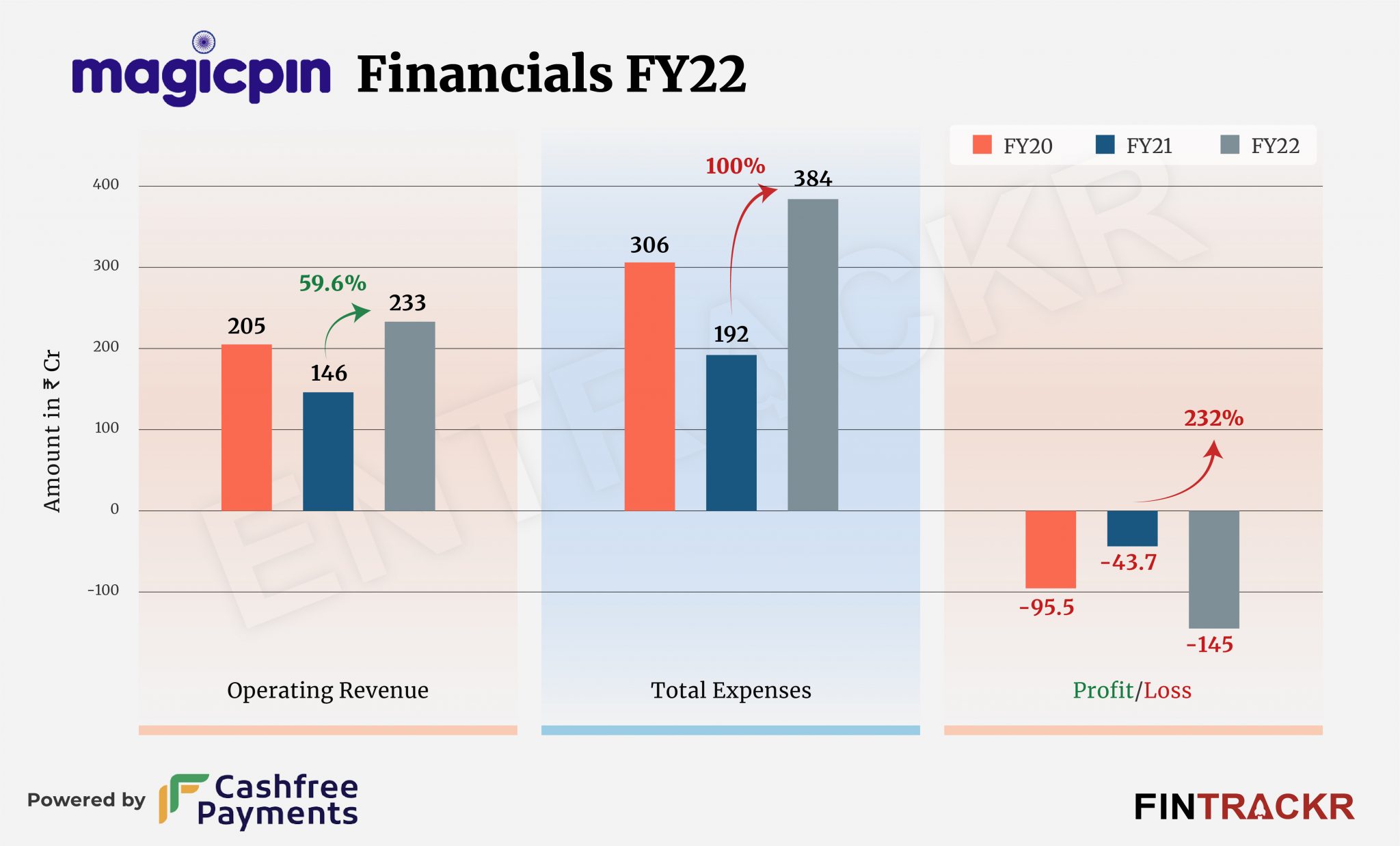

After facing a depletion in scale during FY21, offline discovery and reward platform Magicpin has hacked over 59% growth in the last fiscal year. However, the six-year-old company bled heavily and its losses soared over three fold during the same period.

Magicpin’s revenue from operations grew 59.6% to Rs 233 crore during the fiscal year ending March 2022 as opposed to Rs 146 crore in FY21, according to its consolidated annual financial statements with the Registrar of Companies (RoC).

Revenue verticals

Magicpin primarily makes money from the sale of vouchers which accounted for 90% of the total operating income. Collections from this vertical increased 49.3% to Rs 209 crore in FY22 from Rs 140 crore in FY21.

The Gurugram-based company also builds engagement and visibility for its partner retailers and brands to help drive up their new and repeat business and categorizes these collections as marketing and commission revenue. This income shot up 3.8X to Rs 23.8 crore during the year from Rs 6.3 crore in FY21.

It earned Rs 6.62 crore from interest on fixed deposits, current investments and other non-operating activities which took its overall revenue to Rs 239 crore during the last fiscal year.

