Partners Group was set to acquire high-speed fiber-optic broadband provider Atria Convergence Technologies (ACT) in a deal worth $1.2 billion. However, the private market fund, which is an existing investor in the firm, walked out of the deal. The fallout of the deal has had an impact on its top and bottom line.

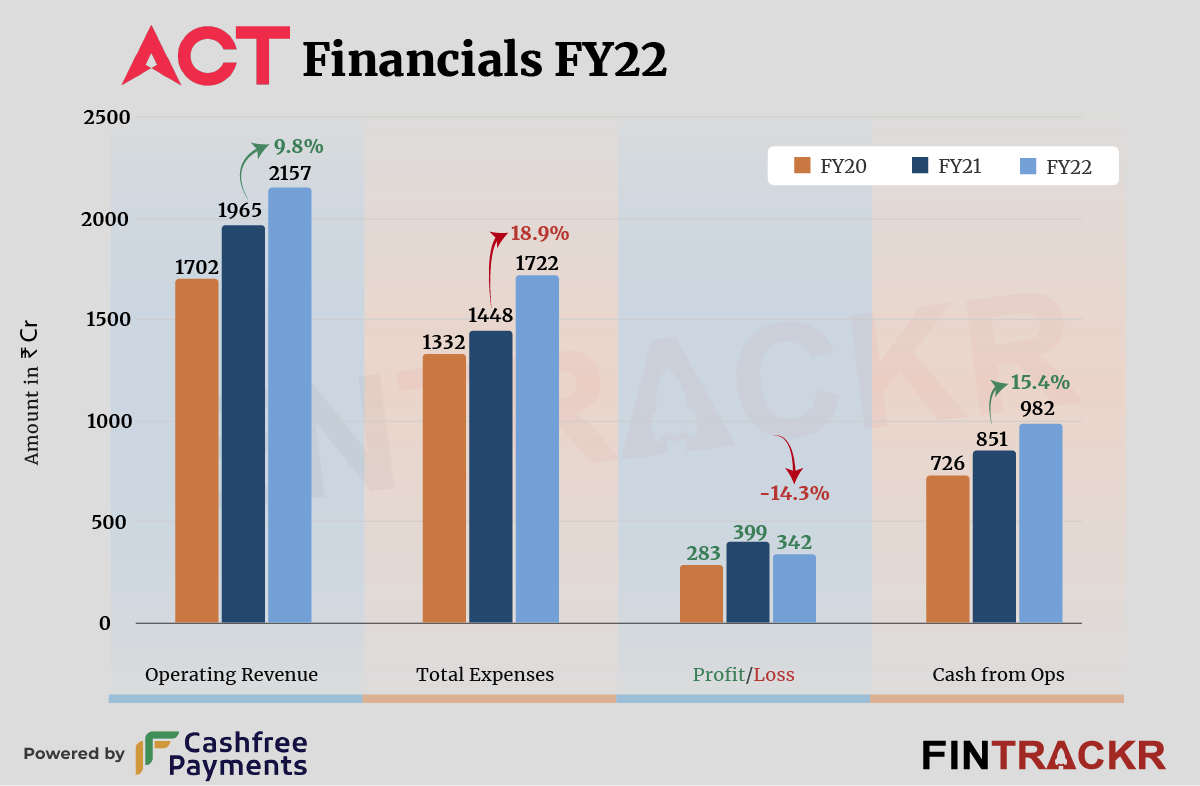

ACT’s growth of scale during FY22 was just shy of venturing into double digits, whereas its profit declined by over 14%.

The company’s operating revenue grew 9.8% to Rs 2,157 crore in the fiscal year ending March 2022 from Rs 1,965 crore in FY21, according to its annual financial statements filed with the RoC.

