Re-commerce marketplace Cashify has emerged as the posterboy in the space and this was evident from its $90 million funding and booming scale which neared the Rs 500 crore mark in FY22.

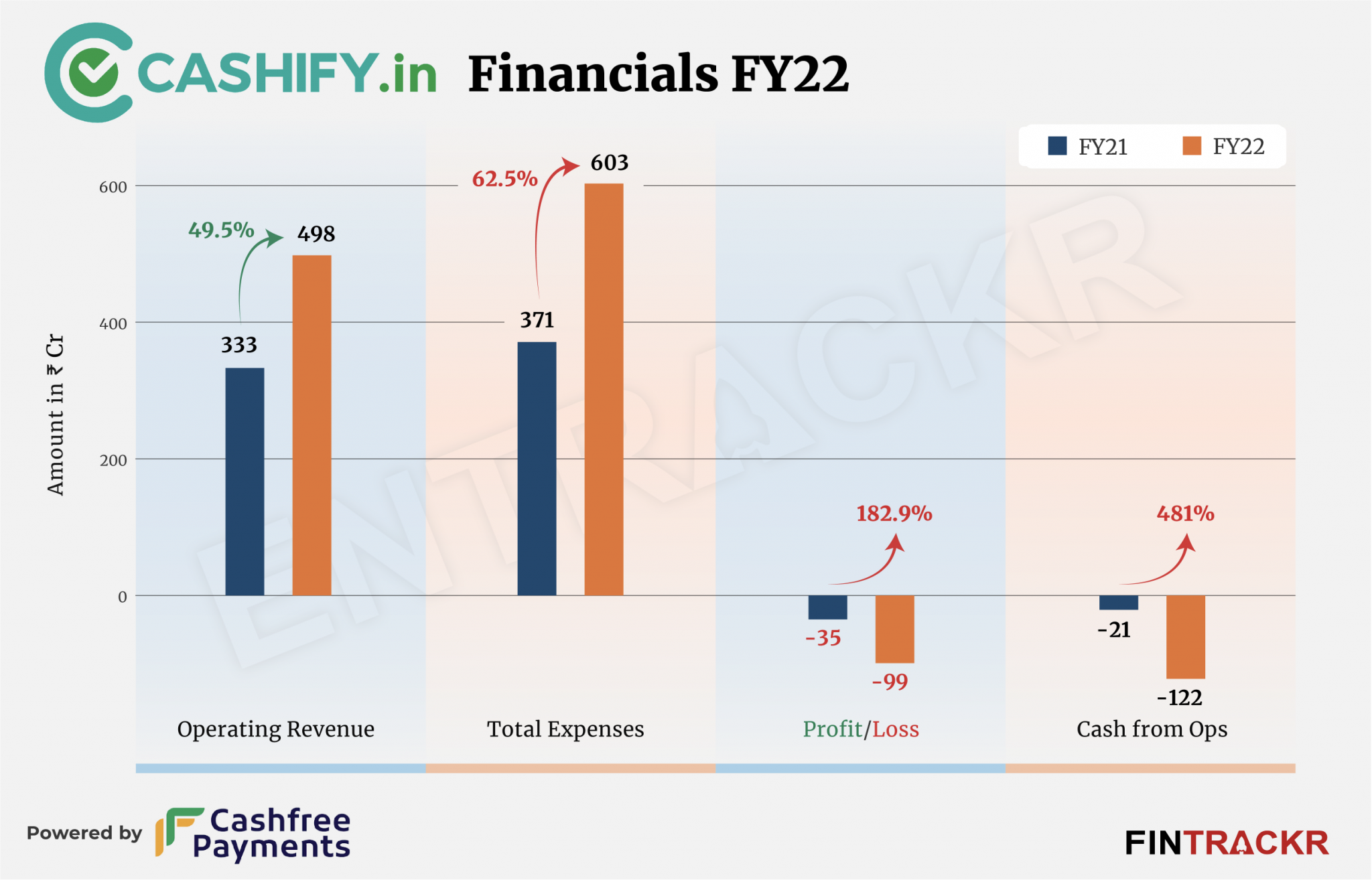

With refurbished laptops and smartphones in demand, Cashify’s revenue from operations grew 50% to Rs 498 crore in FY22 from Rs 333 crore in FY21, as per the firm’s annual financial statements with the Registrar of Companies (RoC).

