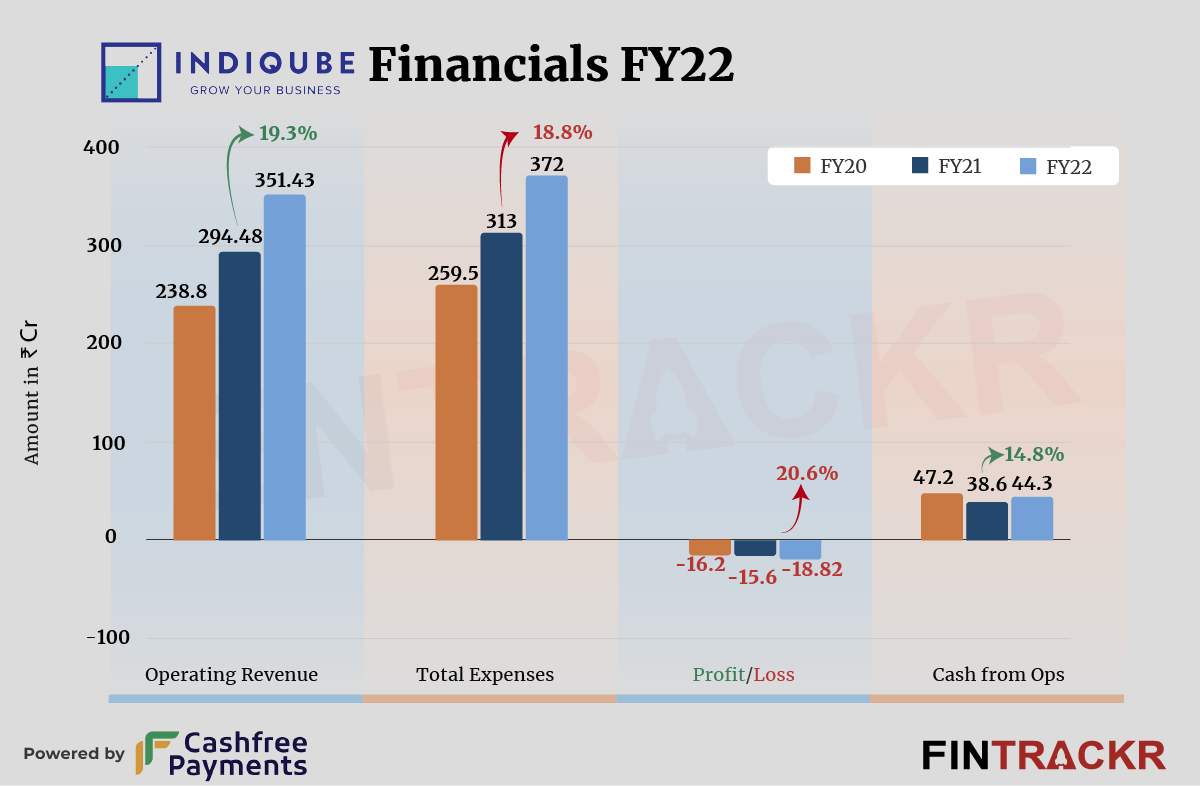

Flexible workspace provider IndiQube crossed Rs 350 crore in revenue during the fiscal year ending March 2022, but its rate of growth dipped when compared to the previous financial year.

Indiqube’s scale grew 19% with its operating income at Rs 351.43 crore during FY22, according to IndiQube’s annual financial statement with the RoC for FY22.

