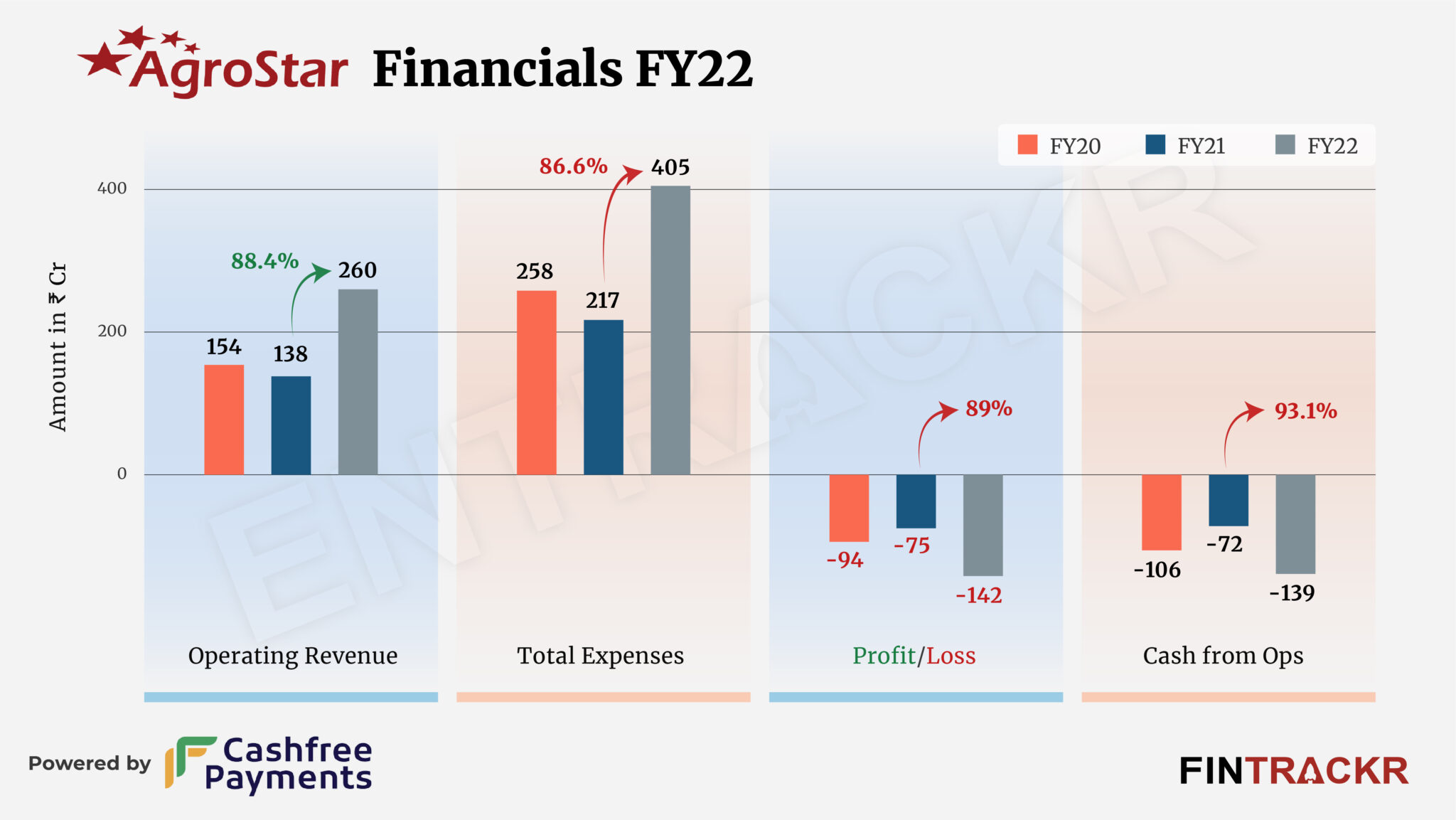

Agritech startup Agrostar bounced back in FY22 with 88.4% growth in its scale after witnessing a dip during FY21. The company’s operating revenue grew to Rs 260 crore in FY22 from Rs 138 crore in FY21, according to the company’s annual financial statement with the Registrar of Companies (RoC).

