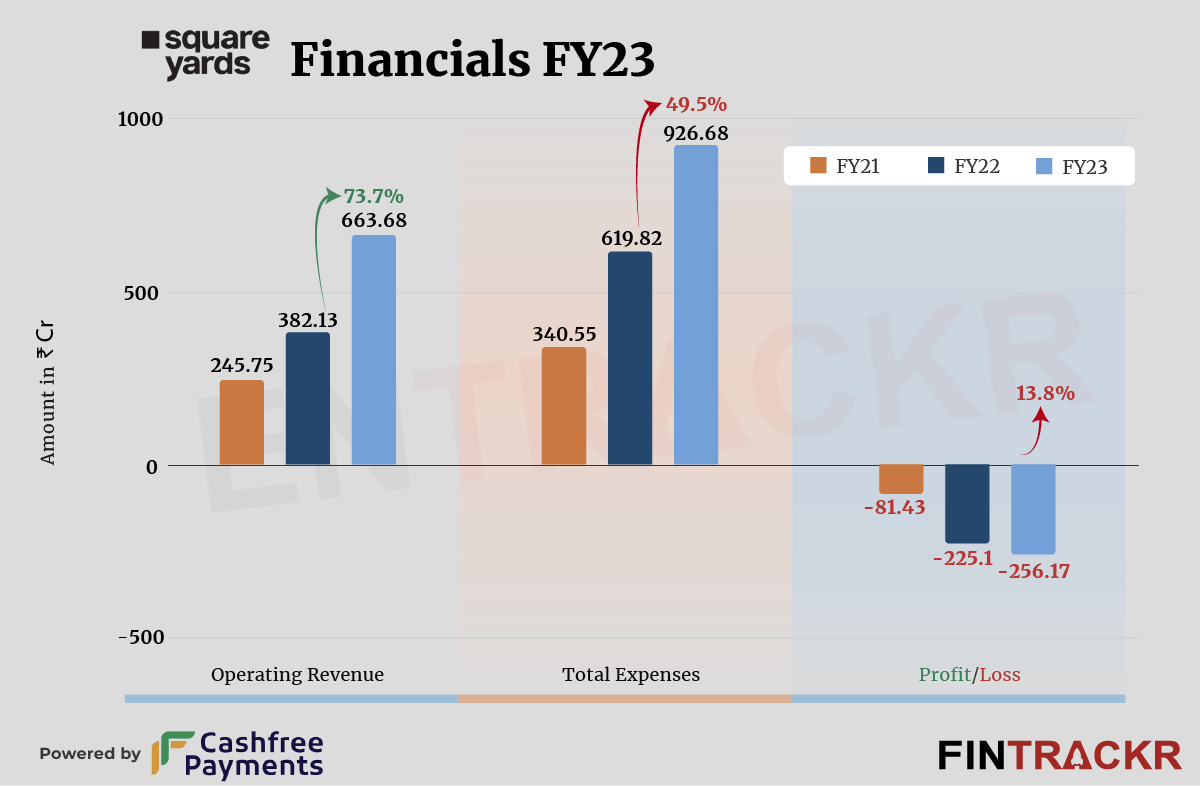

Proptech firm Square Yards has registered a 2.7X growth in revenue during the last two fiscal years and crossed Rs 650 crore in FY23 from Rs 245.75 crore in FY21, according to the company’s provisional financial statement reviewed by Entrackr.

The company’s scale grew 73.7% to Rs 663.68 crore in FY23 from Rs 382.13 crore in FY22. Square Yards deals in housing and home loan brokerage. Real estate and financial services remain the largest contributor with approximately 87% of the overall revenue.

Meanwhile, Square Yards’ GTV (Gross Transaction Value) grew 67% YoY to Rs 22,870 crore during FY23 while the number of transactions saw a two-fold jump during the last fiscal year.

India was the largest market for the Gurugram-based firm which formed 77% of total collection while 10% came from Gulf countries and 13% from the rest of the world. According to the company’s website, it has over eight million monthly traffic and processes $3 billion GTV with presence in over 100 cities across 9 countries.

