Like global, Indian startups are facing tough times amid funding crunch and mass firings. This can be evident from the weekly and monthly reports and now the quarterly funding report for the first three months of 2023 shows a similar trend. However, there is a sign of improvement.

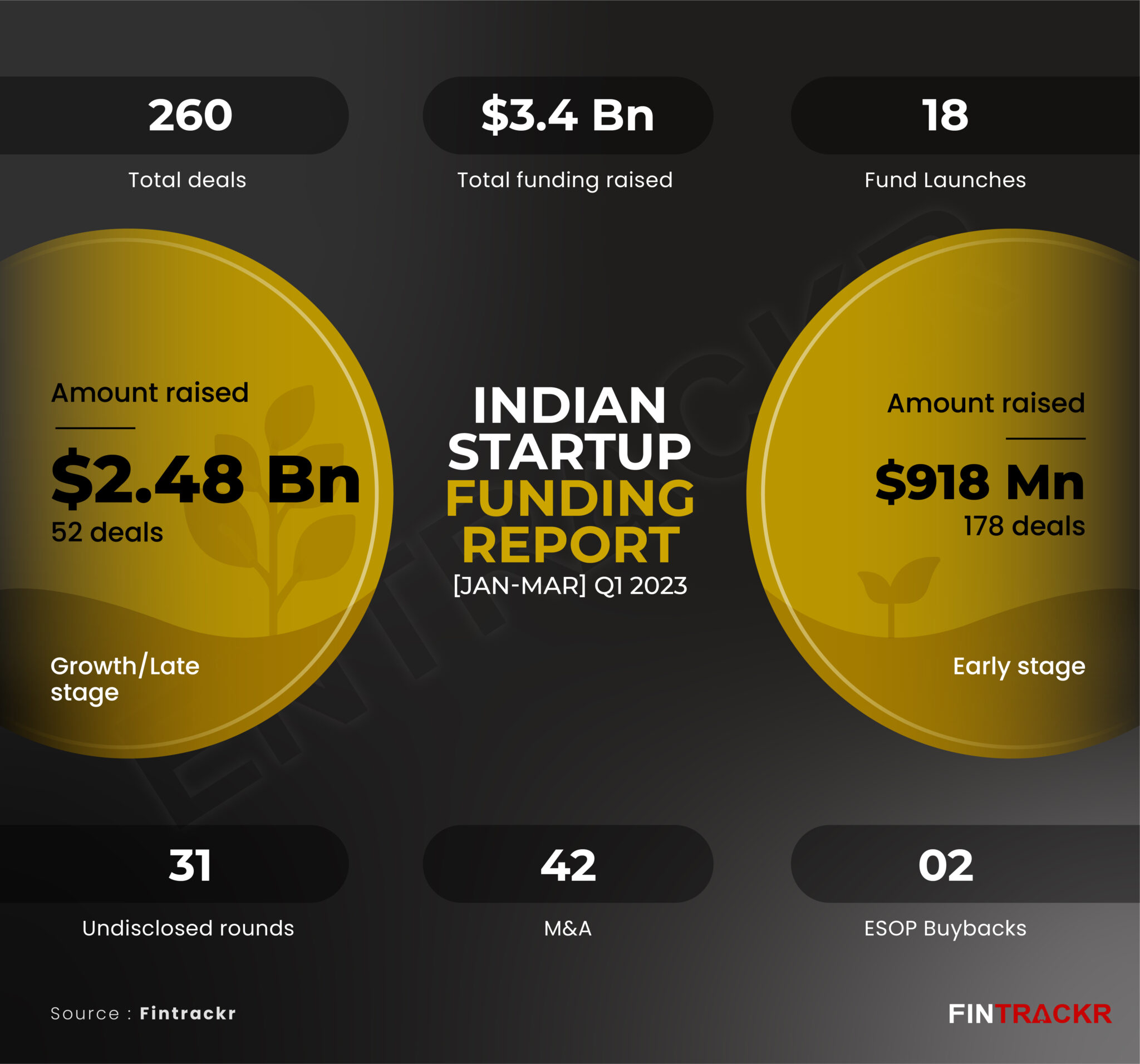

Data compiled by Fintrackr shows that nearly 260 startups have announced their funding during the Q1, 2023. Among them, 229 deals were disclosed amounting to $3.4 billion while 31 startups did not divulge their transaction details.

