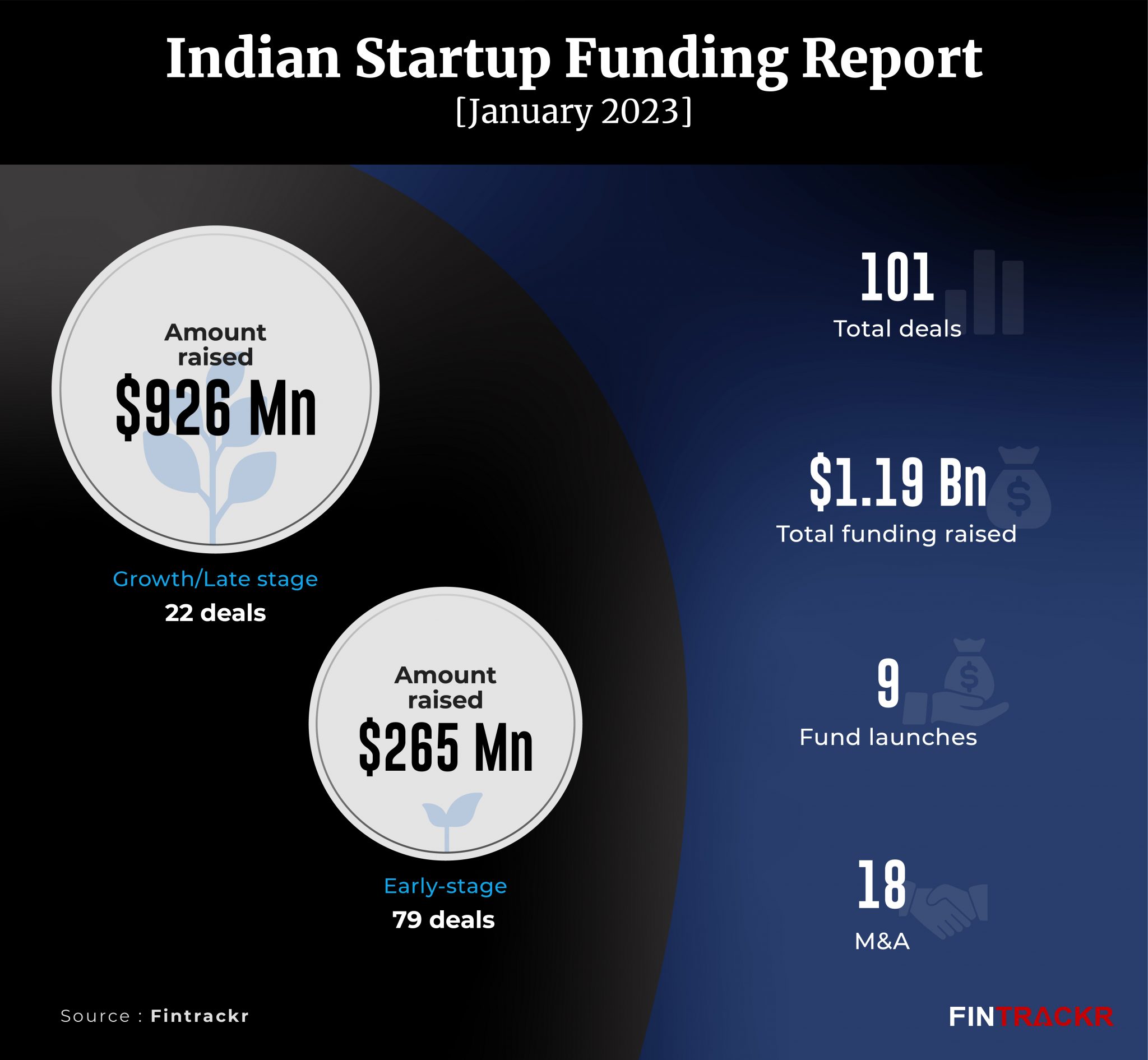

Even as a funding winter continues, and tech companies are laying off a part of their workforce, Indian startups managed to raise over $1 billion in funding during January — something that has become a new normal of sorts for the past six months.

