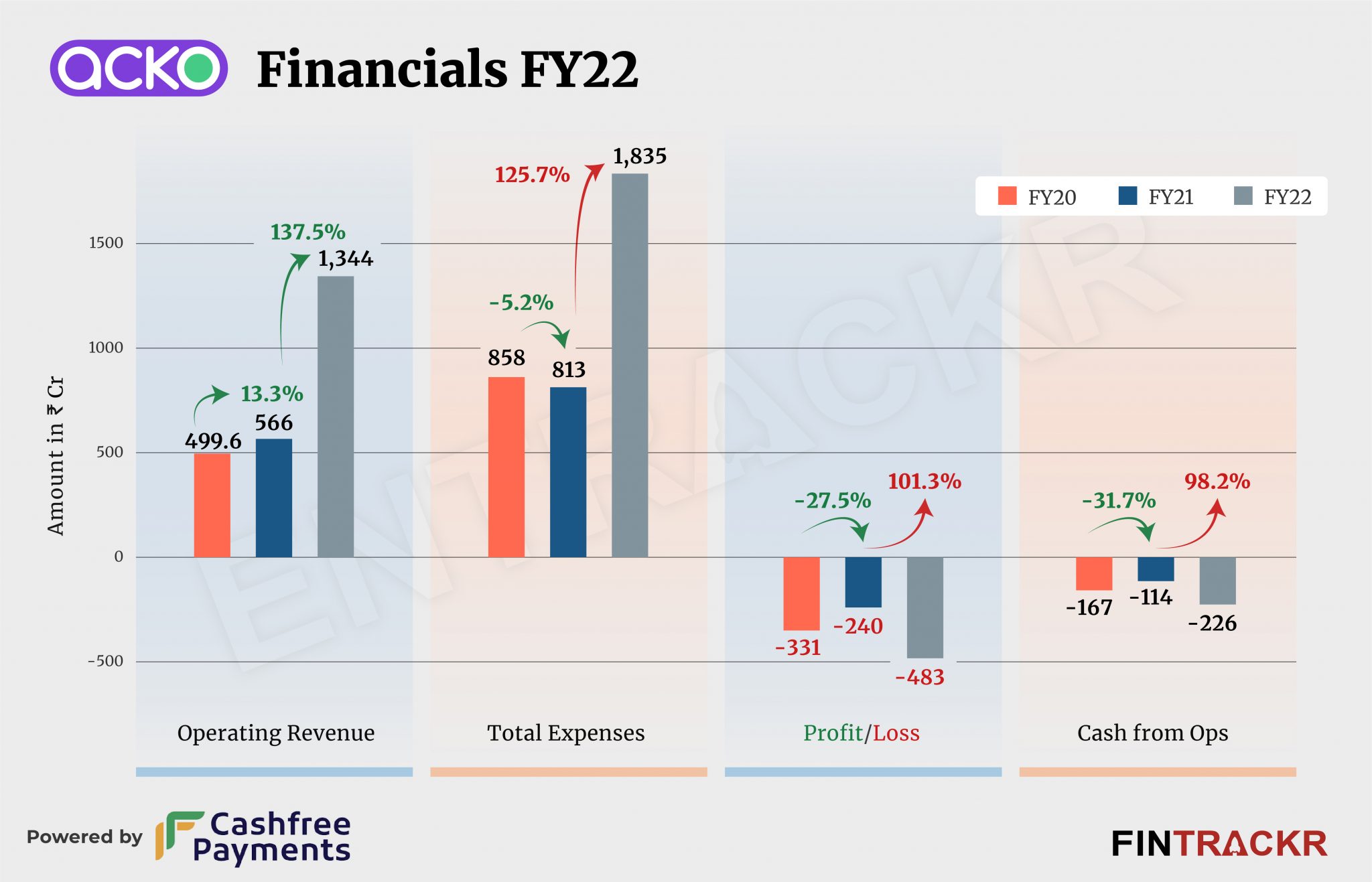

New age insurance firm Acko turned unicorn in October 2021 with a $255 million round co-led by General Atlantic and Multiples Private Equity. The mammoth fundraising accompanied an over two-fold growth in its gross scale during the fiscal year ending March 2022.