The first quarter of this year also failed to produce a unicorn, which was quite common in 2021 and first half of 2022. Molbio was India’s last unicorn that gained the status in September 2022.

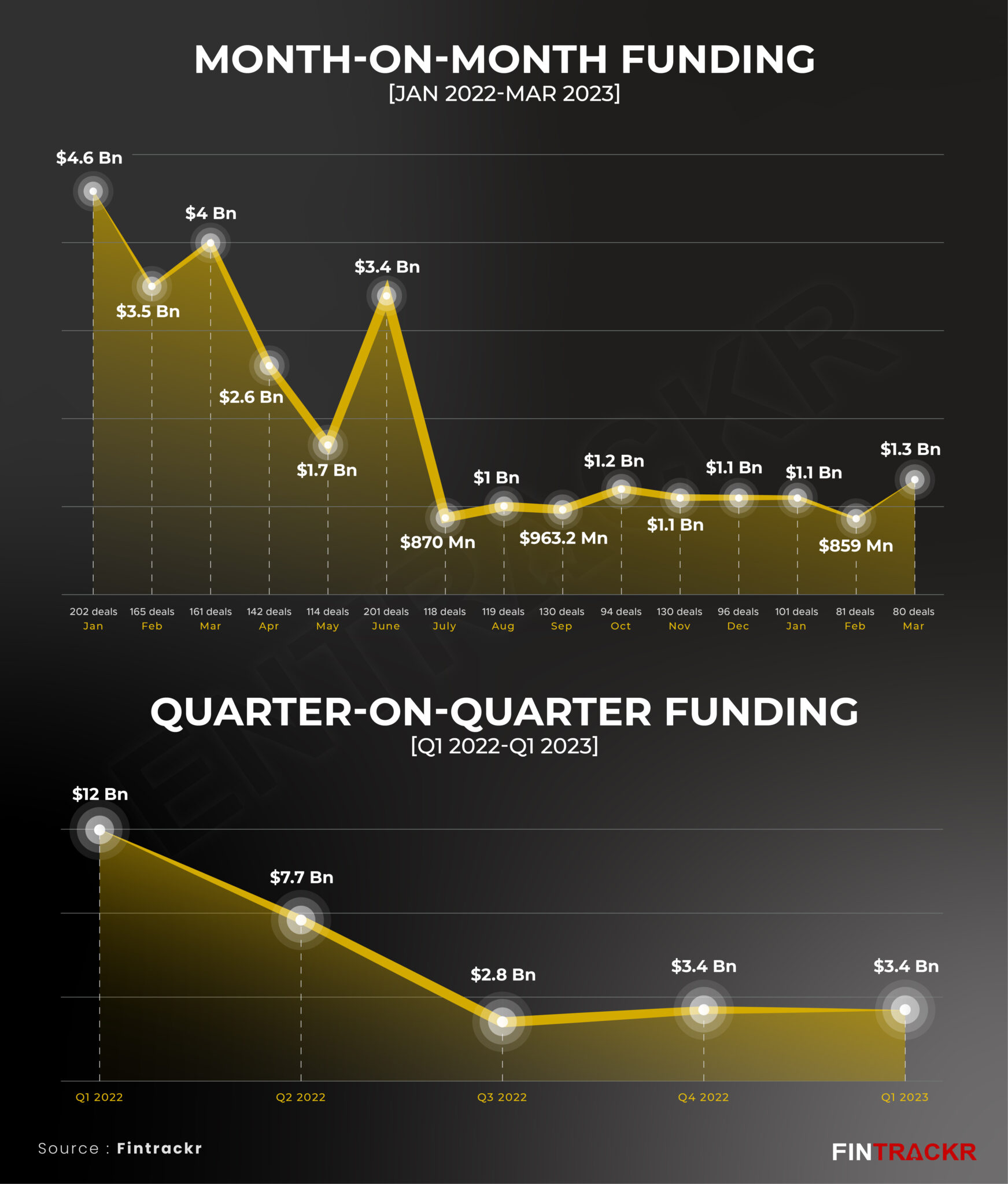

[Month-on-month and quarter-on-quarter funding trend]