As per data compiled by Fintrackr, more than 100 startups mopped up nearly $1.2 billion in funding in the first month of 2023. Growth stage startups saw 22 deals worth $926 million. It came on the back of PhonePe’s $350 million and KreditBee’s $120 million round which accounted for 40% of the overall financing. Early stage startups received $265 million across 67 deals while 12 startups did not disclose their transaction details. Notably, the average deal size for early stage startups stood at around $4 million.

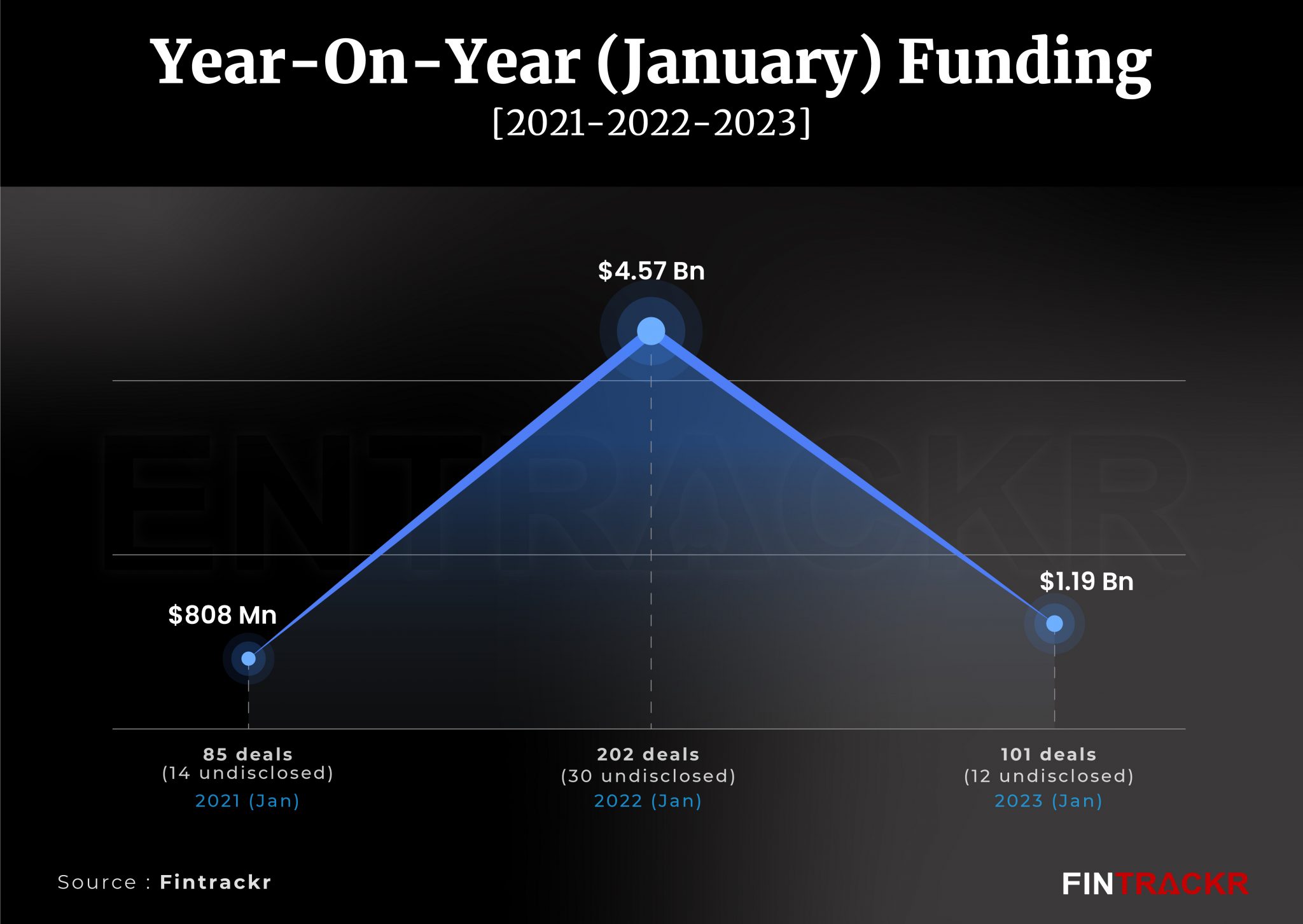

In Entrackr’s yearly report, we saw that startups saw their first downfall in July 2022 when the funding fell below the $1 billion mark for the first time that year. Since then, the numbers have hovered around the $1 billion mark. While taking year-on-year data of January for the past three years we found that 2021 saw $808 million ($0.8 billion) in funding which climbed to $4.57 billion in January 2022 and then slipped to $1.19 billion in 2023, showcasing the bumper year than 2022 was when it came to startup funding.

