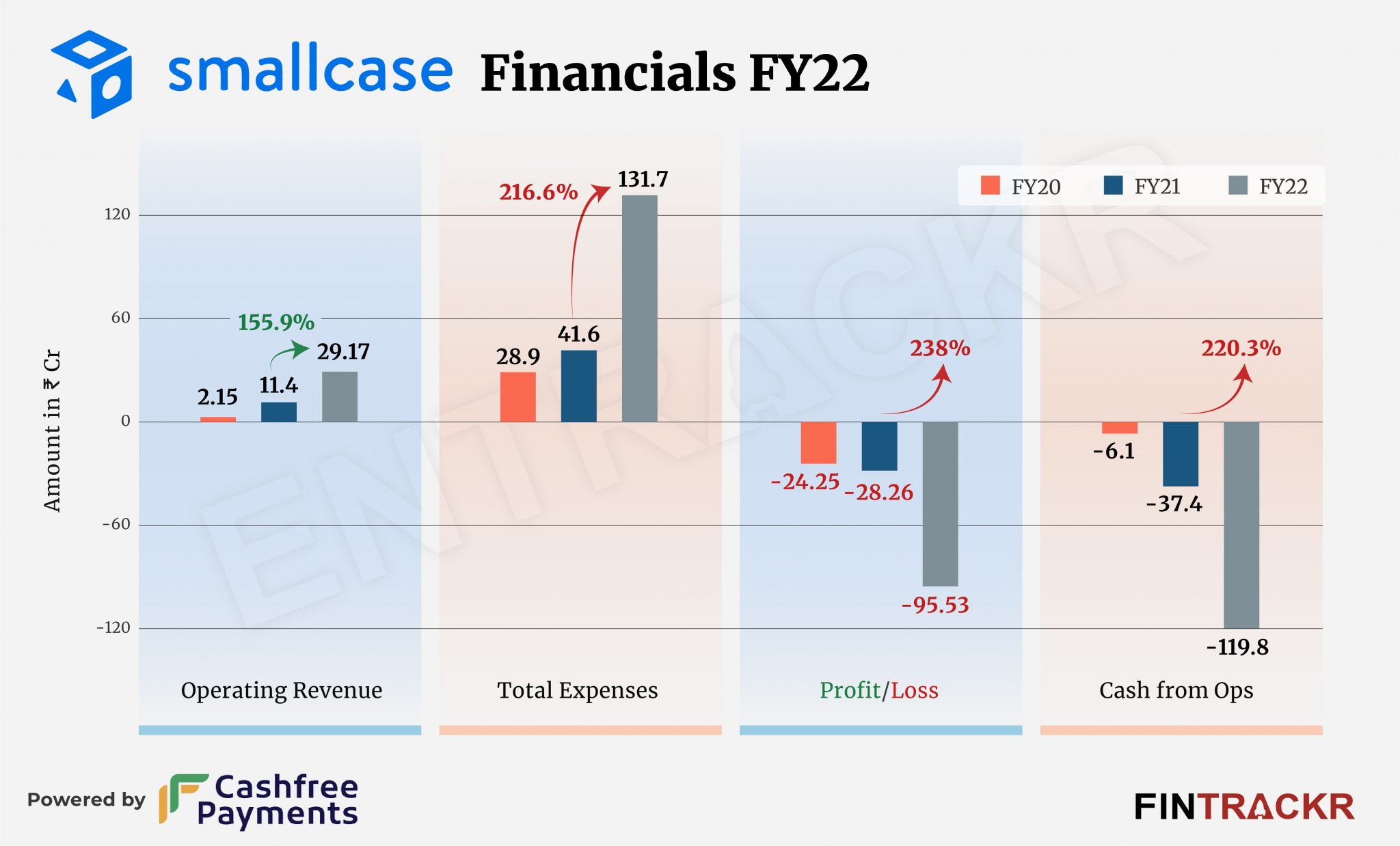

Amazon-backed wealth management company Smallcase has grown at a rapid clip in the last two fiscal years as its operating scale surged over 13-fold. While the company had a revenue of Rs 2.15 crore in FY20, it flew to over Rs 29 crore in the last fiscal.

Smallcase’s operating income grew 2.5X to Rs 29.17 crore in FY22 while its losses crossed Rs 95 crore, according to the firm’s consolidated financial statements with the Registrar of Companies.