Entrackr has prepared month-on-month and quarter-on-quarter charts to understand fund inflow in Indian startups since January 2022. A slight improvement from January and February, the investment in March was recorded at $1.3 billion. Interestingly, this is the highest funding since June 2022. The average monthly funding in 2021 stood at over $3 billion and over $2 billion in 2022. Coming to quarter-on-quarter growth, the trend is also the same for the past two quarters.

Despite a flat growth, a bunch of companies have managed to grab big deals in equity and debt funding. Let’s analyse this through top 25 deals across growth and early stage deals.

[Top 25 growth stage deals]

In the top 25 growth stage deals, PhonePe and Lenskart have managed to go past the $500 million mark. While Walmart-owned PhonePe scooped up $650 million across three tranches, SoftBank-backed Lenskart scooped up $500 million from Abu Dhabi Investment Authority (ADIA).

Fintech companies KreditBee and Stashfin, supply chain financing platform Mintifi and FreshToHome, an online platform for fresh meat, fish and seafood, have managed to rake in $100 million plus funding each during the first quarter.

[Top 25 early stage deals]

CarDekho-owned InsuranceDekho made a blockbuster entry with $150 million in Series A round, making it one of the largest funded startups at Series A stage. Electric vehicle-focused company Charge+Zone, upskilling startup NxtWave, AI startup SpotDraft, SaaS company Beconstac, dronetech company Garuda Aerospace and others also raised a sizable amount in their early stage.

The list of top 25 deals clearly reflects that investors have been backing startups in different spaces.