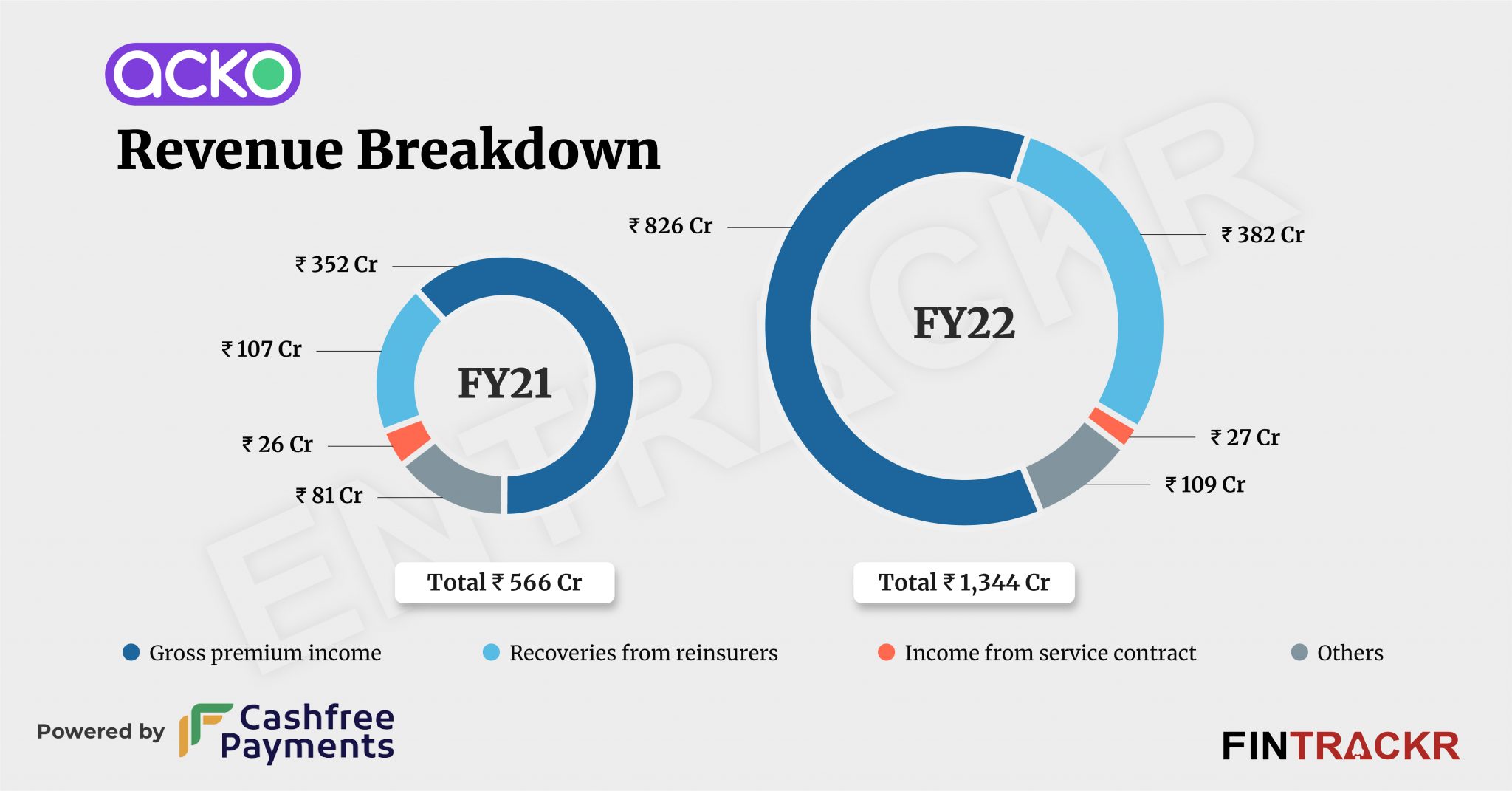

Acko’s gross revenue grew over 2.37X to Rs 1,344 crore in the last fiscal year (FY22), according to its consolidated financial statements filed with the Registrar of Companies (RoC).