The full report can be downloaded here.

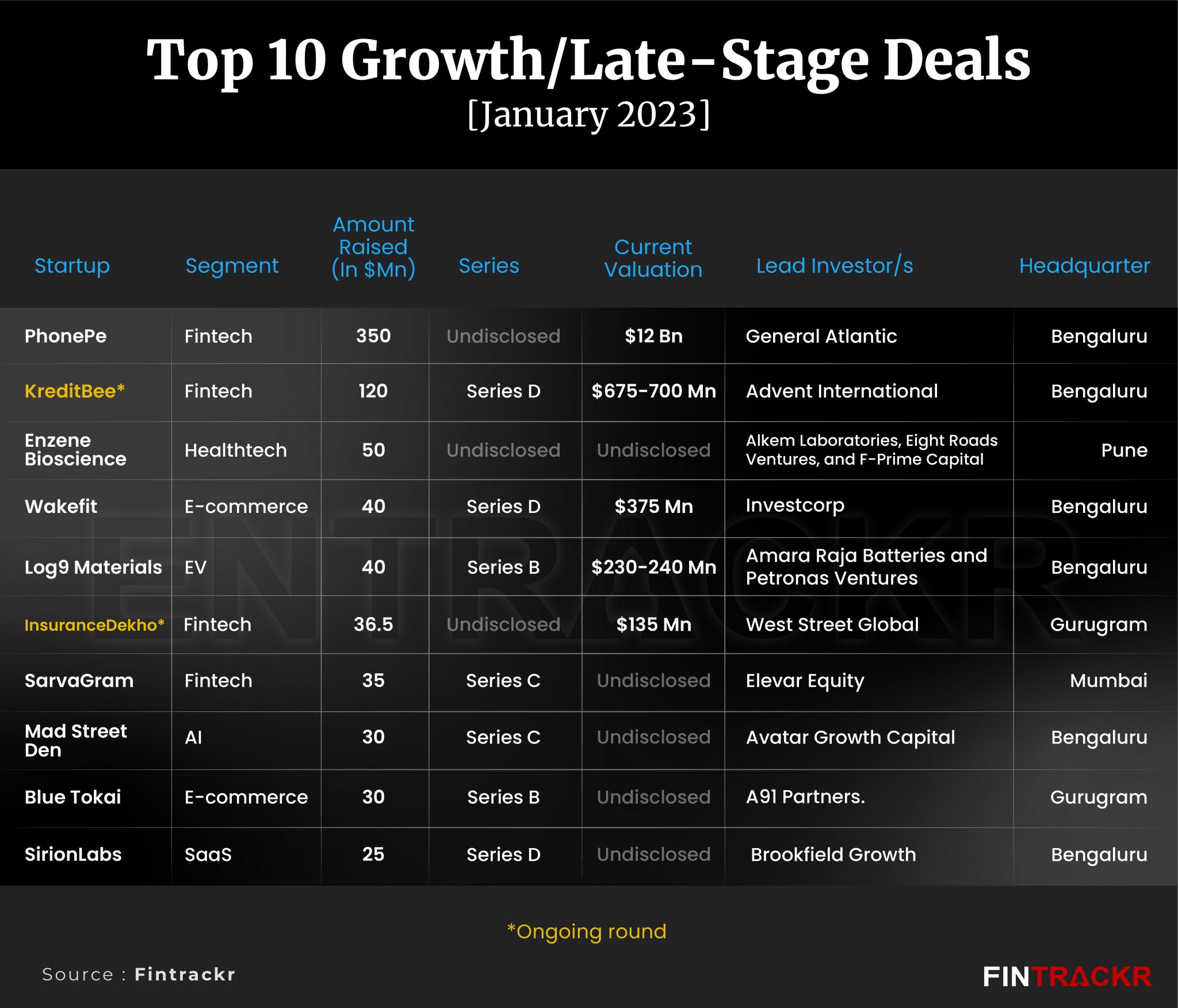

[Top 10 Growth stage deals]