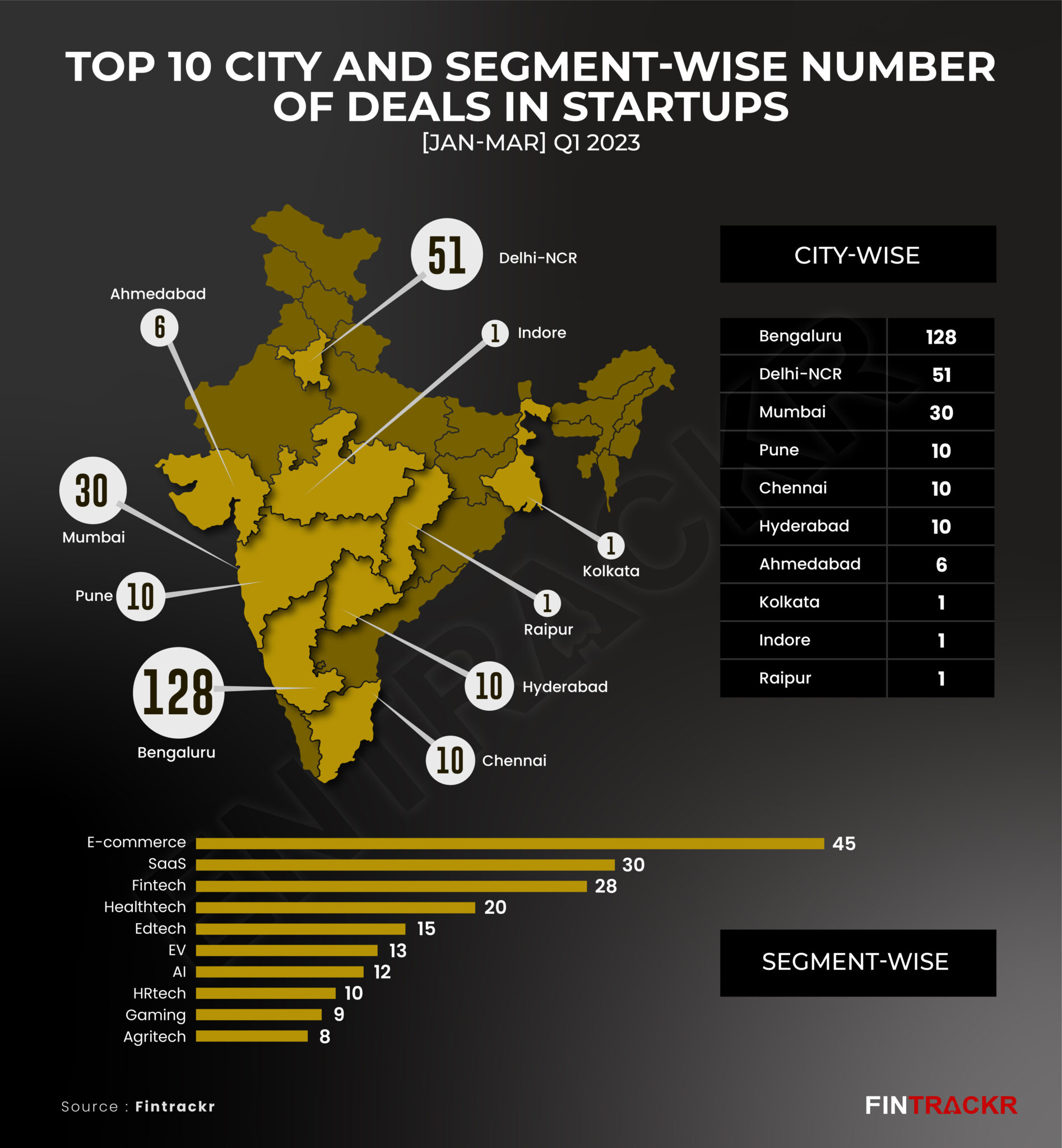

[City and Segment wise deals]

Startup capital Bengaluru saw 128 deals amounting to $1.7 billion, around 50% of the total deal size. Delhi NCR-based startups remained in second spot with $960 million in funding across 51 deals. Mumbai was in third position with 30 deals whereas Pune, Chennai and Hyderabad saw 10 deals each.

Segment wise, e-commerce, which also included D2C brand, dominated the chart. SaaS, fintech and healthtech were next on the list while edtech managed to keep itself in the top 5 segment in terms of number of deals. Value wise, EV was in the top 5 list.