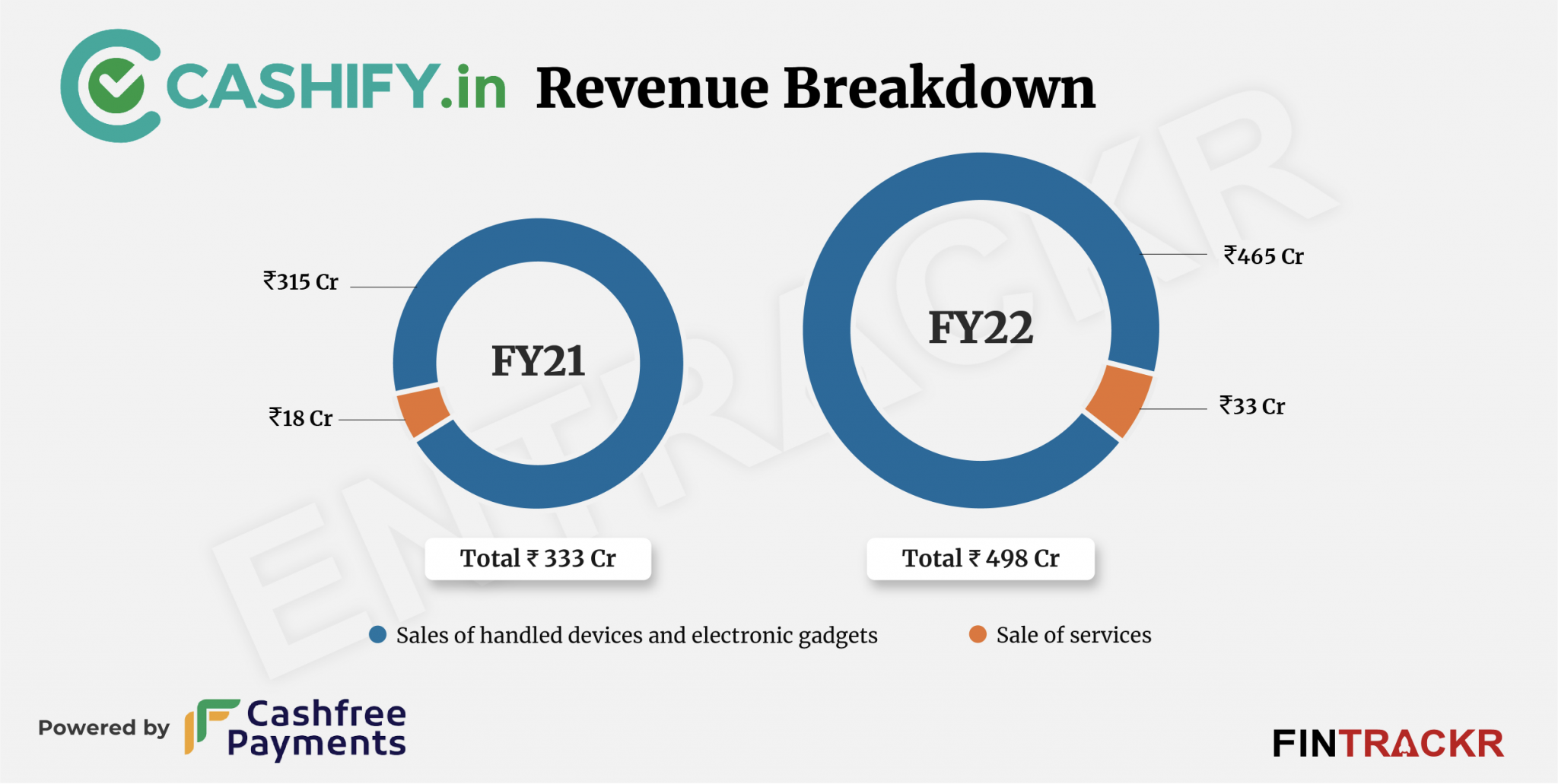

Sales of used mobile phones and other electronic gadgets like speakers, laptops, tablets, gaming consoles, and smartwatches formed 93.37% of the total collection which increased 47.62% to Rs 465 crore in the fiscal year ending March 2022.