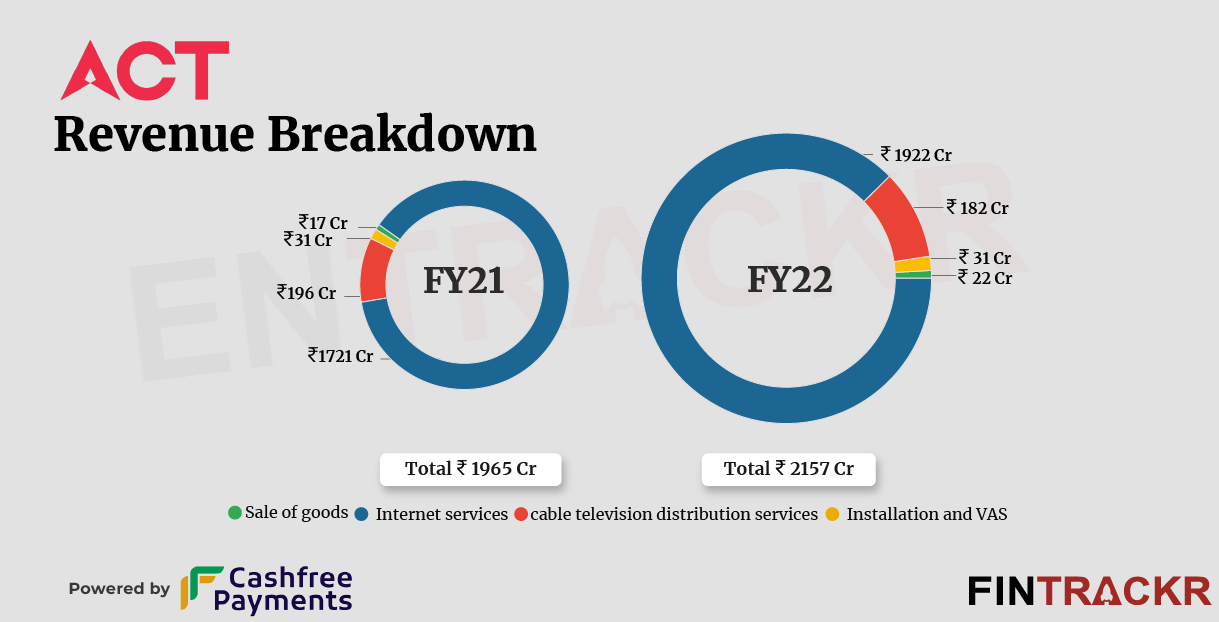

ACT provides wired internet services, TV, and other broadband services. Internet service was a substantial source of income, forming 89.1% of the total operating revenue. This income grew by 11.7% to Rs 1,922 crore in FY22 from Rs 1,721 crore in FY21.

Collections from cable television and distribution services formed 8.4% of the total operating revenue. Income from this vertical shrank 7.1% to Rs 182 crore in FY22.

ACT also earns income from installations/value added services and the sale of traded goods such as Wifi routers, set-top boxes, and Edge Qam. Revenue from these services collectively increased by 10.4% to Rs 53 crore in FY22.

The company also made Rs 36.2 crore from interest on fixed deposits which increased 27.4% during FY22.