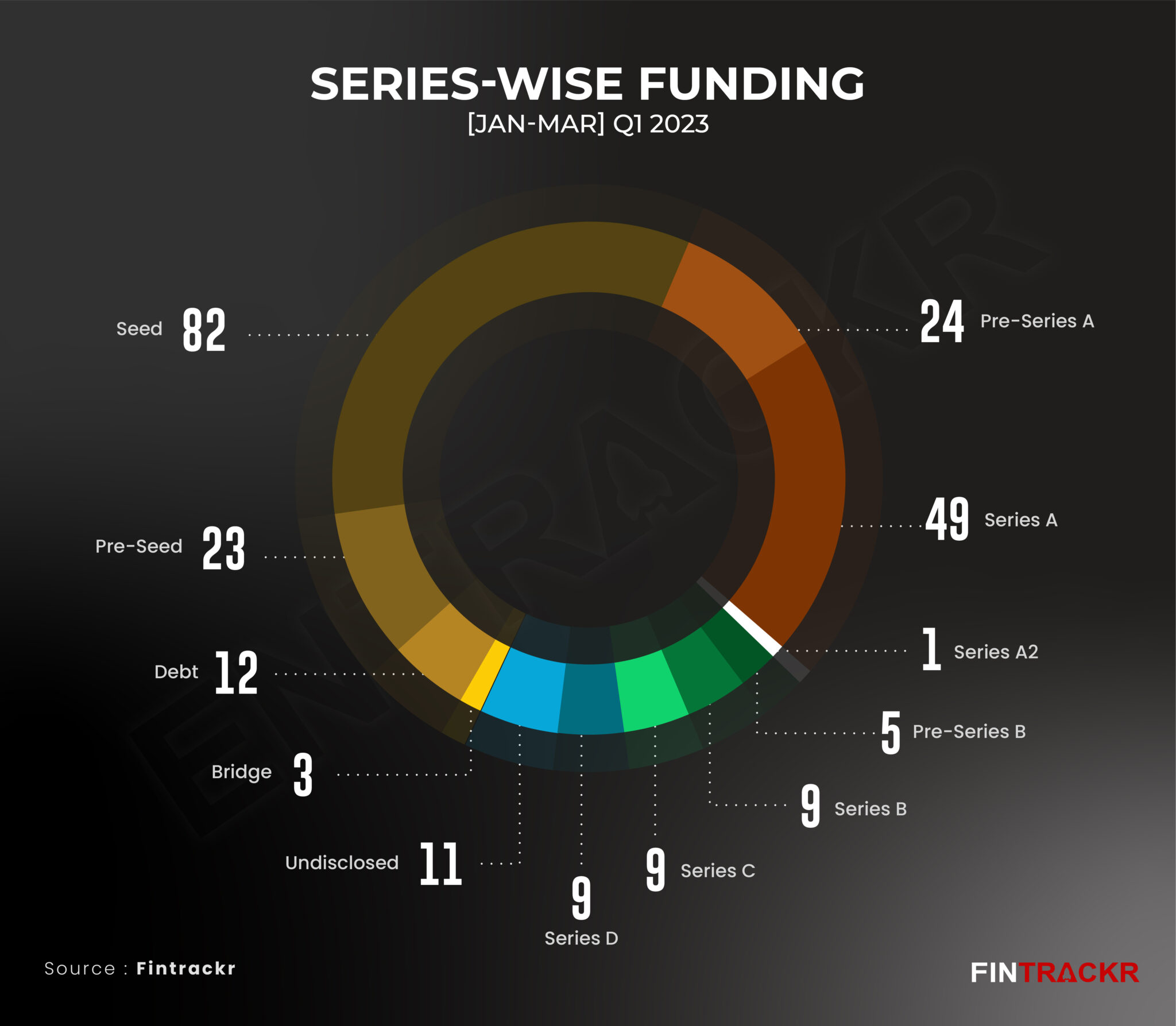

[Series wise deals]

Q1 saw 82 seed funding whereas 23 deals were in pre seed stage. This was followed by Series A, pre Series A where 49 and 24 startups got funded. In growth stage deals, pre-Series B, Series B and Series C saw 5, 9 and 9 deals respectively. In lates stage funding, Series D also saw 9 deals while there were 12 debt rounds, 3 bridge rounds and 11 undisclosed deals.