Income from the collection of the gross premium contributed 61.5% of the total revenue which surged 2.3X to Rs 826 crore in FY22.

Recoveries from reinsurance and income from selling ‘service packs’ to e-commerce customers added Rs 409 crore. This income soared 3X during FY22 while it also made Rs 109 crore from other operating activities. Acko insures mobile phones and other electronic gadgets sold on online platforms such as Amazon which seems to form a significant chunk of service packs’ income.

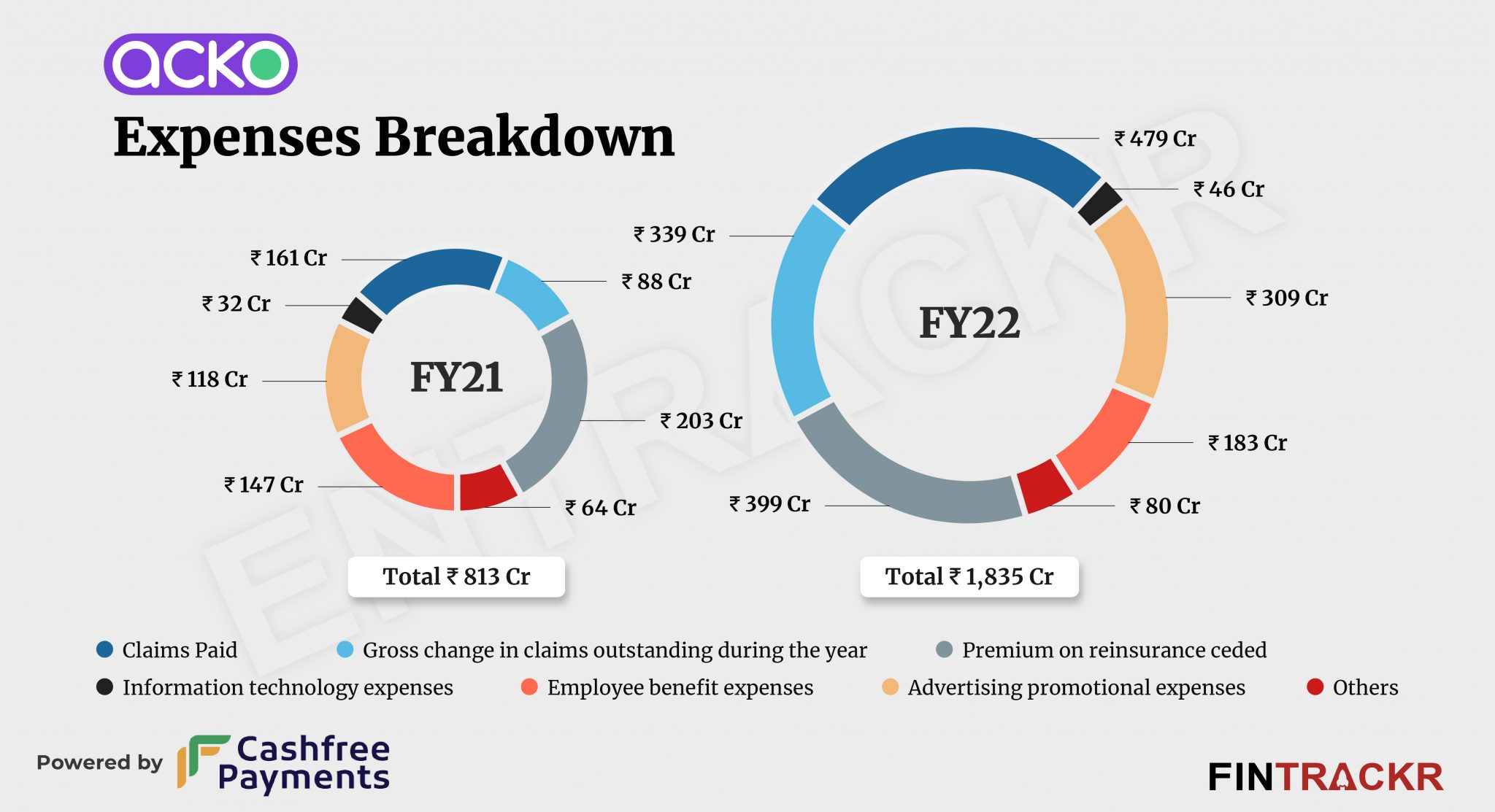

On the expense side, claims paid to customers accounted for 26% of the overall cost. This expenditure grew around 2X to Rs 479 crore in FY22. Its outstanding claims were shot up 3.85X to Rs 339 crore in FY22. For context, these claims have been incurred by the customer but are yet to be paid by the company.

