API Holdings, the parent company of online drug dispenser PharmEasy, has been going through a rough patch in 2022. The firm had shelved its initial public offering (IPO) plans citing market conditions and is in the market to raise funds with an up to 25% haircut from its peak $5.1 billion valuation.

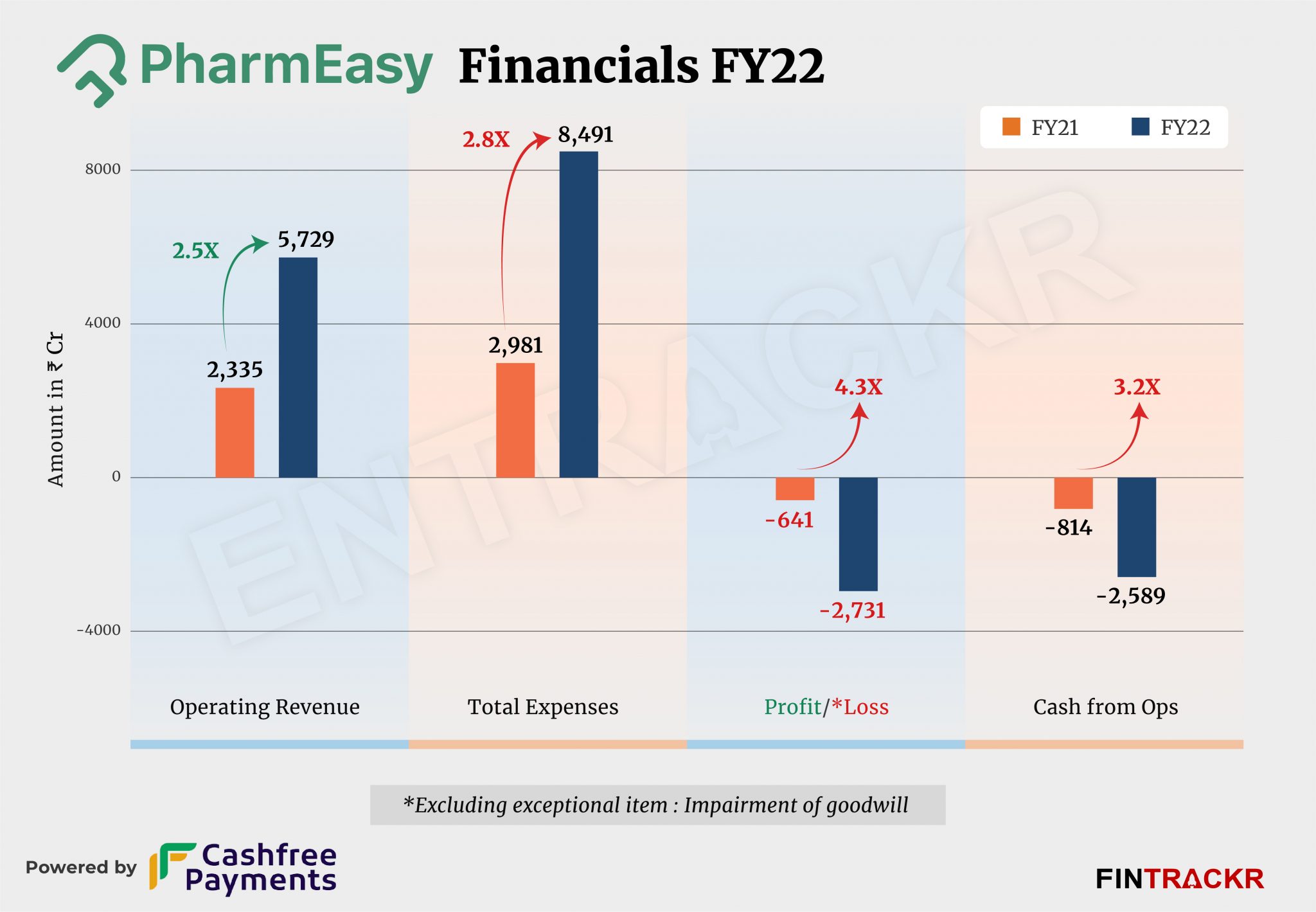

While the new round for the Mumbai-based company is still in the making, the company has bled profusely in FY22 as its losses grew four times. We will talk about expense patterns and losses in the later part of the story. For now, let’s focus on its revenue which grew 2.5X in the last fiscal year.

