Merchant commerce platform Pine Labs is back on track in FY22 after witnessing a dip in its scale during FY21 due to the pandemic. The fourth-largest valued fintech startup has managed to go past Rs 1,000 crore in operating revenues in the fiscal year ending March 2022.

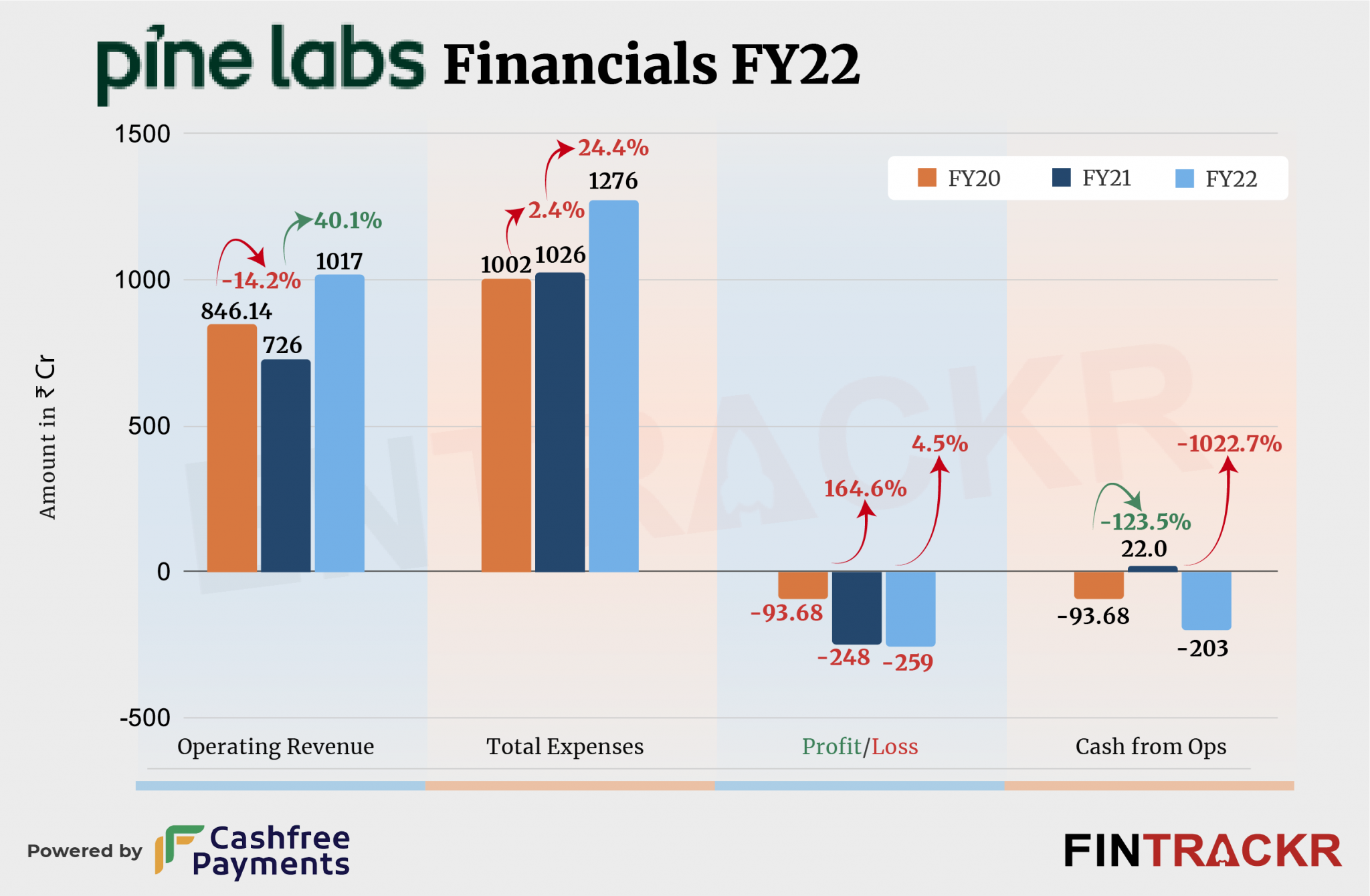

Pine Labs’ operating scale grew by 40.1% to Rs 1,017 crore in the last fiscal from Rs 726 crore during FY21, as per the company’s financial statements filed by its holding company Pine Labs Pte Ltd in Singapore.