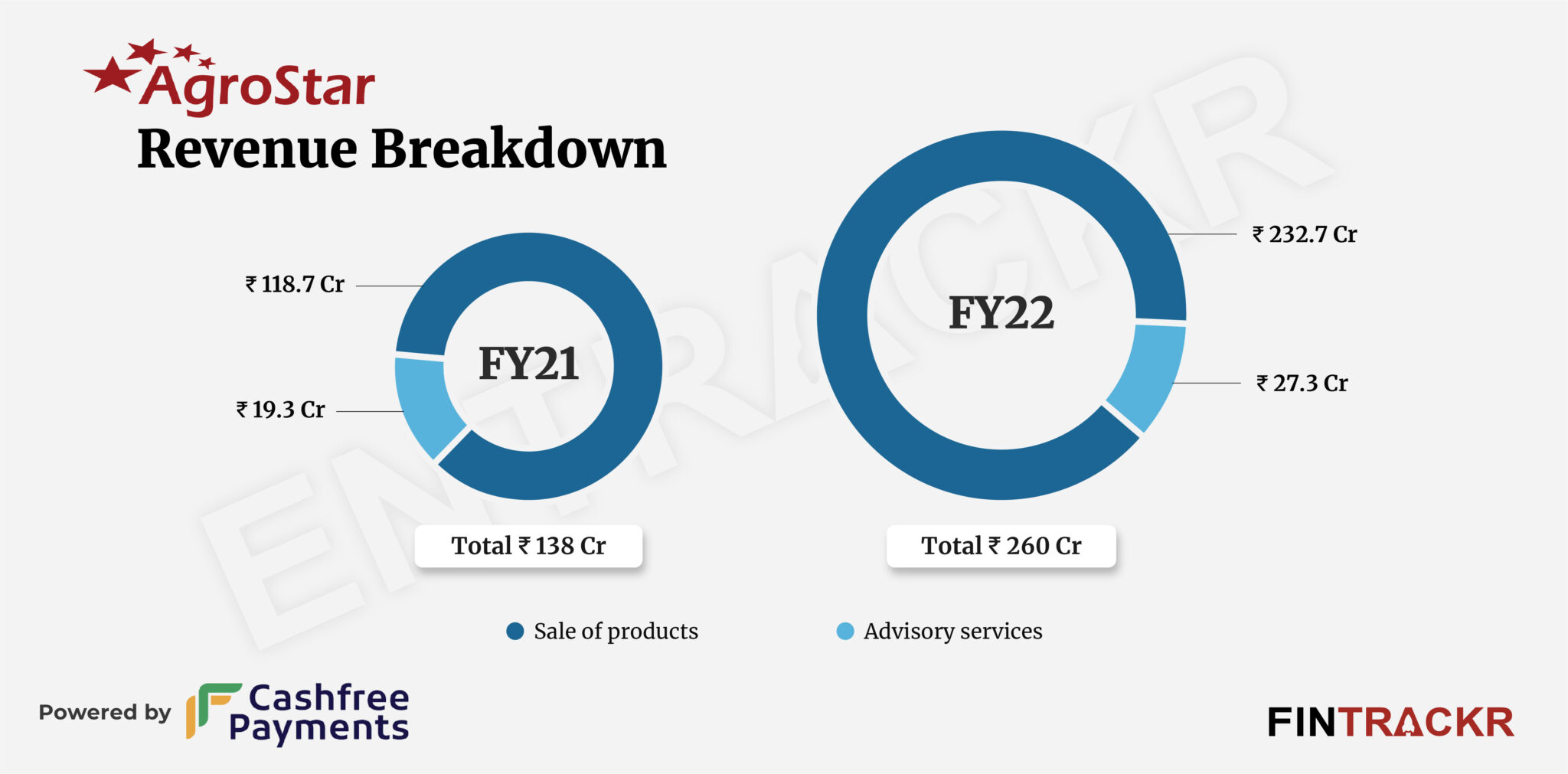

Agrostar operates as a comprehensive platform catering to farmers, offering both online and offline channels for farm advisory solutions and agricultural inputs. Income from the sale of agri inputs accounted for 89.5% of the total operating revenue. This collection surged 96% to Rs 232.7 crore in FY22.

