Chennai-based digital supply chain startup Wiz Freight raised Rs 275 crore in the largest Series A round seen in the logistics space at the end of fiscal year ending March 2022. The fundraising was followed by scorching growth in its collection and achieving profitability during FY22.

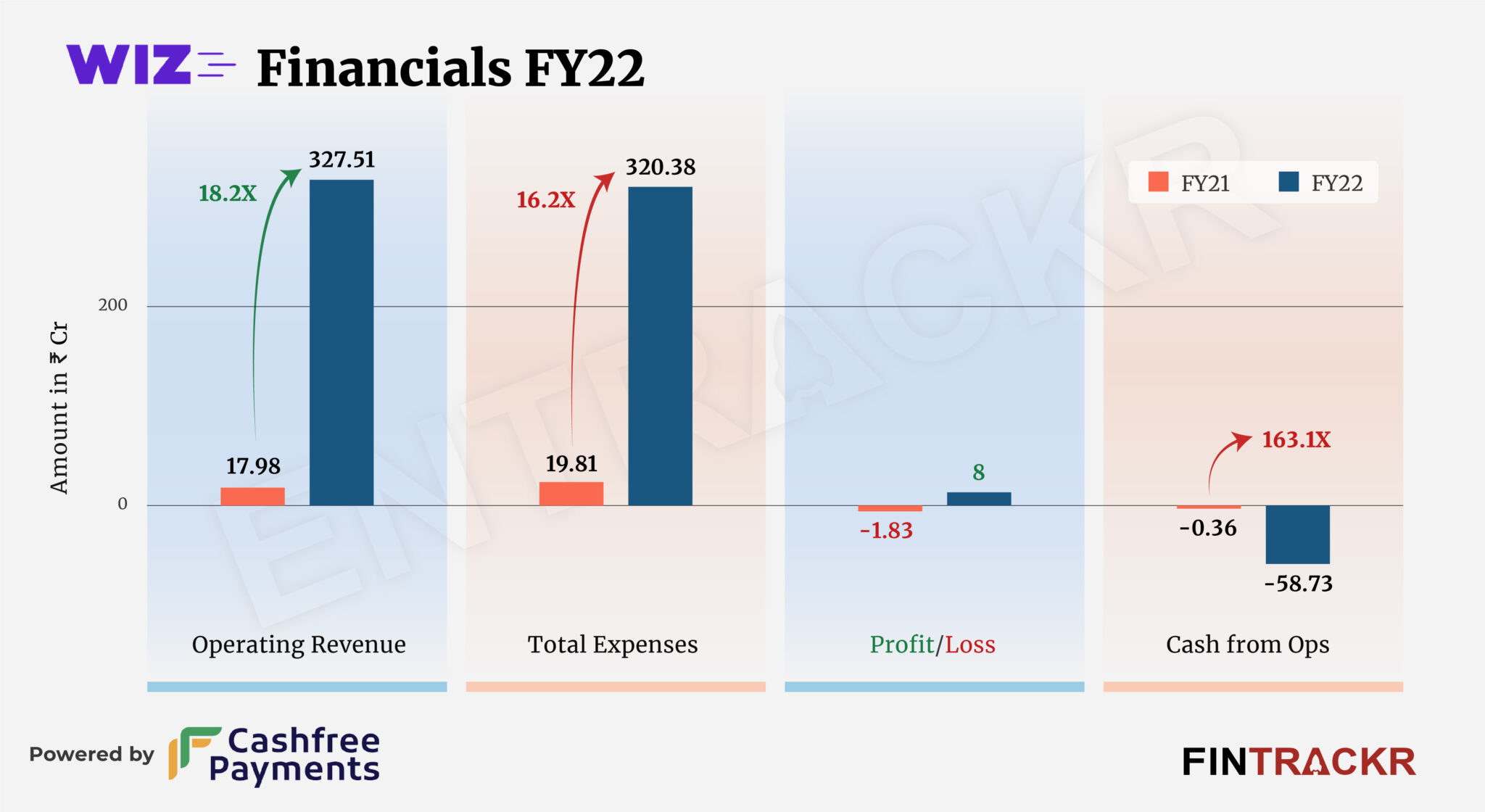

Wiz Freight’s revenue from operations ballooned over 18X to Rs 327.51 crore in FY22 from Rs 17.98 crore in FY21, according to its consolidated financial statements filed with the RoC.

