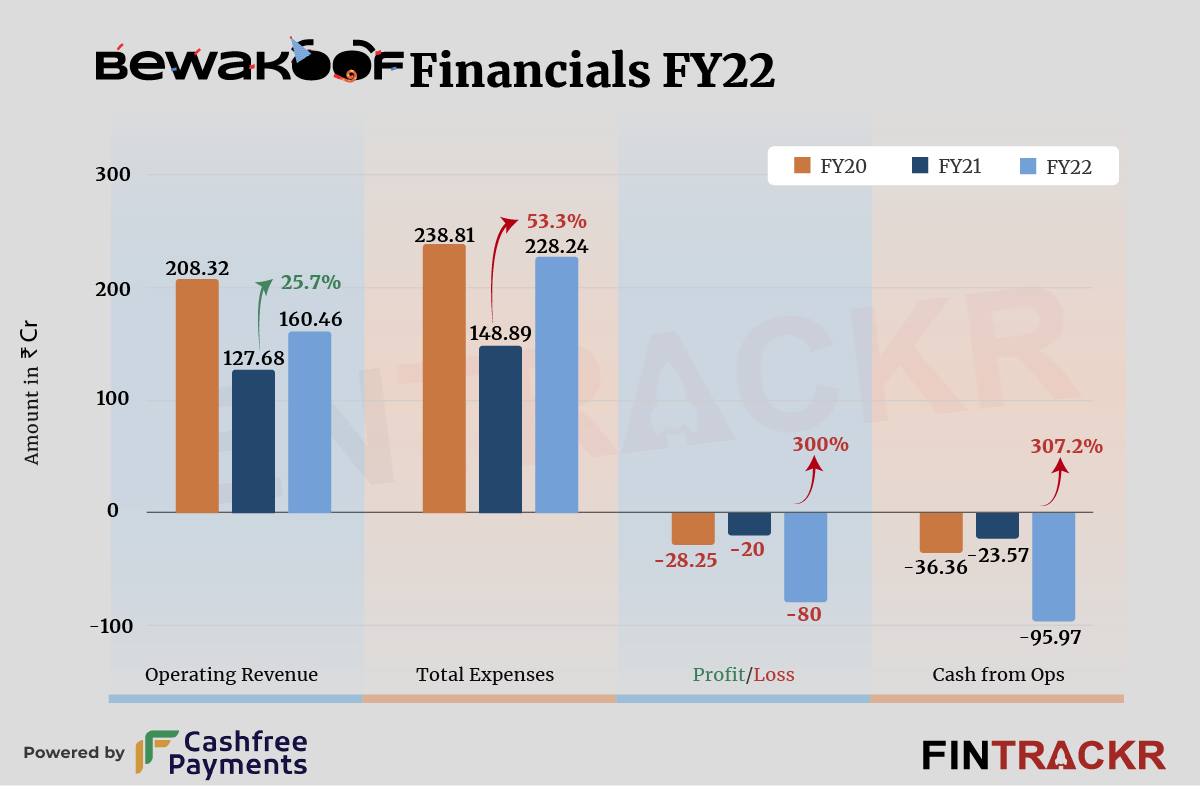

After witnessing a depletion of 38% of its scale during the pandemic-stricken fiscal (FY21), direct-to-consumer fashion brand Bewakoof managed to grow its business by one-fourth in FY22.

The Aditya Birla Group-controlled company’s operating revenue spiked 25.7% to Rs 160.46 crore in FY22 from Rs 127.68 crore in FY21, according to its consolidated financial statements with the Registrar of Companies.

It’s worth highlighting that the company clocked more than Rs 200 crore in revenue in FY20.