Magicpin provides an online platform in the form of a website and mobile app to enable retailers and brands across categories like fashion, food, electronics, grocery, pharmacy, home delivery, spa, nightlife and entertainment among others.

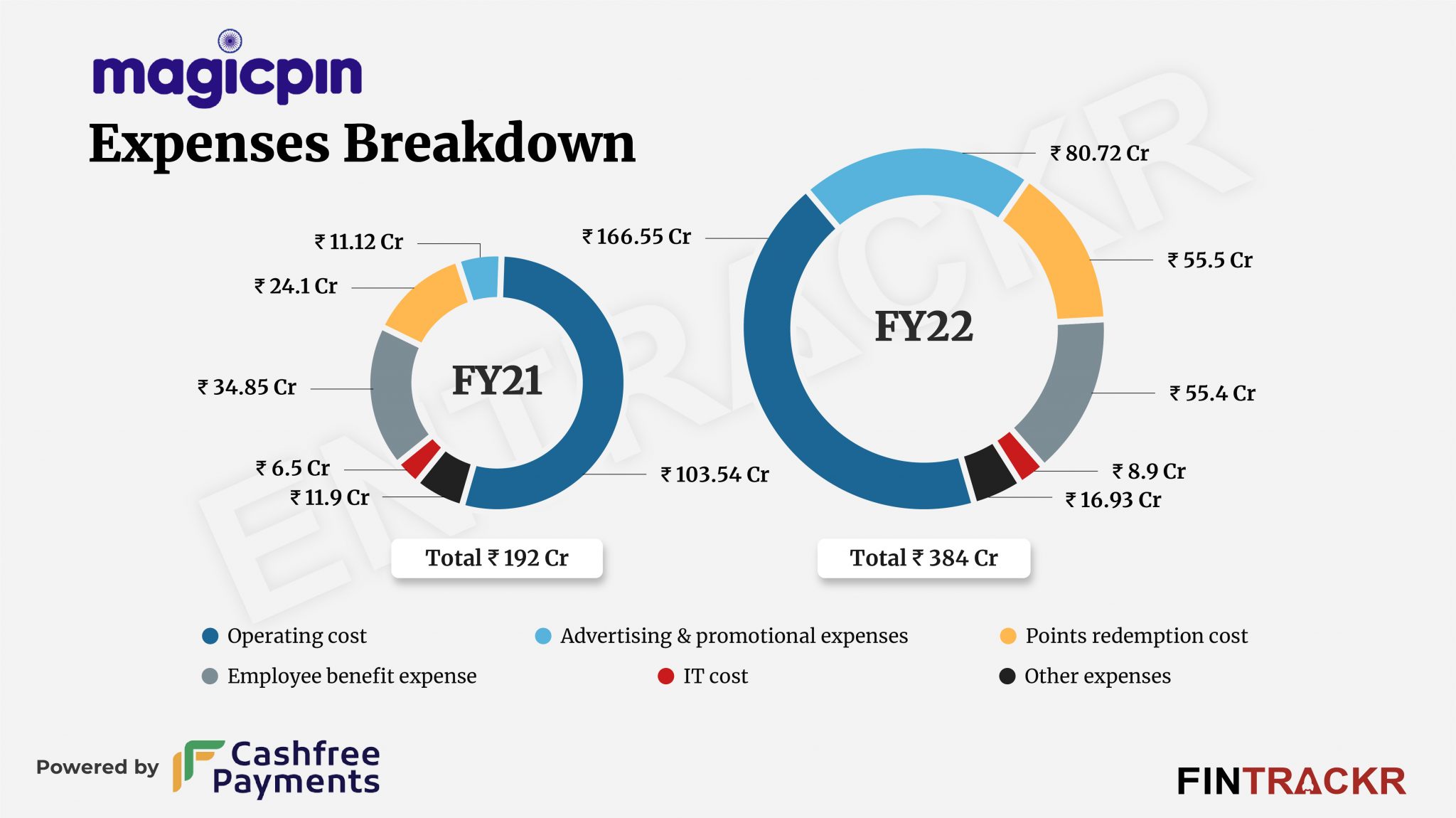

Breakdown of expenses

The growth in scale is also evident from the operating expenses (likely includes step-cost) which grew 61% to Rs 166.55 crore in FY22 from Rs 103.54 crore in FY21. Significantly, this is the largest cost element for the company forming 43.4% of the total expenditure in FY22.

To acquire more customers and engagements, Magicpin aggressively spent on advertising and promotional activities. Thus, its marketing expenses exploded over 7X to Rs 80.72 crore in FY22 from Rs 11.12 crore in FY21.

The company issues ‘magic points’ to all users on every transaction and its points redemption cost ballooned 2.3X to Rs 55.5 crore during the last fiscal. Further, employee benefits expense inclined 59% to Rs 55.4 crore in FY22 whereas information technology cost went up 37% to Rs 8.9 crore. For context, during the last quarter of FY22, Magicpin also expanded its ESOP Pool to Rs 217 crore.