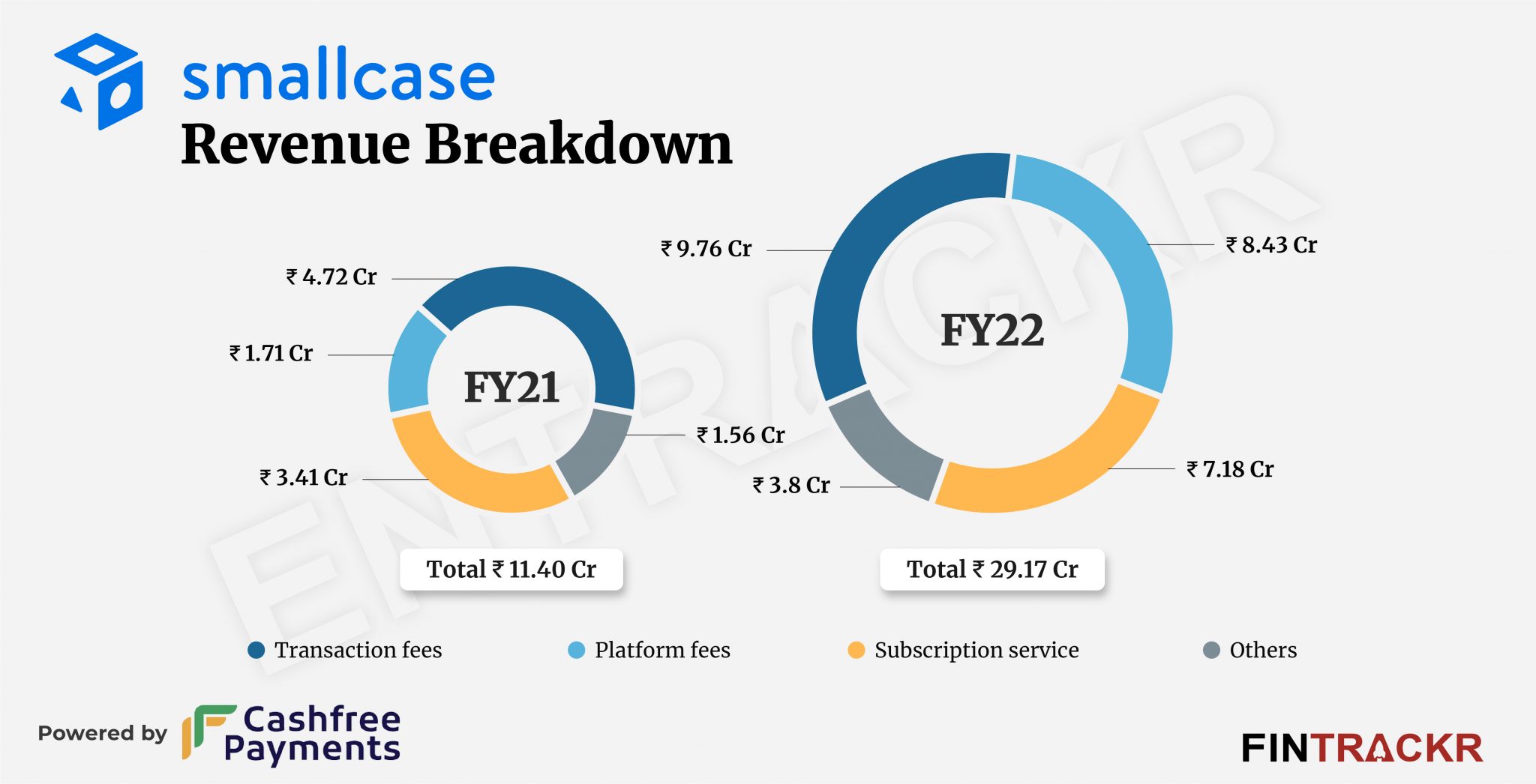

Transaction fees charged by the company to the brokers formed 33.5% of its total collection which soared 2X to Rs 9.76 crore in FY22. Income from platform fees and subscriptions (Tickertape Screener) collected from users ballooned 4.9X and 2.1X to Rs 8.43 crore and Rs 7.18 crore respectively during the last fiscal (FY22).

Gateway, one-time integration, and referral fees collectively contributed Rs 3.8 crore to the company’s coffers in FY22.

