Online investment platform Upstox continues to bleed heavily in its quest for scale and market share. Considered as Zerodha’s main rival, the Tiger Global-backed firm is at least six times smaller when compared to the Zerodha scale during the fiscal year ending March 2022.

Zerodha recorded Rs 4,964 crore in operating revenue in FY22 whereas Upstox’s scale is yet to touch Rs 800 crore during the same period.

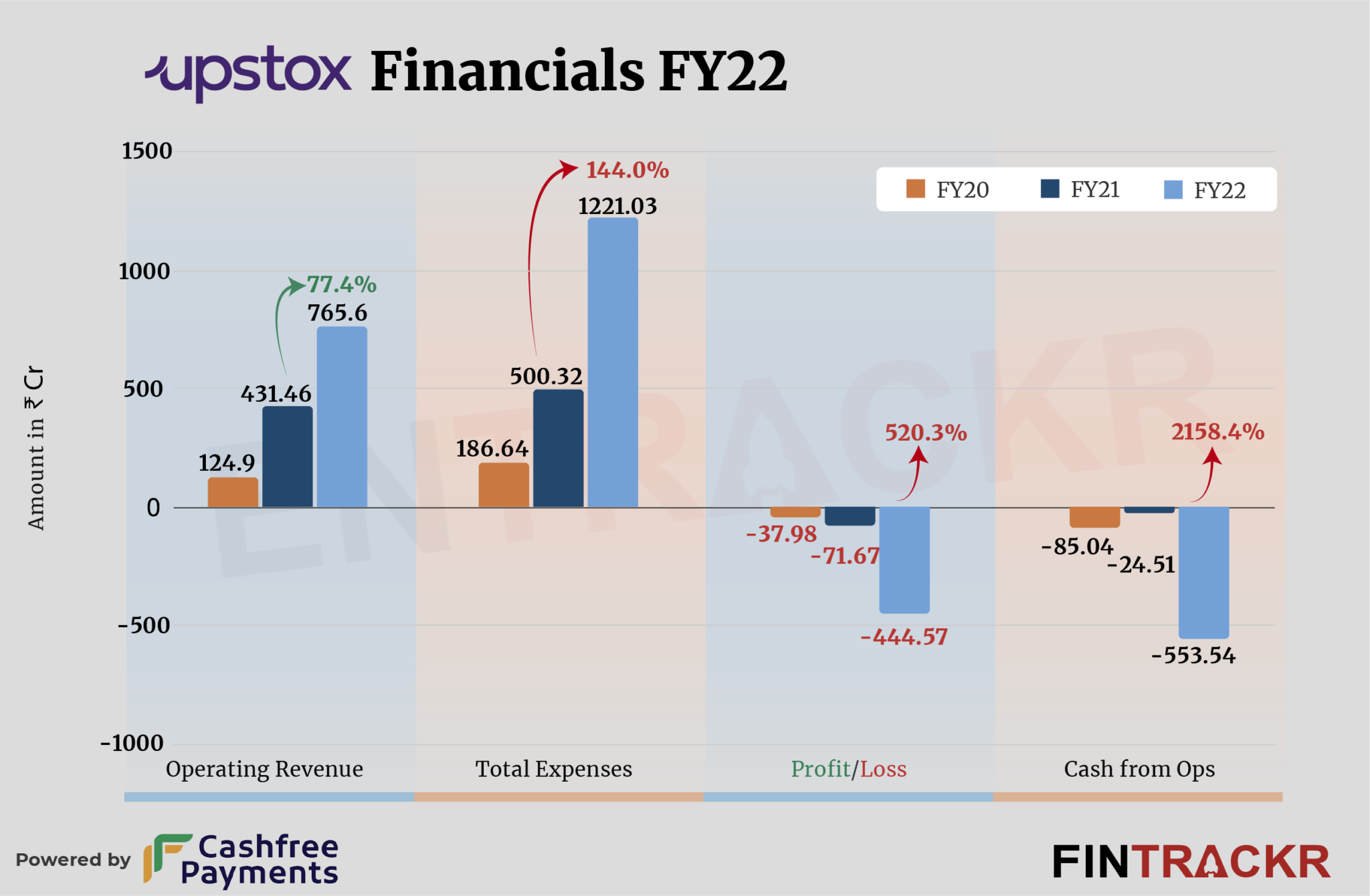

Upstox’s revenue from operations grew 77.4% to Rs 765.6 crore in FY22 from Rs 431.46 crore in FY21, according to its annual financial statements reviewed by Entrackr.