The rest of the revenue came from the advisory service given to customers which increased 41.5% to Rs 27.3 crore in FY22. The company also has other income of Rs 2.95 crore during FY22 from the interest on current investment.

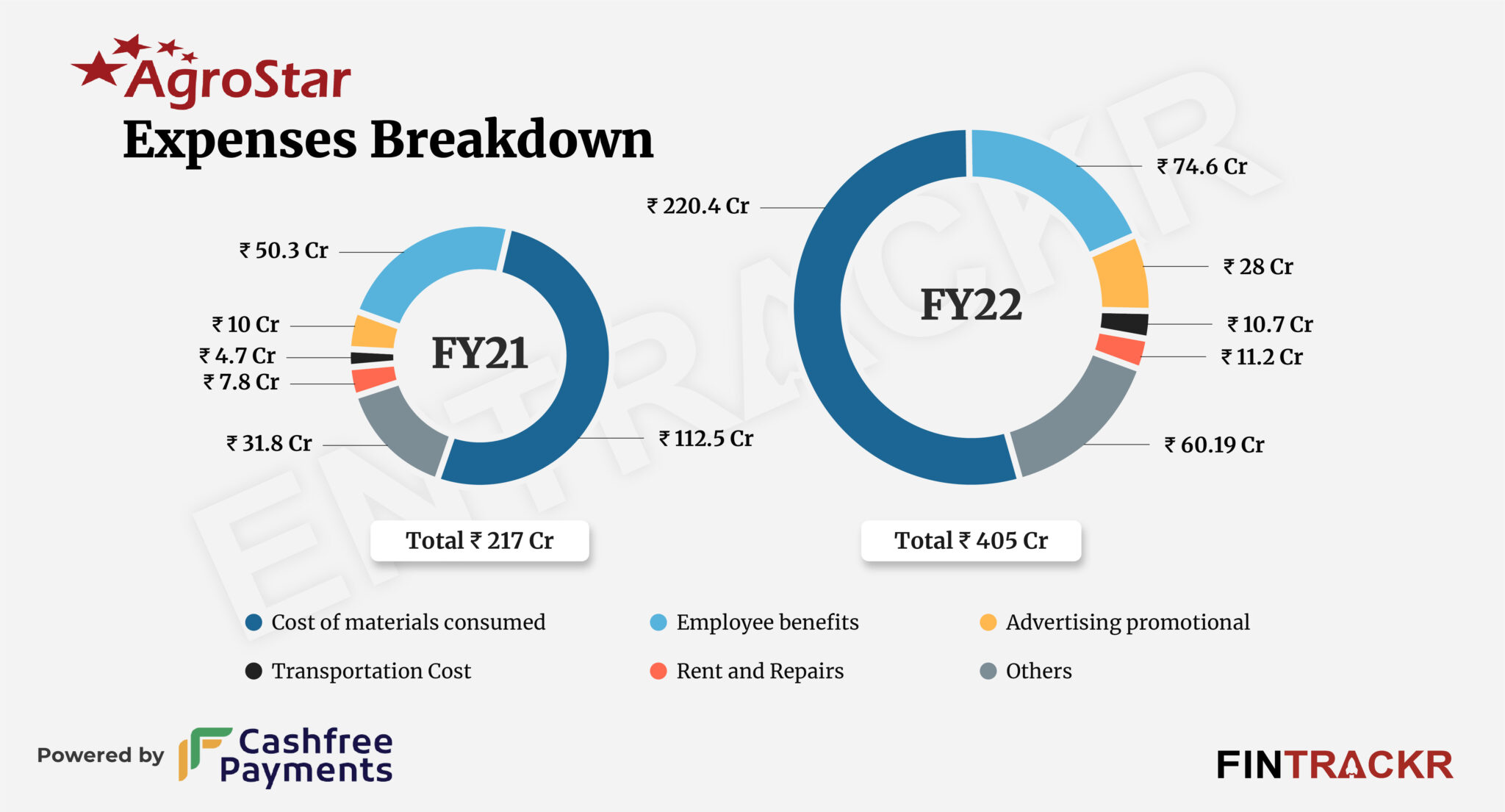

In the line of scale, the cost of material consumed became the largest cost center for the company which formed 54.4% of the total expenditure. This cost grew 96% to Rs 220.4 crore in FY22 from Rs 112.5 crore in FY21.