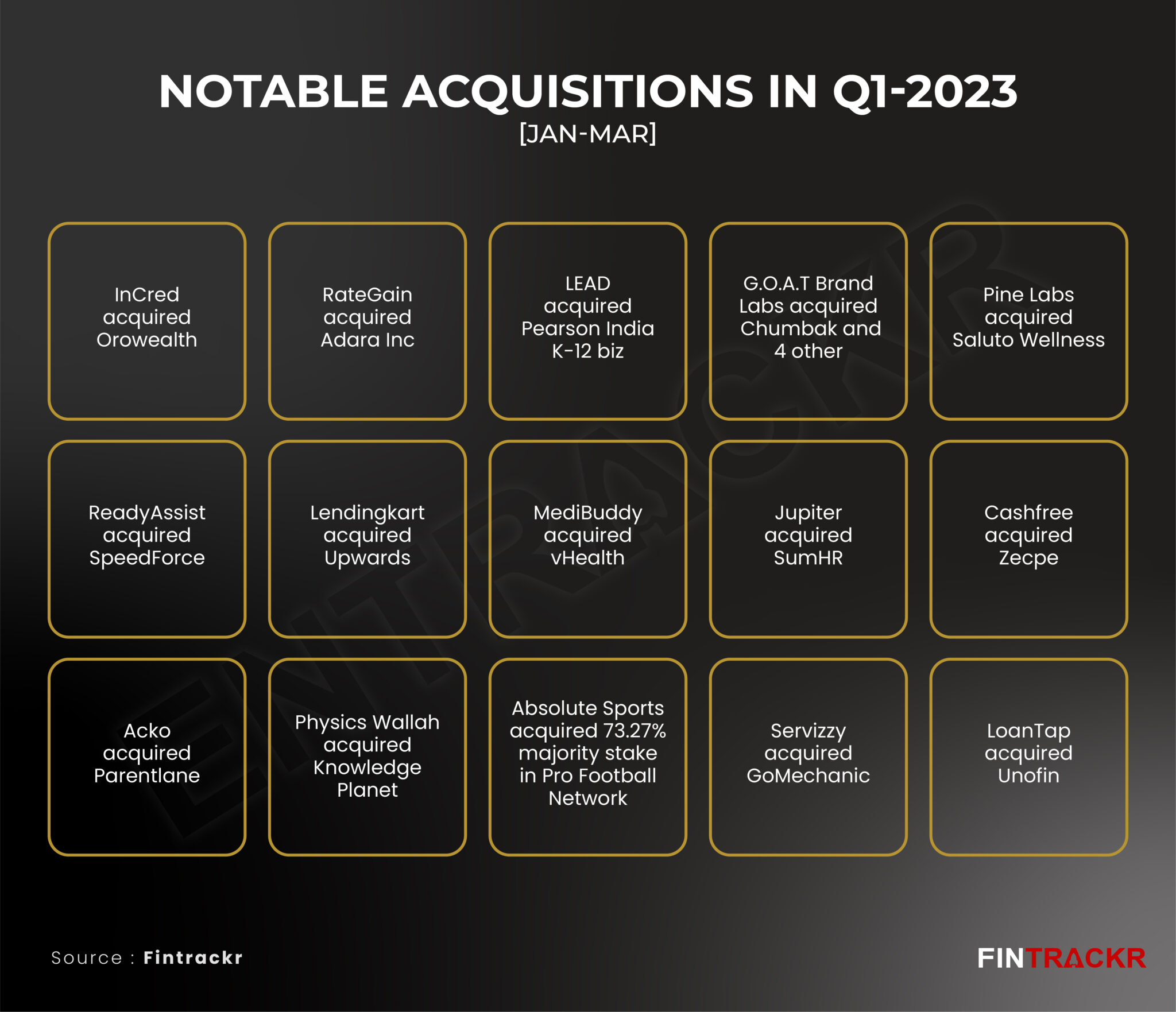

[Mergers & Acquisitions]

Amid fall in funding and bleak future, merger and acquisition among startups are inevitable. The first quarter saw few deals which were directly impacted by the ongoing crises. The acquisition of Sequoia and Tiger Global-backed GoMechanic by Lifelong-owned Servizzy is one such example. Once a promising soonicorn company got acquired by the Delhi-based auto components manufacturer in a slump sale. In January, e-commerce roll up firm G.O.A.T Brand Labs acquired home and lifestyle brand Chumbak, which has raised over $30 million in funding, for an undisclosed sum. As per sources, this was another fire sale acquisition. Meanwhile, edtech company LEAD entered into an agreement with Pearson to acquire its K-12 learning business in India for an undisclosed sum.

Entrackr has prepared a list of notable mergers and acquisitions in Q1, 2023 which also include the acquisition of personal loan provider Upwards by digital lending platform Lendingkart in a cash-and-stock deal worth Rs 100- 120 crore.