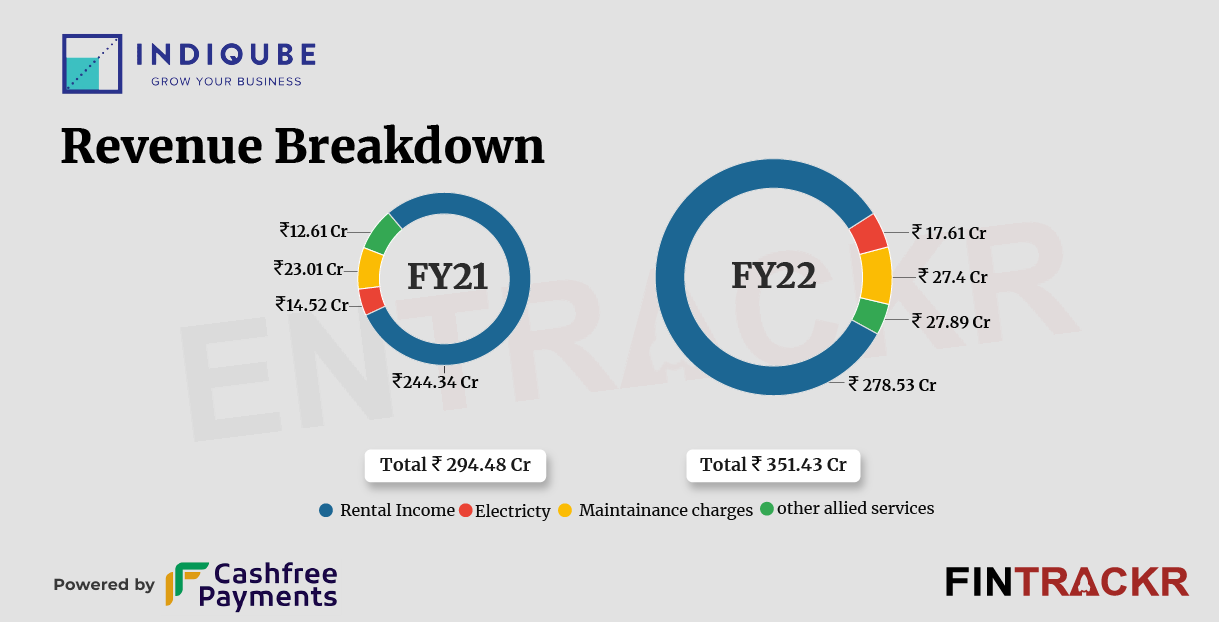

IndiQube provides workspaces to startups, offshore development centers, and large enterprises across India. The rental income received from the companies formed 79.3% of the total collections. This income grew 14% to Rs 278.53 crore in FY22.

Electricity, maintenance, and revenue from allied services collectively increased 45.4% to Rs 72.9 crore in the same period.

