After witnessing an erosion of over 75% of its scale in the pandemic-stricken fiscal year (FY21), B2B travel portal Travel Boutique has bounced back with over three-fold growth in its operating collection during the fiscal year ending March 2022.

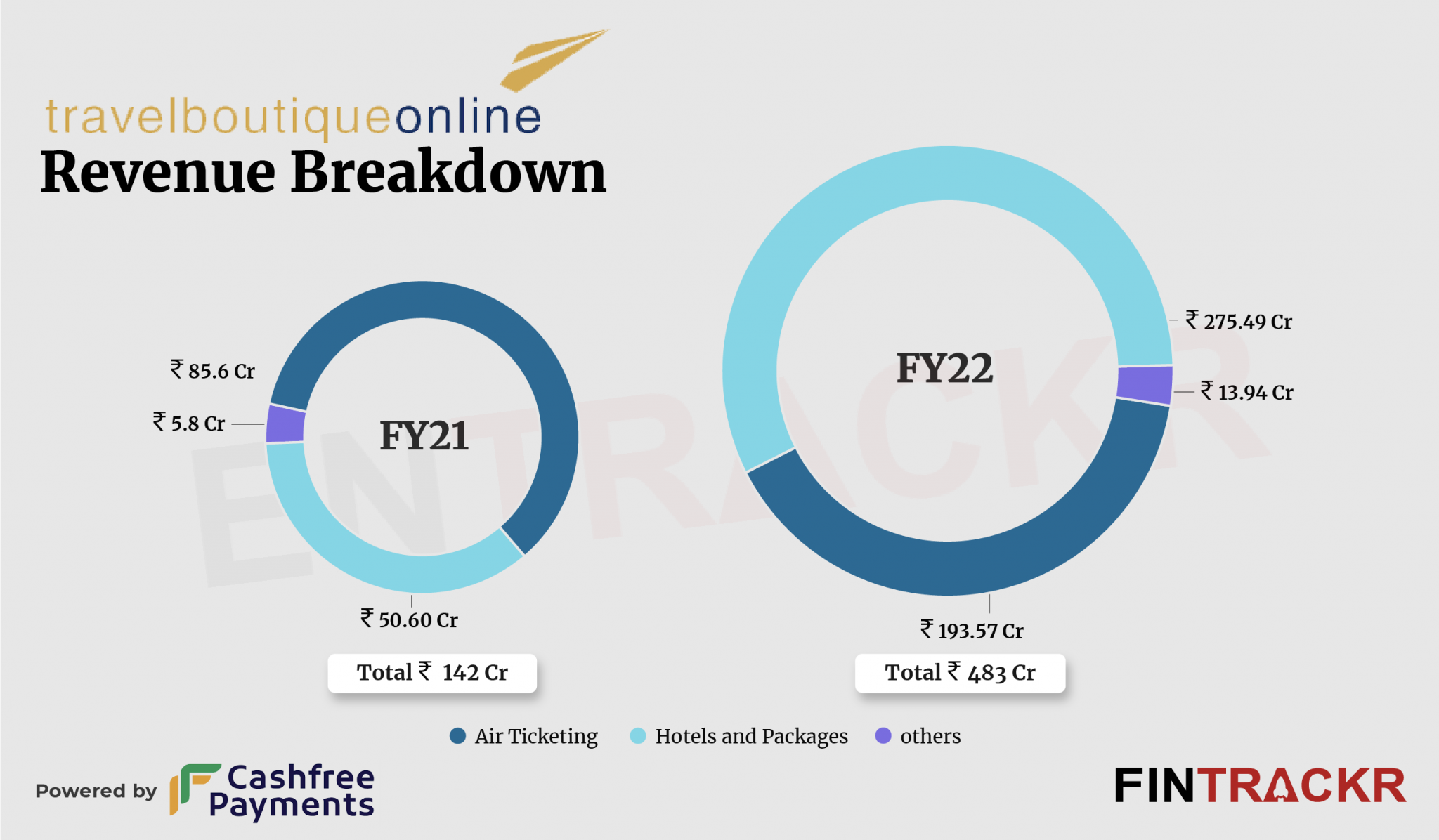

Travel Boutique’s revenue from operations spiked 3.4X to Rs 483 crore in FY22 from Rs 142 crore in FY21, according to its annual financial statements filed with the Registrar of Companies (RoC).

