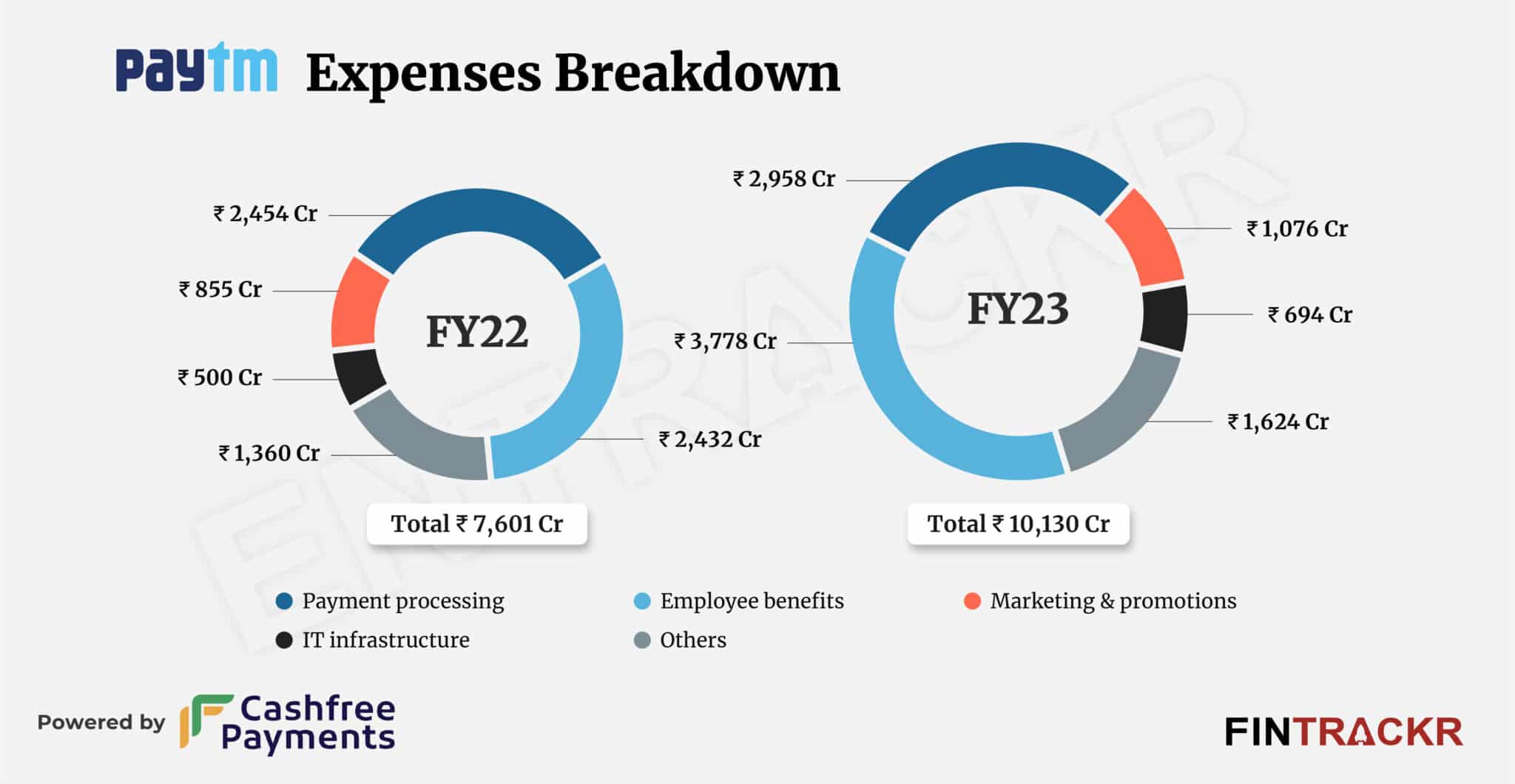

Heading towards the expenses, employee benefits accounted for over 37% of the total expenditure. This cost surged 55.3% to Rs 3,778 crore in FY23 from Rs 2,432 crore in FY22. The jump in employee cost can also be attributed to an 80% hike in share based payments to employees, which stood at Rs 1,456 crore in FY23.

Expenses related to payment processing formed 29% of the total expenses and increased 20.5% to Rs 2,958 crore during the fiscal year. The cost was registered at Rs 2,454 crore in FY22.

Further, promotional and IT infrastructure (software, cloud and data center expenses) spiked 25.8% and 38.8% respectively to Rs 1,076 crore and Rs 694 crore during FY23. At the end, Paytm’s total expenditure soared 33.3% to Rs 10,130 crore in FY23 from Rs 7,601 crore in FY22.

