The Good Glamm Group, which houses brands for both content and commerce, has emerged as one of the fastest-growing companies in the space: More than 5X growth in scale during the last two fiscal years. But their losses also went up at a similar pace and crossed Rs 270 crore in the fiscal year ending March 2022.

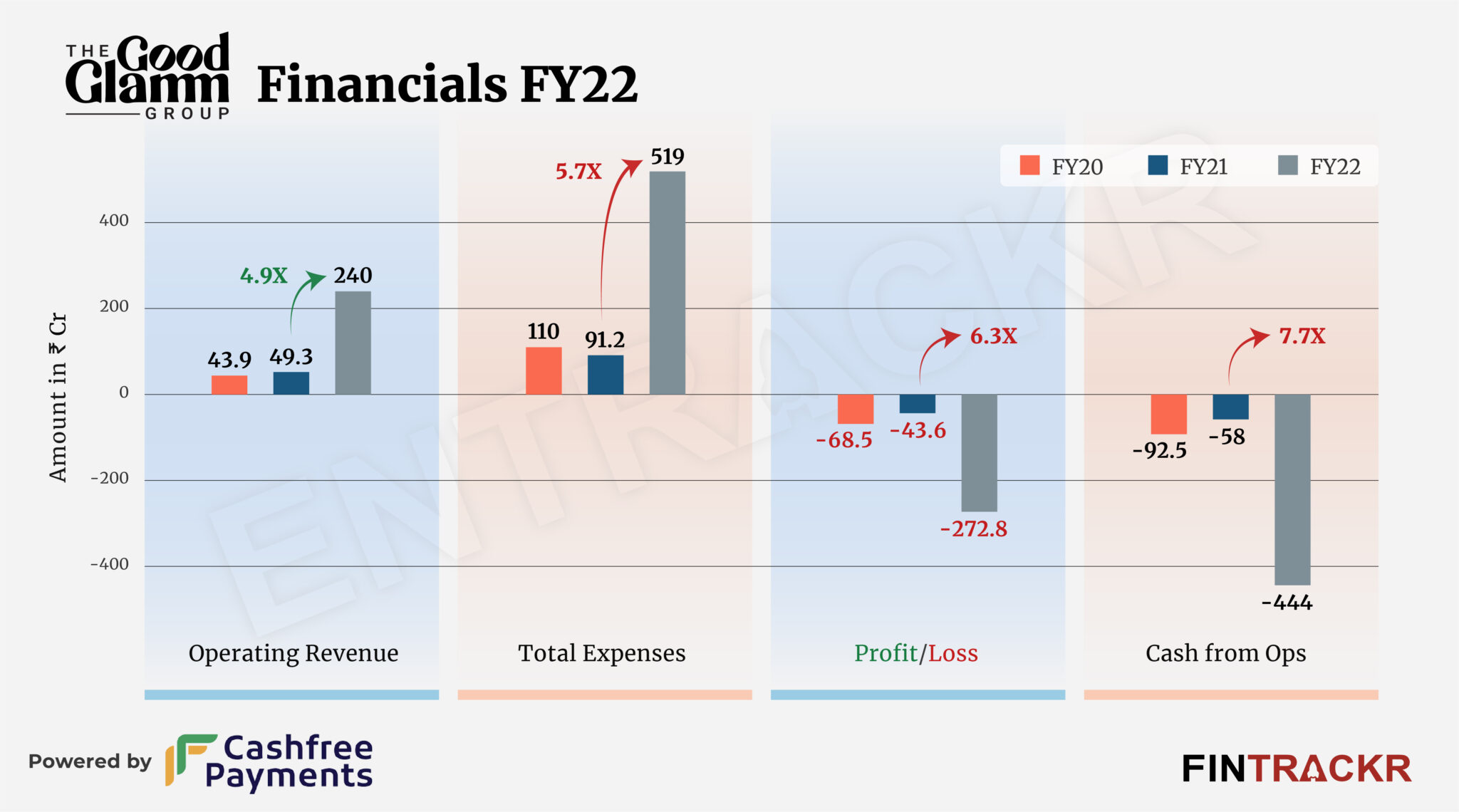

The Good Glamm Group’s revenue from operations surged 4.9X to Rs 240 crore during FY22 in contrast to Rs 49.3 crore in FY21, the company’s consolidated financial statement with the Registrar of Companies shows.

Collection from sale of products was the primary source of revenue followed by sale of services. Besides this, it also cornered Rs 45 lakh as affiliate & adsense income during FY22. Other than operating income, the company also earned finance income of Rs 12.7 crore during the last fiscal which took the overall revenue to Rs 252.7 crore in FY22.