Wiz Freight provides a platform for exporters and importers to book and manage their cross-border shipments. Income from freight forwarding and warehousing was the sole source of revenue for the company. It also has a non-operating income of Rs 2.51 crore from interest on current investments during FY22.

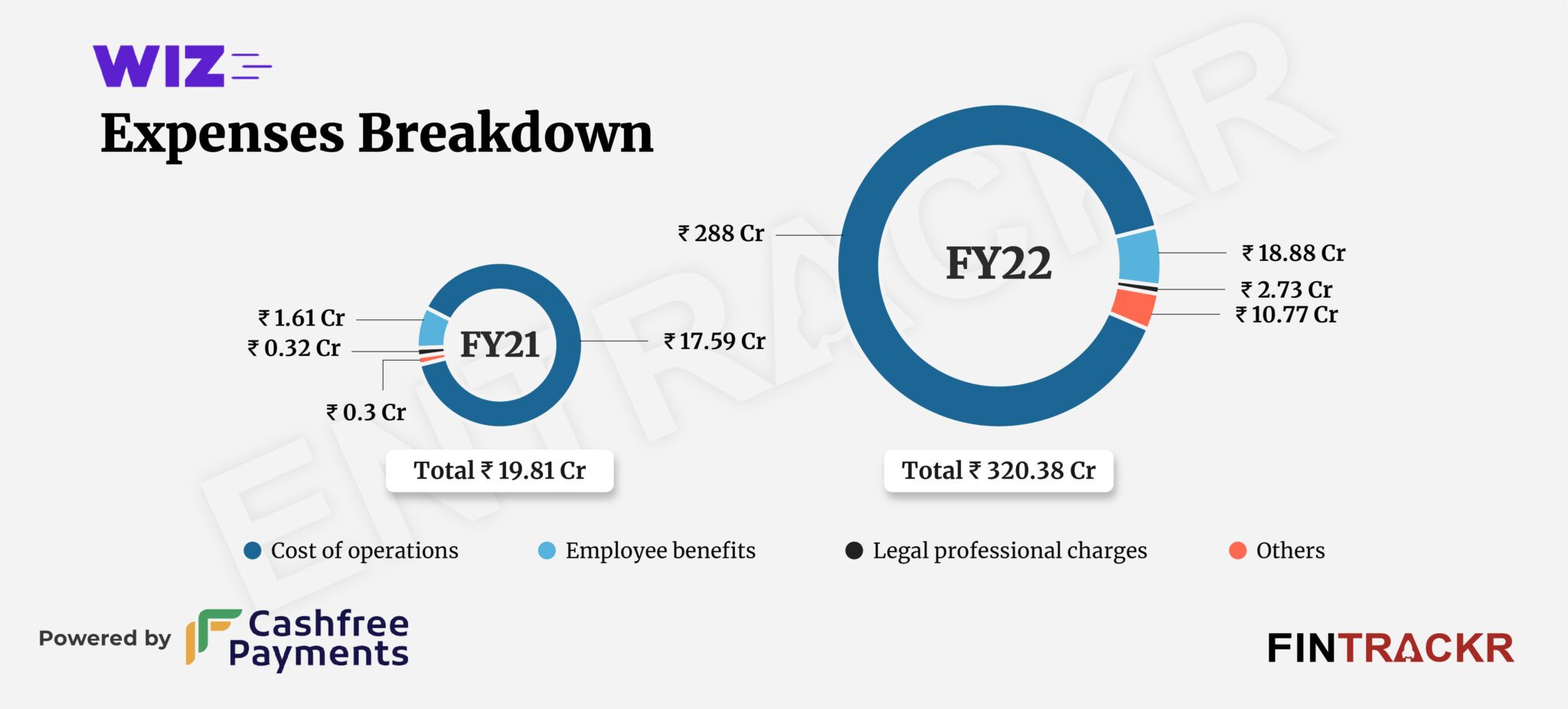

The cost of operations which includes freight and warehousing charges was the largest cost center for Wiz Freight which accounted for 89.9% of the overall expenditure. Akin to its scale, this expenditure grew 16.37X to Rs 288 crore in FY22 from Rs 17.59 crore in FY21.

