Last year, Blinkit was all the rage as it rebranded itself from Grofers to foray into the then hot 10-minute grocery delivery space. But as unit economics didn’t pan out and money in the bank ran short, Blinkit was bought out by Zomato for $568 million in an all-stock deal with a 43% haircut in valuation. The distress deal was perhaps driven by Blinkit’s stagnant revenue and mounting losses.

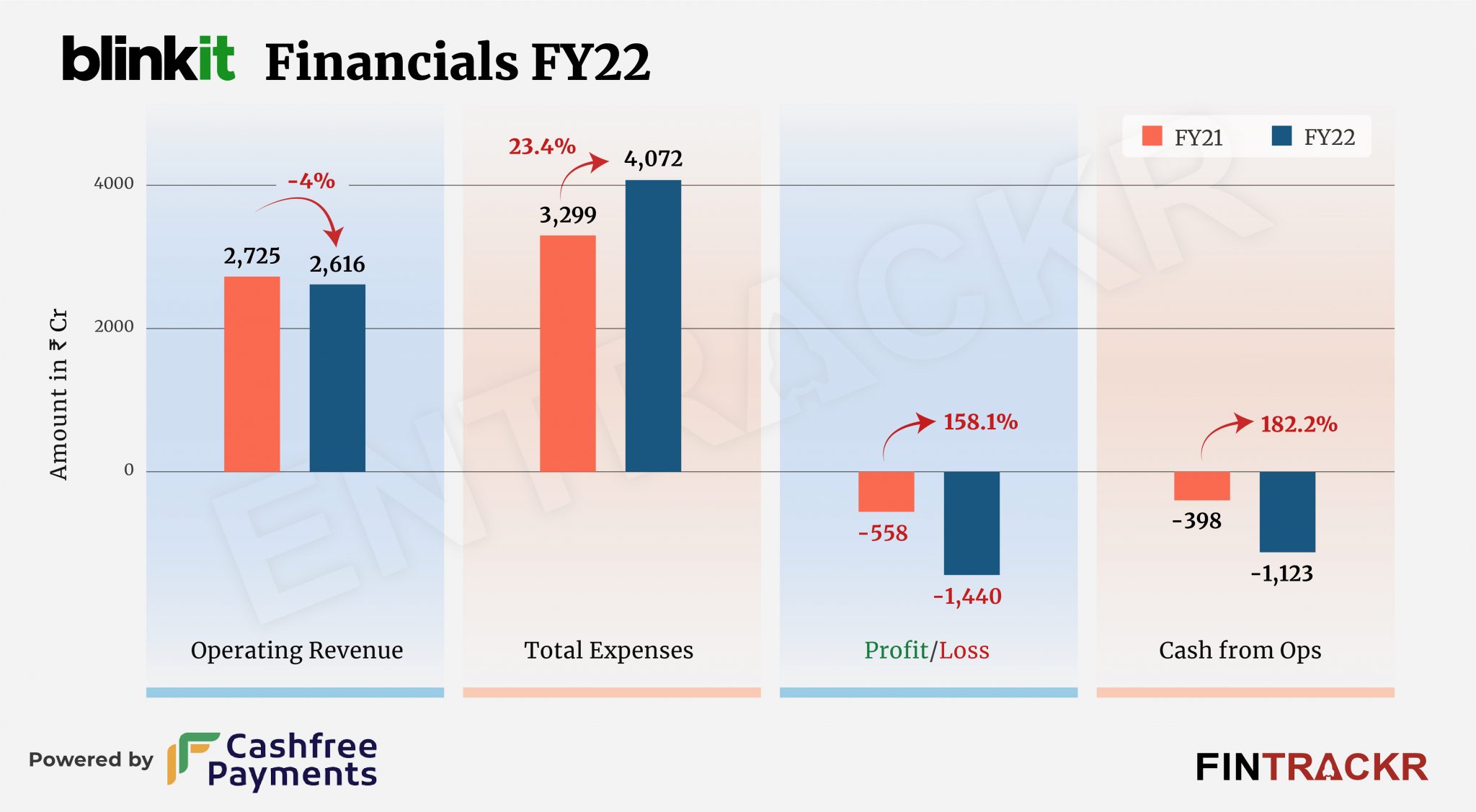

Quick commerce startup Blinkit’s gross merchandise value or GMV shrank 4% to Rs 2,616 crore in FY22 while its losses surged 2.58X to Rs 1,440 crore during the same period, according to Sefrog International’s annual financial statement in Singapore.

Sefrog International (previously Grofers International Pte) was a Singapore-based company which owned and operated Blinkit until the fiscal year ending March 2022.