The Good Glamm Group claims to be the largest D2C beauty platform, which consists of personal care brands: MyGlamm, The Moms Co., St. Botanica, Sirona, and Organic Harvest. Its content portfolio includes POPxo, ScoopWhoop, BabyChakra, and MissMalini among others. Most of these were acquired in the last couple of years.

The management’s notes to the financial statements further revealed that its makeup brand MyGlamm scaled 3.8X on the back of its content-creator-commerce strategy and accelerated digital reach by acquiring multiple market leading companies in the digital content and influencer spaces. Its customer base grew to over 4 million in FY22, up from 800,000 in FY21.

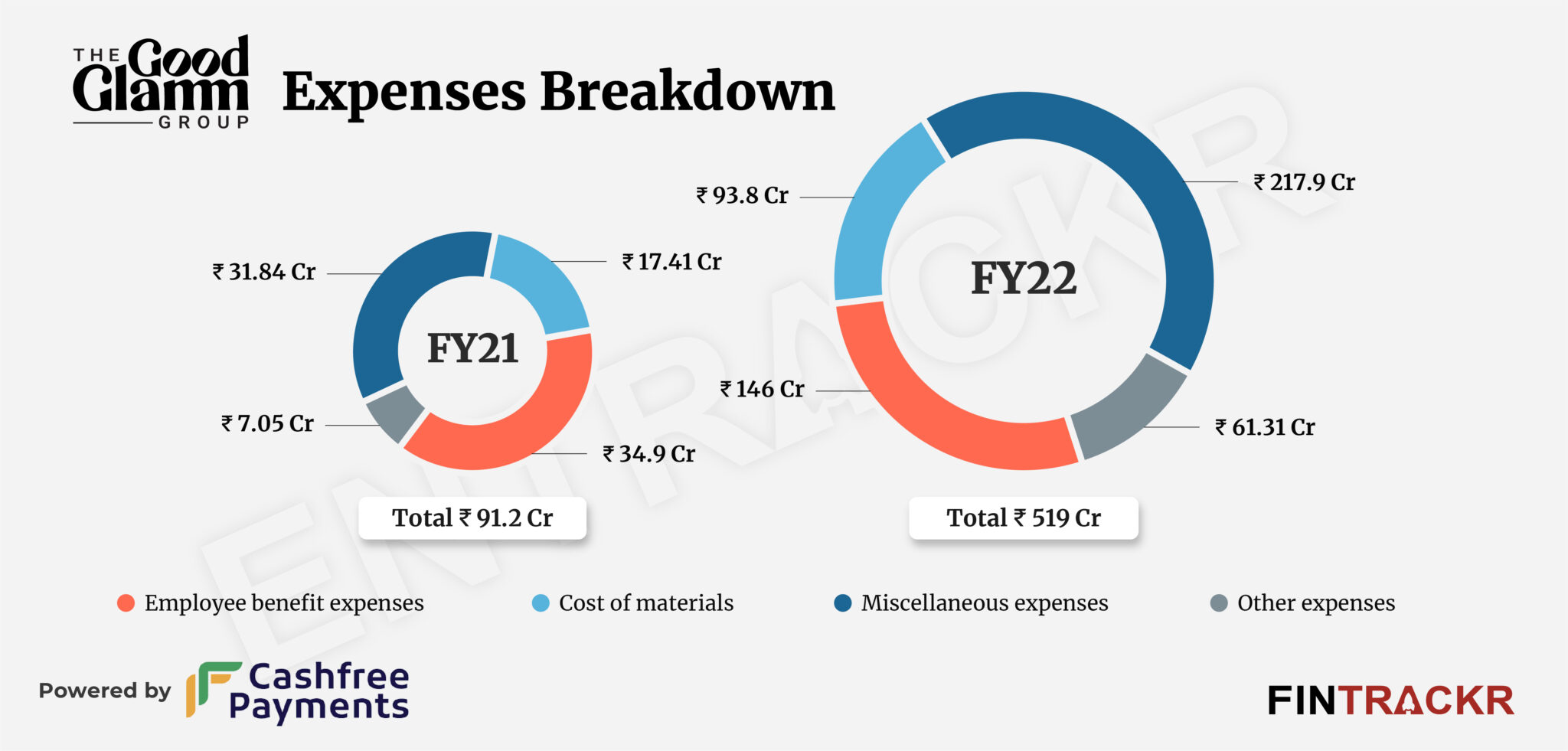

Moving over to the cost side, employee benefit expenses accounted for 28% of the total expenditure. This cost ballooned 4.2X to Rs 146 crore during the year from Rs 34.9 crore in FY21. Importantly, this cost also includes ESOP expense of Rs 22.86 crore during FY22.