Smallcase raised a $40 million Series C round in August 2022. As a result, its financial income mainly from interest on fixed deposits jumped 3.64X to Rs 7.03 crore in FY22.

Smallcase lets retail investors choose themed portfolios having stocks and exchange-traded funds (ETFs) in a proportion that creates the highest return on investment. It works with broking partners including AxisDirect, Zerodha, HDFC Securities, 5Paisa, and Edelweiss and claims to have 5 million users on the platform.

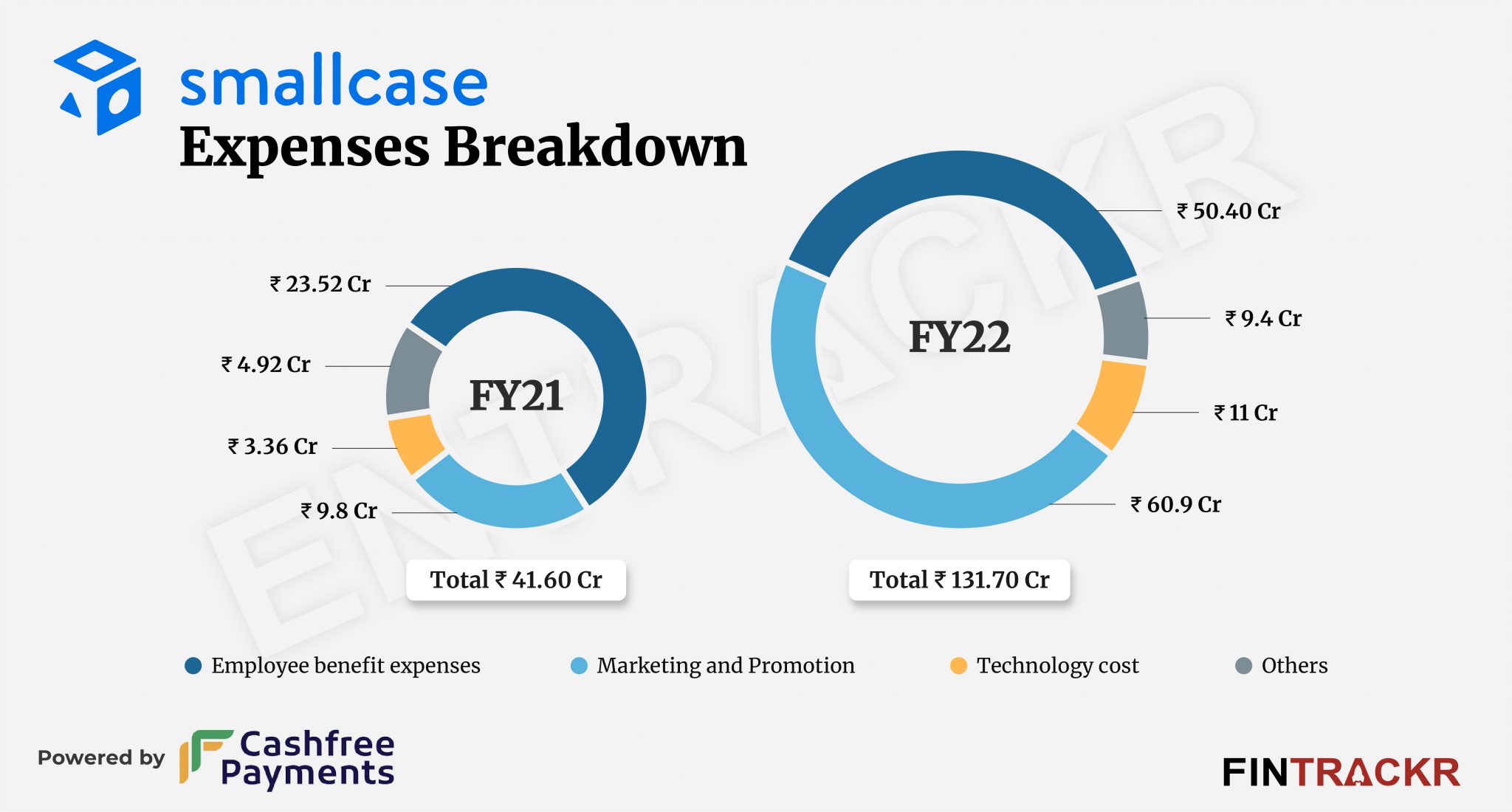

On the expense side, marketing and promotion spends turned out to be the largest cost center for the Vasant Kamath-led company, forming 46.2% of the overall expenditure. This cost blew 6.2X to Rs 60.9 crore in FY22.

