Agritech ecosystem in India is yet to churn a unicorn but the segment seems to have gotten increased investor attention in 2022. According to Fintrackr, around 60 startups in the segment mopped up $772 million in funding during 2022, up from $636 million in 2021. DeHaat, Ninjacart, and WayCool were the top three startups, both with respect to funding and scale during the last fiscal year (FY22).

While DeHaat and Flipkart-backed Ninjacart emerged as top two companies in the segment with Rs 1,274 crore and Rs 967 crore revenue in FY22, WayCool took the third position with Rs 927 crore in gross revenue during the last fiscal.

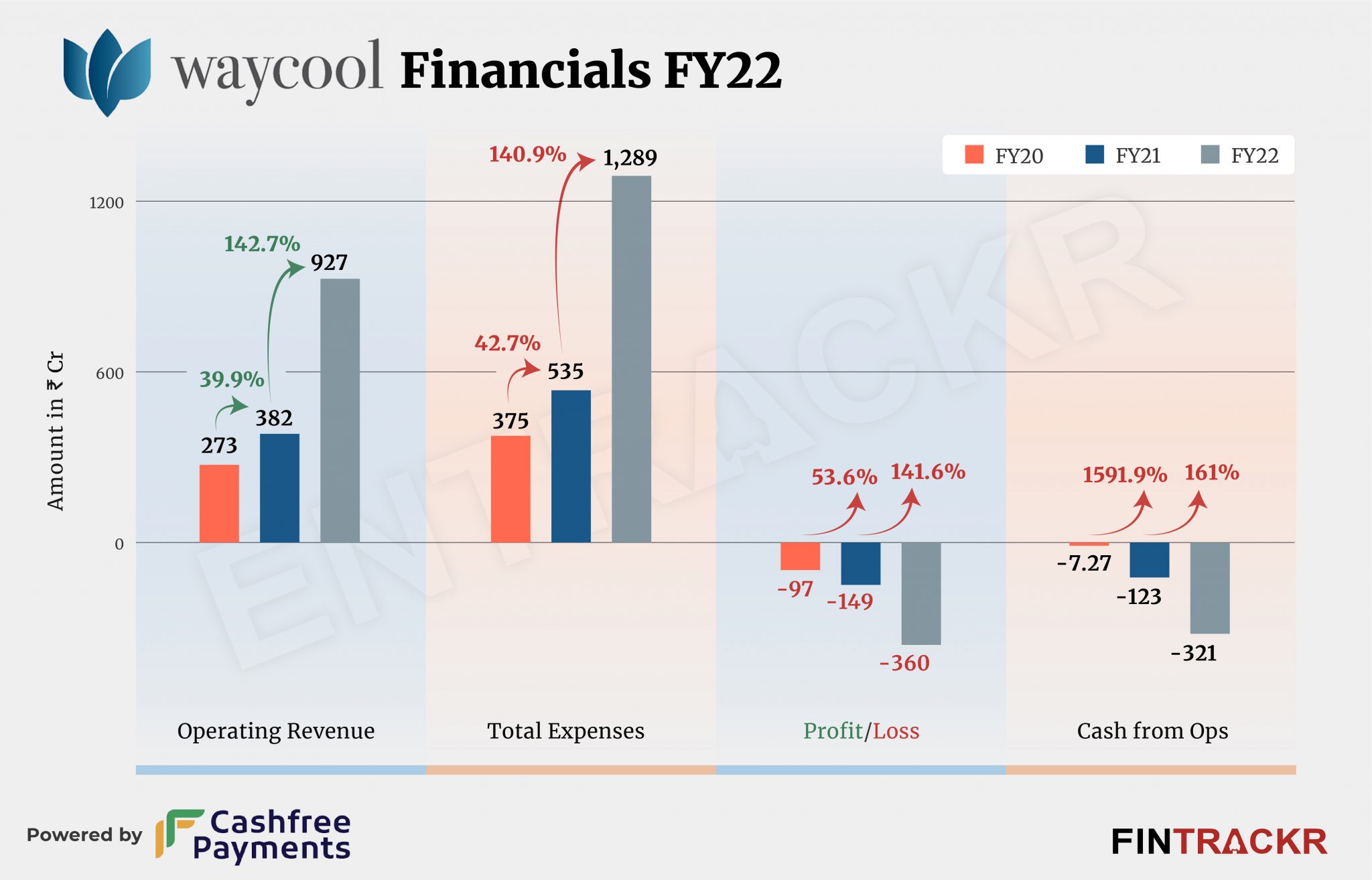

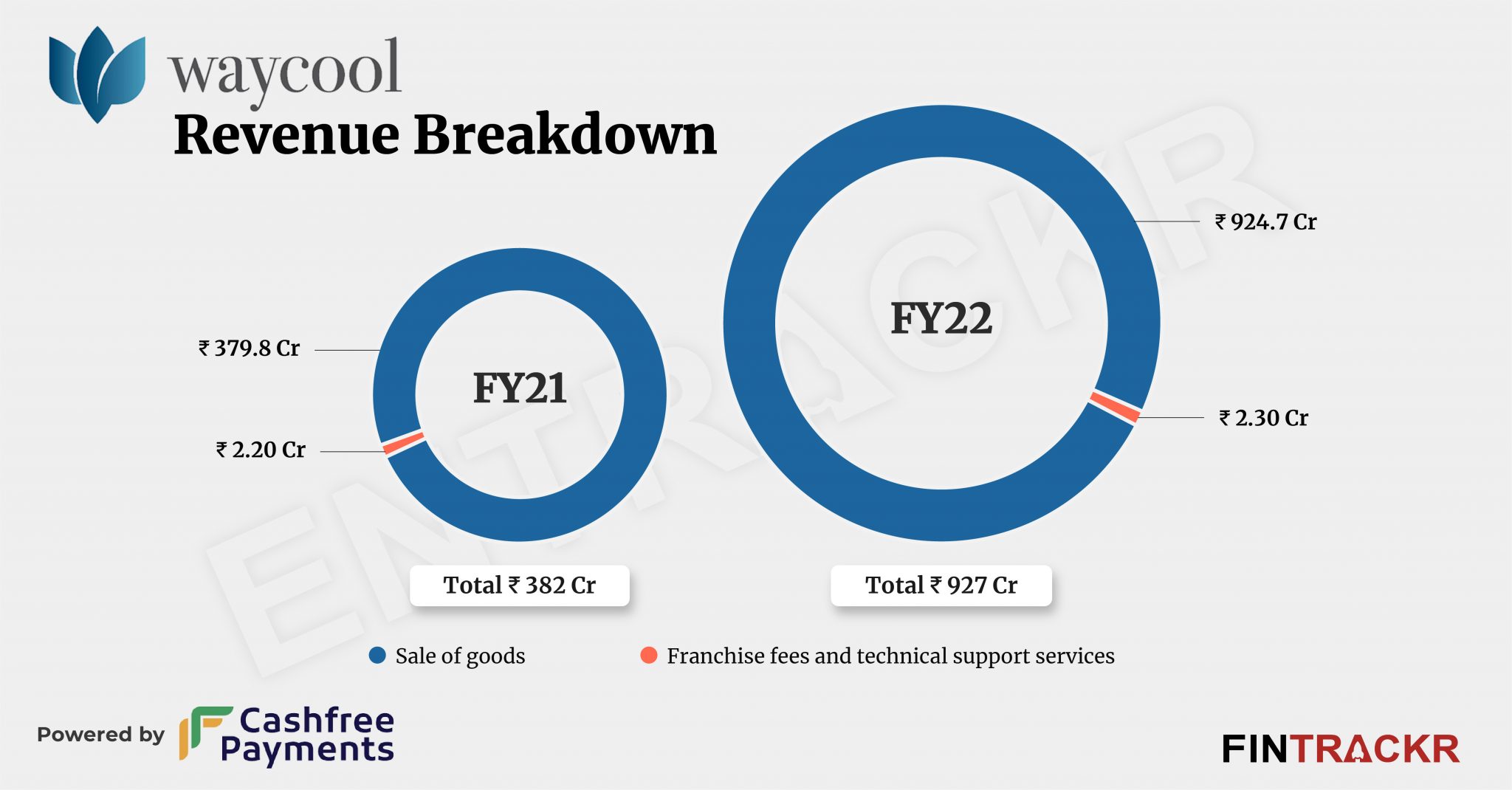

WayCool’s revenue from operations spiked 2.4X to Rs 927 crore in FY22 from Rs 382 crore in FY21, according to its consolidated annual financial statements with the Registrar of Companies (RoC).