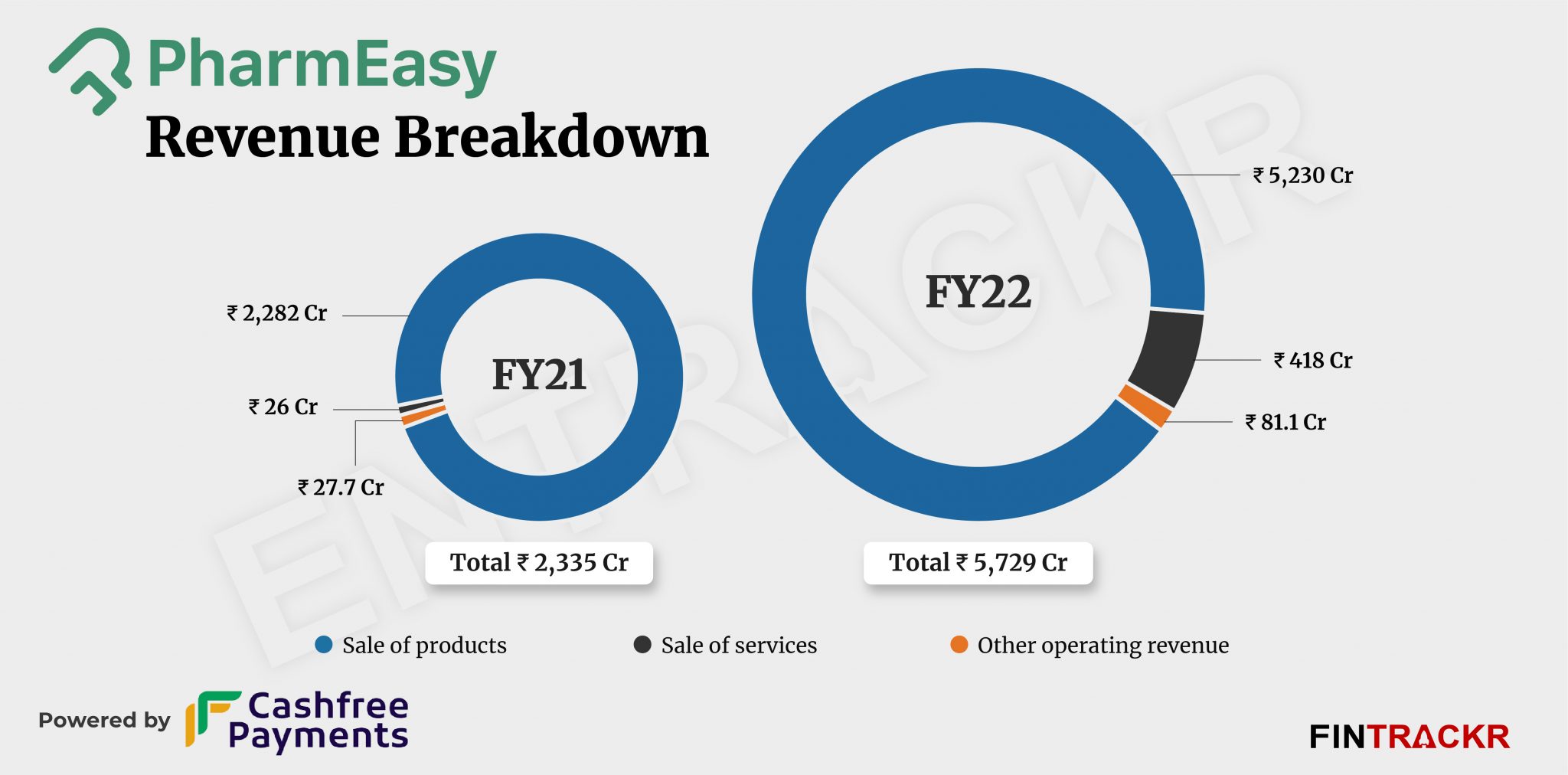

PharmEasy’s revenue from operations grew to Rs 5,729 crore during the fiscal year ending March 2022 as opposed to Rs 2,335 crore in FY21, according to its annual financial statements with the RoC.

The company sells a range of pharmaceutical and cosmetic products which accounted for 91.3% of overall operating revenues. Collections from this segment grew 2.3X to Rs 5,230 crore during the last fiscal from Rs 2,282 crore in FY21. Revenue from diagnostic services, licensing of internet portals, teleconsulting, software, subscriptions et al shot up over 16X to Rs 418 crore during FY22 from Rs 26 crore in FY21.

PharmEasy also cornered Rs 81 crore via rendering services of delivery persons, lease of software and hardware, warehousing, and commission earned on facilitating diagnostic tests via its marketplace.

Meanwhile, earnings from interest on current investments, deposits, and other non-operating revenue stood at Rs 52.2 crore which drove the total income to Rs 5,781 crore during FY22.