Employee benefit expense jumped 11.7X to Rs 18.88 crore in FY22 from Rs 1.61 crore in FY21. The firm also incurred Rs 2.73 crore on legal-professional fees which catalyzed its total expenditure by 16.2X to Rs 320.38 crore in FY22 from Rs 19.81 crore in FY21.

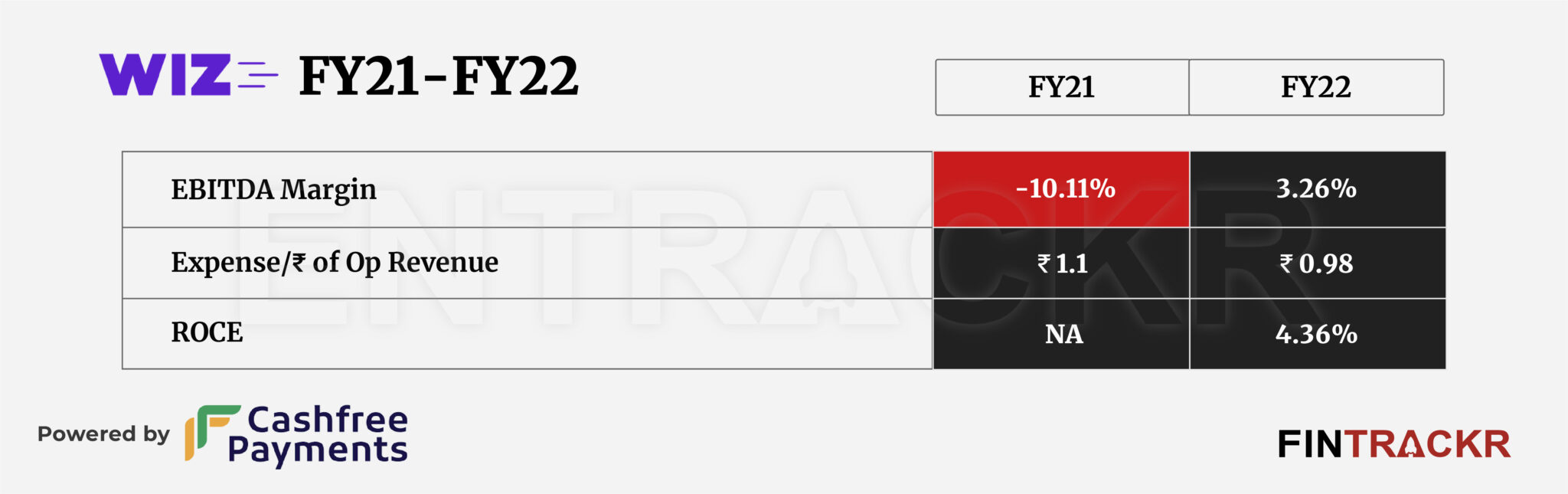

Wiz Freight’s tight control on expenses helped the two year old-company achieve profitability. It posted Rs 8 crore in profit during FY22. Its ROCE and EBITDA margin stood positive with 4.36% and 3.26% respectively in FY22. On a unit level, Wiz Freight spent Rs 0.98 to earn a single unit of operating revenue.

Backed by founders with decades of experience in the sector, Wiz Freight had acquired the India operations of Swiss Firm M+R last year and plans to acquire more relevant firms in the near future too. With its focus on tech-enabled solutions the firm has done well to deliver well enough to build a strong roster of clients and deliver scorching growth. Focusing on international trade, a relatively specialised area has also helped it grab market share by moving fast. With a plan to raise a further $150 million in the works, being profitable will do the firm no harm at all in driving a hard bargain with potential investors.