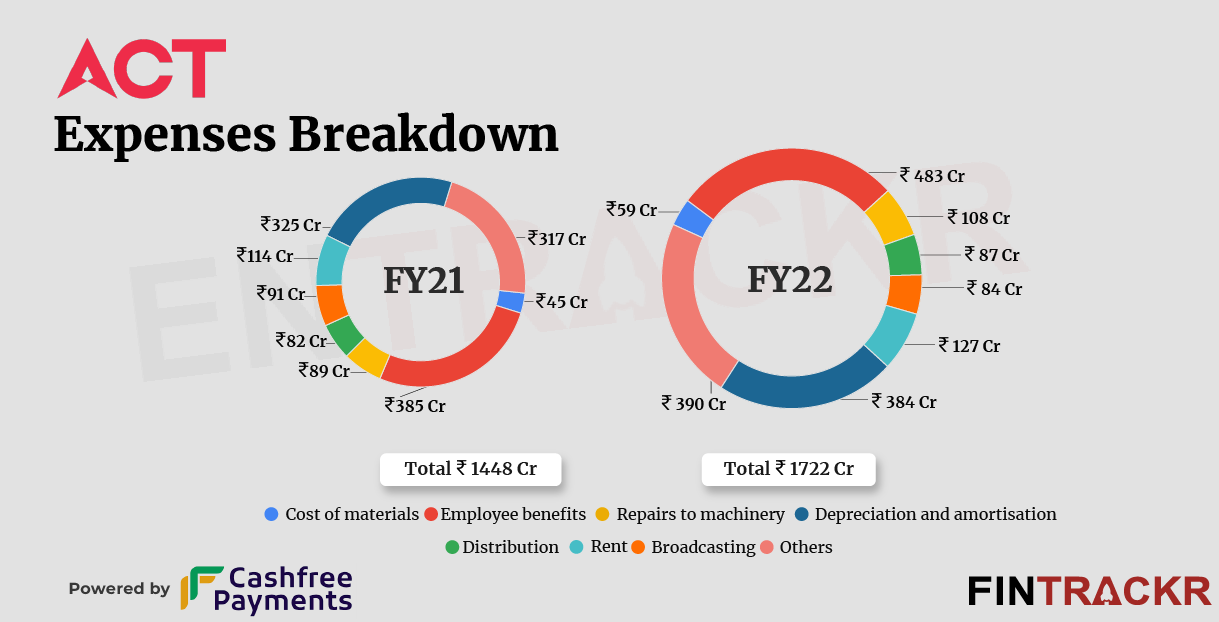

Employee benefits were the largest cost center for ACT, accounting for 28% of the overall expenditure. This cost surged 25.5% to Rs 483 crore in FY22 from Rs 385 crore in FY21. It also includes Rs 9 crore as ESOP expenses which were non-cash.

ACT has net tangible assets of Rs 1,678 crore, against which the company charged depreciation and amortization of Rs 384 crore during FY22. The cost of repair and machinery grew by 21.3% to Rs 108 crore in FY22.

With the inflation of the market, the cost of rent went up 11.4% to Rs 127 crore in FY22. Distribution expenses grew 6.1% to Rs 87 crore while the broadcasting charges shrank 7.7% to Rs 84 crore.

The company also added Rs 59 crore toward the procurement of WiFi routers, set-top boxes, and Edge Qam which steered its overall cost by 18.9% to Rs 1,722 crore in FY22.

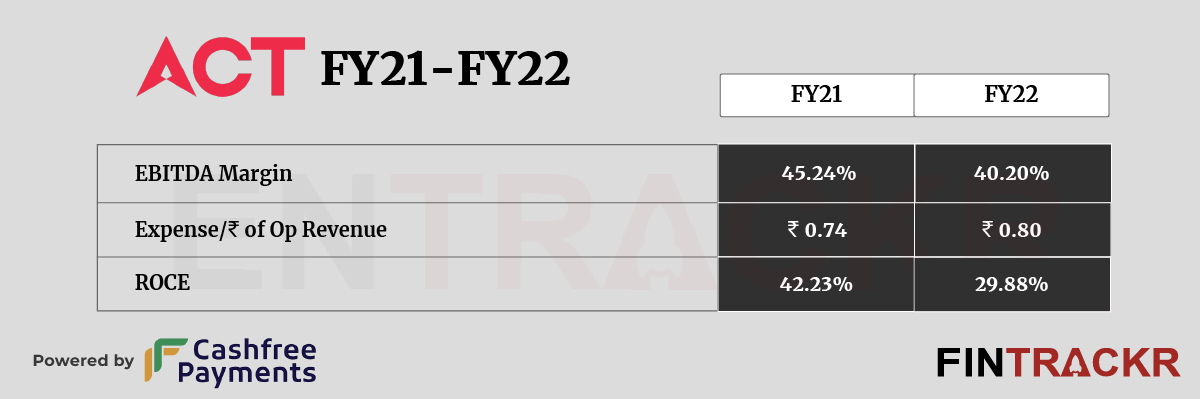

Unlike FY21 when its profit grew over 41%, Atria Convergence Technologies (ACT)’s profits declined by 14.3% to Rs 342 crore in FY22 from Rs 399 crore in FY21. With the surge in total cost, its ROCE and EBITDA margin also dwindled to 29.88% and 40.20%. On a unit level, ACT spent Re 0.8 to earn a single unit of operating revenue.

Broadband providers like ACT face a tough future on the face of it, hemmed in as they are from giant firms like Jio or Airtel on one side, and the on ground complexities of the business in terms of permits, access and more. Thus, even as the firm runs a tight ship and churns out a profit to convince investors that it has a future, investors will know that the next big bout of capex spending is never too far away in an evolving market. That explains why most of the smaller players have ended up as primarily regional plays, protecting turf where they can. With a relatively spread out network, ACT has its task cut out when it comes to both protecting existing markets, as well as expanding for growth.