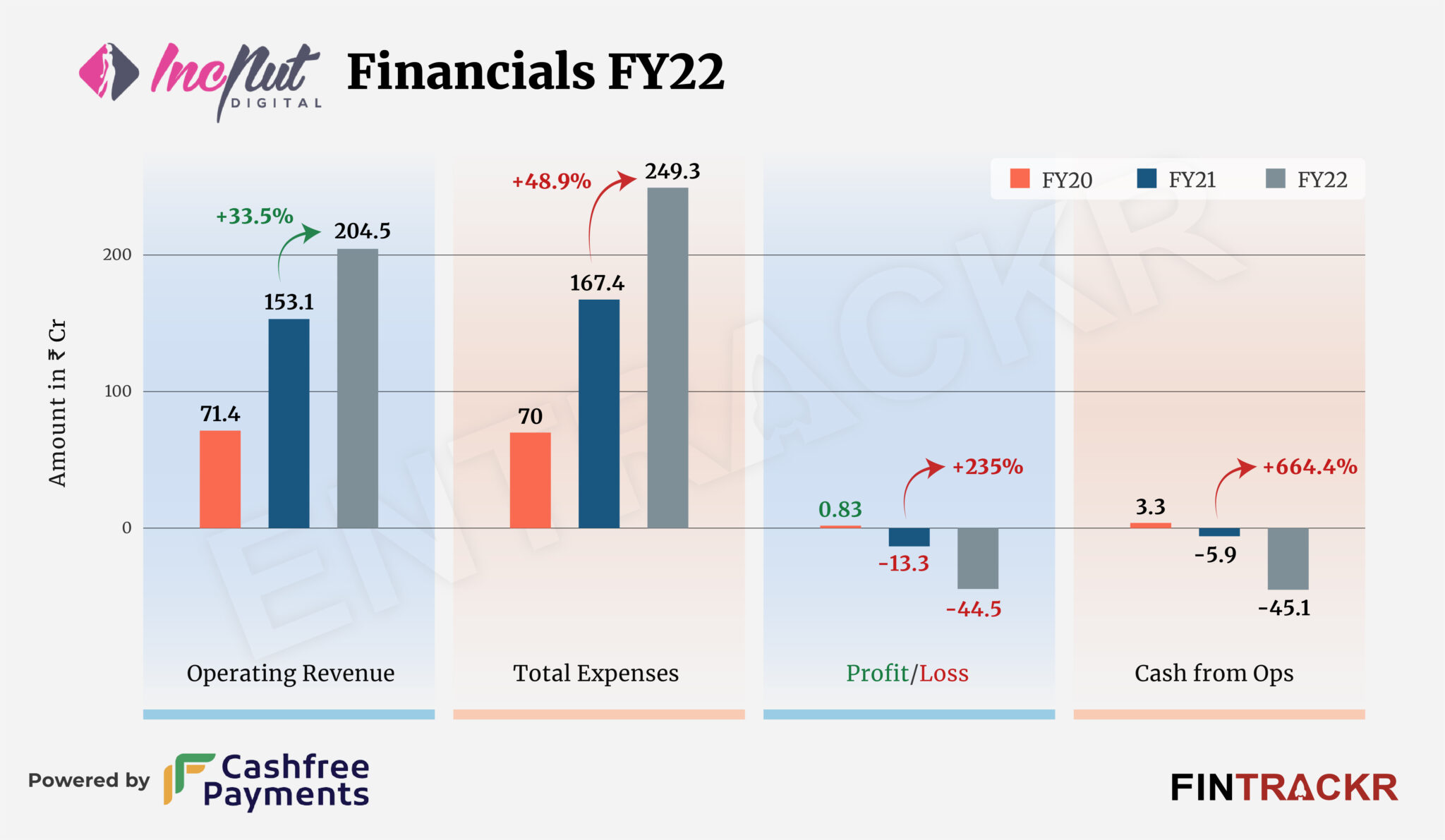

Personalized beauty care and ecommerce startup IncNut Digital witnessed a decent scale but growth has come at a high cost for the Hyderabad-based firm. The company crossed Rs 200 crore in revenue with over a 3X jump in its losses during FY22.