Apart from PhonePe and KreditBee, no other startups managed to touch the $100 million mark in January. In fact, the third largest deal was worth $50 million by Enzene Bioscience. Entrackr has prepared the top 10 deals in both early and growth stages.

Sequoia Capital-backed Wakefit, Log9 Materials, Sarvagram, Mad Street Den, Blue Tokai, and SirionLabs were included in the top 10 growth stage startups. InsuranceDekho, which raised $36.5 million in its ongoing round, also made it to the list.

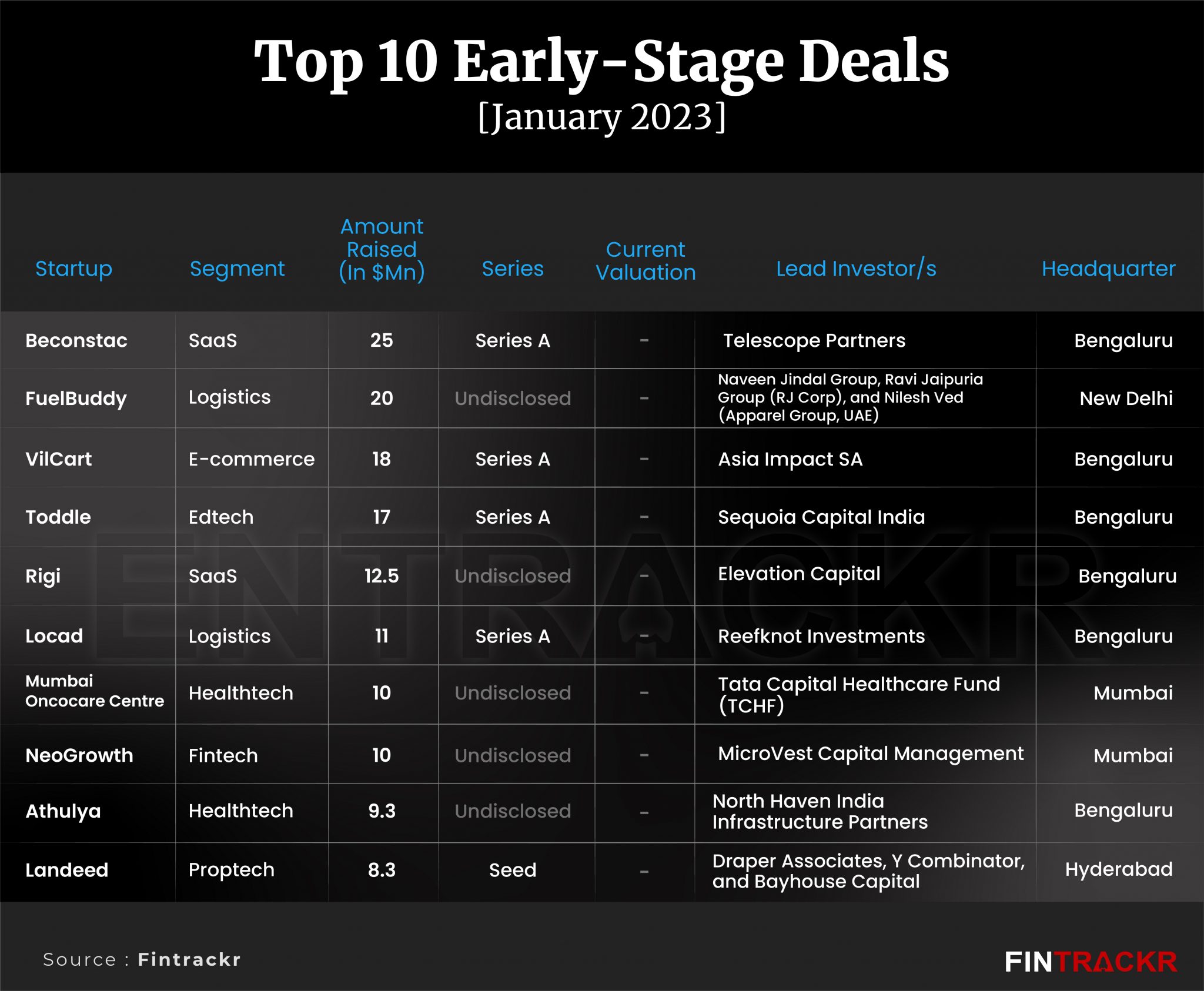

[Top 10 early stage deals]

In the top 10 early stage deals, QR code-based customer engagement platform Beconstac, fuel delivery startup FuelBuddy, rural commerce startup VilCart and edtech startup Toddle dominate the table.

SaaS startup Rigi, logistics company Locad, healthtech company Mumbai Oncocare Centre, and fintech platform neoGrowth also managed to raise over $10 million in their new fundraise.