The 16-year-old company is India’s leading travel distribution platform which offers white-label solutions to travel agents and tour operators across India and earns commission on their air travel, hotel booking, and tour packages.

Commission from hotel booking and packages formed 57% of the company’s total collections. Income from this segment shot up 5.4X to Rs 275.49 crore in FY22 from Rs 50.60 crore in FY21.

Commission from air ticketing is another vital source of the collection which increased 2.26X to Rs 193.57 crore in FY22. The company also made Rs 13.94 crore from annual software maintenance fees.

Travel Boutique booked Rs 28.6 crore as finance income which comprised interest on current investments and net gain on foreign currency fluctuations.

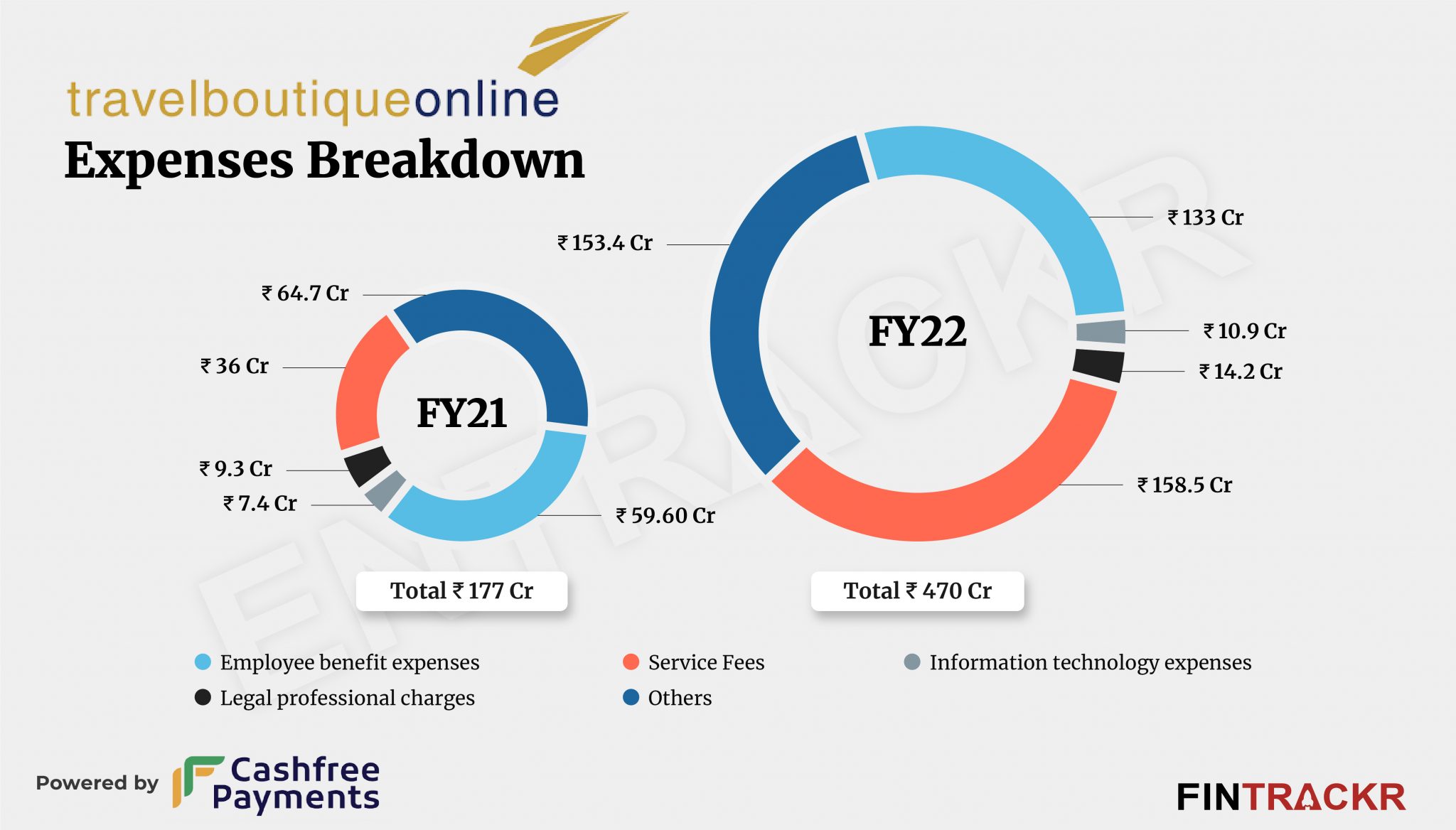

Service fees were the expenses that represent the cost of services incurred by the group and this component accounted for 33.7% of the overall cost and surged 4.4X to Rs 158.5 crore in FY22.