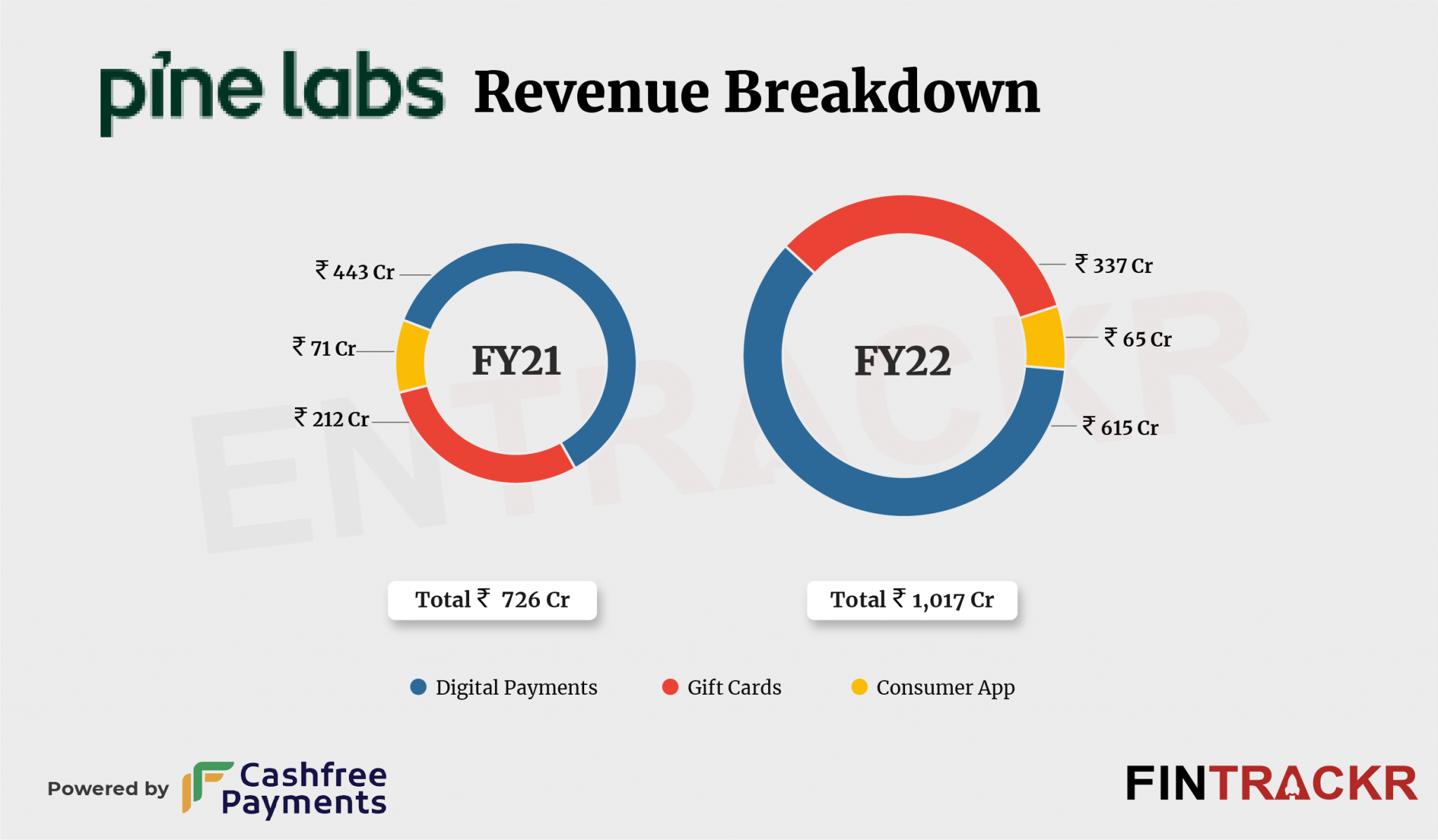

Its core offering: point of sale (PoS) accounted for 60.5% of the total collections which grew 38.8% to Rs 615 crore in FY22. Pine Labs’ PoS terminals let merchants accept plastic cards and QR-based payments in their stores. The company’s PoS income consists of fixed charges or variable fees from merchants, banks, and brands.