WayCool claims to work with more than 150,000 farmers and 100,000 clients who source agricultural and dairy products from the company. The sale of these products contributed 99.8% of the collections and increased 143.5% to Rs 924.7 crore in FY22 from Rs 379.8 crore in FY21.

Franchise fees and technical support services grew by only 4.5% and contributed Rs 2.3 crore to the company’s coffers. Besides operating income, it also made Rs 3.74 crore in FY22 through financial instruments.

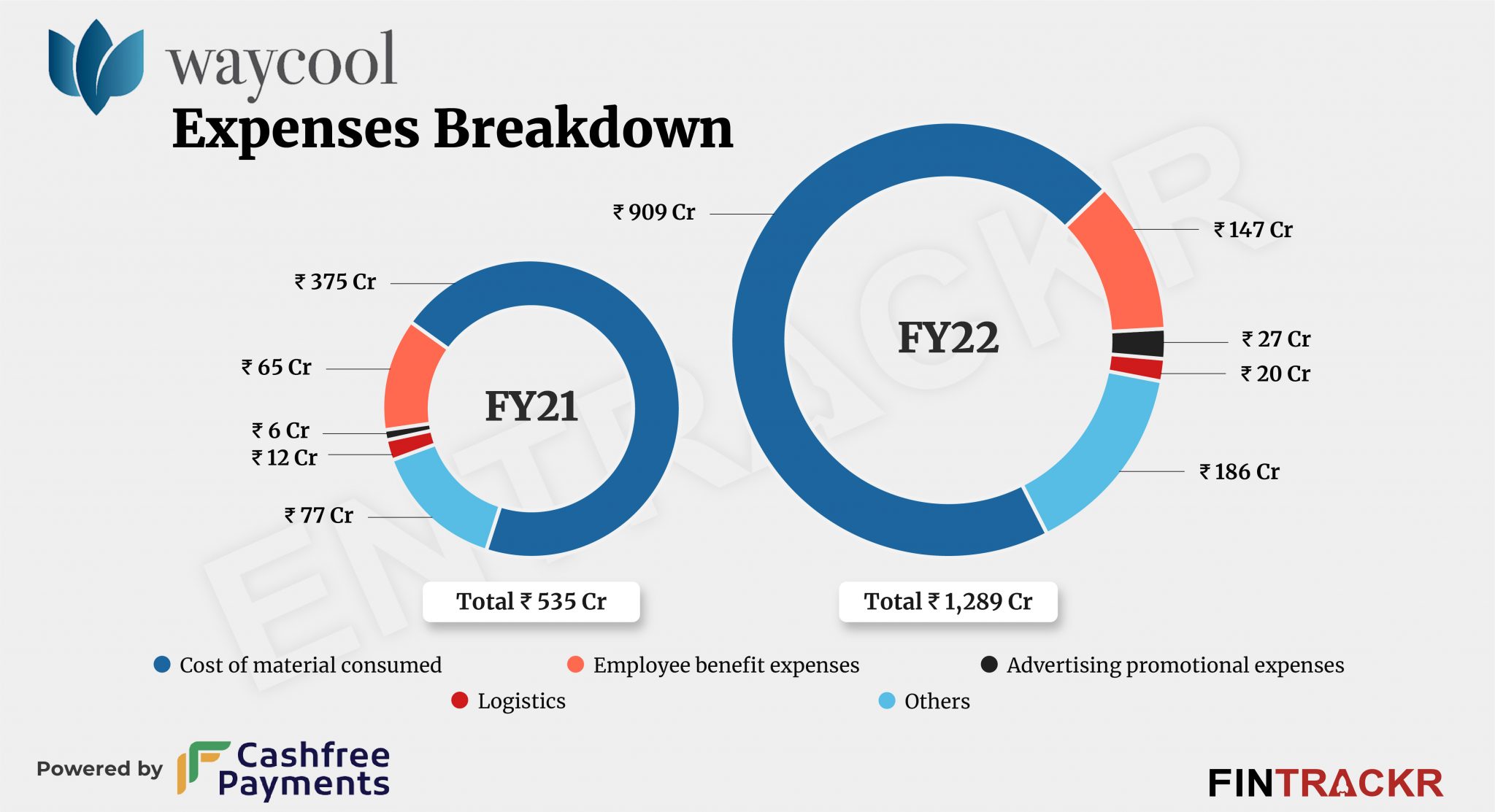

On the expense side, the cost of procurement of materials accounted for 70.5% of the overall cost and soared 2.4X to Rs 909 crore in FY22. Employee benefit costs also shot up over 2.2X to Rs 147 crore in FY22 from Rs 65 crore in FY21.