Employee benefit cost for Agrostar grew 48.3% to Rs 74.6 crore which also includes Rs 3.77 crore as ESOP expenses (non-cash). Its advertising and transportation costs jumped 2.8X and 2.27X to Rs 28 crore and Rs 10.7 crore respectively during the fiscal year ending March 2022.

Agrostar incurred another Rs 11.2 crore against rent and repair which pushed its overall expenditure by 86.6% to Rs 405 crore in FY22.

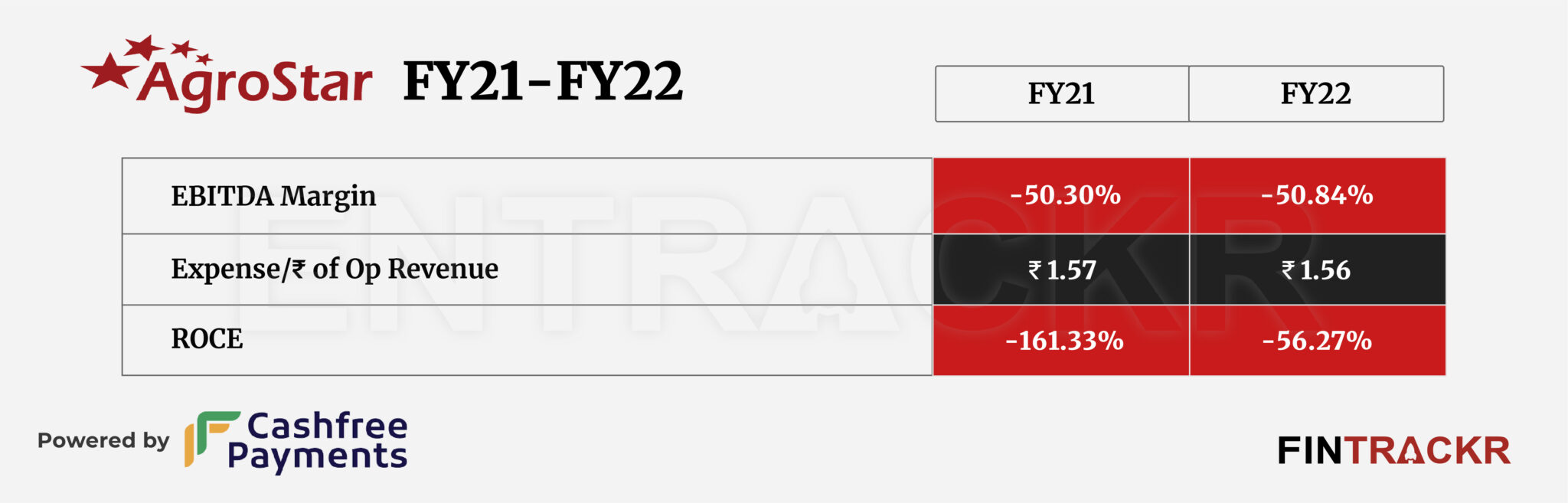

Outpacing its revenue growth, the firm’s losses spiked 89% to Rs 142 crore in FY22 from Rs 75 crore in FY21. Its ROCE and EBITDA margin stood at -56.27% and -50.84% respectively. On a unit level, Agrostar spent Rs 1.56 to earn a rupee in FY22.

In categories like agritech, we remain convinced that while the opportunity is obvious, what is not as obvious is the need to ensure a bottom-line driven approach. Agrostar’s numbers are disappointing to that extent, with almost every cost head on the higher side vis a vis revenues. Agritech is usually not a category that allows significant price flexibility once a base has been established. Agrostar will probably have to take some tough calls sooner than later on its expenses.