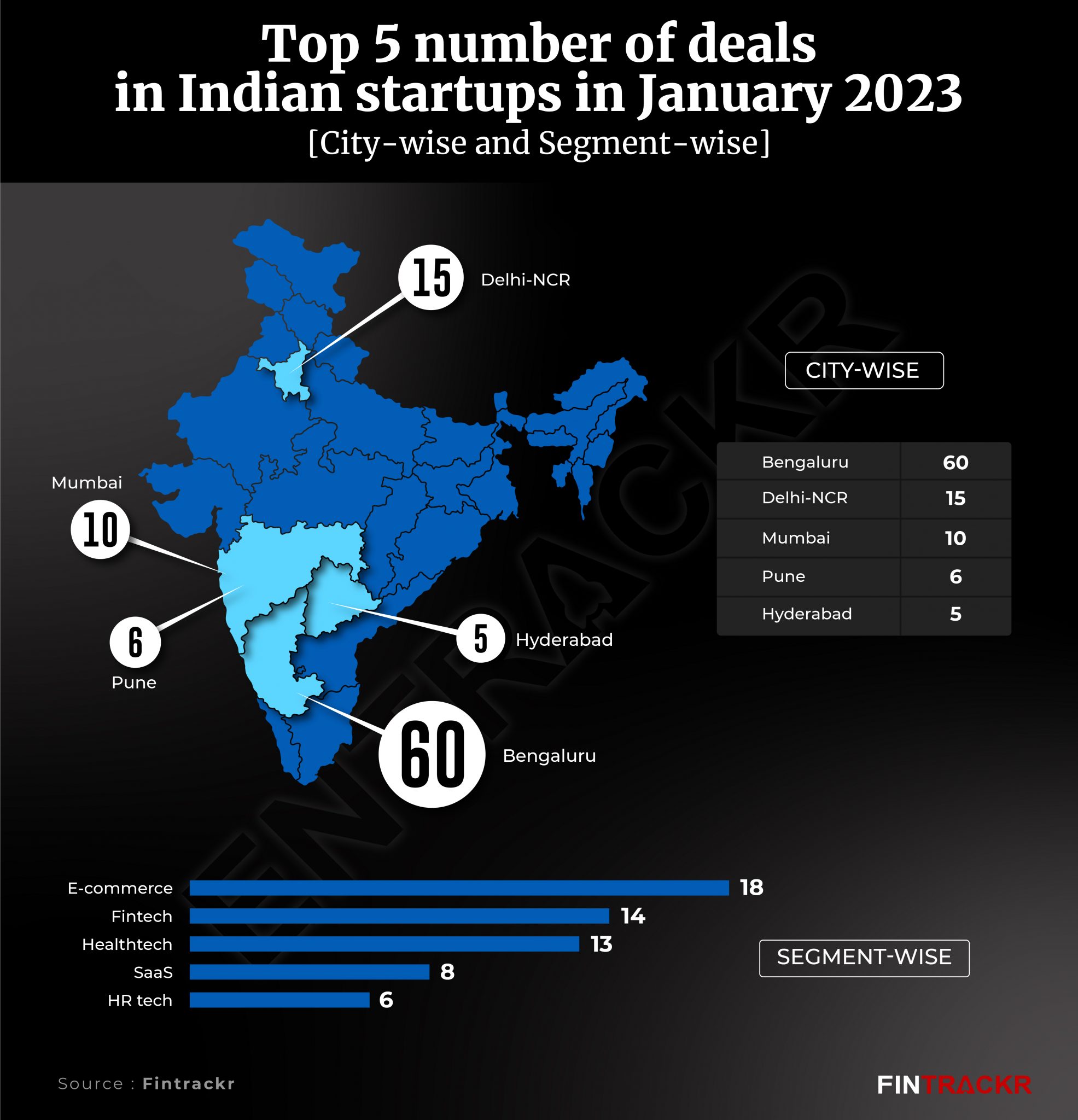

[Segment and city wise deals]

Segment wise, e-commerce (including D2C startups) saw more deals than any other. However, fintech continued to dominate with $587 million (approx 50%) in total funding. Healthtech was in the third spot with 13 deals followed by SaaS (8 deals), HR tech (6 deals), edtech (5 deals), and agritech (4 deals) respectively. It’s worth mentioning that out of 5 edtech deals, Upsurge and Moat School are gaming-focused edtech platforms, Virohan is paramedic-focused edtech company and LEAD received funding in debt.

City wise, Bengaluru remained on the hot seat with 60 deals (60% of overall deals in January) while Delhi NCR saw 15 deals. Mumbai, Pune and Hyderabad recorded 10, 6, and 5 deals respectively.

[Mergers and Acquisitions]

Indian startups saw 18 mergers and acquisitions across segments in January. The acquisition of Chumbak by e-commerce roll up company Goat Brand Labs grabbed headlines. Gurugram-based Chumbak had raised more than $30 million before getting acquired.

Roadside assistance startup ReadyAssist, which has raised around $6 million so far, acquired Vadodara-based SpeedForce for $10 million worth cash and stock deal. Merchant commerce platform Pine Labs acquired a proprietary enterprise platform from Bengaluru-based Saluto Wellness Private Limited at an undisclosed amount. It was the fourth acquisition for the company since January 2022.

[Startups saw layoffs almost every day]

Like the second half of 2022, layoffs continue to hamper the growth story of Indian startups. Data compiled by Fintrackr (sourced from various media reports such as Inc42, Economic Times, Moneycontrol, and The Morning Context) shows that around 27 startups went through layoffs in January. In other words, startups registered layoffs almost every day during the opening month. In total, more than 3,000 employees have been impacted so far while a few companies (such as Byju’s) are in the process of mass firings.