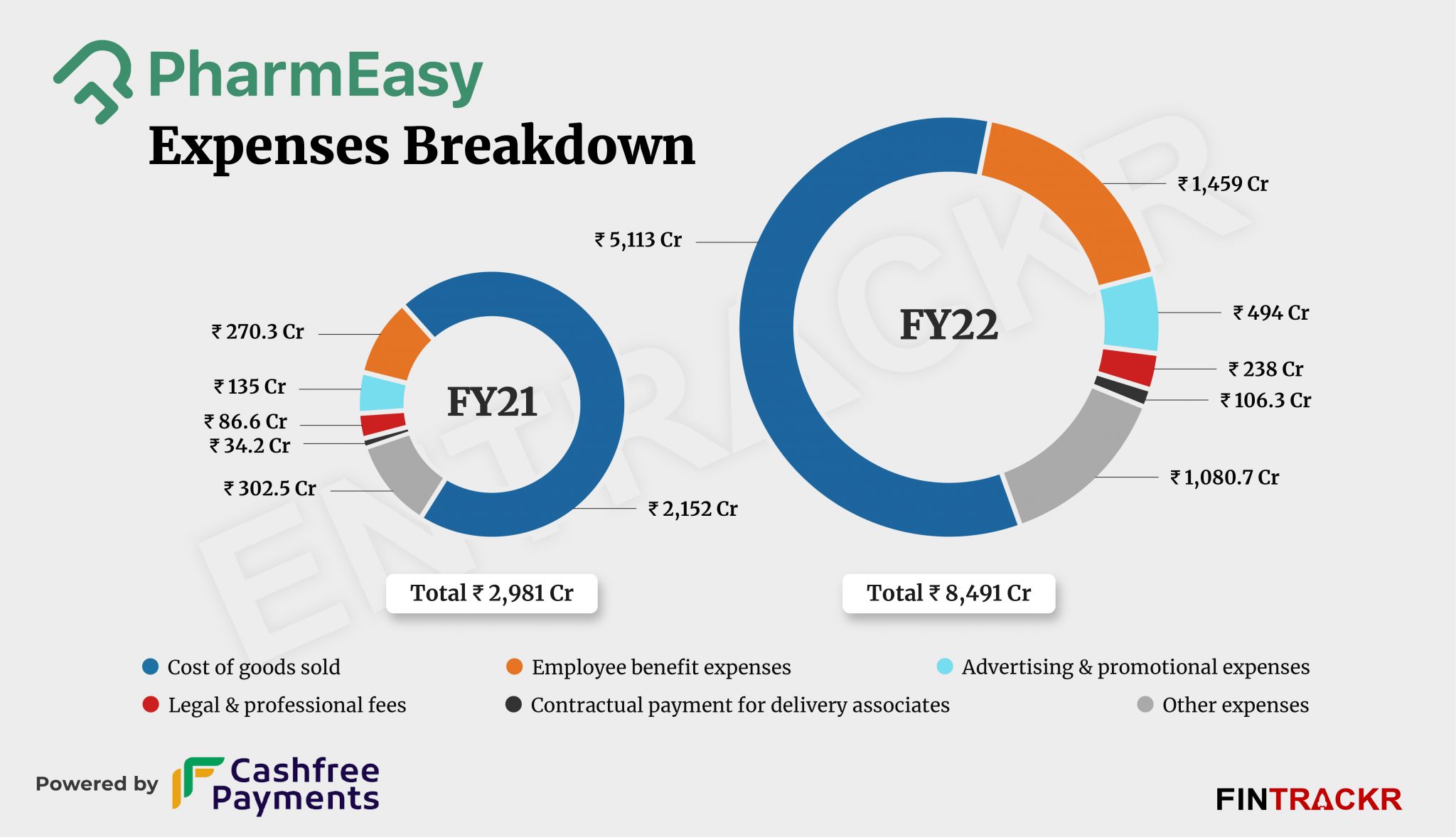

As per Fintrackr’s analysis, the cost of procuring the stock in trade was the largest cost element which constituted over 60% of the total expenses. This cost surged 2.4X to Rs 5,113 crore during the last year from Rs 2,152 crore in FY21.

While promotional expenses and legal costs of the company blew 3.7X and 2.7X to Rs 494 crore and Rs 238 crore during FY22, the rise in legal costs could be ascribed to acquisitions of Thyrocare for about $610 million and Aknamed for $144 million during FY22.

To fuel its growth, the company hired resources across functions aggressively and this could be evident from its spending on employee benefits expenses which ballooned 5.4X to Rs 1,459 crore in FY22 from Rs 270.3 crore in FY21. Importantly, the company also included Rs 630 crore as employee share based payment settled in equity.

PharmEasy also reported contractual payment for delivery associates, commission & brokerage, packing materials, and consumables costs of Rs 106.3 crore, Rs 25 crore, and Rs 52.64 crore respectively in FY22.