Processing fees from issuing Gift cards turned out to be the second income generator and formed 33.1% of its total collection. Revenue from this vertical grew 59% to Rs 337 crore in FY22. For clarity, Pine Labs charges processing fees on the value of gift cards/vouchers activated or reloaded as per the agreement with the merchants.

In July 2020, the company acquired Southeast Asian consumer fintech firm Fave in a $45 million cash and stock deal. Fave provides deals, vouchers, and e-cards to customers and collection from these services stood at Rs 65 crore in FY22.

Pine Labs has raised over $1 billion in several funding rounds since January 2021 and this catalyzed its income from the gain on financial assets by 3.1X to Rs 64.48 crore in FY22 from Rs 20.69 crore in FY21.

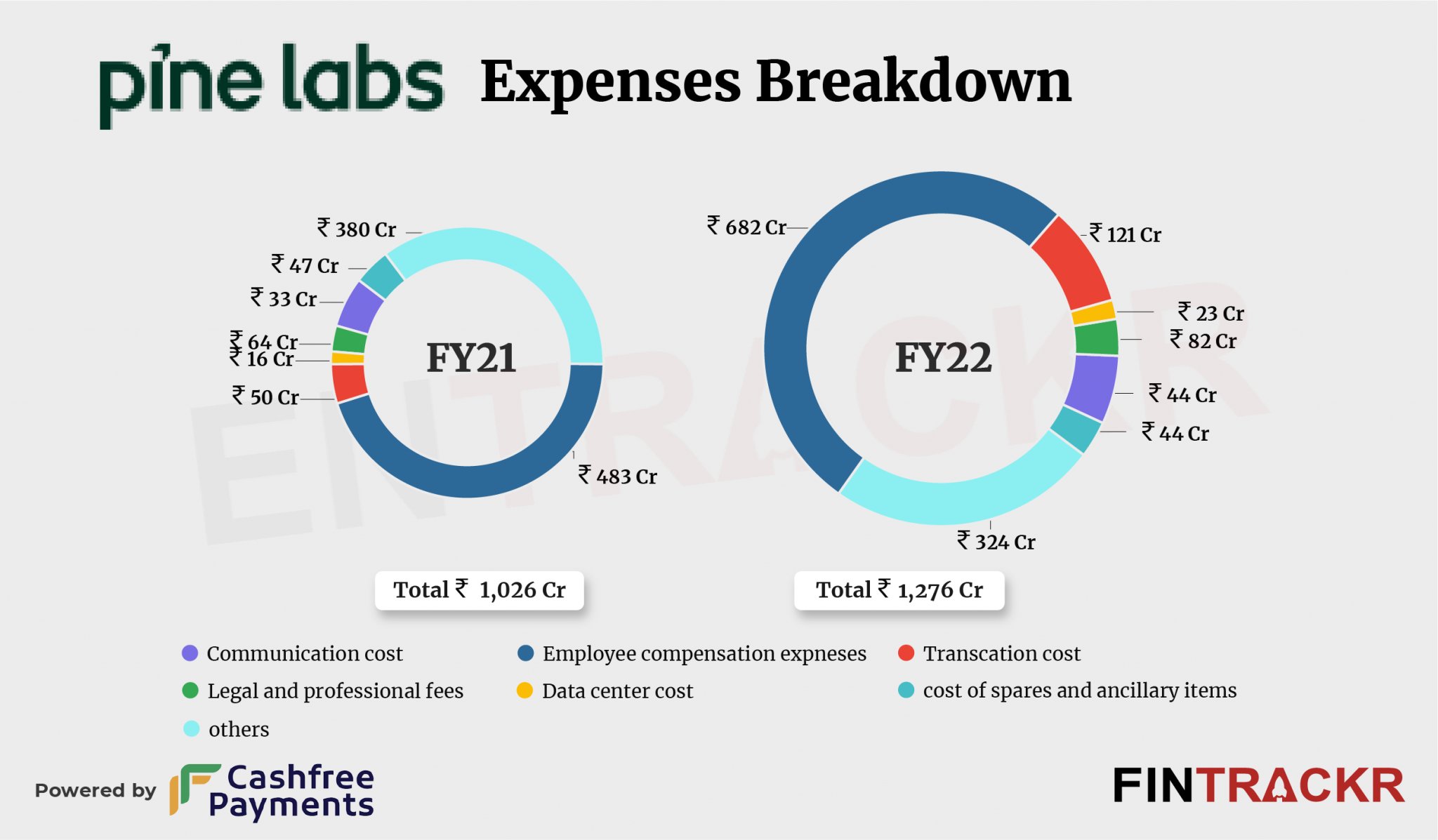

On the cost side, employee benefits constituted 38% of the annual cost which grew 41% to Rs 682 crore in FY22 from Rs 483 crore in the preceding fiscal year. This cost also includes Rs 187.3 crore on ESOPs.

