Modern banking tech platform Zeta which provides technology infra to banks and fintech firms has emerged as one of the key players in its segment. This could be evident from Zeta India’s scale which surged 5X in the last two fiscals with a stable bottomline.

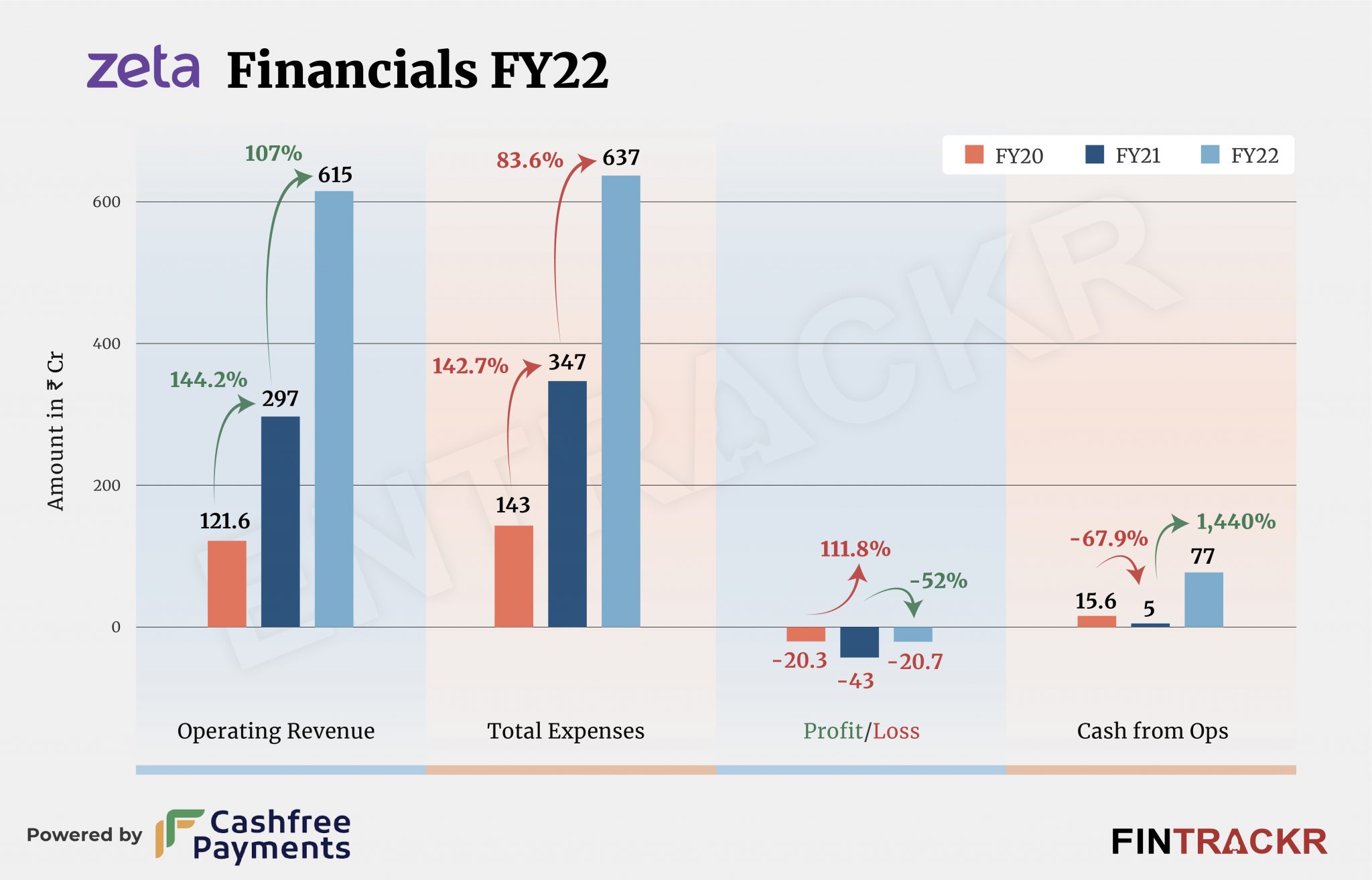

Zeta’s Indian entity (Better World Technology Private Limited) has registered a 2X growth in revenue to Rs 615 crore during FY22 in contrast to Rs 297 crore in FY21, according to its standalone annual financial statement with the Registrar of Companies.