The growth in scale is also reflected in the 5.4X rise in procurement cost of products, which rose to Rs 93.8 crore in FY22 from Rs 17.41 crore in FY21.

The company also booked miscellaneous expenses of Rs 217.9 crore during FY22 which are likely to include promotional, warehousing and product delivery expenses. The Good Glamm Group’s standalone financials show an 8X surge in promotional costs which stood at over Rs 110 crore in FY22 while warehousing and product delivery charges were registered at around Rs 26 crore.

In the end, its total expenses exploded 5.7X to Rs 519 crore during FY22 as compared to Rs 91.2 crore in FY21. Along with rising expenditure, cash outflows of the company also jumped 7.7X to Rs 444 crore in FY22.

The Good Glamm Group’s aggressive spending gave way to a 6X rise in losses to Rs 272.8 crore in FY22 against Rs 43.6 crore in FY21. It’s worth noting that the company has excluded exceptional items of Rs 16.3 crore from losses, which majorly include legal and professional expenses incurred towards raising funds and acquisition of new brands during FY22. Moreover, its outstanding losses mounted 2.3X to Rs 474 crore during the same period.

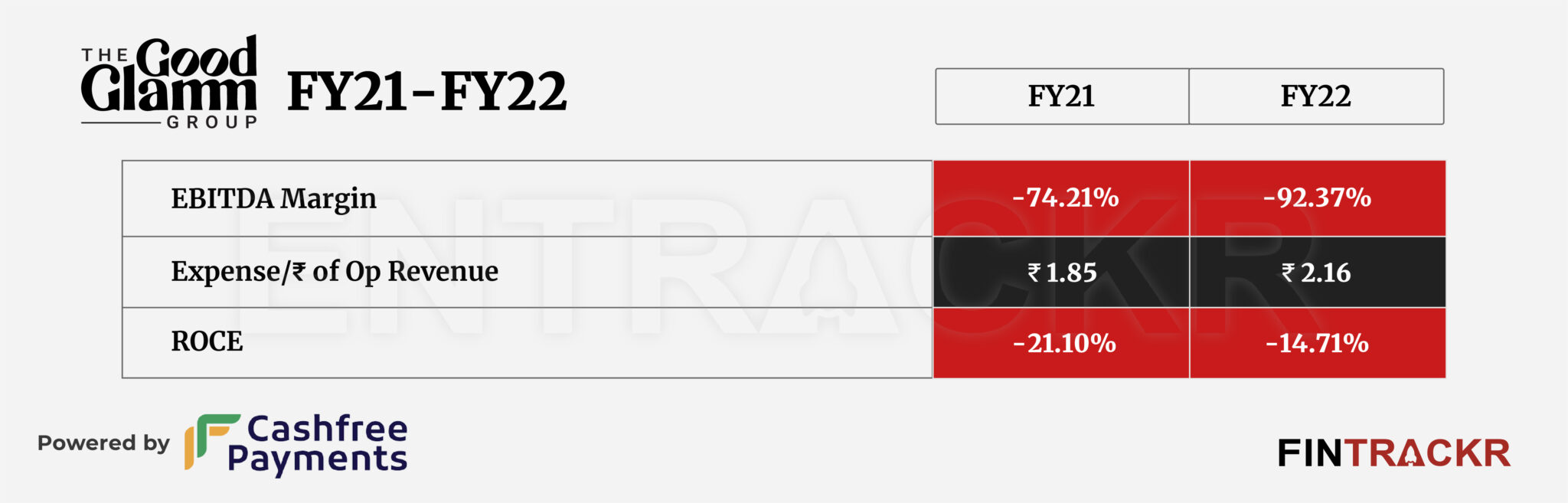

During FY22, the company’s EBITDA margin and ROCE registered at -92.37% and -14.71%. On a unit level, the Pune-based firm spent Rs 2.16 to earn a rupee of operating income.

The Good Glamm Group entered the unicorn club in November 2021 after raising $150 million in Series D round. The company has raised over $235 million to date and is backed by Prosus Ventures, Warburg Pincus, Amazon, Accel and more.

The viability of Good Glamm’s strategy of acquiring multiple content plays remains up in the air, with many believing it’s only the content org stakeholders that managed a decent exit through Good Glamm’s buy-in. While the firm seems to have a runway for at least another 24 months considering the funding it raised, showing that the Content-Creator-Commerce route actually works is proving to be a lot more challenging than the firm expected. A failure to arrest losses could place a question mark on almost everything the Good Glamm Group has done so far, instead of the expected bouquets for blazing a brave new trail for content and creator-led commerce in India. It is also obvious that the firm might struggle to stay in the Unicorn club if it goes for a fund raise, considering the valuation hit larger listed plays like Nykaa have taken in the past few months. Not a good place to be in.