Rest of the operating revenue came from ancillary services such as phone recycling, refurbishing, and repairing which surged 83.33% to Rs 33 crores in the last fiscal. The company currently has 170 stores with plans to expand that number to 250 by March.

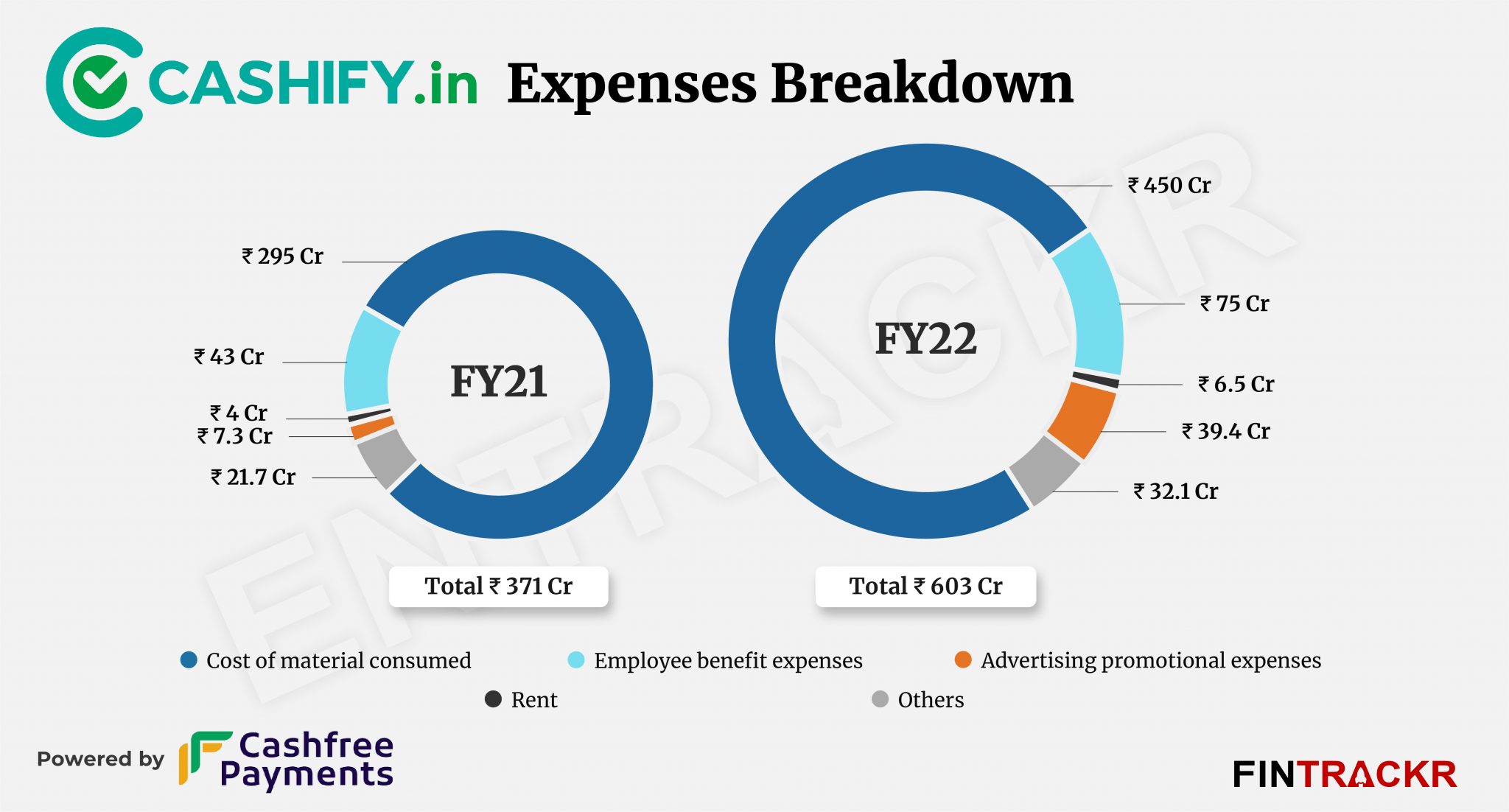

When it comes to expenses, the cost of material consumed accounted for 74.6% of the overall cost. This cost grew 52.5% to Rs 450 crore in FY22 from Rs 295 crore in FY21.