Zeta provides software development services such as credit and debit card processing, APIs to operate natively within cloud-native apps. Its tech powers RBL Bank, IDFC First Bank, and Kotak Mahindra Bank among others. Significantly, this was the only source of revenue for the company during FY22.

The entity (Better World Technology Private Limited) generated around 90% of its operating revenue in the UAE while only 10% came from India.

It’s worth noting that these numbers are of Zeta’s Indian entity only. It enables financial institutions to launch modern retail and corporate fintech products in several geographies especially Asia and Latin America.

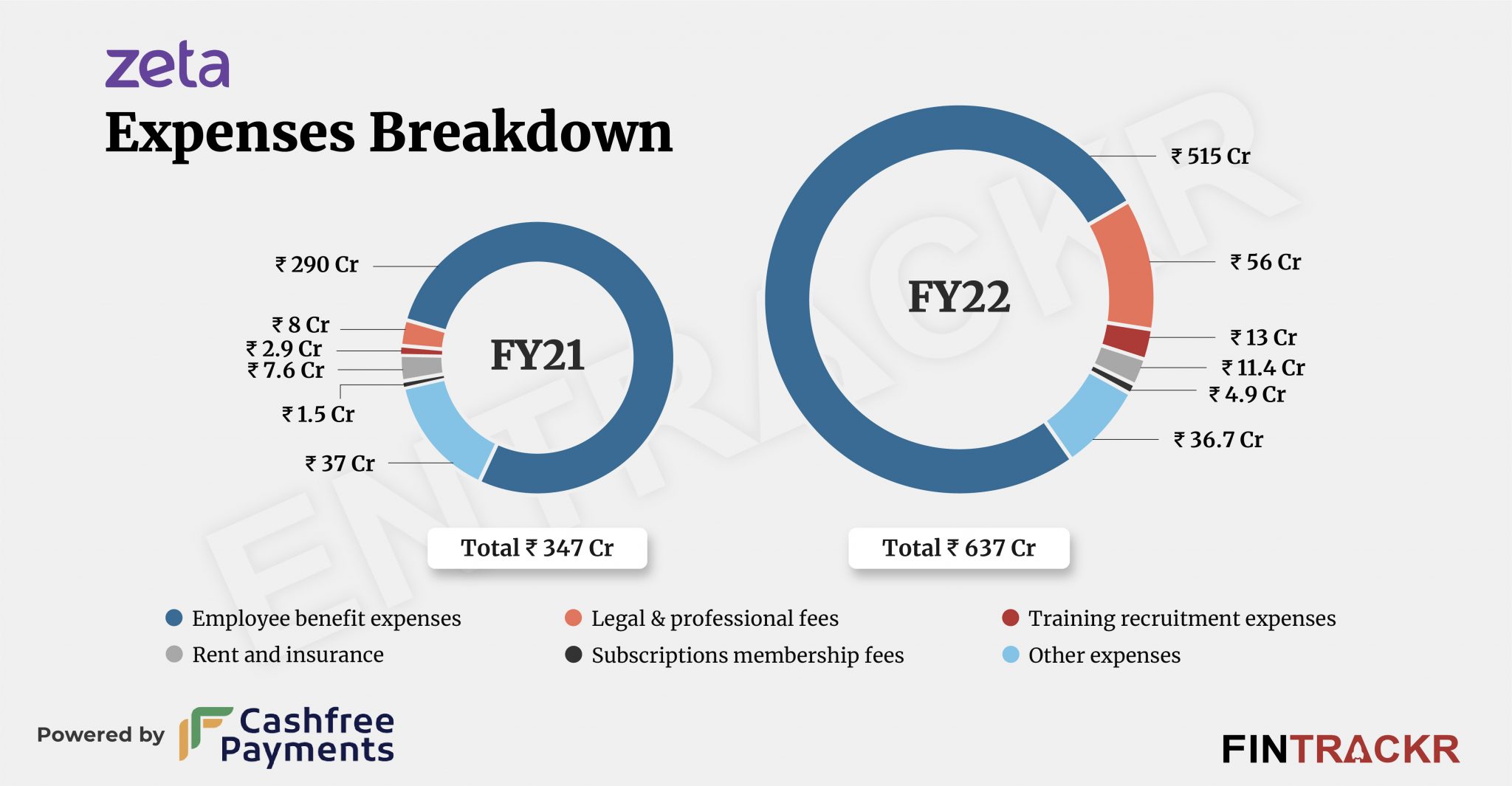

To keep up with growth, the company expanded its tech workforce in FY22 and its employee benefits expense ballooned 77.6% to Rs 515 crore in FY22 from Rs 290 crore in FY21. Importantly, this cost formed over 80% of the total expenses and also includes ESOP expenses of Rs 98.7 crore during the last fiscal year.