WayCool ran aggressive promotional and advertising campaigns in FY22 and recently roped in actress Sneha Prasanna as its ambassador. Its cost on marketing blew 4.5X to Rs 27 crore in the fiscal year ending March 2022.

WayCool incurred Rs 20 crore on logistics and transportation which pushed its total cost 2.4X to Rs 1,289 crore in FY22 from Rs 535 crore in FY21.

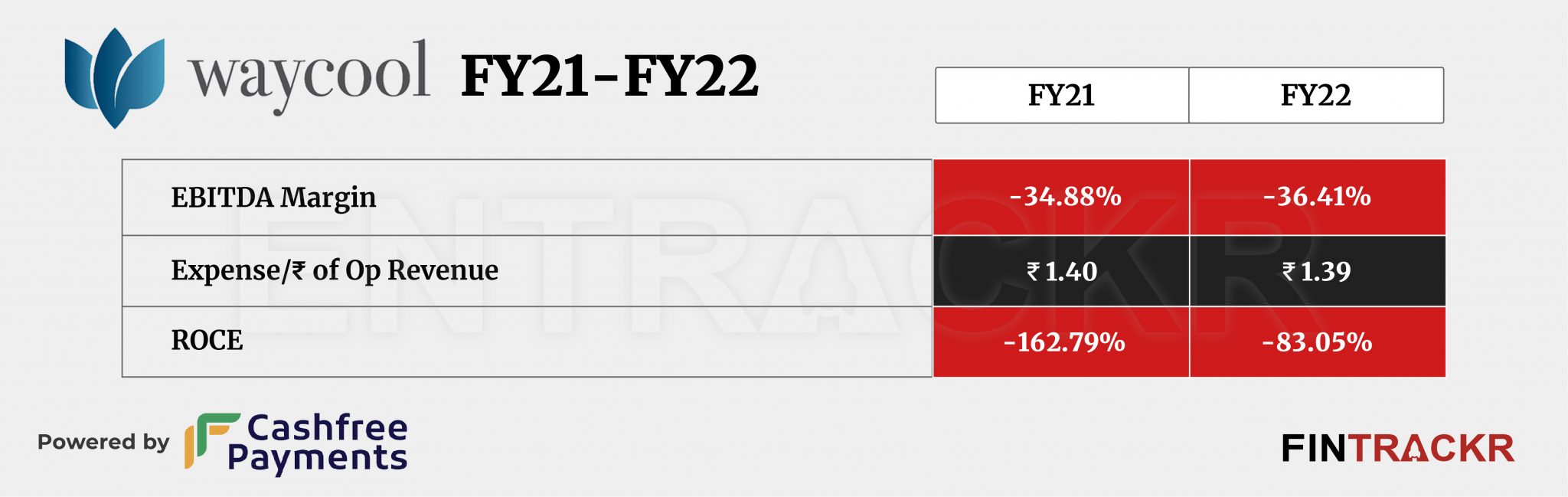

In the end, the company achieved a 2.4X surge in its scale by losing money at the same pace. WayCool’s losses widened 2.4X and stood at Rs 360 crore in FY22. Its ROCE and EBITDA margins were registered at -83.05% and -36.41%. On a unit level, WayCool spent Rs 1.39 to earn a rupee of operating revenue in FY22.

While the strong topline performance of agritech firms is no surprise, considering the sheer size of the sector and the possibilities for organising parts of it, this is not a sector where firms can justify losing money after a point. The agriculture economy might offer lower margins, but reversing loss making or subsidised business with a shift to ‘viable’ margins can become very difficult in this segment. Which is when even tom-tomming your ‘impact’ on the sector will be of little help, as almost every agritech never fails to remind stakeholders. Too much talk of ‘impact’ seeks to give the business a needless hue, when what India’s agritechs need to show is that the sector offers real and long term returns. That is when they will do the greatest good for the sector. While investments into infrastructure like a cold chain are justified and much needed, spending shooting up in areas like marketing isn’t.