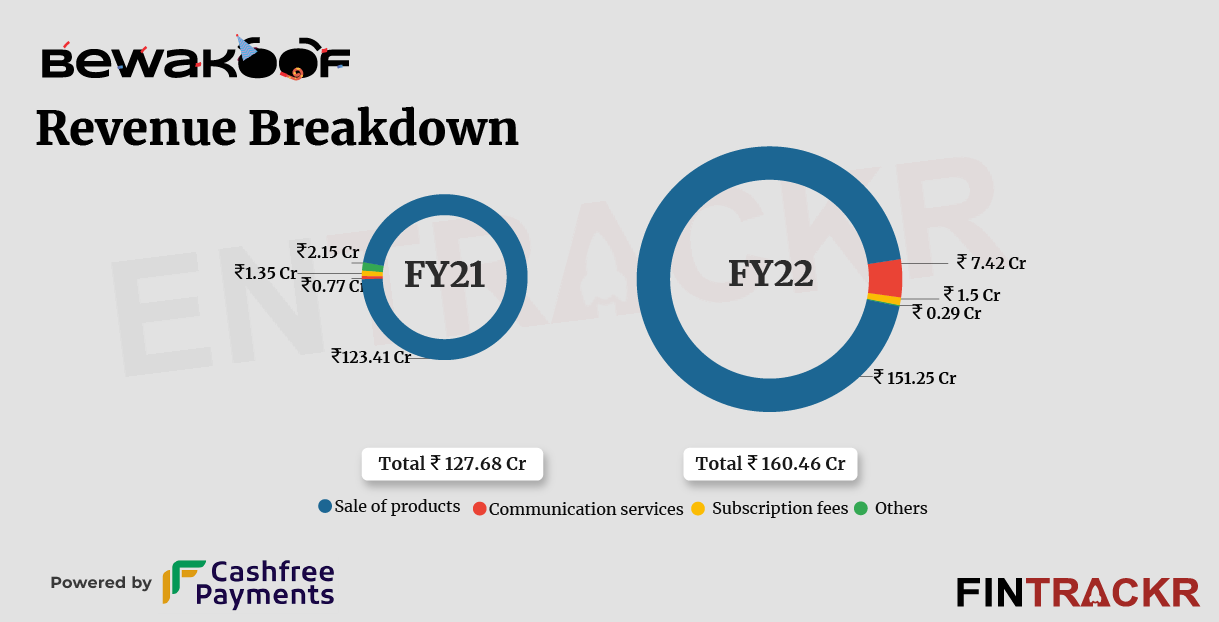

Bewakoof sells trendy apparel and accessories and a huge section of its customer base includes millennials. The sale of such products accounted for 94.3% of its total operating collection. This income grew by 22.6% to Rs 151.25 crore in FY22.

The sale of subscription services and commissions from other brands for advertising and marketing collectively shot up 2.15X to Rs 9.21 crore in FY22 from Rs 4.27 crore in FY21. The company also recorded other miscellaneous income of Rs 1.21 crore.

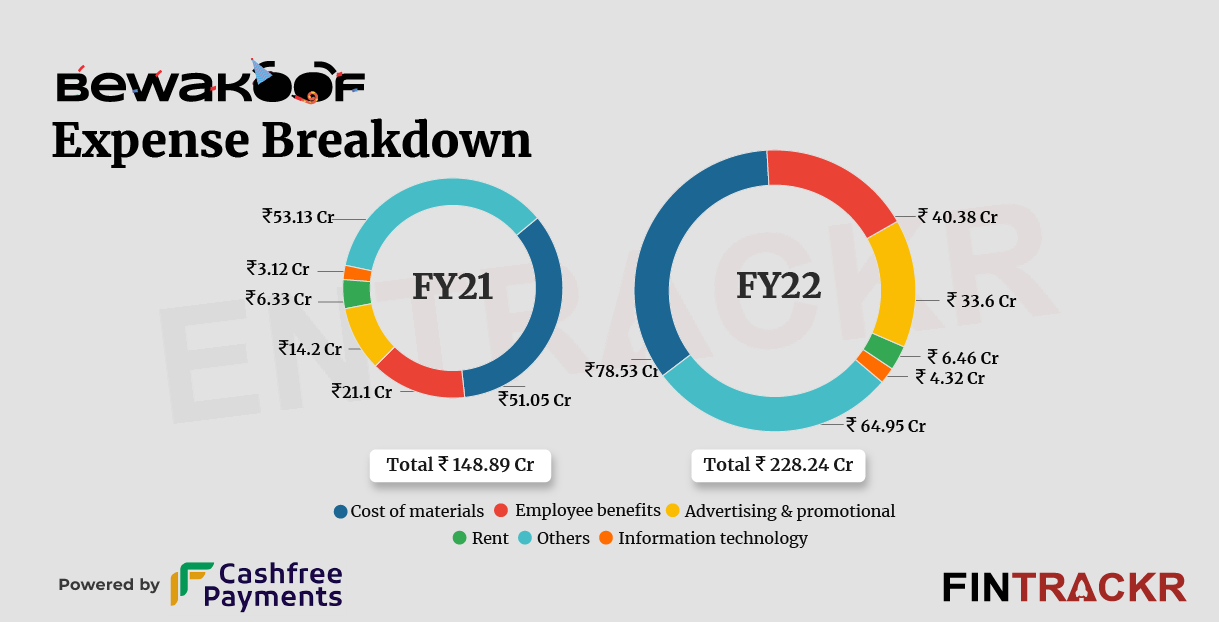

The cost of procurement of products was the largest cost center for the company, forming 34.4% of the overall expenditure. This cost grew by 53.8% to Rs 78.53 crore in FY22 from Rs 51.05 crore in FY21.