Spends on legal and training-recruitment shot up 7X and 4.5X respectively to Rs 56 crore and Rs 13 crore in FY22. The cost of rent and insurance rose 49.6% to Rs 11.4 crore in FY22.

Zeta also incurred Rs 22.2 crore on business support, software, training education sponsorship, card network, and server costs which catalyzed its total expenditure by 83.6% to Rs 637 crore in FY22 as compared to Rs 347 crore in FY21.

Corresponding to its scale which outpaced its expenditure, Zeta managed to control its losses by 52% to Rs 20.7 crore in FY22 against Rs 43 crore in FY21. However, its outstanding losses climbed to around Rs 128 crore at the end of the last fiscal year.

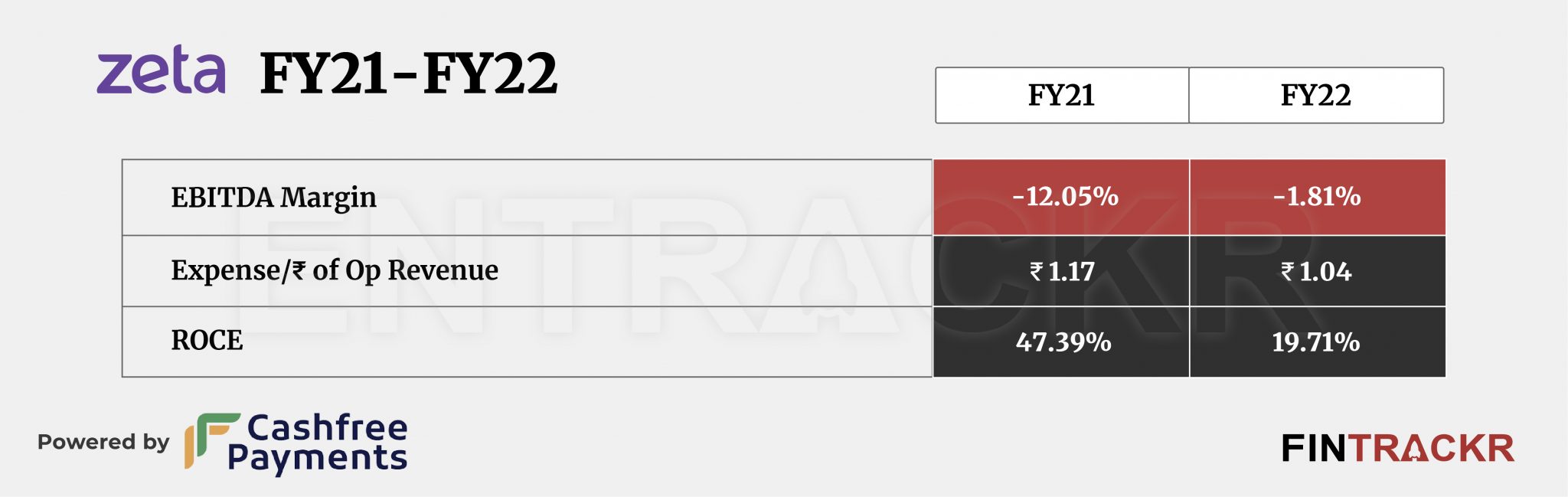

Following the improved topline and bottomline, Zeta’s EBITDA margin bettered by 1,024 BPS to -1.81%. On a unit level, the company spent Rs 1.04 to earn a rupee of operating income in FY22.

Zeta turned unicorn in May 2021 after raising $250 million in its Series C round from SoftBank. In March 2022, it raised another $30 million as a part of strategic investment from Mastercard and other investors, taking the valuation to $1.5 billion.

For Zeta, which has emerged as a key success story in the BFSI space, these are exciting times. The form has demonstrated a clear ability to read and build products for a sector in transition. The good times have just started for this unicorn.