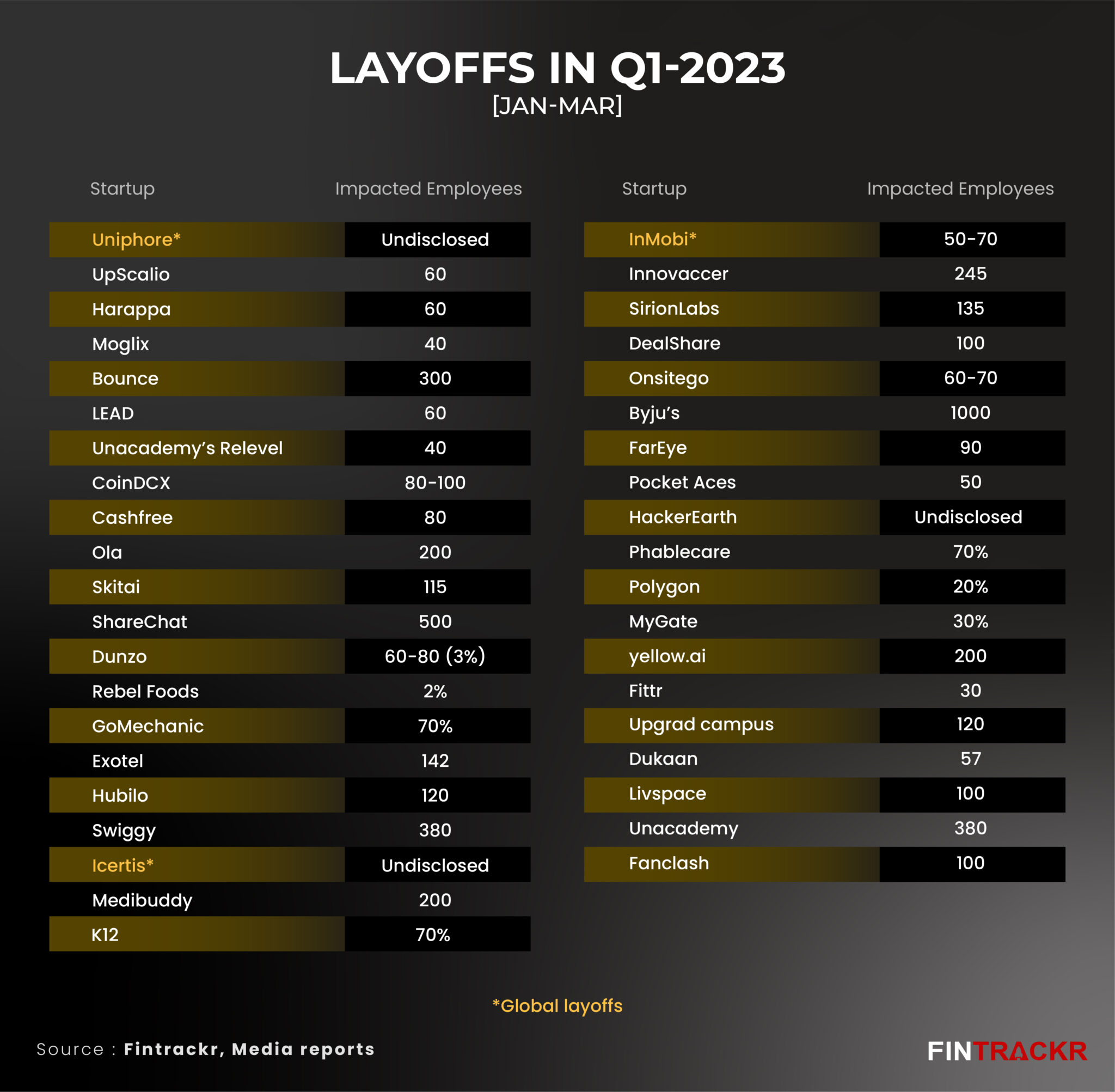

[Layoffs]

Layoffs continued to haunt the Indian startup ecosystem during the first quarter of 2023. However, the frequency of firing employees was quite low in March and February against January when we saw layoffs almost every day. As per data compiled by Fintrackr, citing various media reports, more than 6,000 employees have been fired during Q1, 2023. Edtech companies including Byju’s, Unacademy, upGrad Campus, saw the most number of layoffs followed by ShareChat, GoMechanic and Swiggy.

Several global startups with significant presence in India such as Icertis, InMobi and Uniphore also fired employees during the first quarter. This number could be more than expected as several layoffs might have not been reported. In 2022, the layoff numbers were more than 20,000.