Transaction cost which includes switch fees paid to service providers, listing fees to merchants, payment gateway charges and support charges for the deployment of PoS machines shot up 2.4X to Rs 121 crore in FY22.

Cost of spares and ancillary items such as cost of paper rolls used in merchant equipment, cost of equipment sold, and consumables reduced by 6% to Rs 44 crore in FY22. The company added another Rs 82 crore as legal and professional fees which pushed its overall cost by 24.4% to Rs 1276 crore in FY22 from Rs 1026 crore in FY21.

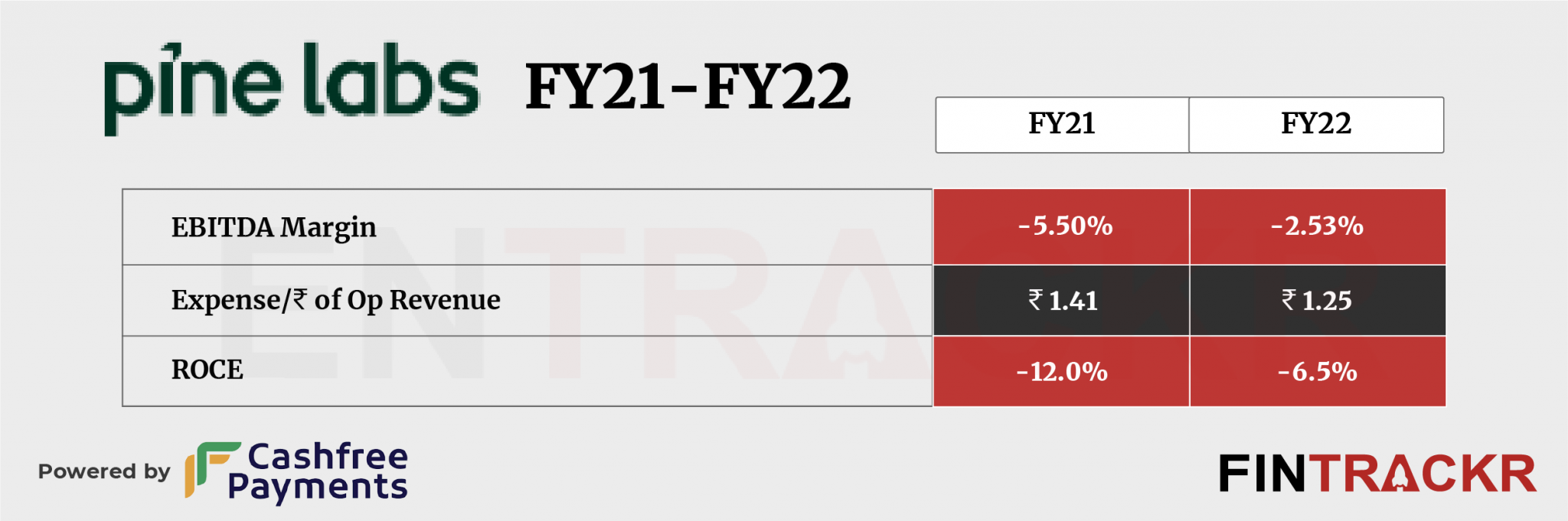

With a growth of over 40% in FY22, Pine Labs managed to keep a tab on its losses which merely grew 4.5% to Rs 259 crore in FY22. Moving to the ratios, its ROCE and EBITDA margins stood at -6.5% and -2.53% respectively in FY22. On a unit level, the company spent Rs 1.25 to earn a single unit of operating revenue during the last fiscal year.

The company certainly seems poised to break even, looking at its cost structure and growth momentum. When last heard, a planned ‘500m’ US IPO was possibly being shifted to India. Even though the Indian markets have not been as weak as the US markets recently, the fact remains they are possibly even more unforgiving of loss making startups now, making a clear case for some strong results for FY23 from this fintech pioneer.