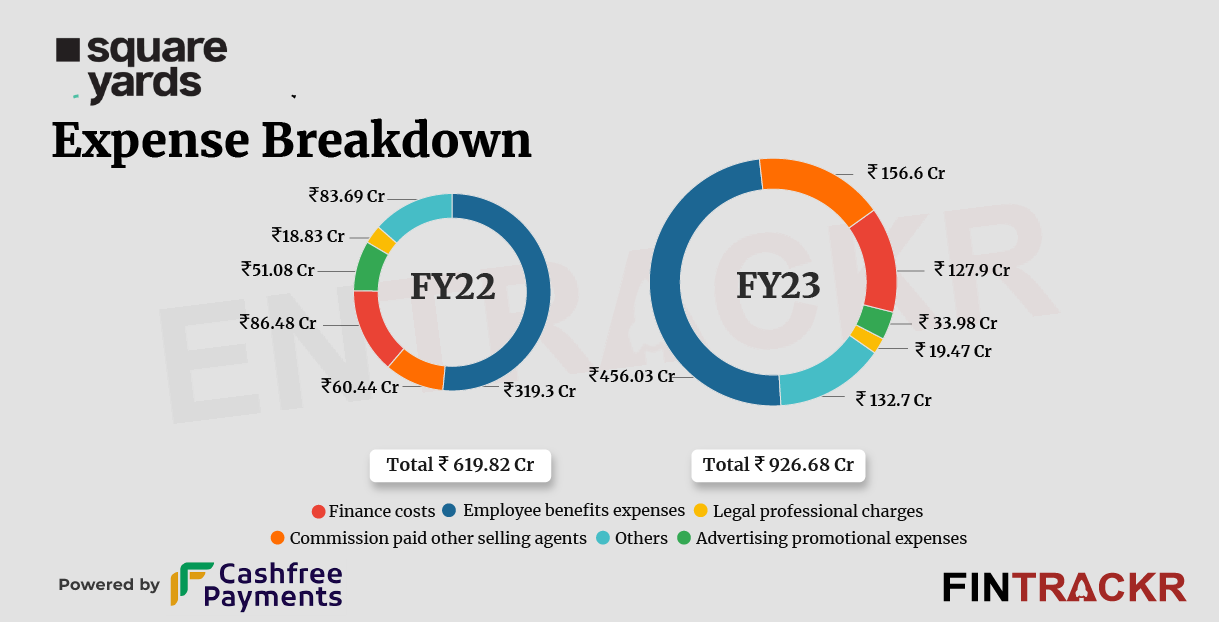

Employee benefit remains the largest cost center for Square Yards forming 49.21% of the overall cost. This cost surged 42.8% to Rs 456.03 crore in FY23, according to the statement.

Commissions paid to agents surged 2.59X to Rs 156.6 crore in FY23 from Rs 60.44 crore in FY22. With the huge debt and aggressive approach toward home loans, its finance cost grew 47.9% to Rs 127.9 crore in FY23.

Square Yards added another Rs 33.88 crore and Rs 19.47 crore towards advertising and legal-professional costs which steered its overall expenditure by 49.5% to Rs 926.68 crore in FY23.

With significant growth in scale and controlled expense, Square Yards’ losses grew only 13.8% to Rs 256.17 crore in FY23 from Rs 225.1 crore in FY22. FY23 seems the best fiscal for the firm as its provisional statement also mentioned that the fourth quarter of the last fiscal (January to March 2023) was profitable.

On a unit level, Square Yards spent Rs 1.4 to earn a single unit of operating revenue.

With a strong roster of investors as well as momentum behind it, Square Yards is much more likely to deliver an IPO than most startups in the space. It is clearly gaining market share in an expanding market, something that will ensure strong backing for the firm from investors if required. With FY 24-25 promising to be the first full year of profitability, expect this firm to fly high, and soon.