Magicpin further incurred Rs 4.11 crore of legal & professional charges which steered its overall cost by 2X to Rs 384 crore in FY22 as compared to Rs 192 crore in FY21. Following the extensive cash burn, its cash outflows spiked 2.5X to Rs 127 crore.

Though the scale of Magicpin grew around 60%, over two fold jump in expenses left its bottomline bleeding. The company’s losses deepened 3.3X to Rs 145 crore during FY22 against Rs 43.7 crore in FY21. Moreover, its outstanding losses registered at Rs 395 crore.

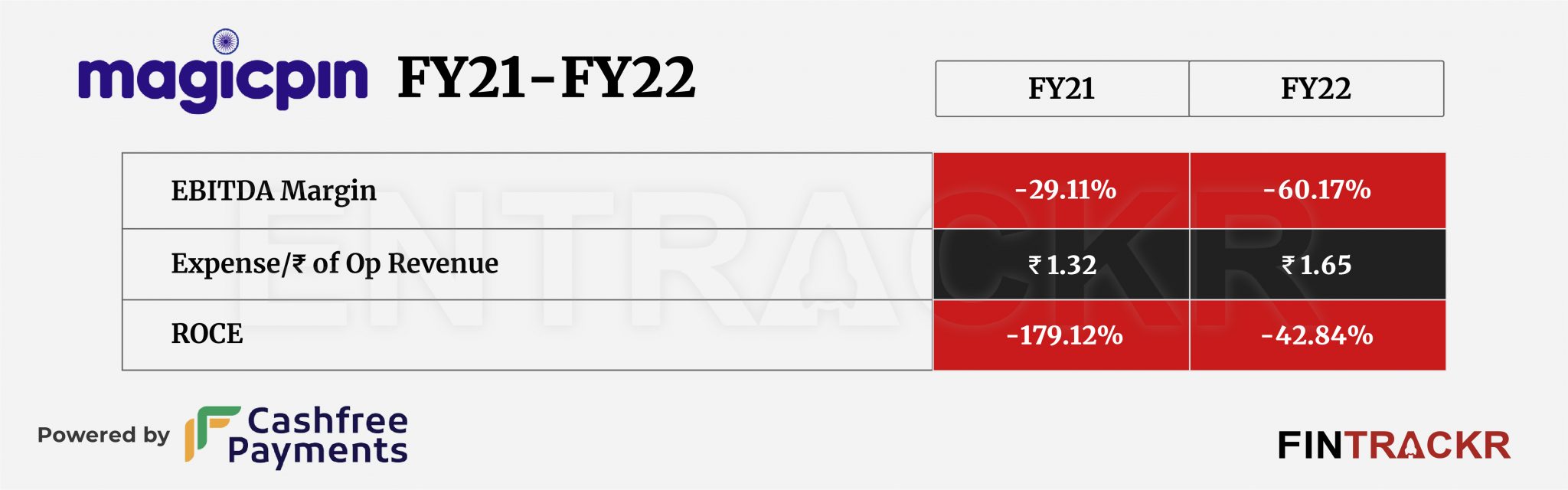

Heading towards ratios, the EBITDA margin depressed to -60.17% which could be attributed to multifold jump in customer acquisition costs during FY22. On a unit level, Magicpin spent Rs 1.65 to earn a rupee of operating income during the same period.

Recent developments

Magicpin has raised over $100 million to date. During FY22, the firm raised $60 million in its Series D round led by Zomato. As per Fintrackr’s analysis, it was valued at around Rs 2,300 crore ($310 million). Zomato, which put $50 million alone in the round, holds a 16.13% stake while Lightspeed remains the largest stakeholder with 34.26% shares post-allotment. Further, the company’s co-founders—Anshoo Sharma and Brij Bhushan— hold 14.53% stake each.

The company currently has 650 employees and claims to have 6.5 million active users and 9 lakh merchant partners on its platform across more than 50 cities.

Online travel platform EaseMyTrip entered into a strategic partnership with Magicpin in August last year with an aim to bring travel and shopping experiences together through cross promotion to give their customers a holistic purview.

Magicpin competes with Paytm-owned NearBuy which barely grew its scale by 8% to Rs 8.6 crore in FY22 whereas its losses narrowed by 67% to Rs 3.55 crore during the period.

A bare look at the numbers would indicate that Magicpin has work to do on its marketing and commission revenues, the best indicator of partner satisfaction and repeat business. As it probably shares significantly in the offers it brings to its users. Investor traction would have been driven by user acquisition and partner volumes, but that is clearly not a sustainable proposition beyond a point. Magicpin needs to pull out some magic, and soon for its business partners to make its own case for a market fit, as deal seeking users will always flit to the next better option when given a chance.