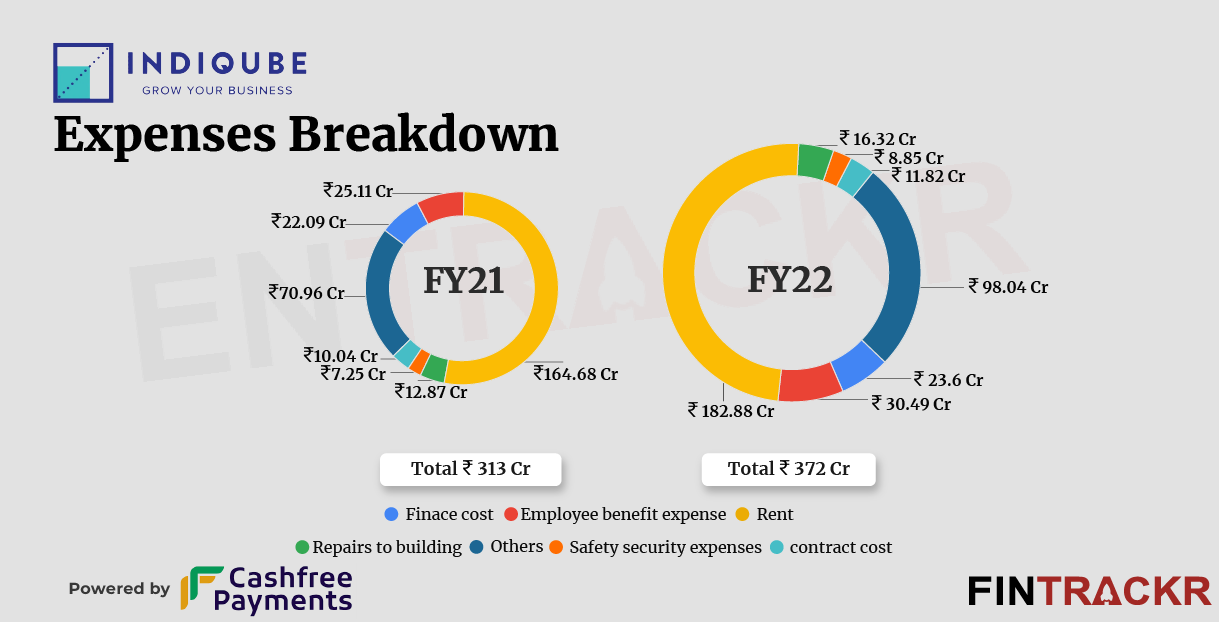

Rent was expectedly the largest cost center for IndiQube accounting for 49.2% of the total expense. This cost surged 11.1% to Rs 182.88 crore in FY22. Its employee benefits expenses grew 21.4% to Rs 30.49 crore in FY22. IndiQube also has long-term liabilities of Rs 167 crore during FY22, due to which the interest and finance cost increased to Rs 23.6 crore in FY22.

The costs for repair of buildings jumped by 26.8% to Rs 16.32 crore while the firm added another Rs 11.82 crore and Rs 8.85 crore on safety, security and contract costs which pushed its overall expenditure by 18.8% to Rs 372 crore in FY22.

Outpacing its revenue growth, IndiQube’s losses increased 20.6% to Rs 18.82 crore in FY22 from Rs 15.6 crore in FY21.

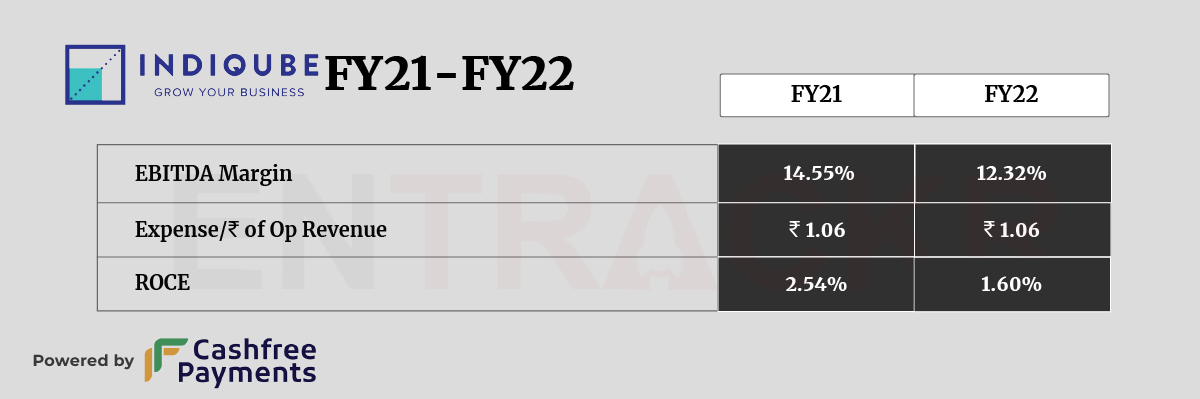

Moving to the ratios, its ROCE and EBITDA margin stood at 1.60% and 12.32%. IndiQube spent Rs 1.06 to earn a single rupee in FY22.

The co-working space has seen a strong return post Covid, and the market is expected to remain strong with many established players back in expansion mode. That will keep pressure on margins for most, although some of the smaller domestic players have shown profits very early. These are also the players who saw this market as a pure real estate play and focused on minimal services at a value price to ensure quick ROI for themselves. Others have gone for a services-driven approach, sometimes stopping just short of turning into full-fledged accelerators for the startups calling them home temporarily. A truly standout success story among coworking firms is still elusive, however. One can’t help thinking the time for that story is coming soon.