IncNut Digital runs a media and e-commerce platform centered around personal and beauty care products. The company encompasses five distinct brands. Stylecraze, Mom Junction, and The Bridal Box are media platforms that provide valuable content and insights to their audiences. On the other hand, Skincraft and Vedix specialize in ecommerce and offer a wide range of skin and hair care products.

The sale of products from Skincraft and Vedix was the largest source ( ~99.85%) of revenue for IncNut which surged 38.1% to Rs 204.1 crore in FY22 from Rs 147.8 crore in FY21, according to its consolidated financial statements filed with the Registrar of Companies.

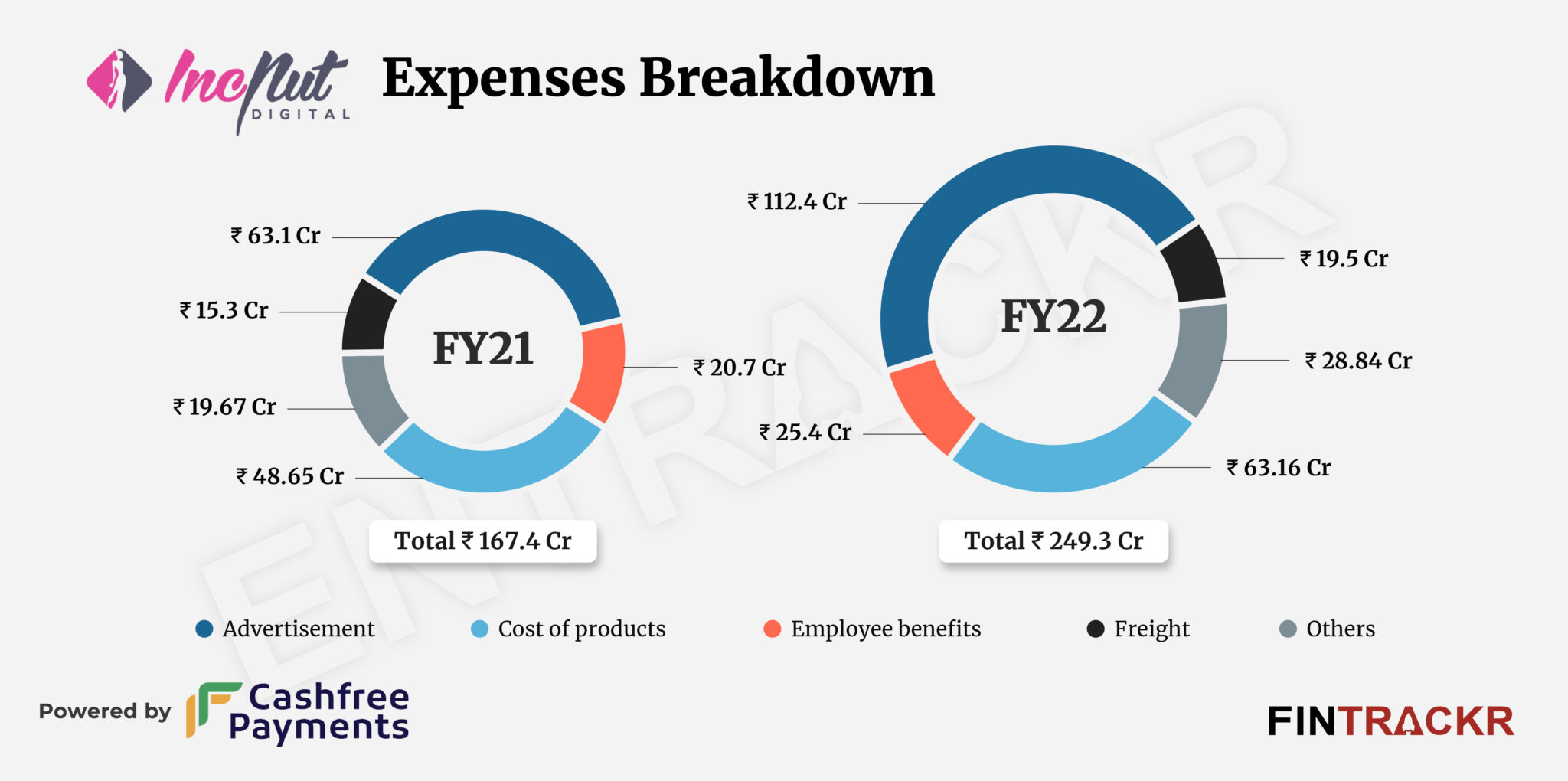

On the cost side, advertisement and promotion accounted for 45% share of the overall expenditure. This cost surged by 78% to Rs 112.4 crore in FY22. Importantly, the ad spends for IncNut Digital ballooned over 5X in the previous two reported fiscal years.

