Most venture capital-backed edtech companies were deeply in the red in FY22 and appeared to have maintained status quo in FY23 as well. Some edtech firms like DailyRounds and PW (PhysicsWallah), however, remained profitable in FY22. One new addition to the profitable club is Jaro, a 14-year-old education company, which turned profitable in FY22.

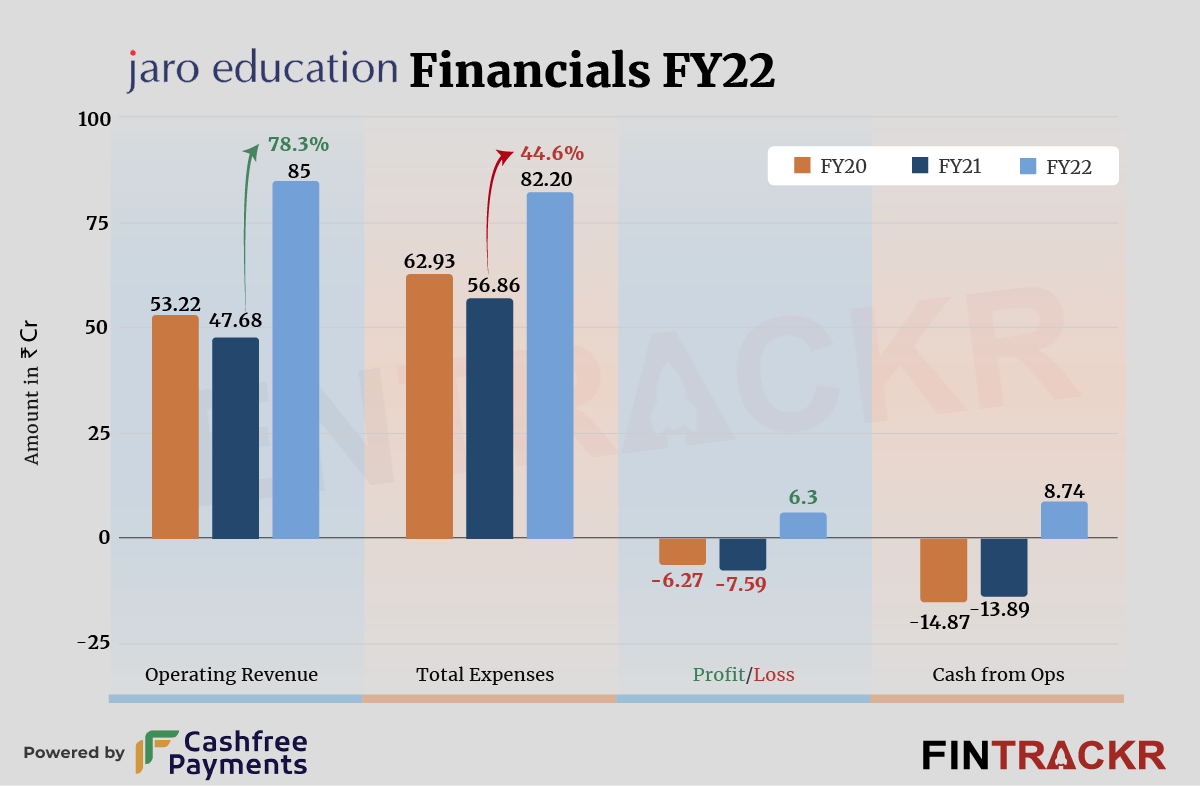

The Mumbai-based firm’s scale spiked 78.3% to Rs 85 crore during FY22, according to its consolidated annual financial statement with the Registrar of Companies (RoC).

Started in 2009, Jaro Education offers over 28 courses in collaboration with universities and institutes, such as Michigan Ross, Imperial College, Business School London, IU- Germany, NITIE and several IIMs. The commission collected from the course fees was the sole source of income for Jaro Education.

The firm also has other income mainly from interest on unsecured loans which grew 22.4% to Rs 4.31 crore during FY22.