[Trends in 2023]

No unicorn race: Indian startup ecosystem saw its last unicorn in September when healthcare diagnostic firm Molbio announced its $85 million round led by Temasek at $1.5 billion valuation. No startups managed to go past the $1 billion valuation mark in the past four months. Notably, around half a dozen startups including Zepto, Turtlemint, Rapido, and Money View raised their last round in the range of $850-950 million.

ESOP buyback: ESOP buyback saw a sharp decline in the second half of 2022. The trend continued in January 2023 as there were no such announcements except BrightCHAMPS which awarded stock options worth $1 million to its 400 high-performing teachers.

Tiger Global kept quiet: Where Tiger Global had already started staying away from large deals in 2022, it was completely missing from the investment list in January. As per reports, this is for the first time in two years when the New York-based fund refrained from investment for the month. Besides Tiger, SoftBank also did not show interest in the first month of 2023.

Hiring amid layoffs: Amid the bloodbath in startups, a few companies are still hiring. Edtech unicorn PhysicsWallah said that it plans to hire 2,500 employees across verticals within the first quarter of 2023. Zomato and Cars24, which have fired employees in the past, are also ready for new talent. While industry experts expect more layoffs in the coming months, a bunch of established startups are trying their best to retain their employees in the ongoing turmoil. Recently, Zoho’s co-founder and chief executive Sridhar Vembu said that layoffs will be the absolute last thing at the company. Well earned, we would say, from one of the most profitable and bootstrapped companies in the country today.