The cost of procurement of products grew by 29.8% to Rs 63.16 crore in FY22 while the employee benefit and freight cost escalated by 22.8% and 27.5% to Rs 25.4 crore and Rs 19.5 crore, respectively in FY22. Overall, the total cost surged 48.9% to Rs 249.3 crore in FY22.

Outpacing the revenue growth, the losses for IncNut Digital spiked 3.34X to Rs 44.5 crore in FY22 from Rs 13.3 crore in FY21. Its net cash outflows from operations also soared 7.6X to Rs 45.1 crore in FY22.

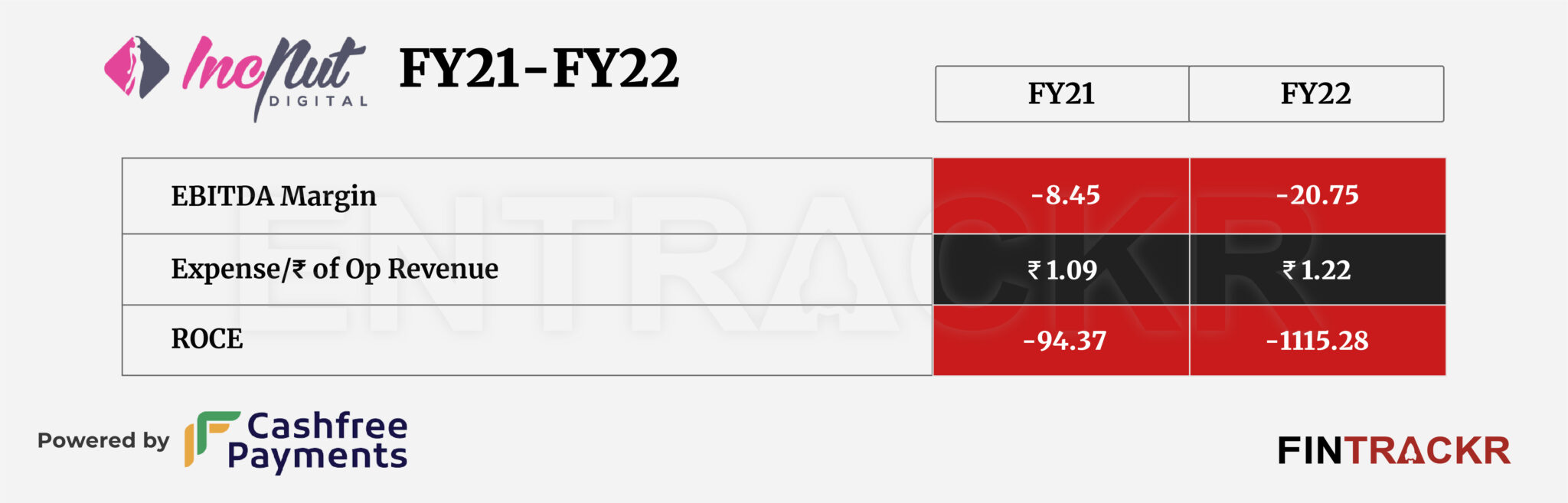

On the ratio side, the ROCE and EBITDA margin registered at -1115% and -20.75% respectively In FY2. On a unit level, the company spent Rs 1.22 to earn a unit of operating revenue.

IncNut has a problem that seems universal to most D2C ecommerce platforms. An inability to drive sales without a generous, unsustainable push from advertising. Not only are the spends on advertising too high, but they seem to be stuck in the sort of performance-based metrics that seems justified on spreadsheets but rarely delivers in the final analysis. Especially when it comes to building a real brand. IncNut’s problems also spotlight the whole premise of the content-led D2C approach, which is simply failing to deliver a sustainable growth proposition in India so far.