Despite the over 30% surge in expenses, Paytm managed to control its annual losses by 26% to Rs 1,776 crore in FY23 against Rs 2,396 crore in the preceding fiscal year.

The improved top and bottom lines also helped the company to make its operating cash flows positive to Rs 415.6 crore during the year from Rs 1,236 crore negative cash flows in FY22.

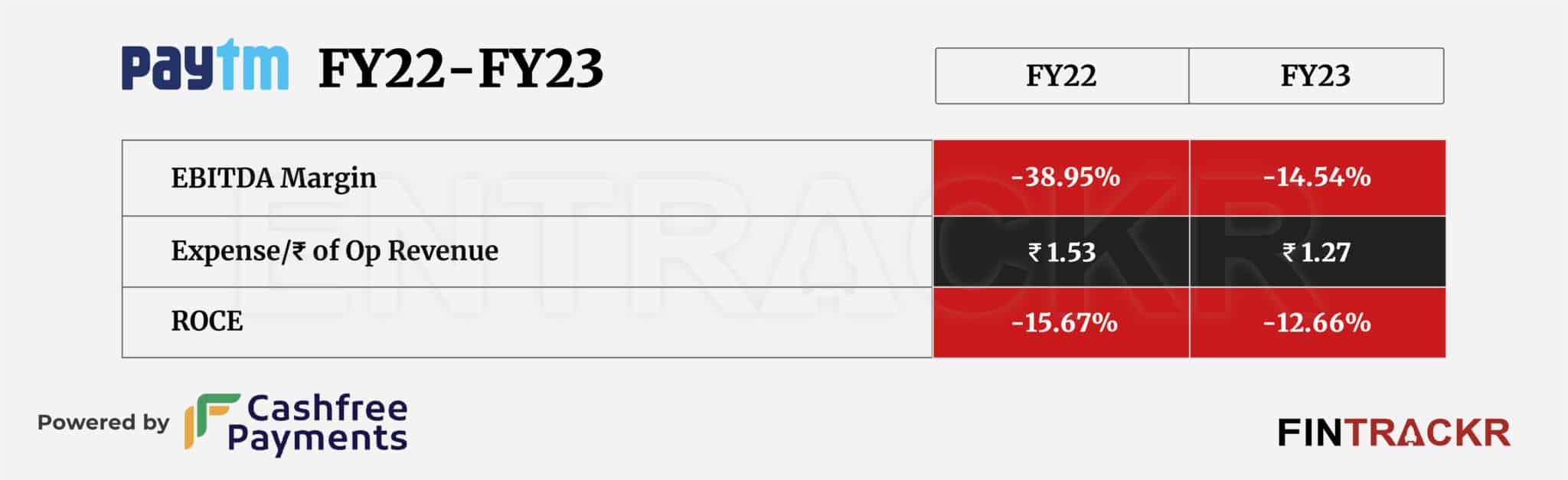

Coming to ratios, EBITDA margin and ROCE of Paytm strengthen to -14.54% and -12.66% respectively. On a unit level, the company spent Rs 1.27 to earn a rupee of operating income in FY23.

On a quarterly basis, Paytm scaled up 13.2% to Rs 2,334 crore during the Q4 of FY23 from Rs 2,062 crore in Q3 of the same fiscal year. Losses of the company reduced by 57.4% to Rs 167 crore in Q4 as compared to Rs 392 crore during the third quarter of FY23.

Digging deeper into the document, Entrackr found that Paytm has utilized half of its net IPO proceeds of Rs 8,113 crore up to March of 2023. As per the proposed offer document, Paytm had allocated Rs 4,300 crore for marketing, merchants and its payment platform, Rs 2,000 crore for investments and acquisitions and Rs 1,813.4 crore for general corporate purposes.

While employee benefits have been flagged as a drag well into the future for Paytm thanks to generous ESOPS, beyond that, the firm does seem to have found something close to a sustainable business model for itself. Q4 was the second successive quarter of EBITDA profitability (without ESOPS), as highlighted by Founder and CEO Vijay Shekhar Sharma.

The payments business is going strong, the loans business is delivering, and many other promising segments are at play, the firm will do well to trigger its exits fast, where traction is not visible. Net profits beckon in FY24-25, and it remains to be seen if the firm finally finds a course that will make it an investor favourite again.

Paytm got listed on Stock Exchange in November 2021 at a price of Rs 2,080-2,150 per share. Within six months its price fell under Rs 600 per share. Currently, its price is hovering around Rs 670 to 690 per share and its market cap stands at Rs 43,700 crore or $5.4 billion.