Brokerage and allied services income accounted for 92% of the operating revenue which grew 82.6% to Rs 704.55 crore during FY22. The company collected another Rs 61.05 crore from operations in the last fiscal year but didn’t disclose its bifurcation.

Upstox also made Rs 10.85 crore mainly from the gain of the sale of current investments which ballooned 16.6X in FY22 as compared to Rs 65 lakh in FY21.

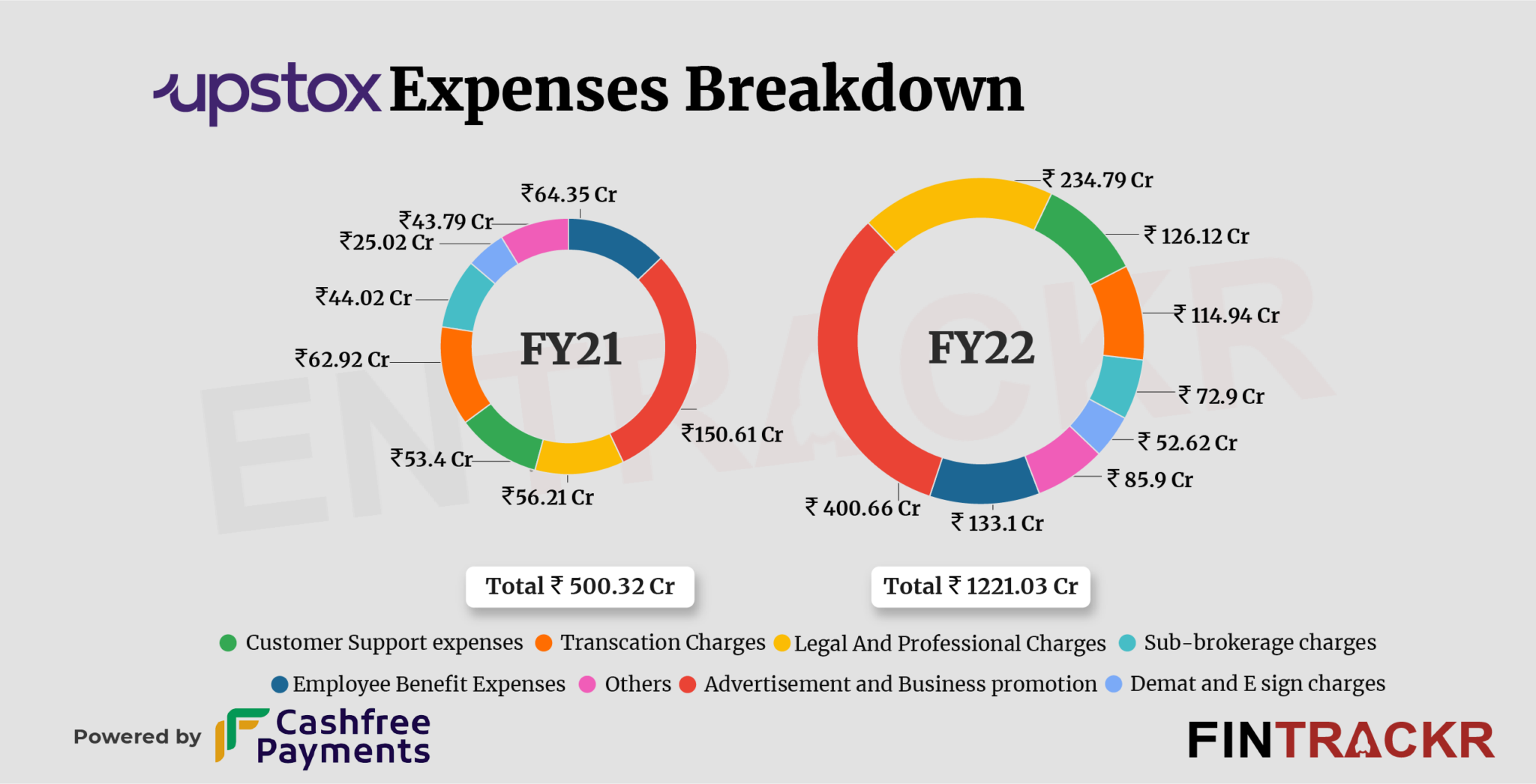

On the cost side, advertising and business promotions formed 32.8% of the total expenses which surged 2.6X to Rs 400.66 crore in FY22 from Rs 150.61 crore in the previous fiscal year.