Bewakoof seems to have hired aggressively during FY22 and this could be noticed from its employee benefit expenses, which increased 91.4% to Rs 40.38 crore during the year from Rs 21.1 crore in FY21. Importantly, this also includes Rs 3.68 crore expenses on ESOPs.

With the launch of various campaigns and onboarding of actor Sidharth Malhotra and Fatima Sana Shaikh as brand ambassadors, Bewakoof’s advertisement and promotional cost jumped 2.36X to Rs 33.6 crore in FY22 from Rs 14.2 crore in FY21.

Its rental and IT cost increased by 2.1% and 38.5% respectively to Rs 6.46 crore and Rs 4.32 crore during FY22. Bewakoof booked miscellaneous expenses of Rs 53.47 crore that includes freight, commission, job workers, and contract labor charges which pushed its total expenditure by 53.3% to Rs 228.24 crore in FY22.

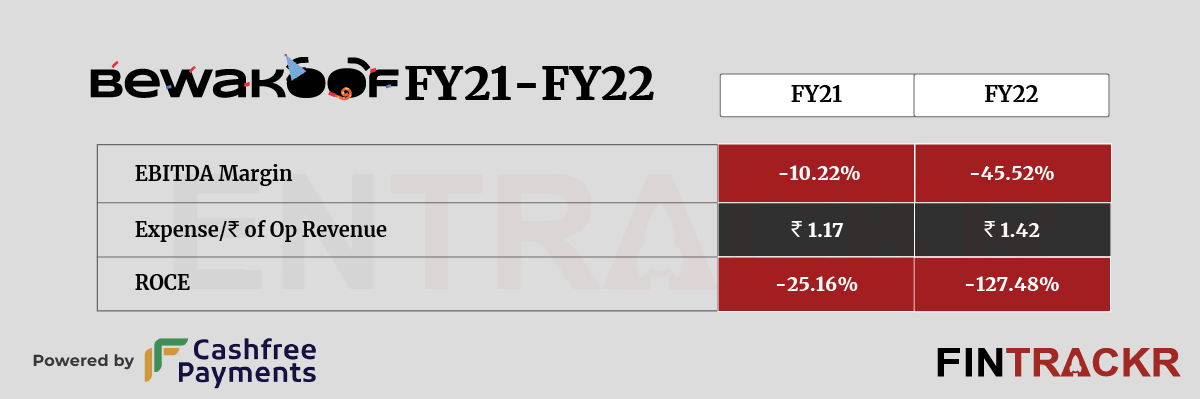

Unlike its revenue which only grew 25%, the firm’s losses shot up 4X to Rs 80 crore in FY22 from Rs 20 crore in FY21. Its ROCE and EBITDA margin also worsened to -127.48% and -45.52%. On a unit level, the firm spent Rs 1.42 to earn a single unit of operating revenue.

Bewakoof has raised Rs 187 crore ($23 million) in funding till date from investors including InvestCorp, IvyCap Ventures and Spring Marketing Capital. After acquiring a controlling stake in Bewakoof, Aditya Birla Group’s TMRW is reportedly going to invest Rs 200 crore to fuel the growth of the D2C brand.

Led by Prabhkiran Singh, the decade-old company has a stated aim to touch Rs 1,500 crore in revenues over the next five years.

While topline targets are fine, the issue obviously is its ability to get to the profitably. So far, most D2C platforms and brands have shown a distressing (for investors) correlation between marketing expenses and sales, making a decisive shift from their cash burn very challenging for most . While this approach worked in fund raising mode, as purse strings tighten up, a runway lit up with burning money does not seem attractive at all. It also puts into question their ability to generate user loyalty, something that is emerging as the question of the century for Indian brands built in the past decade on a discount driven model.