B2B supply chain financing firm Mintifi raised $110 million funding in the last quarter of FY23 and projected Rs 60-80 crore profit in FY23. This claim can only be verified once the company files its FY23 financials, but meanwhile let’s decode its FY22 numbers.

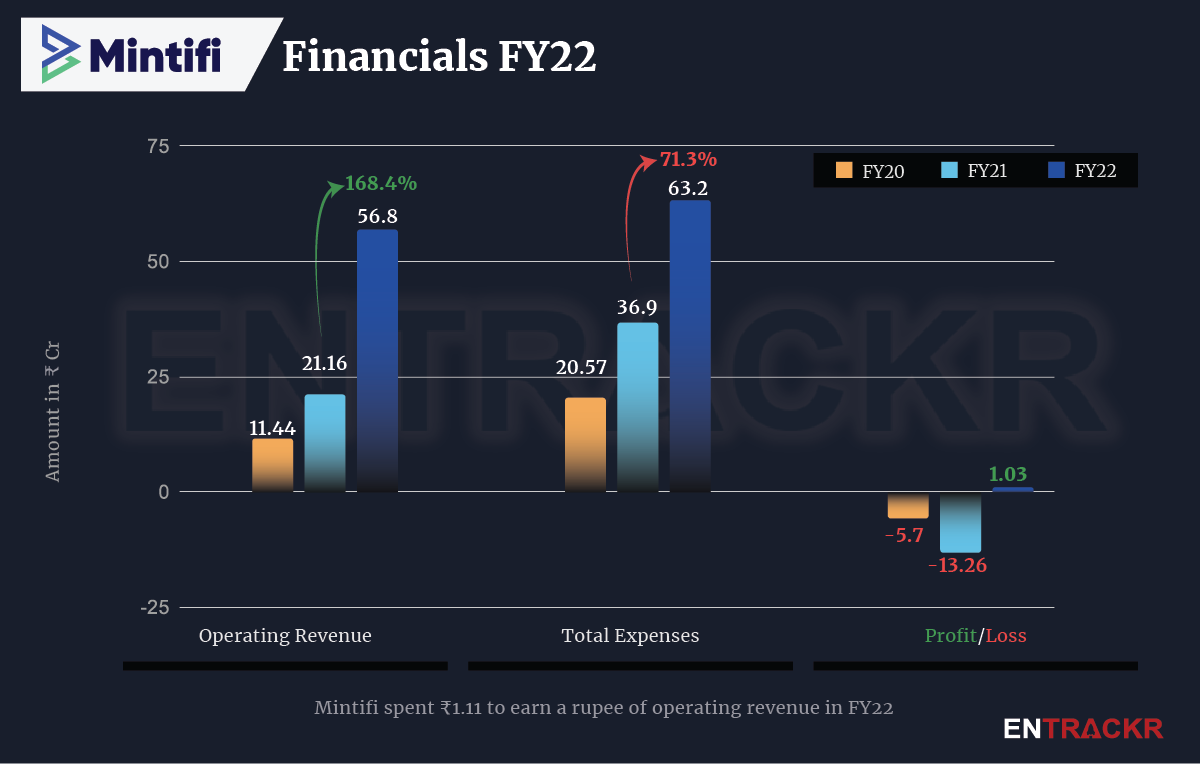

Mintifi’s revenue from operations surged 168.4% to Rs 56.8 crore during the fiscal year ending March 2022 as compared to Rs 21.16 crore in FY21, according to its annual financial statements with the Registrar of Companies.

Mintifi is a B2B supply chain financing platform catering to the last mile distribution network. It offers payments solutions, invoicing and customized financing solutions to small and medium enterprises (SMEs) across industries.

Collection of interest on loans and advances remains the primary driver of revenue and accounted for 75% of the total operating collection followed by sale of products (13%) and processing fees (9%) during FY22. The rest came from commission and other operations during the year.

Mintifi also earned Rs 2.51 crore as gain on redemption of mutual funds and other non-operating income which took its overall topline to Rs 59.3 crore during FY22.

To fuel up the growth, Mintifi spent a total Rs 63.2 crore during FY22 which was 71.3% more than preceding fiscal year. With an over two-fold surge in scale, Mintifi turned profitable and recorded Rs 1.03 crore profits during FY22 against Rs 13.26 crore loss in FY21.

Coming to the breakup of expenses, employee benefits turned out to be the largest cost, forming 34% of the total cost. This expenditure inclined 22% to Rs 21.61 crore in FY22.

To meet the demand for credit, Mintifi took loans from banks and other financial institutions. Hence, its finance expenses jumped over 2X to Rs 14.77 crore while the company wrote off advances worth Rs 5.6 crore during FY22.

Cost of materials and commission fees stood at Rs 7.2 crore and Rs 1.06 crore respectively. On a unit level, the company spent Rs 1.11 to earn a rupee in FY22.

The startup has raised around $170 million to date including a Series D round of $110 million in March this year. Mintifi competes with the likes of KredX and B2B building materials marketplace OfBusiness’ arm Oxyzo among several others.