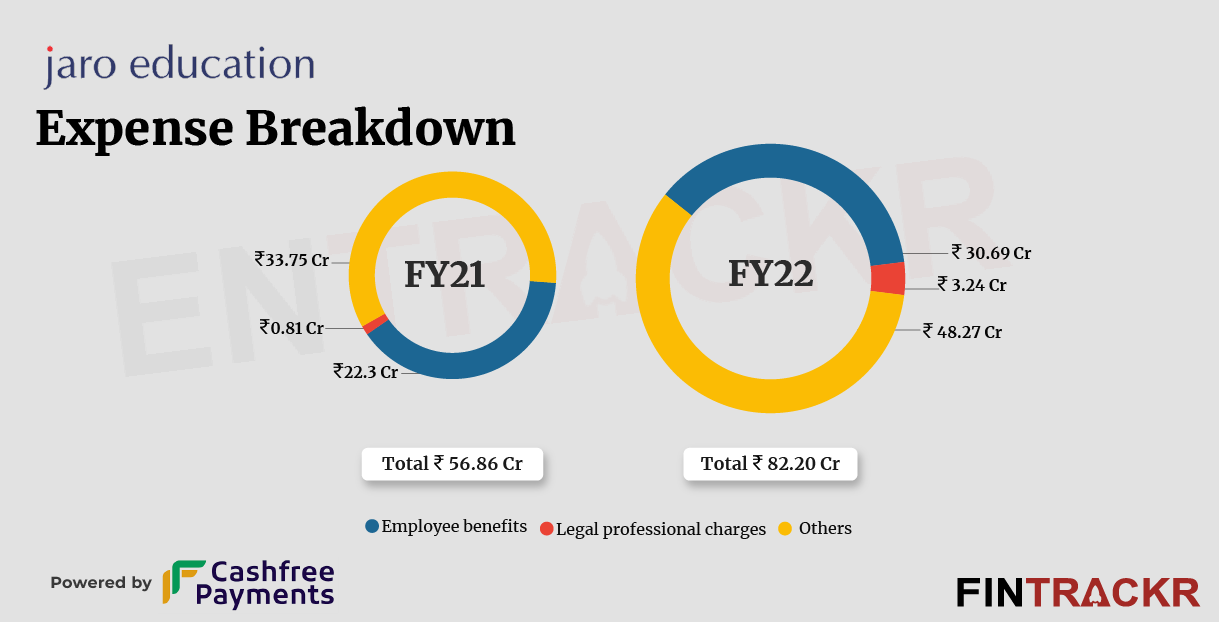

When it comes to costs, employee benefits formed 37.3% of the overall expenditure. This cost grew 37.6% to Rs 30.69 crore in FY22 from Rs 22.3 crore in FY21. The company’s cost on legal and professional fees soared 300% to Rs 3.24 crore during FY22.

Jaro didn’t disclose much about its expenses, but other Rs 48.27 crore was primarily spent across advertisement, IT, rent et al.

With a tight control on expenses, Jaro Education registered a profit of Rs 6.3 crore during FY22 as compared to a loss of Rs 7.59 crore in FY21 (consolidated). The company was profitable for the last three years, on a standalone basis. Importantly, Jaro Education also hived off one of its subsidiaries Top Scholars in FY22.

As per the provisional statements provided by Jaro Education, the company collected a net revenue that grew 76.4% to Rs 150.97 crore in FY23 while its profit jumped over 150% to Rs 15.7 crore.

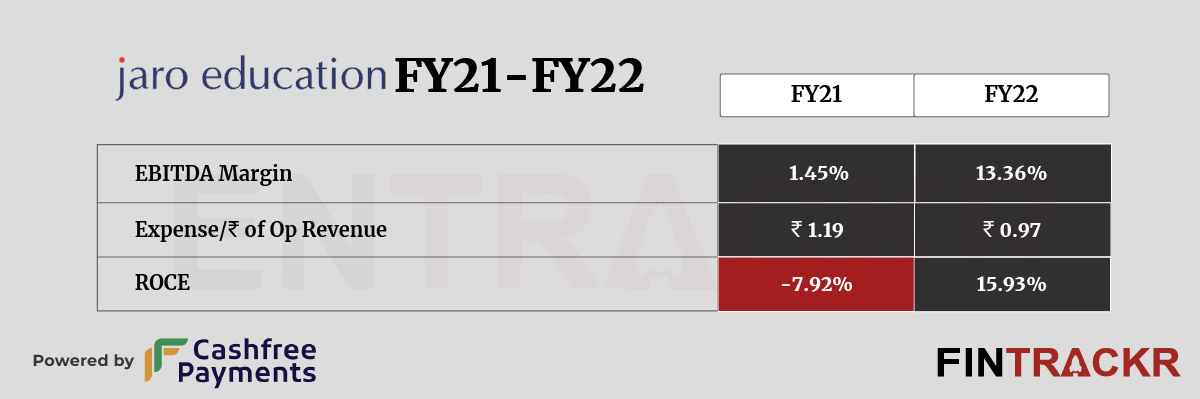

Its ROCE and EBITDA margin stood at 15.93% and 13.36% respectively in FY22. On a unit level, the company spent Re 0.97 to earn a single unit of operating revenue.

Jaro Education, besides being an early entrant, has also picked its markets well. With its focus on executive and online education, the firm got in early into a booming market and has clearly learnt enough itself to ensure a profitable existence, even without any VC funding.

While one would love to be a fly on the wall and listen to what the founder believes the firm to be worth, considering how highly some of its competitors are valued despite their losses, Jaro does face challenges going ahead.

A long legacy in many ways brings in the comfort of predictability when it comes to future performance, something that can go against a founder when it comes to VC funding. The legacy can also lock in the firm and the founder to a certain viewpoint and way of operating, when contrasted with newer firms promising ‘disruption’.

With unicorn competitors still having enough cash in the bank to disrupt the market by operating with a heavy loss or worse, poach talent, it’s creditable that Jaro has withstood the onslaught as well as it has. Should be very interesting to see if a wholesale exit at a rich valuation is what the future holds for the founder.