Outpacing its revenue growth, the firm’s total expenditure grew 2.8X to Rs 8,491 crore in FY22 as compared to Rs 2,981 crore in FY21. The company also booked an exceptional item of Rs 1,261 crore as impairment of goodwill (non-cash expense) taking the losses to Rs 3,992 crore. It’s worth noting that Entrackr has excluded this expense while calculating the overall losses.

Following the rise in expenses, annual losses of the company jumped 4.3X to Rs 2,731 crore in FY22 against Rs 641 crore in FY21. Its cash outflows from operations also surged 3.2X to Rs 2,589 crore in FY22.

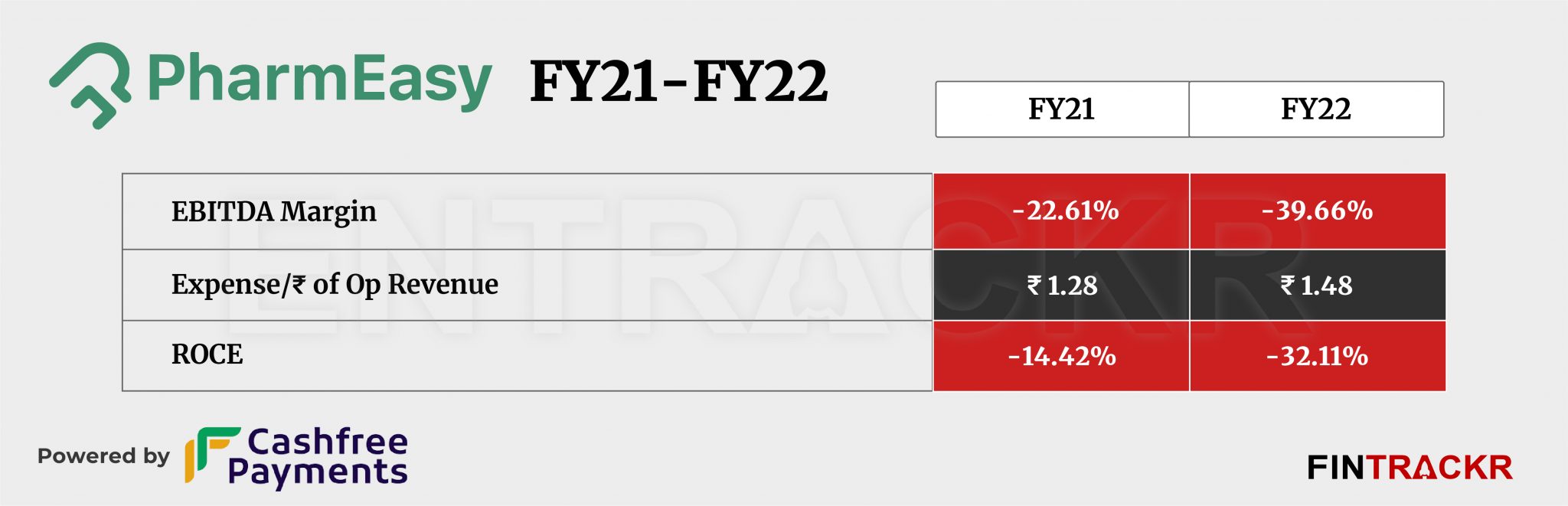

EBITDA margin and ROCE depressed by 1,705 and 1,769 BPS to -39.66% and -32.11% respectively in FY22. On a unit level, PharmEasy spent Rs 1.48 to earn a rupee of operating revenue during the same period.

PharmEasy has raised over a billion dollars to date including a $217 million worth round at over $5 billion valuation in October last year. The company turned unicorn in April 2021 after raising a $350 million round led by Prosus and TPG Growth. Another player in the medtech space, the Tatas-owned 1mg joined the unicorn club and witnessed a 2X growth in scale to Rs 627 crore while its losses surged 67.5% to Rs 526 crore during FY22.

PharmEasy’s worsening margins are probably linked to its acquisitions, which, in retrospect, may have been too richly valued. However, with that in the past, the firm faces the tough challenge of sustaining its leadership in the pharma space, especially now that it has a full suite of offerings, from prescriptions to diagnostics. FY23 and FY24 are also when its acquisitions will get a chance to show their worth to the firm.

However, the looming drop in valuations for the next fundraise, and that is simply unavoidable at this stage, does not augur well for the firm, now that IPO plans are in cold storage. Its market leadership will count for little in the fiercely competitive online pharma market, if it cannot back it with a clear long term commitment to its partners. With key competitors backed by giant conglomerates like the Tatas and Reliance, it has its work cut out.