Employee benefit expenses became the second major cost which constituted around 12.4% of the total cost. During FY22, the company hired more resources and its cost on salaries and other benefits surged 74.4% to Rs 75 crore. By March 2023, Cashify also plans to hire close to 300 people for its stores. This will further increase the expenses in FY23-24.

To keep up with growth, the Gurugram-based company splurged heavily on marketing and ran campaigns across television and digital channels. Its advertising and promotional expenses ballooned 5.3X to Rs 39.4 crore in FY22 which pushed its total cost by 62.5% to Rs 603 crore in FY22.

Cashify’s losses have outpaced its revenue growth by a huge margin which shot up 2.8X and stood at Rs 99 crore in FY22.

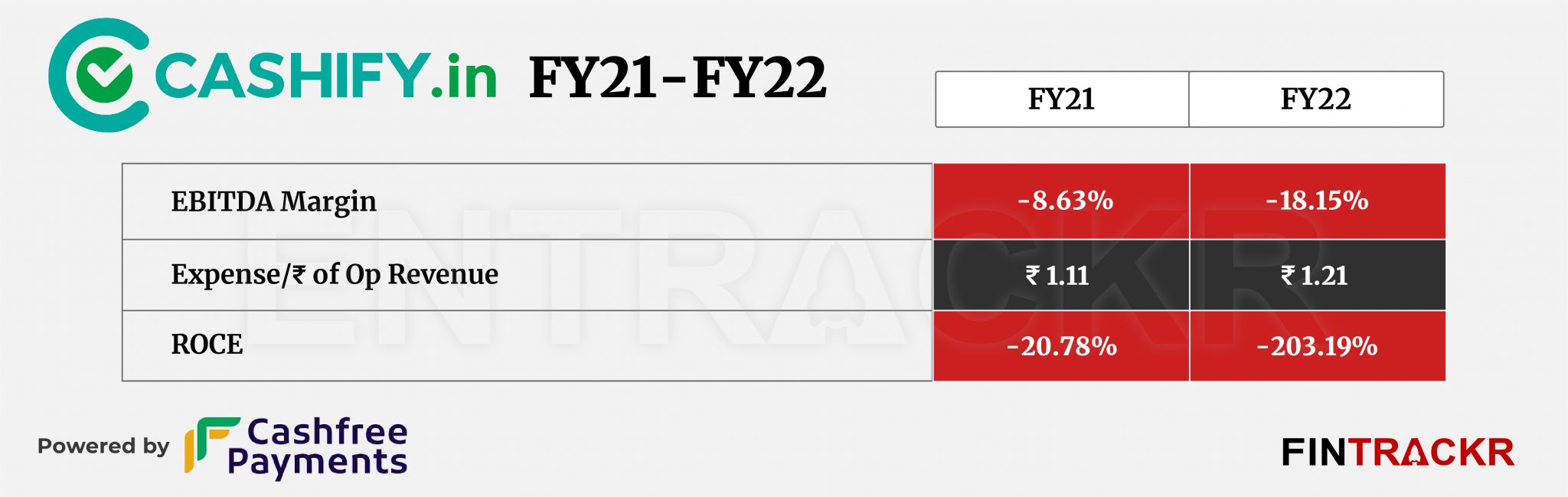

Its ROCE and EBITDA margin registered at -203.19% and -18.15% in FY22. On a unit level, Cashify spent Rs 1.21 to earn a single unit of operating revenue during the last fiscal year.

Backed by Amazon, Cashify has raised $130 million to date and it competes with Yaantra which was acquired by Flipkart in a $40 million deal in January last year.

Filling a vital need in a large market like India, one feels the firm has missed a trick by not stressing on its reuse and recycle theme as a sustainability focused firm. Throw in the use of green energy for operations, and the firm could be a much prouder poster child for sustainability in a market as large as India. Who knows, in time the firm might even be able to earn carbon credits for its work. On the spike in expenses, it has become almost a given after large funding rounds, as firms try to deliver on enhanced promises. Expect a turnaround on the margins front at least in FY23.