To ramp up growth, Travel Boutique increased its workforce in the last fiscal year and this led to a 2.2X jump in its employee benefit expenses. This cost stood at Rs 133 crore in FY22.

It incurred Rs 10.9 crore and Rs 14.2 crore as information technology as well as legal and professional fees in FY22 which propelled its overall cost by 2.65X to Rs 470 crore during the last fiscal.

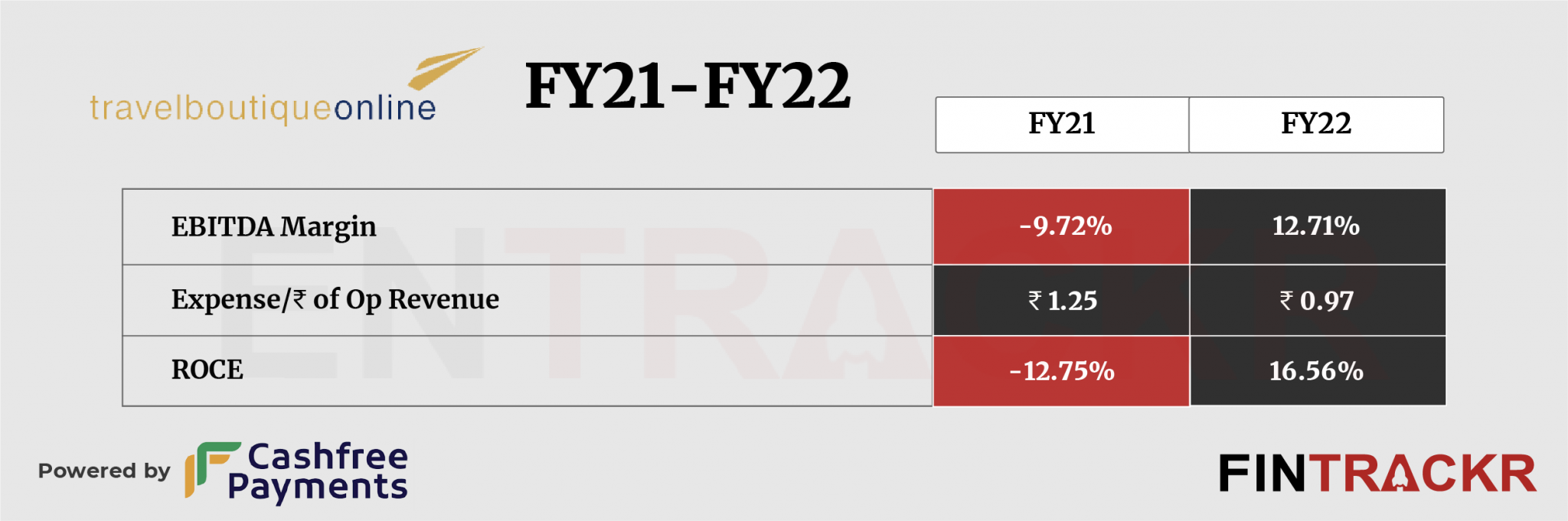

The pandemic had pushed the company into losses —Rs 34 crore— during FY21 but Travel Boutique pulled off a profit of almost the same amount: Rs 33.7 crore in FY22. Its ROCE and EBITDA margins turned positive and registered at 16.56% and 12.71% respectively in FY22. On a unit level, Travel Boutique spent Re 0.97 to earn a single unit of operating revenue.

While the recovery in the travel segment is still playing out, which augurs well for the firm, the air ticketing business is surely not one to count on, considering the margins and competition there. That seems to be the one to hedge for, even while building in the rest of the portfolio.