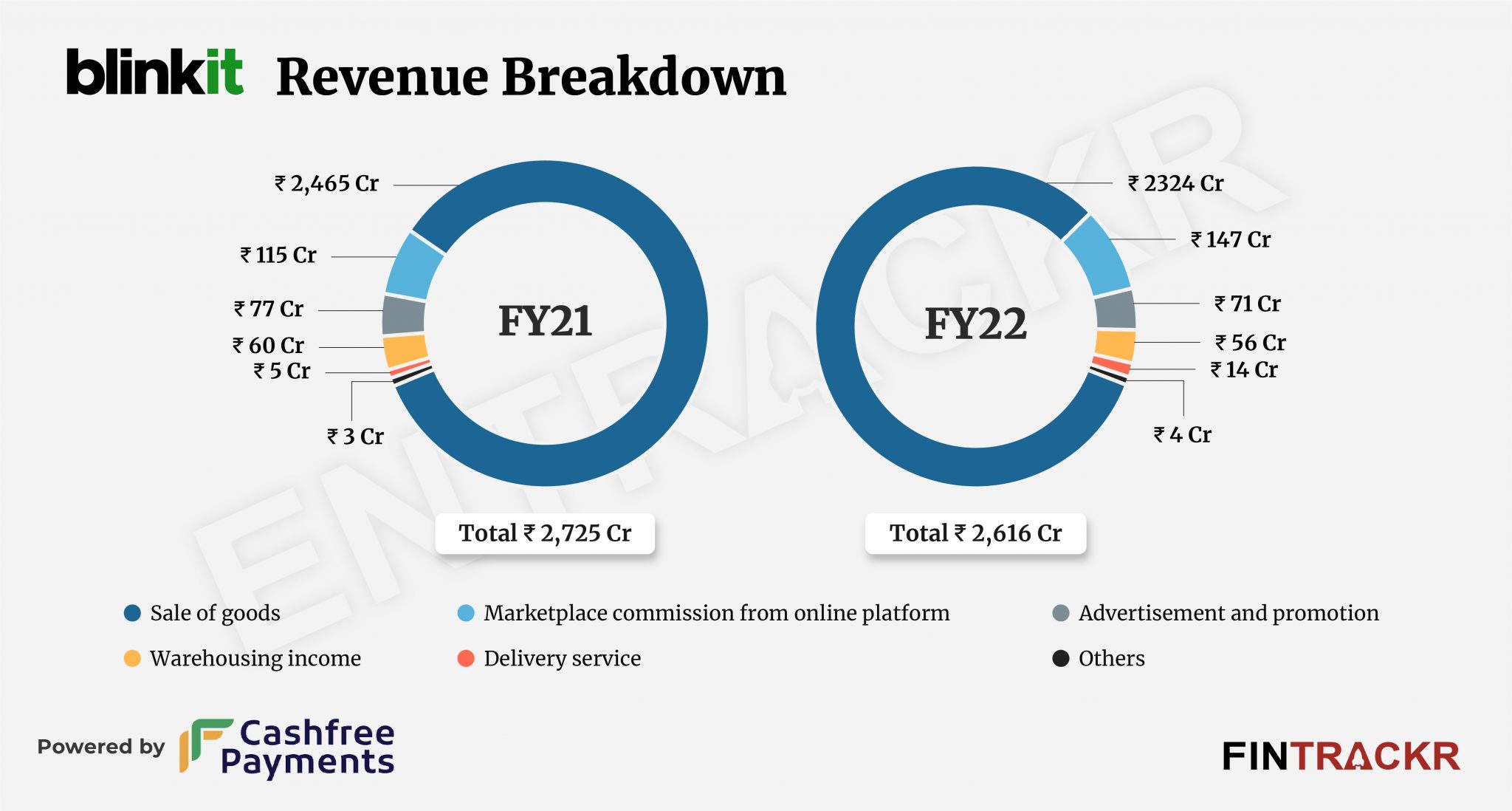

Revenue from the sale of goods turned out to be the largest source of income for Blinkit which formed 88.83% of its total collections. This income dipped 5.7% to Rs 2,324 crore in FY22. It’s worth noting that Blinkit used to have an inventory-led model in FY22 – and FY23 financials will be a much clearer reflection of the company’s quick commerce business which started in December 2021.

Blinkit also renders facilitation services through its marketplace platform to third-party merchants. Income from marketplace commissions grew 27.8% to Rs 147 crore in the last fiscal year.

