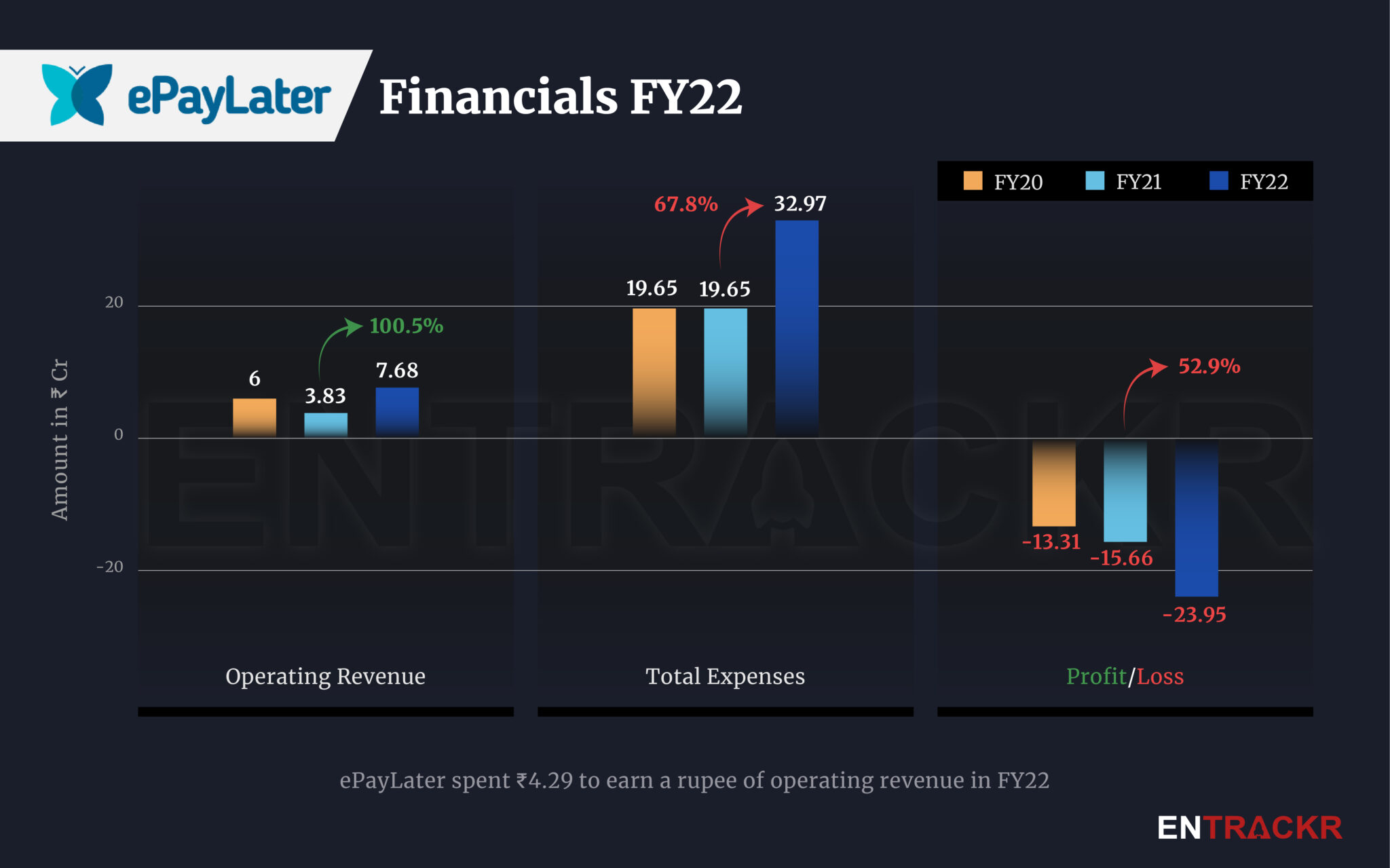

After a 36% drop in operating revenue during FY21, B2B buy now, pay later (BNPL) fintech firm ePayLater bounced back in FY22 as its scale surged over two-fold and neared the Rs 8 crore mark.

ePayLater’s revenue from operations grew 2X to Rs 7.68 crore during the fiscal year ending March 2022 from Rs 3.83 crore in FY21, according to its annual financial statement with the Registrar of Companies.

Eight-year-old ePayLater’s payment solutions help retailers purchase inventory across categories. As per its website, it allows small businesses to avail a 14-day interest free credit to procure inventory from sellers. ePayLater also works with small businesses and provides zero-cost credit on up to Rs 25 lakhs.

The company works with B2B majors including JioMart, Metro Cash and Carry, Flipkart Wholesale, BigBasket, et al. The startup claims that its retail base is spread across over 650 cities and has disbursed over Rs 3,000 crore in facilitating inventory purchases.

ePayLater collected around 91% of its operating income from transaction fees, while the rest came from penal charges and interest. It also earned a non-operating revenue of Rs 1.29 crore mainly from interest on fixed deposits.

Moving towards expenses, employee benefits accounted for 31% of the total expenses and stood at Rs 10.21 crore in FY22, while operating expenses, including transaction & service charges, performance penalty to NBFCs and other tech infrastructure costs surged 54.8% to Rs 4.38 crore.

Promotion and marketing expenses jumped 3.3X to Rs 7.24 crore during the fiscal year, while loyalty discounts given to customers based on their spendings stood at Rs 4.8 crore.

ePayLater’s total expenditure surged 67.8% to Rs 32.97 crore in FY22 as compared to Rs 19.65 crore in FY21. Meanwhile, its losses increased 53% to Rs 23.95 crore in FY22. On a unit level, the company spent Rs 4.29 to earn a single rupee in FY22.

ePayLater has raised around $20 million (Rs 157 crore) to date from Pravega Ventures, ICICI Bank, and Blue Ashva Capital, among others. It last raised $10 million in September 2021 at a valuation of around $44 million (Rs 330 crore).