Employee benefit expenses grew 2.14X to Rs 50.4 crore during FY22 which also includes non-cash expenses of Rs 7.68 crore against ESOPs.

Smallcase spent Rs 11 crore on technology expenditure which catalyzed its overall cost by 3.16X to Rs 131.7 crore during FY22 from Rs 41.6 crore in FY21. In the end, its losses jumped 3.38X to Rs 95.53 crore in FY22 from Rs 28.26 crore in FY21.

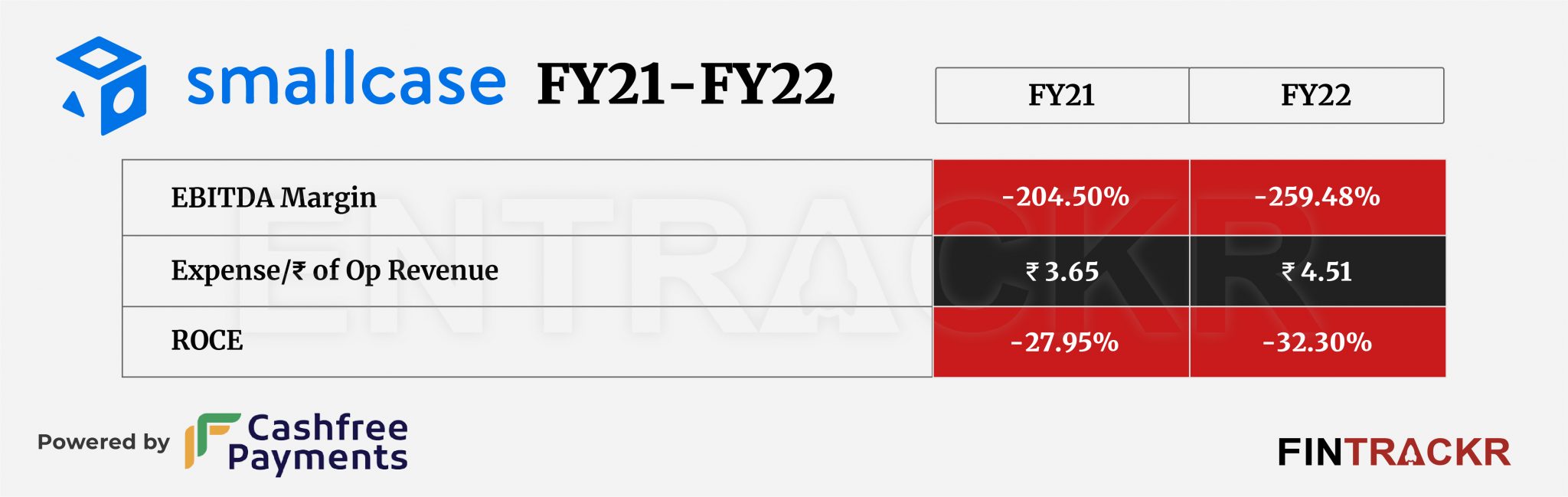

Moving on to ratios, the ROCE and EBITDA margin worsened to -32.3% and -259.48% respectively. On a unit level, Smallcase spent Rs 4.51 to earn a single unit of operating revenue in FY22.

Started in 2016 by Vasanth Kamath, Anugrah Shrivastava and Rohan Gupta, the company counts WealthBasket as its direct competitor while it remotely competes with INDmoney and Cube Wealth. The firm has raised around $62 million from investors including Premji Invest, Sequoia Capital and Blume Ventures and was last valued at $200 million. Notably, Zerodha’s Rainmatter is also an investor in Smallcase.

The smallcase premise is built around delivering performance for its subscribers first(through its curated portfolios), followed by a larger engagement with them (or their money). At 5 million users, like many other firms tied to the capital markets, the firm is likely to discover the limits of the investor universe soon, especially at its current burn rate.

With growth set to become more uphill, the firm will soon be face to face with the question many others in the space face when the climb turns steeper. Is it better to seek independence or be a star feature on a larger financial offering? We believe 2023 will be the year where the firm makes a decisive move on this issue.