Surprisingly, legal and professional fees became the second largest cost center for Upstox, accounting for 19.2% of the overall expenditure. This cost grew 4.17X to Rs 234.79 crore in FY22.

Upstox’s employee benefit cost jumped over 2X to Rs 133.1 crore which also includes Rs 31.16 crore ESOP (non-cash) expenses. The cost of customer support and transaction charges increased by 136.2% and 82.7% respectively to Rs 126.12 crore and Rs 114.94 crore during FY22.

The company incurred another Rs 72.9 crore and Rs 52.62 crore against sub-broker and demat charges which catalyzed its overall cost by 144% to Rs 1221.03 crore in FY22.

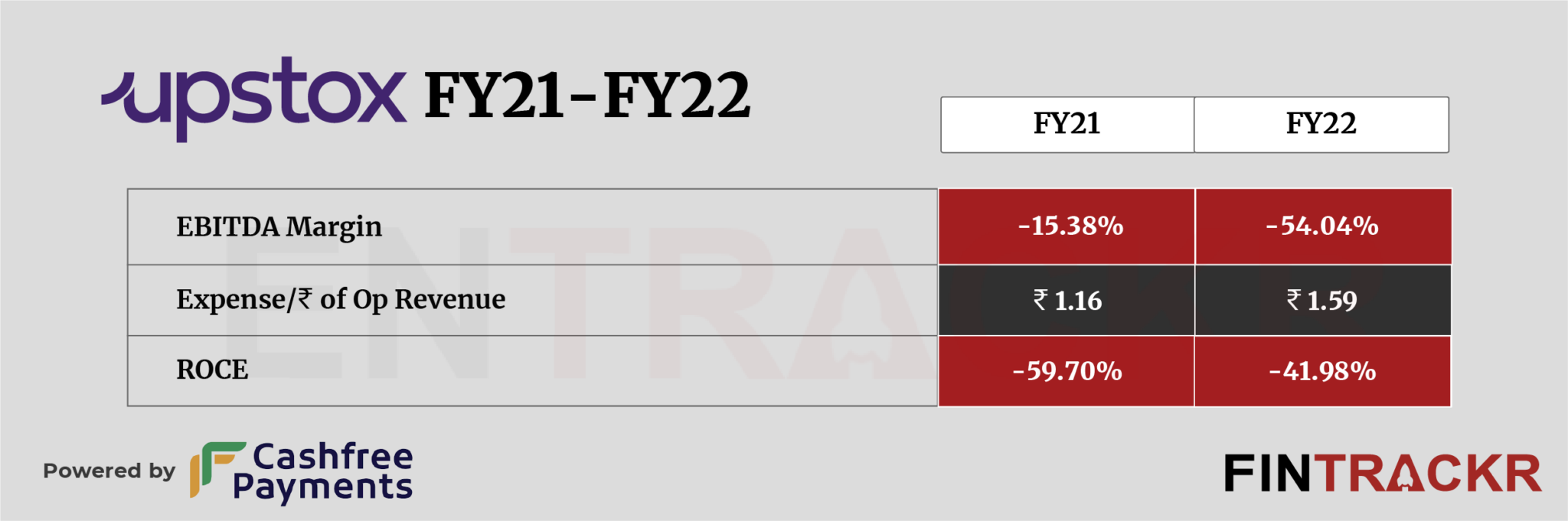

Outpacing its revenue growth by about five times, Upstox’s losses skyrocketed 6X to Rs 444.57 crore in FY22 from Rs 71.67 crore in FY21. On a unit level, the firm spent Rs 1.59 to earn a single rupee.

Its cash flow from operations worsened to negative Rs 553 crore during FY22 whereas the company’s ROCE and EBITDA margin stood at -41.98% and -54.04% respectively in FY22.

There are firms where the long view is important, and then there are firms where the immediate view is also important. In Upstox’s case, as the firm effectively makes Rs 3.35 cr per day and loses Rs 1.21 cr doing it, the number matters because it is competing with players that are not just bigger but profitable. With no ‘disruptive’ tool in its armory other than lower or cheaper trades, and a trading platform rated highly by ‘professional’ traders, Upstox has its work cut out. Its costs are simply out of control, and the firm needs to get a grip on those as quickly as possible. The financial products market is massive by all accounts, but other than life insurance perhaps, no business in the sector requires such a high burn rate or use of capital as Upstox has done before achieving profitability. Upstox needs to relook fundamental aspects of how it’s doing business before even customers start worrying about its long term viability.