The company also charged advertising fees to FMCG brands and sellers for promotion. Income from this head decreased 7.8% to Rs 71 crore in FY22 while collection from delivery and freight offerings grew 7.7% to Rs 70 crore in the preceding fiscal year (FY22).

Blinkit also made Rs 16 crore from its financial assets (interest income) and other sources (gain of mutual funds and net foreign exchange) during the fiscal year ending March 2022.

On the cost side, procurement of FMCG products constituted 58% of the total cost which grew marginally to Rs 2,362 crore in FY22 while outsourced manpower expenses shot up 2.9X to Rs 358 crore.

Employee benefit expenditure for Blinkit declined 6.5% to Rs 348 crore in FY22 which also includes Rs 66.3 crore as ESOP expenses in FY22. Its advertising cost grew 47.4% to Rs 280 crore whereas rental and packaging costs stood at 196 crore and 71 crore respectively.

Binkit incurred Rs 25 crore on payment gateway charges which pushed the overall expenditure by 23.4% to Rs 4,072 crore in FY22.

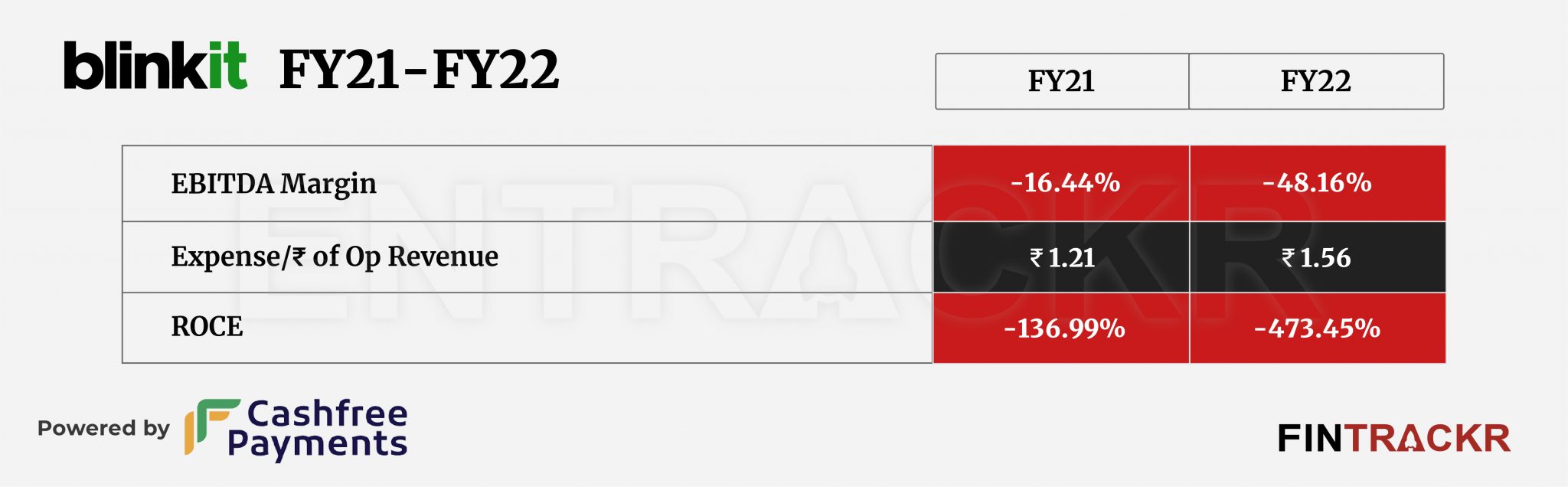

With a flat GMV and over 20% growth in expenditure, Blinkit’s losses spiked 2.58X to Rs 1,440 crore during FY22. Moving to the ratios, its ROCE and EBITDA margin worsened to -473.45% and -48.16% in the last fiscal year. On a unit level, it spent Rs 1.56 to earn a single unit of operating revenue in the last fiscal.

For Blinkit, while survival is no longer an issue inside the Zomato tent, there is a real issue of viability. Procurement costs are atrociously high vis a vis selling prices, something that is surely being reworked. The other area with possible scope for rationalisation after the merger, mainly its employee and people costs, while up for cuts, still do not take it close enough to breakeven. Quite simply, the firm has been a train wreck long in the making, and a turnaround here without giving up on growth will test the best in the business. With the option to isolate its losses in Blinkit as a separate entry no longer there from next quarter, the team at Zomato faces a real task convincing investors that the value they saw in the deal was real.

The first signs are possibly here with news of an Urban Company like services offering from Blinkit. At a time when the primary business is still to turn a profit, no one will envy them for this task.