The Amazon-backed company does reinsurance ceding which means the primary insurer (Acko) passes the portion of risk to another insurer (other insurance company). Acko has to pay a premium for this and it incurred Rs 399 crore as a reinsurance premium ceded in the last fiscal year (FY22).

Its expenses on employee benefits grew 24.5% to Rs 183 crore in FY22 while marketing expenses jumped 2.6X to Rs 309 crore. The company spent another Rs 46 crore on information technology, pushing its overall cost by 125.7% to Rs 1835 crore in FY22.

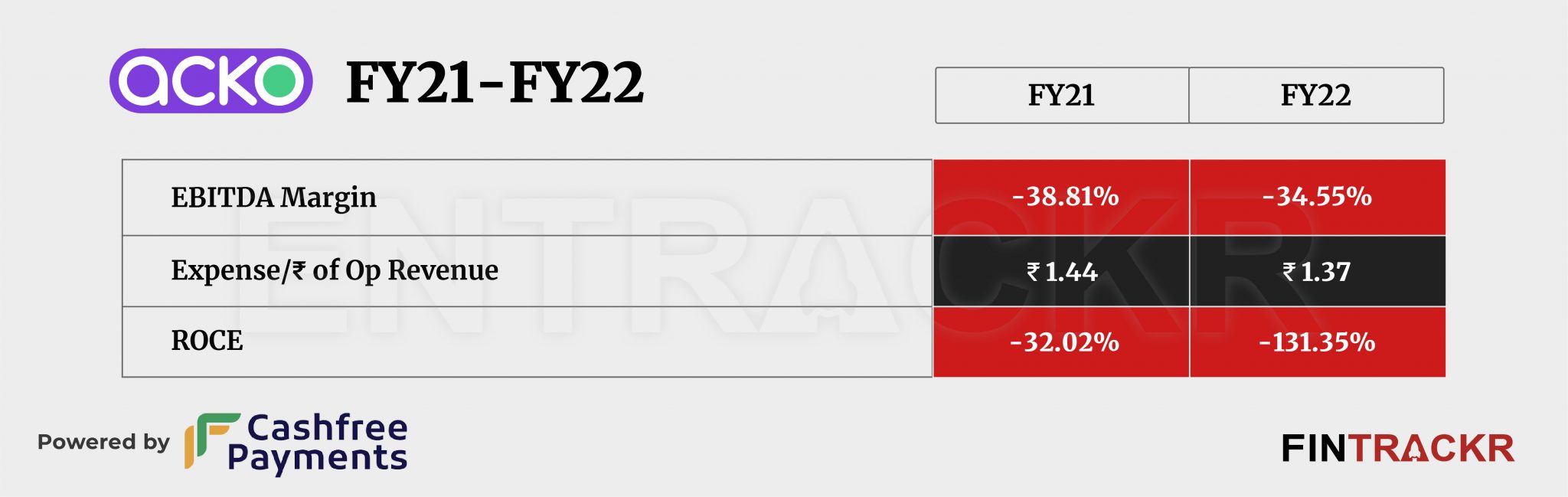

At the end, Acko’s losses spiked over 2X to Rs 483 crore in FY22 as compared to Rs 240 crore in FY21. Its ROCE and EBITDA margin stood at -131.35% and -34.55% respectively in FY22. On a unit level, Acko spent Rs 1.37 to earn a single unit of operating revenue.

The improvement in unit economics augurs well for the firm, which along with other new age insurance firms has decidedly shaken up the general insurance market. Aggressive marketing aside, feedback on claims handling has also been positive, helping Acko grow fast. Expansion into new verticals like health will also ensure strong topline growth, although with most costs front ended, losses are likely to grow too. But in a growing market with many more possibilities for new products and innovations, we imagine the runway for growth remains long for Acko.